🎯 TUESDAY TARGET: Micron Technology (MU) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

The crowd is cheering the capture of Venezuela’s leadership as the return of cheap energy. They see the world’s largest oil reserves and immediately imagine a flood of supply. However, geology offers a sobering counterpoint: Venezuela sits on extra-heavy, sulfur-rich sludge that behaves more like wet pavement than liquid fuel. Turning that asphalt into energy demands billions in capital and years of complex refining. While the headlines obsess over volume, the smart money worries about viscosity.

This scramble for difficult, dirty assets signals the dawn of ProSec: Production for Security. The global operating system is pivoting from green efficiency to raw redundancy. Governments are locking down hemispheric resources to fortify the industrial base, prioritizing physical control over moral comfort.

Wall Street has already priced in the human cost of this transition. The new institutional playbook is ruthlessly specific: Long the companies using AI to replace labor, and Short the businesses relying on the lower-income consumer. Capital is effectively betting on the machines to secure the future while shorting the demographic paying the bill. The empire secures the resources, the algorithms capture the margin, and the average citizen gets the squeeze.

Below, as always, the rest of what’s cooking:

The Hardware Truth Serum

Software valuations often run on marketing hype, but the South Korean KOSPI index offers a grounded signal for actual AI demand. Driven by real semiconductor exports and hardware realities, the Korean market is finally staging a breakout. This suggests the global infrastructure build-out is accelerating, providing a leading indicator that the Nasdaq’s strength is backed by tangible orders and physical shipments rather than just sentiment.

Silver’s Logarithmic Logic

The vertical ascent in silver prices is generating bubble warnings, yet long-term logarithmic charts suggest a rational catch-up is underway. After decades of currency debasement, the metal is reverting to its historical mean against the global money supply. With the dollar’s share of sovereign reserves hitting multi-decade lows, precious metals are behaving less like speculative commodities and more like essential hard asset anchors in a fragmenting monetary system.

Animal Spirits Return

Corporate confidence is roaring back with a 65% surge in global M&A volumes. CEOs are pivoting from organic growth strategies to aggressive acquisitions, utilizing high stock prices as currency. This revival of animal spirits often marks the mature phase of a business cycle. It signals that companies see more value in consolidating competitors than in investing in their own capital expenditure projects, often leading to a final melt-up.

Copper’s Supply Squeeze

Copper prices are breaking out as supply threats collide with strategic stockpiling. Labor strikes in Chile and a rush to front-run potential tariffs are draining inventories rapidly. This is a scarcity event driven by the physical needs of data centers and electrification. The red metal is becoming a critical choke point in the global industrial machine, forcing buyers to secure physical delivery regardless of the price.

THE WEEK: Labor Trumps Geopolitics

While global headlines fixate on the action in Venezuela and Iran, the real market signal lands Friday with the U.S. jobs report. With unemployment hovering at a four-year high of 4.6%, the Fed requires a soft print to justify further easing. Watch Wednesday’s JOLTS and ISM Services for early tremors; if the labor market cracks significantly, bad news may stop being treated as a liquidity signal and start looking like a recession.

Tactics for this Tape

The S&P 500 is currently pinned above the 6,900 gamma flip level, creating a mechanical dealer pull toward 7,000 into January expiration. However, structural support below 6,700 is virtually non-existent. With implied volatility screening historically cheap despite the geopolitical noise, the smart play is simple: ride the momentum in defense and hardware names, but use dirt-cheap puts to insure the portfolio against a sudden air pocket. Long exposure demands a parachute here.

Do not guess. But do reach out. Let’s build a capital-efficient yet risk-managed strategy from the option chain up.

Get Rich Overnight with Options? Yeah Right...

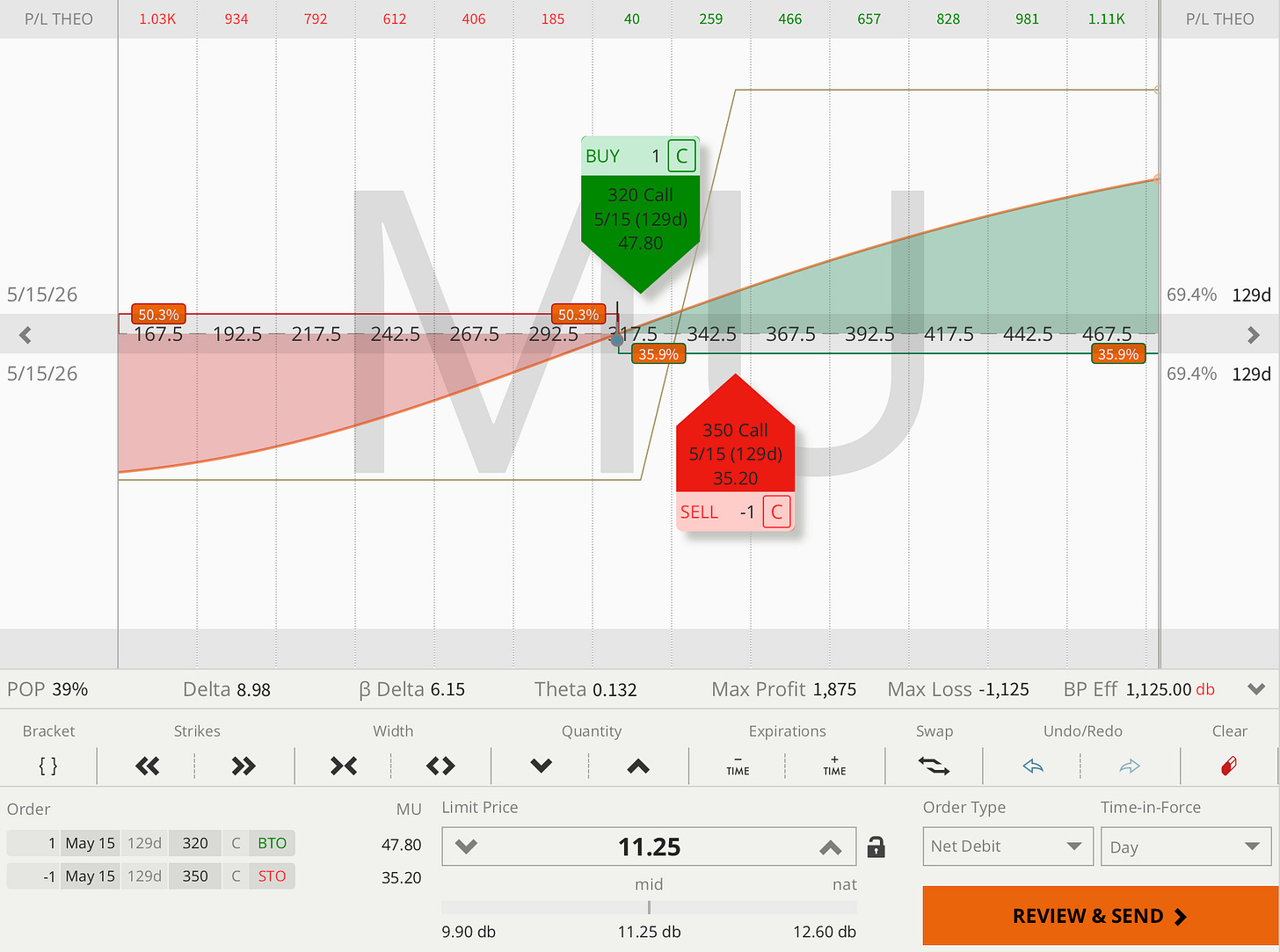

TUESDAY TARGET: Micron Technology (MU)

Pure momentum play. Normally, we would wait for a retrace, but valuation multiples are not expanding in lockstep with the share price, perfectly validating the Hardware Truth breakout we see coming out of Korea. You are buying the physical reality, not the software hype. Be mentally prepared for the price to air-pocket down to $285.

And for that dirt cheap hedge? Why not grab a straight-up XLK Put (Mar 20 maturity, 125 strike)? Tech volatility is cheap, so combining a hardware moonshot with penny-stock insurance on the broader sector… A combo that could be fun.

Not an official trade entry, just food for thought. Official trade entries for your paper trading accounts are available in the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 60-Minute Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious1 investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

If you are only here for the money, look elsewhere. Success requires a dedication to the craft.