🎯 TUESDAY TARGET: Microsoft (MSFT) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

While the market’s comfort story hyperventilates over a healthy correction in software stocks, we see a terminal diagnosis for the subscription economy. The per-seat license model, charging monthly rent for human users, becomes obsolete when AI agents execute the workflow without the human. Agents consume raw compute and bypass the shiny dashboard entirely. The market is violently repricing this realization: the infinite-margin middleman is being disintermediated by the infrastructure that powers him.

Capital, naturally, smells the smoke. It flees the bloated valuations of Silicon Valley and lands in the most despised asset class on earth: European manufacturing. Yes, Germany. The sick man is suddenly posting a pulse in loan growth and factory orders, offering tangible value while American tech chases a dying business model. As for Beijing dumping US Treasuries, the reality is mundane: a domestic plumbing fix for a liquidity-starved banking system ahead of the Lunar New Year.

We are watching a structural rotation from rent-seekers to makers, and the reflex remains the same: buy the dip on the wrong side of history.

Below, as always, the rest of what’s cooking:

The Stealth Liquidity Injection

The Federal Reserve has quietly restarted balance sheet expansion to the tune of forty billion dollars a month. Officials call this technical reserve management, yet the mechanical effect on asset prices mirrors quantitative easing. This consistent liquidity injection lubricates the repo markets and suppresses volatility. It functions as a silent put option for the market, loosening financial conditions regardless of the official interest rate.

Japan’s Fiscal Unleashing

Prime Minister Takaichi’s landslide victory secures a mandate for aggressive fiscal stimulus. This political shift virtually guarantees higher government spending and upward pressure on Japanese bond yields. A steeper yield curve in Tokyo challenges the global carry trade, as the era of the yen serving as a dormant funding currency comes to an end. Global liquidity flows must now account for a waking Japanese giant.

Germany’s Industrial Pulse

European markets are attracting capital simply by being ‘less bad’ than expected. German manufacturing orders and loan growth are suddenly showing signs of life, contradicting the pervasive doom-and-gloom narrative. With US markets priced for perfection, this overlooked recovery in the Eurozone offers a compelling value proposition. Money flows are starting to chase this manufacturing turnaround while American growth stories look increasingly exhausted.

The Crypto-Gold Divergence

Bitcoin and gold have decoupled, revealing distinct roles in the current regime. Crypto trades in lockstep with high-beta tech stocks, acting as a liquidity proxy. Physical gold, however, rallies on sovereign debt concerns and geopolitical risk. This divergence clarifies that institutional capital views bullion as the true hedge against systemic instability, while digital assets remain a leveraged bet on risk appetite.

THE WEEK: Binary Data Gauntlet

We face a rare statistical anomaly: the two most critical macro prints, Jobs and Inflation, colliding within forty-eight hours. The action kicks off today with Retail Sales, but the real volatility engine is the sandwich of Wednesday’s Payrolls and Friday’s CPI. With a deluge of Fed speakers adding noise to the silence, expect algorithmic whiplash where technical supports temporarily yield to binary headline risk. The charts won’t matter until the data settles.

Traditional Tactics for this Tape

The market structure beneath the surface is far more fragile than the index implies. Single-stock volatility continues to explode, signaling that a violent rotation is underway. We are reducing gross exposure and utilizing historically cheap options premiums to hedge downside risk. The smart capital is rotating into ‘real economy’ beneficiaries, specifically regional banks and industrials, that profit directly from a steeper yield curve, while avoiding the overcrowded exit door in software.

Do not guess. But do reach out. Let’s build a capital-efficient yet risk-managed strategy from the option chain up.

Get Rich Overnight with Options? Yeah Right...

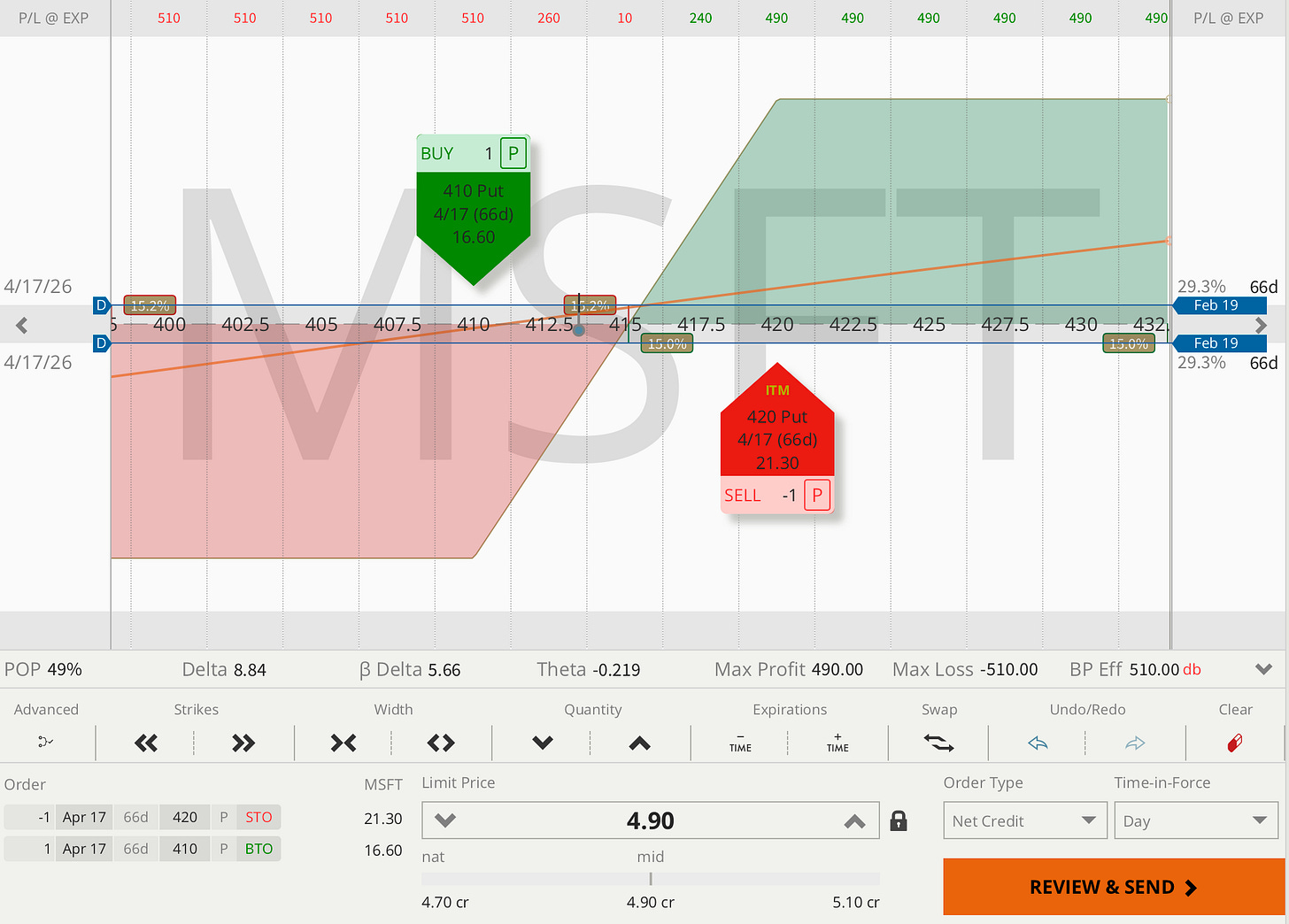

TUESDAY TARGET: Microsoft (MSFT)

The market has punished software so violently that Microsoft now trades at a lower forward P/E multiple than IBM for the first time in a decade. While we believe the “Agentic” threat to SaaS is real, a 30% drawdown suggests the pendulum has swung into absurdity. We are selling into the high-volatility panic to acquire exposure to the world’s best balance sheet at valuations not seen since the ZIRP era.

Not an official trade entry, just food for thought. Official trade entries are available in the Trade Alerts section. Here, we relentlessly innovate and focus on delivering only superior options strategies.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 60-Minute Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious1 investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

If you are only here for the money, look elsewhere. Success requires a dedication to the craft.