🎯 TUESDAY TARGET: Salesforce (CRM) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

The illusion of free markets took a heavy blow this weekend. When the NY Fed conducts a rate check to prop up the Yen, we are witnessing a soft-power Plaza Accord in real-time. The Treasury has effectively turned the dollar into a political tool to save a strategic ally, signaling that authorities will manipulate prices whenever the market threatens their stability.

This frantic need for control appears just as the veneer of stability cracks elsewhere. BlackRock’s private credit fund marking down assets by nearly 20% exposes the dangerous reality behind those smooth, low-volatility charts. The mark-to-model fantasy, where illiquid loans are valued by spreadsheets rather than buyers, is finally colliding with higher rates. We see the cockroaches crawling out from under the floorboards of private equity, proving that accounting magic cannot erase insolvency.

Investors are reacting accordingly. The violent squeeze in Silver and the parabolic bid for commodities represent a total rejection of these managed narratives. The crowd is moving capital away from manipulated fiat and opaque credit models toward the only place where true price discovery still exists: physical reality. When the system tries to fake stability, the market responds by breaking the things they cannot print.

Below, as always, the rest of what’s cooking:

The Software Short Squeeze

Hedge funds hold record long positions in semiconductors while shorting software stocks to historical extremes. This massive positioning divergence creates a coiled spring for a violent reversion. A minor earnings beat in software or a stumble in chips could trigger a brutal squeeze. When consensus trades become this lopsided, the market often punishes the crowd by ripping the hated sector higher while the darlings stall.

China Wins the Auto War

BYD overtaking Tesla in global sales confirms a permanent shift in automotive dominance. Western tariffs act as defensive walls acknowledging this manufacturing defeat. Chinese automakers are scaling production and capturing emerging markets with superior cost efficiency. The global industry now follows Beijing’s lead, leaving legacy brands to retreat behind protectionist barriers while the mass market shifts irrevocably to Asian producers.

Europe’s Digital Power Deficit

Europe regulates AI models, whereas the US and China build the necessary physical infrastructure. The continent faces severe power grid constraints and a lack of compute capacity. By focusing on legal frameworks over megawatts, Europe renders itself structurally uncompetitive in the hardware layer of the technology boom. Capital will flow to energy-rich jurisdictions, ensuring the EU remains a consumer dependent on foreign producers.

Profitable Fragmentation

Geopolitical friction is proving structurally bullish for the shipping industry. Trade wars and route diversions reduce effective fleet supply, forcing vessels onto longer voyages. These inefficiencies act as a profit multiplier for freight operators. While the broader economy suffers from supply chain friction, shipping stocks thrive on the chaos that tightens global capacity and boosts rates. Disorder creates cash flow for those moving the goods.

THE WEEK: Fed, Tech, and Tokyo

Wednesday brings a critical FOMC showdown where Powell must navigate political subpoenas and questions on currency intervention. This coincides with a massive earnings test as Microsoft, Meta, Tesla, and Apple report results that must validate immense premiums. Add in Friday’s US PPI and a Tokyo CPI print capable of breaking the JGB market, and investors face a volatility gauntlet that leaves little room for policy errors or guidance misses.

Traditional Tactics for this Tape

The trade is rotation, not index-chasing. Capital is fleeing crowded mega-cap tech for the scarcity of real assets like Gold and Silver. We favor the “Long Detroit” theme, domestic industrials, over the financialized “Davos” consensus. With asset managers holding record short volatility positions, the market is fragile. Use this artificially cheap volatility to buy protection while maintaining exposure to the tangible economy.

Do not guess. But do reach out. Let’s build a capital-efficient yet risk-managed strategy from the option chain up.

Get Rich Overnight with Options? Yeah Right...

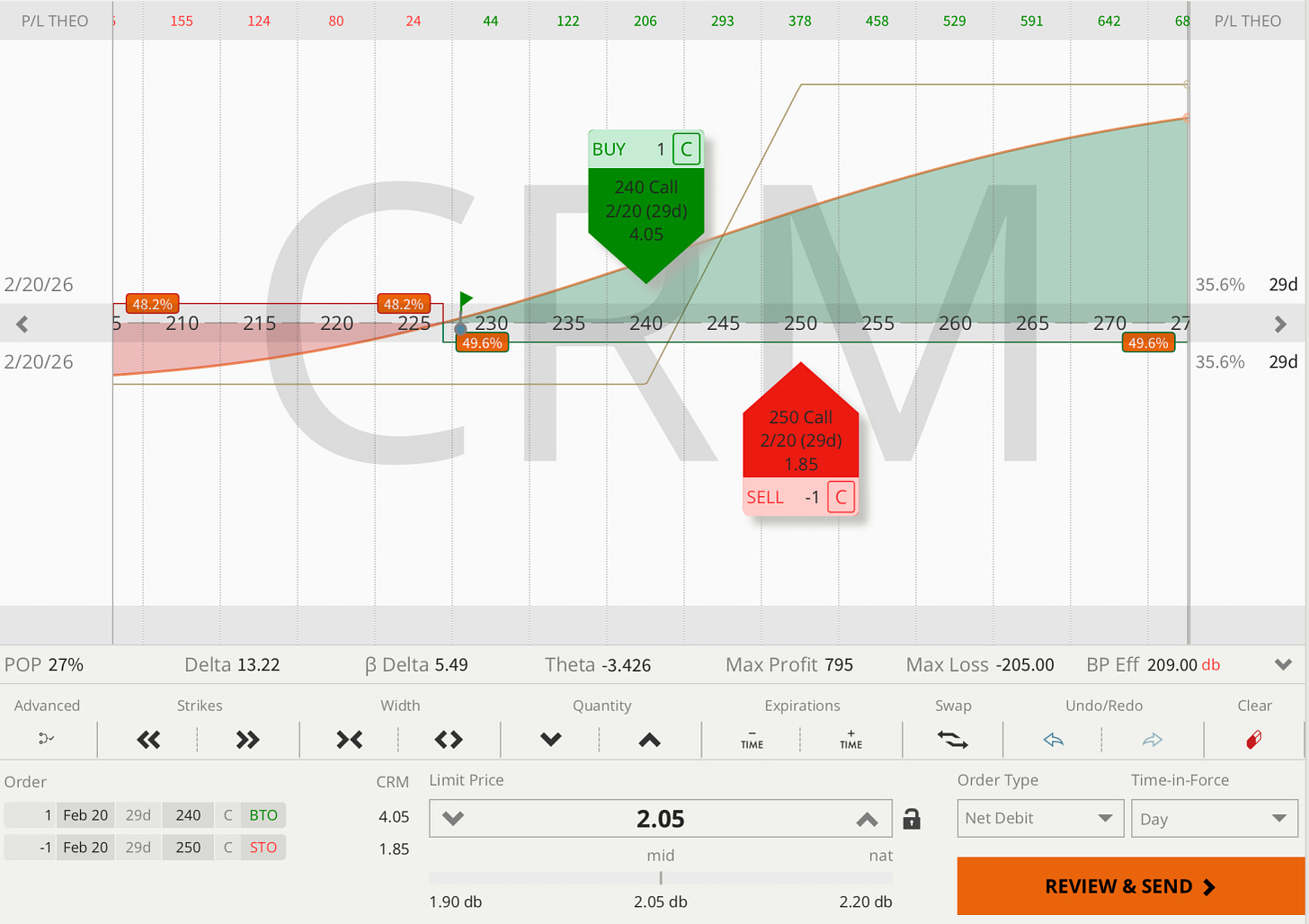

TUESDAY TARGET: Salesforce (CRM)

Tuesday sometimes comes late… (make sure you’re in the elite-trader Discord channel to catch these ideas early), so consider a longer maturity. We’ll post an update when we exit on Discord.

While the crowd is busy chasing semiconductors, hedge funds have pushed their net short exposure in software to the lowest levels on record. With major earnings coming up, expectations couldn’t be lower. We’re fading the clowns and looking to catch a potential short squeeze.

Not an official trade entry, just food for thought. Official trade entries for your paper trading accounts are available in the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 60-Minute Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious1 investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

If you are only here for the money, look elsewhere. Success requires a dedication to the craft.