The Elite Trader Plan

A calm, step-by-step options plan that grows accounts and tames big swings.

📞 Book Elite Trader Call: 👉 Jump to Bookings

🎟️ Top-Up Credits: 👉 Jump to Top-Ups

The Elite Trader Plan

What you’ll learn

Set firm risk limits and size trades by maximum loss, not by maximum profit.

Only use defined‑risk option strategies: vertical spreads, iron condors, butterflies (bullish / neutral / bearish), and LEAPS debit spreads for equity replacement.

Select, enter, and manage trades in TastyTrade / ThinkOrSwim / Interactive Brokers with TradingView for charts.

Repair or exit positions on a schedule (not on emotion), including repairing for a net credit when appropriate.

Build a simple hedge (for example on SPY), or better keep portfolio delta neutral, and keep a big cash sleeve (e.g., SGOV) to reduce swings and to be ready to attack when everybody else suffers.

Who this is for

Beginners can follow the Starter path. Advanced students can skip ahead anywhere they already pass the Skip Check.

Before You Start: Five Guardrails

Per‑trade risk: Fix a dollar amount you can sleep with and stick to it.

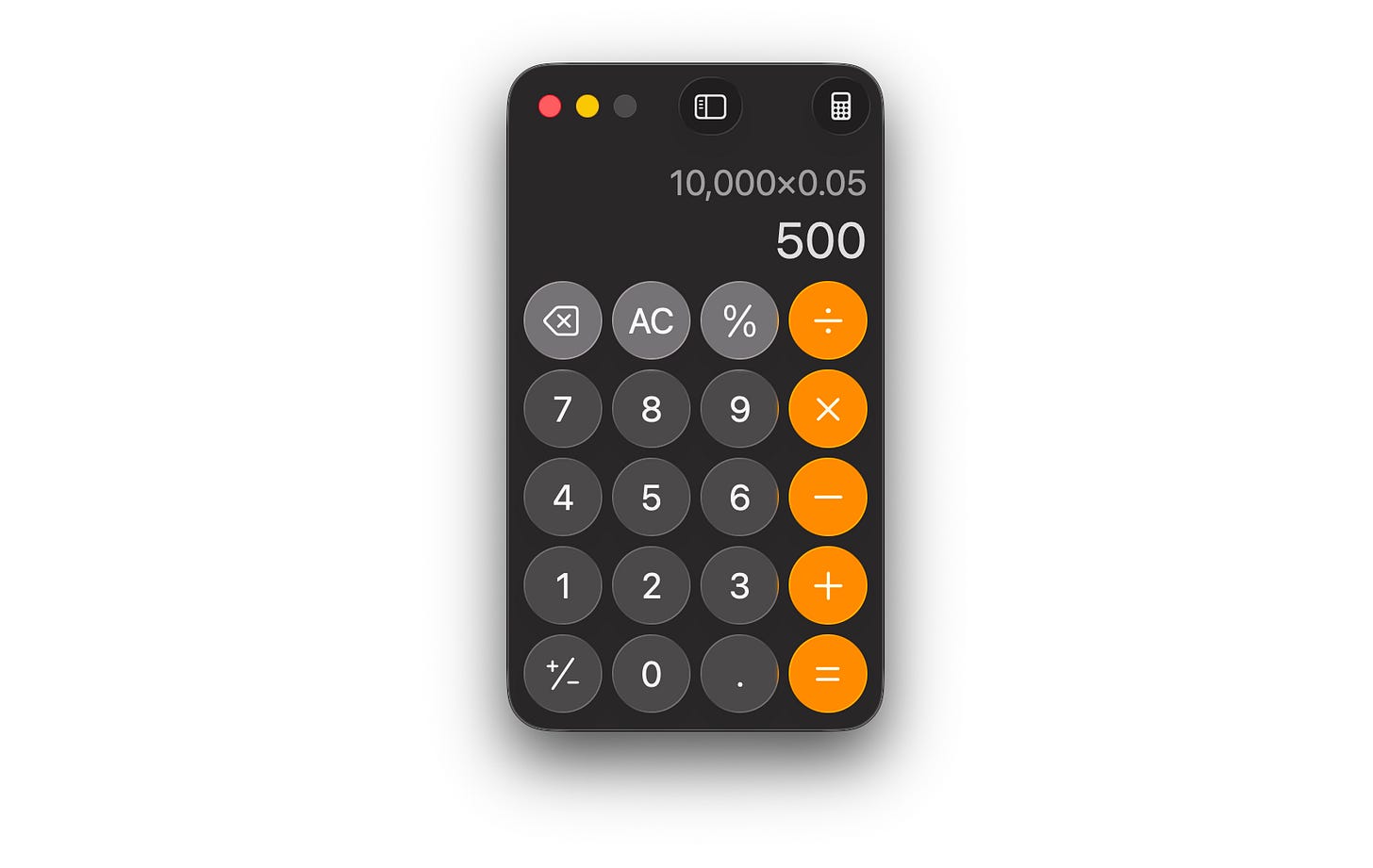

What we use in sessions: 5% of the allocated capital (not total account size), if allocated risk capital is $10,000 your trade size should be $500 or smaller.

Position count: Aim for 3–6 open trades max. Avoid stacking highly correlated bets (for example, two tech trades at once).

Liquidity: Only trade options with tight prices and active markets (healthy trading volume).

Events: Do not trade if earnings or other binary events are before the options maturity date, unless the strategy is specifically for that event.

Management window: Make your keep/repair/close decision about 18–21 days before expiration to reduce last‑minute risk.

Suggested Schedules

6‑Week Starter: Modules ⓵–⓺

8–10 Week Complete: Modules ⓵–⓾ (add more time where you need it)

Advanced students: Start at Module ⓹ or ⓼, prove the Skip Checks, then move to ⓽–⓾

The Modules (⓵–⓾)

⓵ Setup & Workflow (TradingView + Broker)

Goal

Establish a fast, clean workflow so you stop clicking around and start making decisions with confidence.

In Session

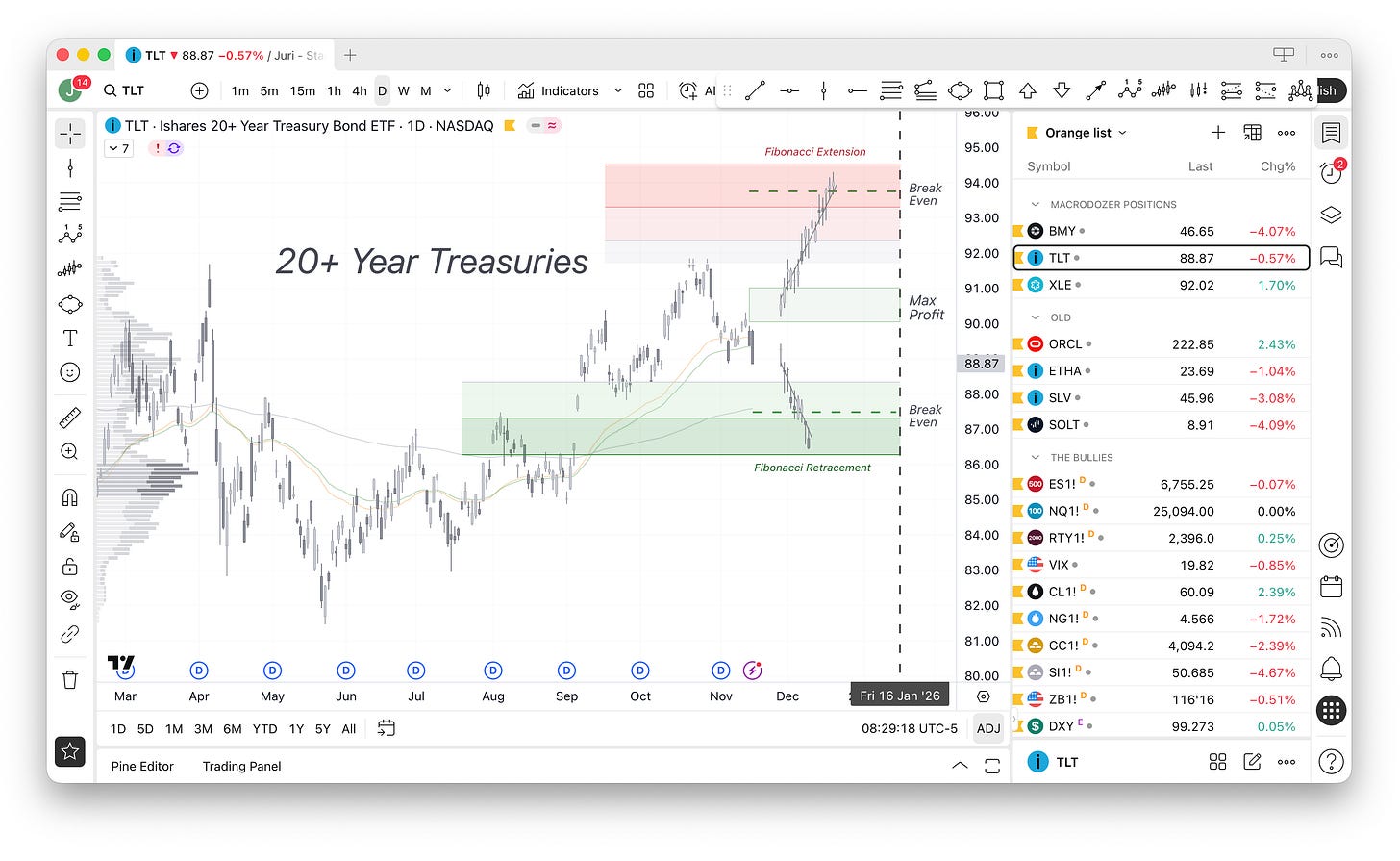

We clean up your TradingView workspace — remove clutter, add moe basic and clean indicators for structure, and set up multiple timeframes (5-min, 1-hour, 4-hour, daily, weekly, monthly).

Add your favourites drawing tool menu for quick access.

Set up Fibonacci and simple wave theory tools.

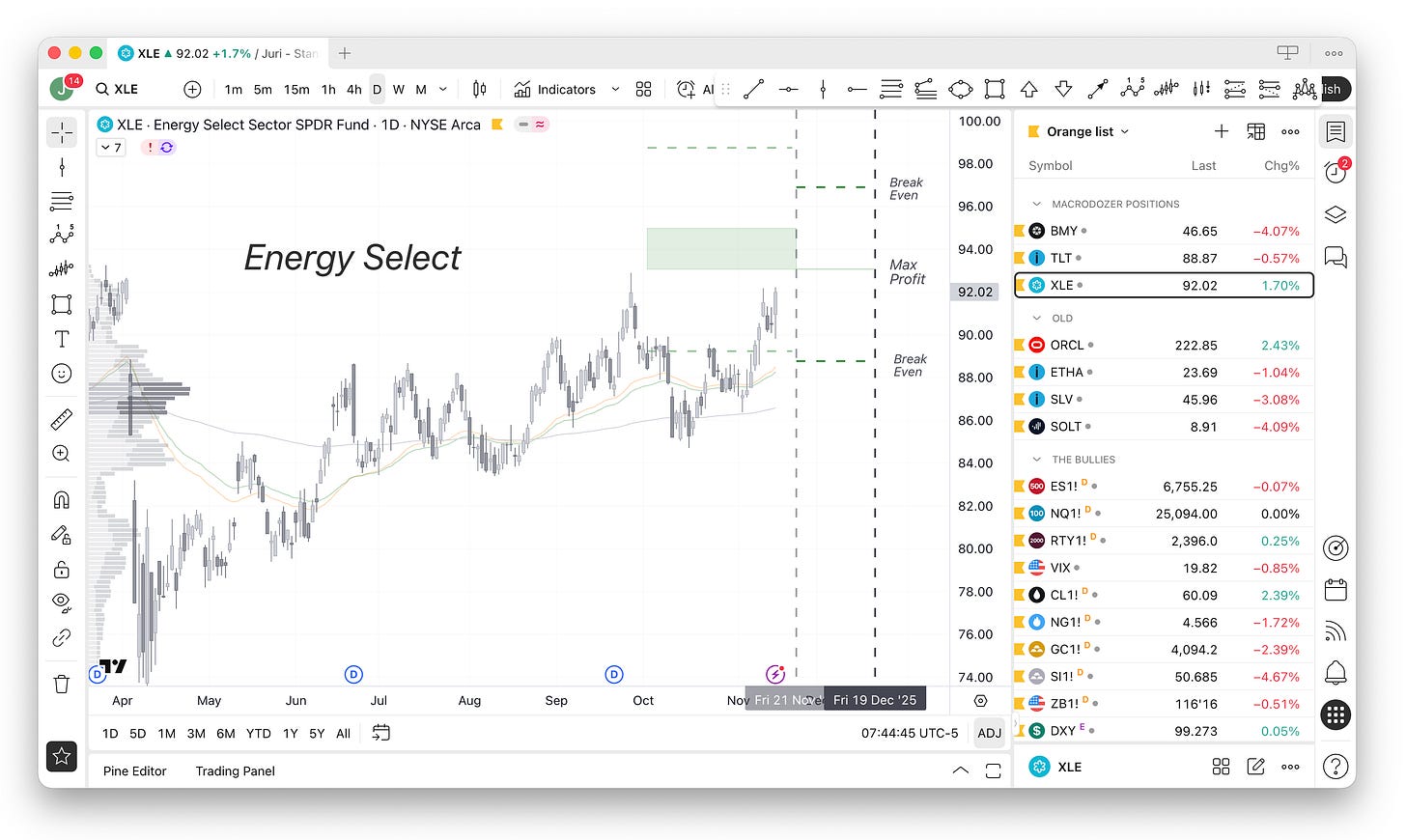

Create a Max Profit & Break-Even drawing template.

Together, we set up your TastyTrade (TT) broker account (or another platform if TT is not available).

Demonstrate how quick and intuitive trade setup and refinement is on TT.

Homework

Create an example trade (e.g., XLE) in both your broker platform and TradingView. Mark the breakeven levels and expiration date on your chart.

Skip Check

Build a trade and save both a payoff diagram and a price chart screenshot within three minutes, without help.

⓶ Sizing & Basic Math

Goal

Know your maximum possible loss before you ever click Send.

In Session

Convert your account into a fixed per-trade dollar risk.

Set cool-off rules: if you reach your monthly options cycle limit, stop adding new trades; same for the day or week if needed.

Understand performance math for credit trades (the ones that pay you upfront):

Percent return = (credit received − debit paid to close) ÷ maximum loss

Homework

Think about your personal one-page Risk Charter (see example at the end).

Skip Check

Given one option chain, you can explain the maximum loss, breakeven points, and why the trade size is appropriate for your account.

⓷ Finding Trades That Won’t Trap You

Goal

Pick trades that are liquid and avoid potential landmines.

In Session

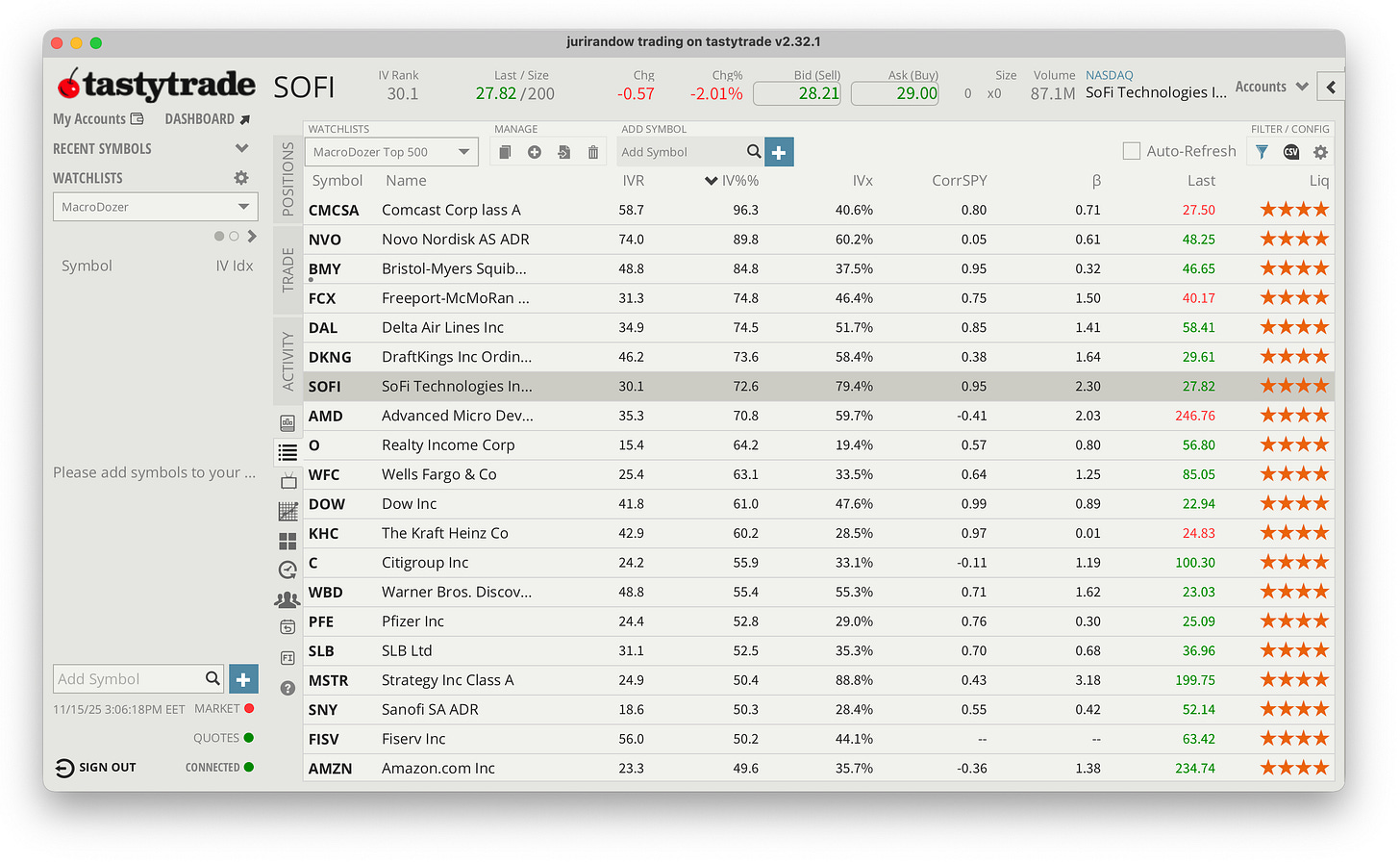

Build a watchlist that can be ranked by implied volatility (credit strategies generally work best in above-average volatility).

Confirm liquidity: look for tight bid–ask spreads and active trading volume.

Avoid binary risk: skip trades with upcoming earnings announcements or biotech trial results that can cause unpredictable moves.

For ETFs, check what’s inside (using Koyfin or your preferred tool) so you understand what you’re really trading.

Homework

Tag three tickers you would trade and three you would avoid, and write one short reason for each choice.

Skip Check

Show me one good candidate and one no-go, each with a one-line explanation.

⓸ Vertical Spreads (Credit & Debit)

Goal

Learn the simplest defined-risk option structures first.

In Session

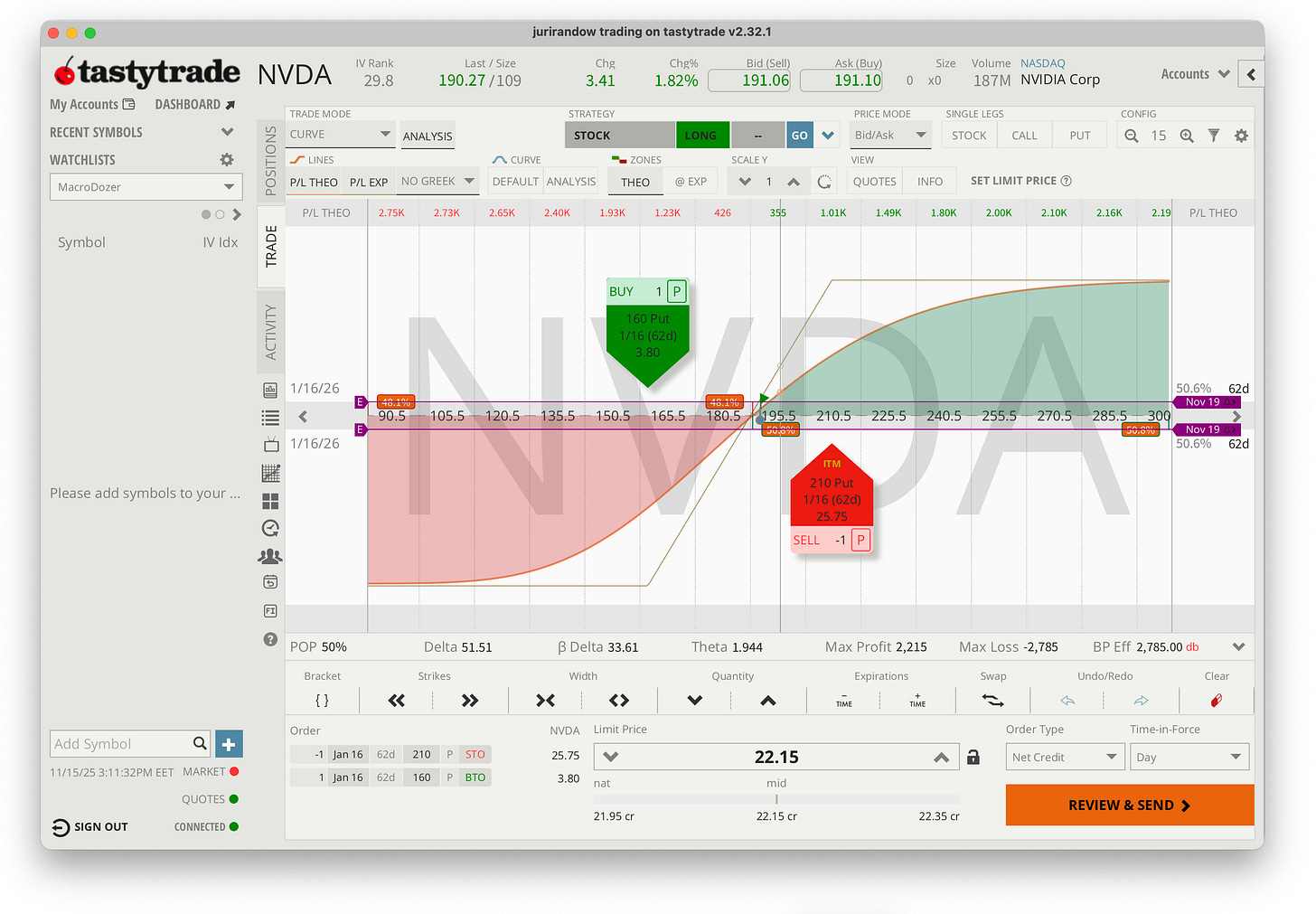

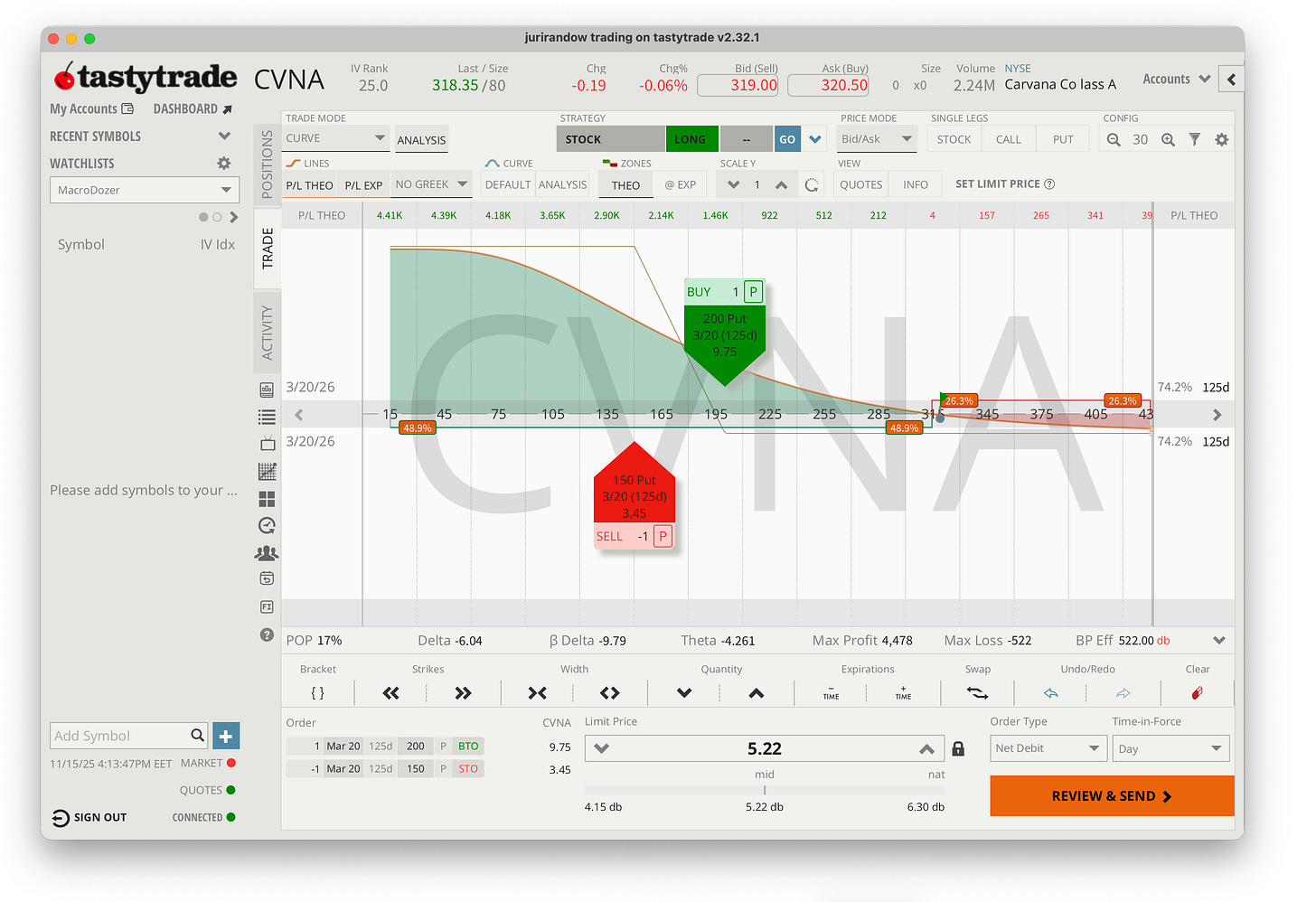

Build one bullish and one bearish vertical spread with 40–65 days until expiration.

Set clear exit rules: take a reasonable profit if it arrives early, or re-evaluate about 18–21 days before expiration.

Case study: Why we generally avoid selling deep in-the-money puts, and how a debit call spread expresses the same bullish idea, but with limited downside risk.

Homework

Place one small vertical trade or paper-trade it. Write down your trade thesis and note what would prove you wrong.

Skip Check

Explain, in plain words, why you chose those strikes and how you plan to exit.

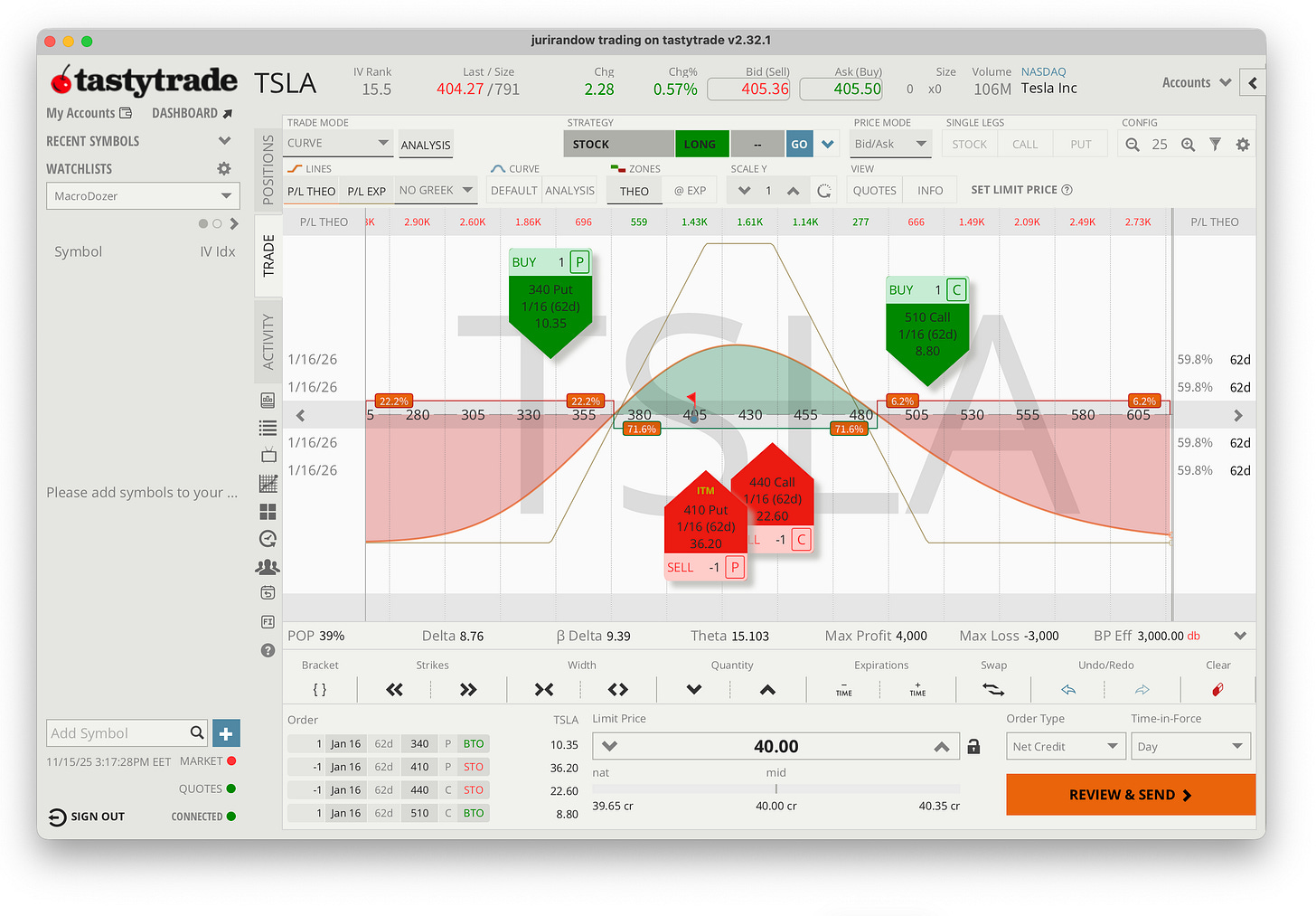

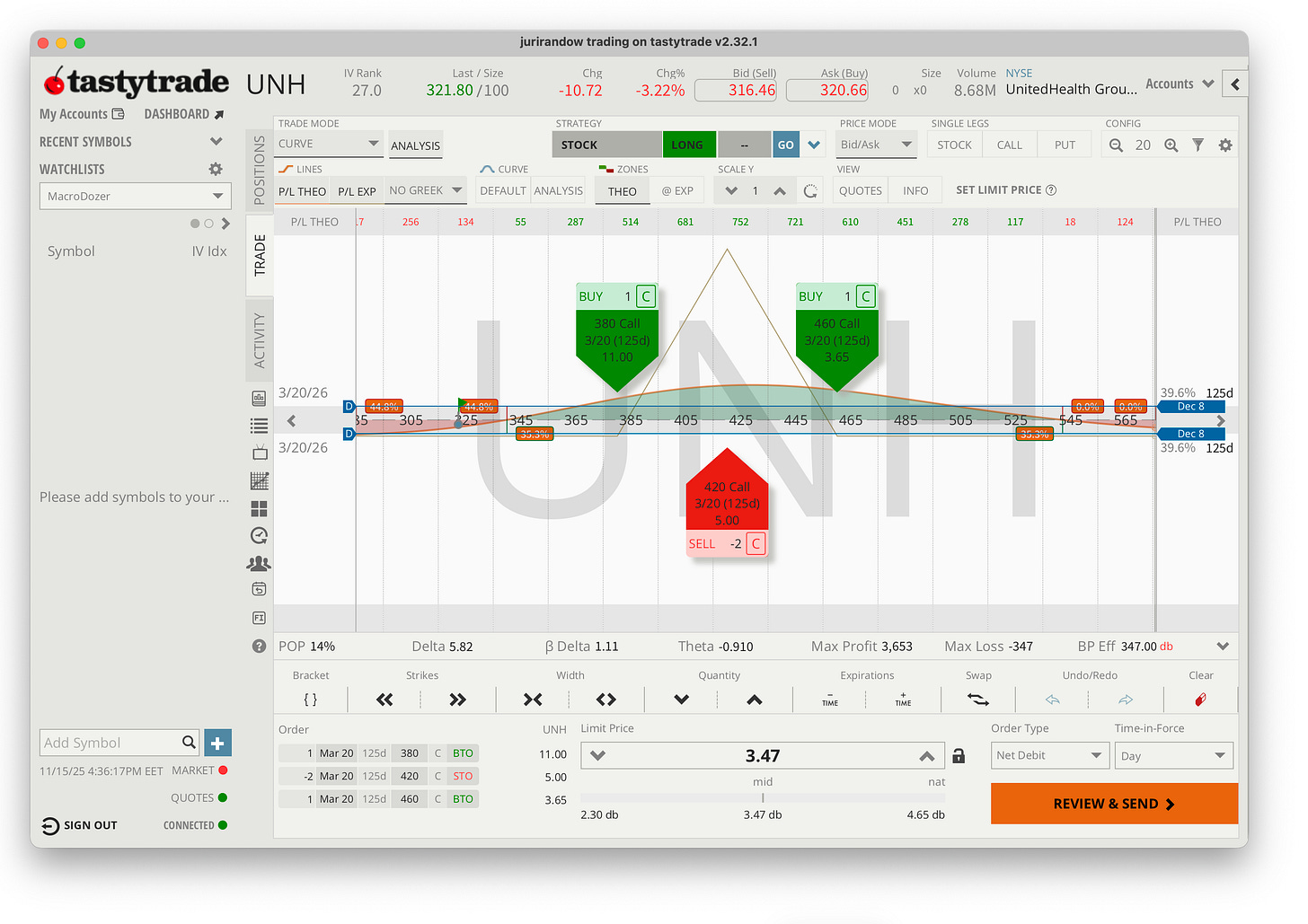

⓹ Iron Condors (Our Way, Not the Textbook Way)

Goal

Create neutral or slightly directional income trades with a balanced risk-to-reward ratio.

In Session

Build an iron condor with roughly 1:1 risk to potential profit, avoid the classic “collect pennies, risk dollars” setup.

Practice a slightly bullish or bearish tilt when the payoff chart or risk line supports it.

Management: Generally, don’t touch the trade during the first couple of weeks. As expiration approaches (around 18–21 days left), decide whether to close, roll, or restructure.

Rolling for a Net Credit (Repair):

If one side is being tested, move that side out in time for a small debit.

Adjust the safer side for a credit.

The goal: achieve an overall net credit so your total risk doesn’t increase.

Homework

Build one balanced and one slightly directional condor. Write a short, two-line repair plan explaining how you’d handle a challenged side.

Skip Check

Walk me through a tested-side scenario and describe your net-credit roll in plain, simple language.

⓺ Trade Repairs, Exits & Assignment (Calm Under Pressure)

Goal

Have a clear script for rough days so you can act calmly and consistently.

In Session

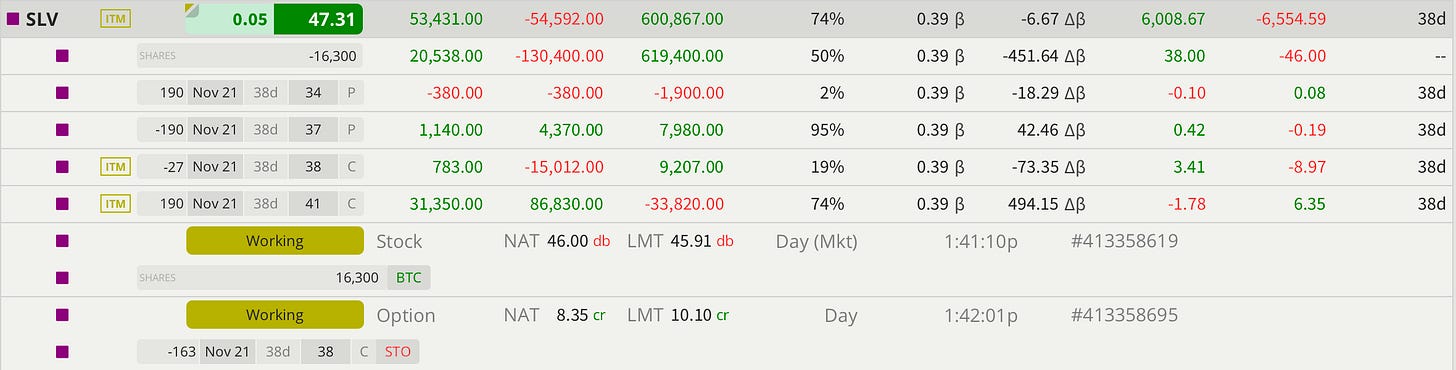

Review a repair playbook with real examples, when to wait, when to roll, and when to close.

Practice an assignment drill:

If you’re assigned shares, use your broker’s “Close Position” feature or place an opposite order at the market open to flatten the position

Re-establish your option trade simultaneously.

You don’t need full cash coverage if you reverse the position quickly and correctly.

Homework

Write down your two preferred repair methods and one hard “I’m out” rule for when you’ll simply close and move on.

Skip Check

Given a challenged trade or an assignment (either from a short call or short put), explain exactly how you would fix it, step by step.

⓻ Technical Edge (Simple and Consistent)

Goal

Use a few tools well, rather than many tools poorly.

In Session

Use the 40-, 50-, and 200-day moving averages, Fibonacci levels, and the Volume Profile (volume-by-price) indicator to forecast share price movement.

Mark breakeven levels and expiration dates directly on your chart for visual clarity.

Practice reading charts across multiple timeframes (for example: 1-hour, daily, weekly) to identify key levels where price has previously stalled or reversed.

Interpret the implied volatility (IV) chart of your chosen underlying in TastyTrade and note where selling a credit strategy would have historically worked well (typically when IV is elevated).

Homework

Create one annotated chart that includes:

Your trade thesis

Breakeven and profit levels

A clear repair scenario (where you’d have to repair the trade)

Skip Check

Explain and defend your strike choices for a debit or credit strategy using the chart levels you identified.

⓼ Hedges & Portfolio Mix (Keep Drawdowns Saner)

Goal

Reduce that “all-eggs-in-one-basket” feeling and make your portfolio more resilient.

In Session

Add a simple hedge using a bearish trade (for example, a bearish iron condor) that can be repaired multiple times and kept running for about three months.

Keep a large cash sleeve — ideally 50–70% of your allocated capital — parked in short-term Treasuries. This earns risk-free interest and gives you buying power during market corrections when others are panicking.

Aim for a delta-neutral portfolio, where your overall exposure to market direction is balanced.

When markets become stretched to the upside, consider adding a bearish hedge on a downtrending or overextended underlying.

If needed, add additional hedge with a put debit spread or a bearish put fly for defined downside protection.

Homework

Find one bearish trade in a downtrending underlying and describe your action plan if the trade moves against you.

Skip Check

Show how your portfolio becomes safer with a well-diversified, delta-neutral structure, and explain when a full hedge might be useful.

⓽ Butterflies (Bullish Call Fly)

Goal

Use a bullish option structure that can perform better than a simple debit spread in certain conditions.

In Session

Build a symmetrical call butterfly — one long call, two short calls, and one long call at a higher strike — with about 90–120 days until expiration so that time decay (theta) has less impact.

Compare its profit curve to a plain debit call spread.

A butterfly can be more profitable on a moderate upward move.

Losses on a pullback are often smaller and more controlled than with a single debit spread.

Homework

Build one bullish call butterfly on a liquid stock or index, and write a clear exit plan — when you’ll take profits or close if the thesis fails.

Skip Check

Explain why you chose the butterfly instead of a debit spread for this chart and market scenario.

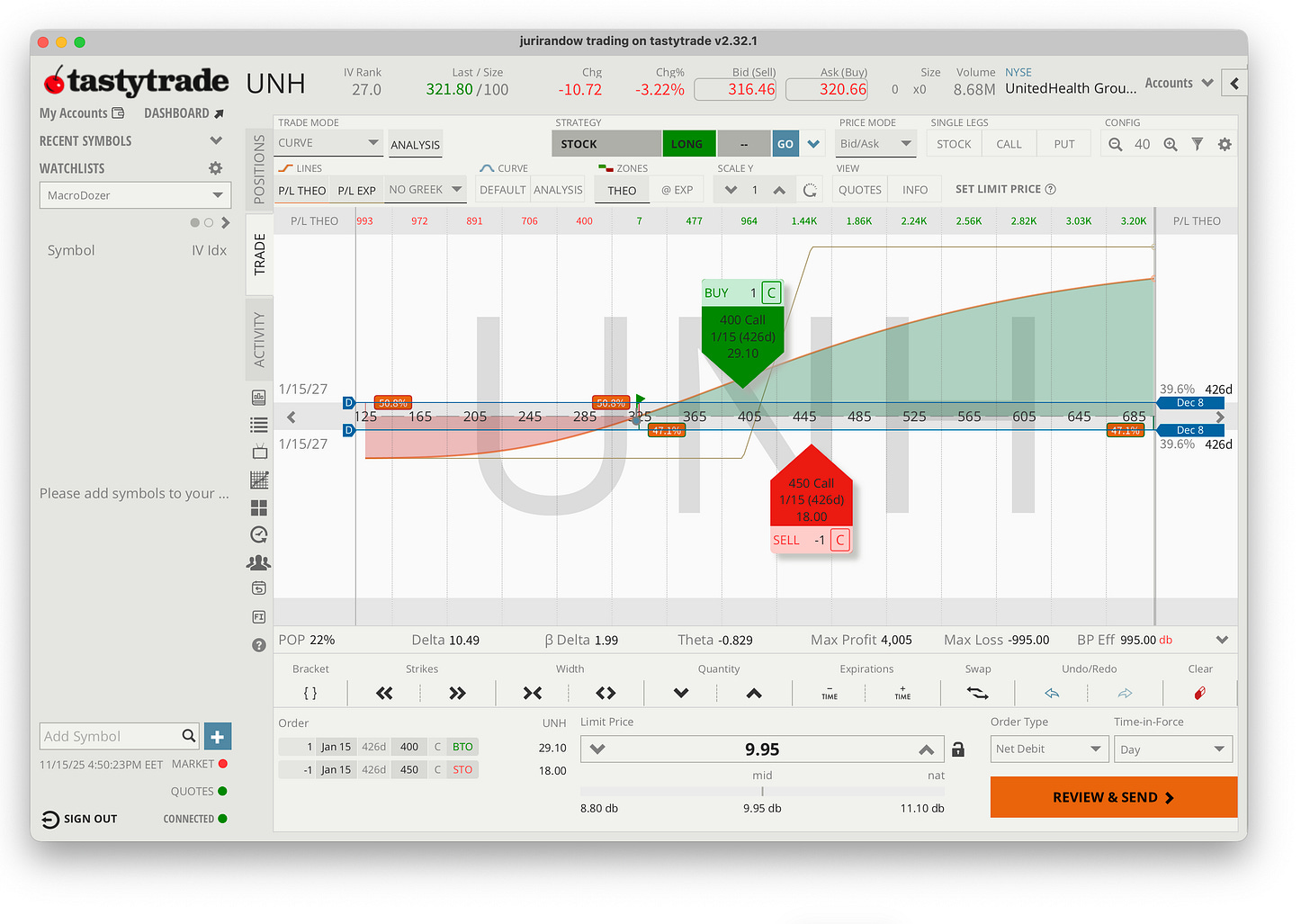

⓾ Equity Replacement (LEAPS)

Goal

Gain stock-like exposure while using far less capital and keeping your risk clearly defined.

In Session

Learn how to replace 100 shares of stock with a long-dated call option or a call debit spread (known as a LEAPS, which stands for Long-Term Equity Anticipation Securities).

Create a check-in schedule; decide when you’ll review, roll forward, or resize the position instead of leaving it to “set and forget.”

Avoid too-narrow spread widths (strikes that are too close together) and illiquid expirations where option trading activity is thin. Liquidity is key for fair fills and flexibility.

Homework

Draft a simple plan for one LEAPS idea that includes:

The reason for the trade

The risk amount and breakeven price

When and how you’d adjust or roll the position

Skip Check

Explain how you’d manage a 40% drawdown on a LEAPS or LEAPS debit spread without increasing your total risk.

One‑Page Tools

(A) Risk Charter

Account: $10,000 • Per‑trade max loss: $500 (or less!)

Max open trades: 5 (avoid overlapping bets)

No earnings between trade opening and contract maturity.

Decision point: 18–21 days before expiration

Only trade liquid options (tight prices, active markets)

Journal. Simple screenshots of the pay-off chart & price graph enough!

(B) Pre‑Trade Quick Check

Is the max loss within your limit?

Is the market liquid enough?

Are you doubling up on the same theme?

Any earnings/ other binary event between now and contract end?

One‑sentence thesis and what could prove it wrong?

Exit plan (18–21‑day decision)?

Saved the screenshot of (1) option pay-off chart and (2) share price graph?

(C) Journal

Screenshot the option payoff chart and the share price graph at (1) entry, (2) repair, and (3) exit.

Calculate your return on risk capital.

Don’t waste time, keep it super light and fun and focus on finding new trades.

Notes We Keep Repeating

Start small. Defined‑risk only. Let time do its job; don’t over‑trade.

Rolling for repair: Aim for an overall net credit; if you can’t get it without increasing risk, don’t roll or roll and decrease the number of contracts.

Assignment is manageable: Reverse quickly and re‑establish the option to gain time; the platform helps you do this. Potentiall restructure trade. THE ASSIGNMENET ITSELF WILL NOT LOSE YOU MONEY!! The long or short shares assigned behave very similar to the short call or short put.

Illiquid products are a trap: If you can’t roll it, don’t open it. Use liquid ETFs when most single names have earnings. Avoid low implied volatility, especially then.

Consistent process beats prediction. We trade plans, not headlines.

Final Word

Use this page as the base plan. We’ll customize your learning journey based on your experience and personality.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.