High Returns, High Taxes?

Definitely Not

Mauritius Update & Tax Optimization

Dear Friends & Family Investors,

We're upgrading our structure to become a fully licensed investment firm (Mauritius GBC) within the next 3-6 months, allowing us to officially manage investments and fees completely tax-free at the corporate level.

How You Can Optimize Your Own Tax Efficiency

If you’re currently based in high-tax countries (U.S., Germany, UK, Spain, Argentina), profits from personal brokerage accounts are typically taxable annually at high rates (up to 40%+).

Legal Solution: You can individually establish your own Mauritius GBC company (separate from ours).

Your personal Mauritius GBC would:

Open a business bank account (Mauritius, Switzerland, UAE, or similar jurisdiction).

Fund this account legally from your home country.

Open a corporate brokerage account at Tastytrade (widely accepted globally).

Appoint MacroDozer as your investment manager (via limited power of attorney).

Tax Benefits for You

Profits realized through your Mauritius GBC remain completely tax-free at the company level as long as they’re not distributed back personally to your high-tax residency countries.

No immediate tax liability: Your earnings compound offshore, tax-free.

Flexibility: When you eventually relocate temporarily (6-12 months) or permanently (e.g., to Portugal, UAE, Singapore, Hong Kong, Monaco, Andorra, Thailand, Malaysia, Costa Rica, or another tax-efficient jurisdiction), you can distribute accumulated profits tax-free.

How Fees Work & Tax Implications

Your Mauritius GBC will handle all fee payments directly to MacroDozer, ensuring full tax efficiency. Fees are only charged when earned, and payments remain tax-free at the corporate level.

2% annual management fee (only if earned).

20% performance fee (only if we beat the S&P 500 and NASDAQ).

Payments are made corporate-to-corporate (Your Mauritius GBC → MacroDozer GBC) with 0% corporate tax.

Investors only face taxation when withdrawing profits into their personal accounts in their home country.

Legality & Transparency

This structure is completely legal and transparent if properly reported:

U.S. investors file annual reports (FBAR/FinCEN, IRS).1

German, UK, Spanish, and Argentinian investors disclose offshore entities to local tax authorities.2

You gain maximum legal tax efficiency without risking compliance issues.3

Typical Costs of Your Own Mauritius GBC

Setup cost: Approx. $5,000–7,000 (one-time).

Annual maintenance: Approx. $5,000–7,000/year.

Company can be useful for other investment or wealth management purposes.

Next Steps & Timeline

Within the next 3-6 months, MacroDozer completes licensing & company setup.

We’ll then personally help interested investors set up their own structures through trusted Mauritius-based partners.

No immediate action needed from your side—we'll guide you step-by-step when ready.

Primary Benefits and Why This Makes Sense

Legal tax deferral and accumulation of wealth offshore.

Globally reputable structure for peace of mind.

Greater net returns due to reduced tax liabilities.

Flexible withdrawals in the future when in a favorable tax jurisdiction.

MacroDozer Update & Return Optimization

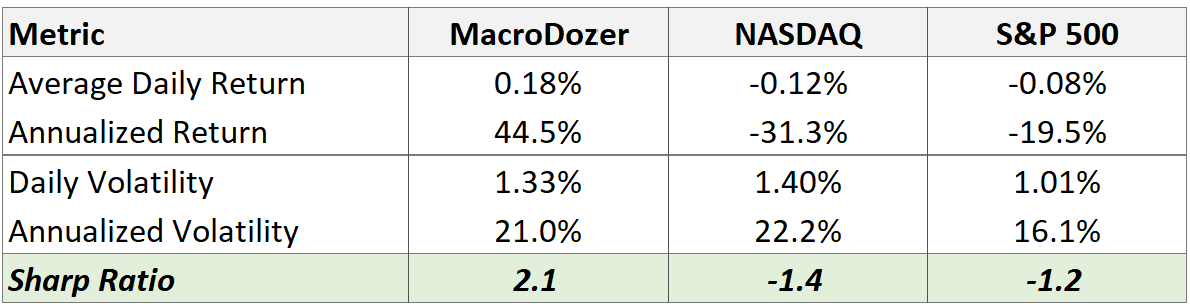

How do we know if MacroDozer’s 8.6% YTD return (2025) comes with less risk than the S&P 500 (-4.0%) or NASDAQ (-6.4%)? One way is the Sharpe Ratio, which measures return relative to volatility (or how “bumpy” price movements are).

Our Sharpe Ratio stands at 2.1, meaning we’re generating strong, risk-adjusted returns—not just following market swings. In contrast, the NASDAQ (-1.4) and S&P 500 (-1.2) show negative returns with no compensation for volatility.

For context, the S&P 500’s historical Sharpe Ratio averages 0.4–0.6, rising to 0.8–1.2 in bull markets. At 2.1, MacroDozer isn’t just ahead—we’re far outperforming historical norms.

More returns, less risk, no taxes. That’s how we optimize.

Cheers,

Juri

Considerations for High-Profile Investors

Executives, public figures, institutional professionals, and journalists must take extra care when structuring offshore investments.

Clear Business Purpose: Your Mauritius GBC should serve a defined investment or wealth management function, not just tax deferral.

Reputational Risk Management: Offshore investing is legal but requires professional handling of disclosures with qualified tax advisors.

Alternative Structures: If a Mauritius GBC isn’t ideal, family offices, private foundations, or trusts in Singapore, UAE, or Switzerland may be better suited.

United States (U.S. Citizens & Residents):

You must report all offshore accounts annually (via IRS forms FBAR/FinCEN, Form 5471, Form 8938).

The U.S. imposes taxes on your worldwide income, regardless of where you live. Offshore profits in a Mauritius GBC offer tax deferral, not exemption.

Advice: Use your Mauritius GBC strictly to defer taxes (profits compound offshore). Eventually, distributions back to the U.S. trigger personal taxation—structure with specialized U.S. advisors to optimize timing and compliance.

Germany, UK, Spain, Argentina:

Your home country’s Controlled Foreign Corporation (CFC) rules could mean annual taxation—even if profits remain offshore undistributed.

Strict mandatory disclosure of offshore structures applies annually (Germany: Finanzamt, UK: HMRC, Spain: Modelo 720, Argentina: AFIP).

Tax deferral offshore is possible but requires a genuine business purpose (investment or wealth management, not solely tax avoidance), active management structure, and detailed annual disclosures.

Recommended Actions (All Jurisdictions):

Clearly establish your Mauritius GBC’s legitimate business/investment purpose (investment or wealth management, not solely tax avoidance).

Engage experienced tax advisors in your home country to ensure transparent annual disclosures and optimal legal tax treatment.

For maximum future tax efficiency, plan relocations strategically to jurisdictions with favorable tax treatments for distributions (e.g., UAE, Monaco, Panama, Portugal NHR, Singapore, Andorra).