🎯 TUESDAY TARGET: MP Materials (MP) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

Wall Street loves a binary debate. The current obsession with labeling Fed nominee Kevin Warsh a hawk or a dove keeps the audience distracted while the architects quietly redesign the building. We are witnessing the effective merger of the Treasury and the Central Bank, the onset of Fiscal Dominance. To manage the debt pile without spiking yields, the system requires a convincing deflationary cover story.

Enter the AI productivity miracle. This narrative serves as the perfect alibi, allowing the administration to run the economy hot while promising that technology will keep prices in check. The smart money is already looking past the flashy chatbot phase to the plumbing required to make this story stick. The rise of AI Agents, persistent digital workers, is shifting the bottleneck from simple processing to massive memory retention. It is a structural hardware supercycle in memory chips disguised as a software boom.

This strategy extends aggressively into the physical world. The sudden agreement with India to drop Russian oil for American energy and tariff favors is the geopolitical leg of the stool. By forcing the Global South into the American energy orbit, Washington secures a guaranteed bid for its exports and reinforces the dollar’s dominance. The plan is unified: use the tech narrative to mask monetary inflation, while ruthlessly securing the physical resources to power it.

Below, as always, the rest of what’s cooking:

The Hidden Subprime in Software

While investors chase semiconductors, a solvency crisis quietly builds in legacy software. Hedge funds are aggressively liquidating software stocks to fund AI bets, crushing the collateral backing billions in private credit loans. Business Development Companies (BDCs) face a subprime moment as their safe allocation to software turns toxic. The market is pricing in obsolescence for the very assets backing the yield trade.

The End of Free Market Minerals

With Project Vault, the US government is effectively nationalizing the critical mineral supply chain. A $12 billion stockpile for gallium and cobalt puts a floor under prices and signals that national security now trumps market efficiency. Manufacturers are racing to lock in supply, realizing that in a bifurcated global economy, access to physical atoms matters more than the price on the screen.

Musk’s Trillion-Dollar Closed Loop

Merging SpaceX and xAI into a $1.25 trillion entity creates a closed-loop economy that bypasses terrestrial constraints. Starlink’s revenue subsidizes AI cash burn, while orbital data centers promise to solve the power bottleneck. This vertical integration renders traditional valuation models useless; it is an independent industrial ecosystem capable of generating its own energy, connectivity, and compute power outside the reach of earthly regulators.

The Timber Supply Vacuum

North American timber capacity has evaporated due to mass mill closures, creating a classic supply-side bottom. Billions of board feet have left the market just as mortgage rates begin to ease. This is a coiled spring; any government housing stimulus will hit a wall of zero inventory, forcing prices higher. The cure for low prices has been low prices, and the reversal is imminent.

Gold’s Volatility Regime

We are witnessing a rare market anomaly where gold volatility has surpassed that of Bitcoin. This inversion signals a regime change where traditional safe-haven assets are being traded with speculative fervor. When the boring insurance asset becomes the most volatile instrument in the room, it often indicates an impending wash-out of leverage before the structural trend resumes.

THE WEEK: Trading the Data Void

The partial government shutdown has scrubbed the calendar, leaving the Fed and investors flying blind without Friday’s critical Jobs Report. The macro narrative now hinges entirely on Wednesday’s Treasury Refunding announcement, the true liquidity signal, while the micro focus shifts to Alphabet and Amazon to justify the AI capex boom. With the RBA hiking overnight and the ECB and BoE set to hold, policy divergence is back on the table in a market starved for actual data.

Traditional Tactics for this Tape

The historic flush in silver proved that leverage is a fragility trap, not a strategy. We are fading the exhausted retail momentum (or better sell its volatility) and rotating into more unloved value asset plays. With systematic funds leveraged to the hilt and the data dashboard dark, the smart play is to tighten stops, stay liquid, and let the herd chase the noise.

Do not guess. But do reach out. Let’s build a capital-efficient yet risk-managed strategy from the option chain up.

Get Rich Overnight with Options? Yeah Right...

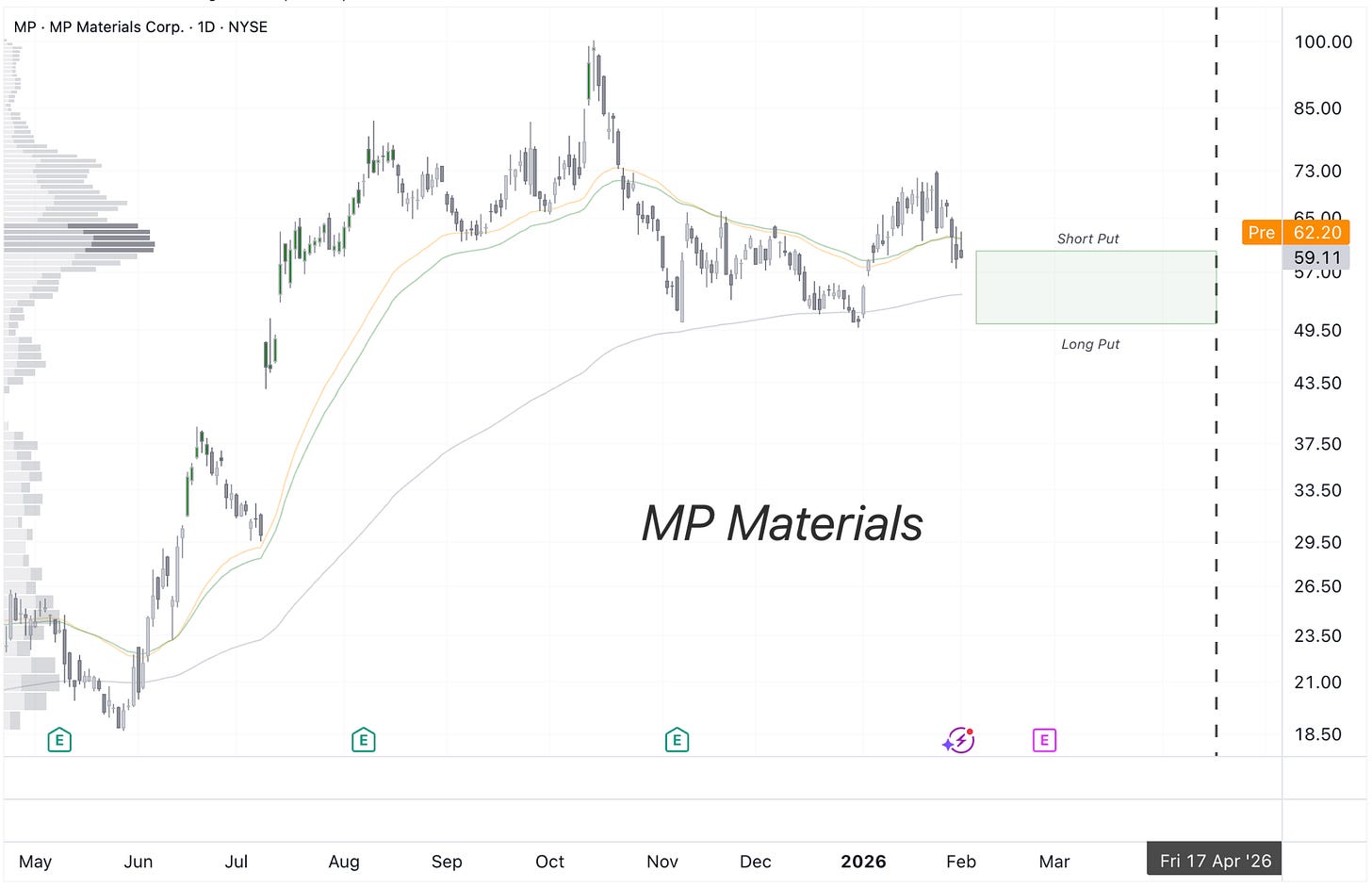

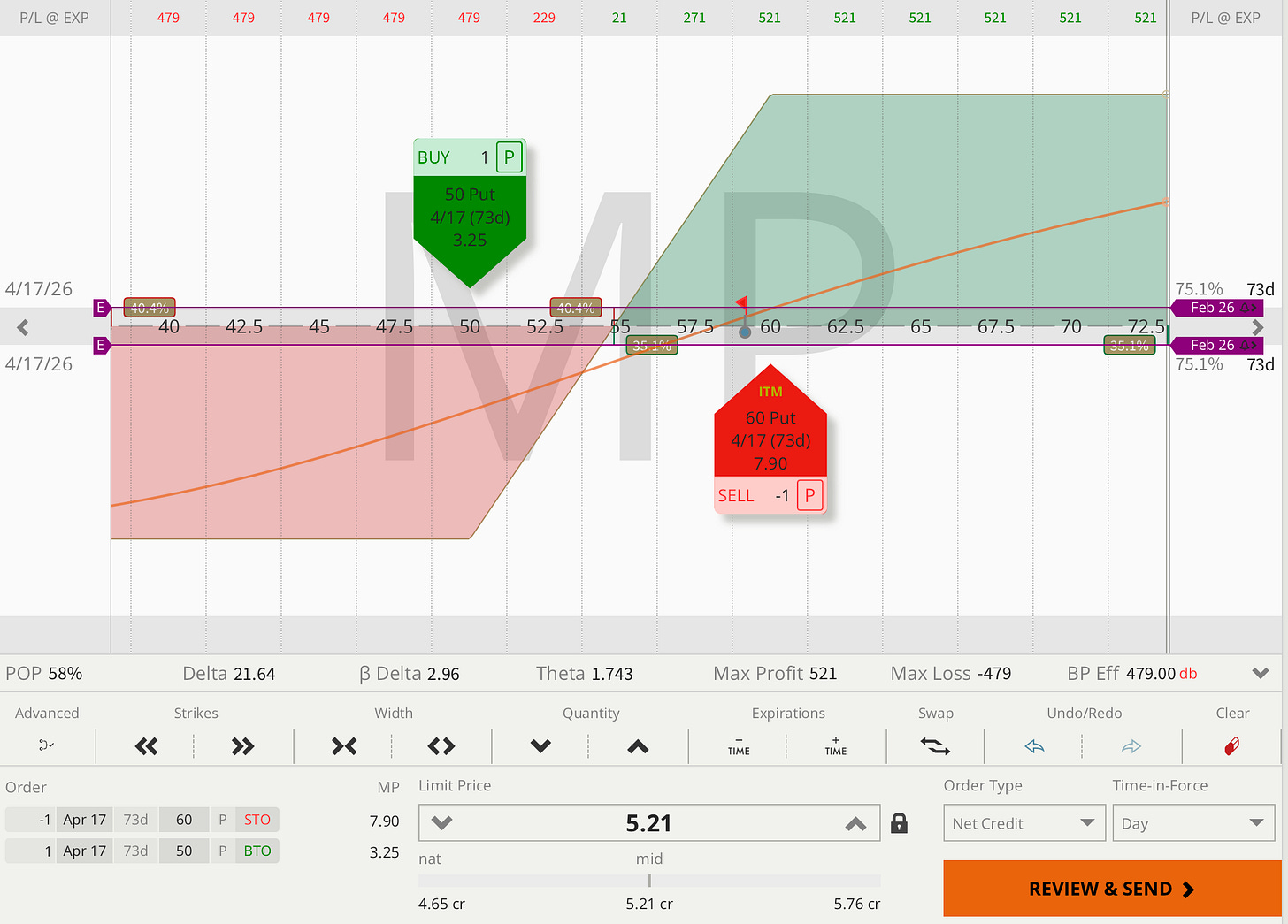

TUESDAY TARGET: MP Materials (MP)

We believe the rare earths chatter isn’t going away anytime soon, so why not consider a relatively defensive put credit spread on MP Materials with more than two months to go. This should provide enough time to manage the position, either exiting for a small loss if things move further south, or locking in a solid profit from a favorable share price move and theta decay.

Not an official trade entry, just food for thought. Official trade entries for your paper trading accounts are available in the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 60-Minute Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious1 investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

If you are only here for the money, look elsewhere. Success requires a dedication to the craft.

Incredible take on the memory bottleneck angle. Everyone's hyped about the next chatbot but the real constraint with AI agents is massive memory retnetion, and hardly anyone is pricing that shift in yet. The comparison between processing and persistent storage is basically right on the money. Saw something similiar when cloud infrastructure first took off,the narrative lagged behind the actual build-out by months. This memory supercycle could be way more significant than most realize.