🎯 TUESDAY TARGET: Nvidia (NVDA) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

While everyone toasts to Nvidia’s clever $20 billion licensing loophole to absorb Groq’s talent without waking the antitrust watchdogs, a much uglier reality festers in the basement.

Buried in the appendix of the latest PJM power auction report lies the dirty secret of this cycle: without regulatory price caps, data center electricity costs would have cleared 60% higher. We effectively subsidize the AI narrative with a grid that physically cannot handle the load. The industry now faces a $5 trillion hangover to rewire the infrastructure for 800-volt architecture.

To fund this, the system relies on a monetary tsunami. With money supply growing at 12% to chase 3% real growth, we dilute the currency to mask the structural friction. The plumbing is leaking, the voltage is unstable, and we print money to cover the repair bill.

Below, as always, the rest of what’s cooking:

Now Who’s Looking Expensive?

Nvidia’s licensing deal with Groq secures critical intellectual property without triggering immediate antitrust blockades. By absorbing the team behind Google’s TPU, Nvidia neutralizes a growing threat to its dominance in inference chips.

The Rewiring Capex Boom

The shift to 800-volt data center architecture requires a complete overhaul of power infrastructure. Current 415-volt systems cannot handle the megawatt-scale density of modern AI racks. This transition directs massive capital expenditures toward industrial suppliers of liquid cooling, advanced power chips, and copper busbars.

The Flying Cash Burn

The hype around air taxi stocks ignores the brutal economics of hardware scaling. Companies like Joby are burning half a billion dollars annually with minimal revenue, trading at stratospheric multiples. The regulatory and safety hurdles create a timeline measured in decades.

THE WEEK: Minutes & Thin Ice

We navigate yet another holiday-shortened calendar where liquidity is scarce and algorithmic noise is high. The main catalyst arrives today with the FOMC minutes, offering a glimpse into the Fed’s internal friction over rate cuts. Wednesday follows with Chinese PMI data, a critical pulse check for the industrial recovery narrative. With markets closed Thursday, expect erratic price action as machines hunt for volume in an empty room.

Tactics for this Tape

We might go for another consolidation move in Silver; we think the somewhat broken squeeze could morph into a 20-40 day sideways chop. Also, dabbling in a long-term equity replacement strategy on Nvidia doesn’t seem completely stupid, as it is trading close to relative valuation lows. We will also do some pricing around copper (FCX) and see what happens.

Do not guess. But do reach out. Let’s build a capital-efficient yet risk-managed strategy from the option chain up.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: Nvidia (NVDA)

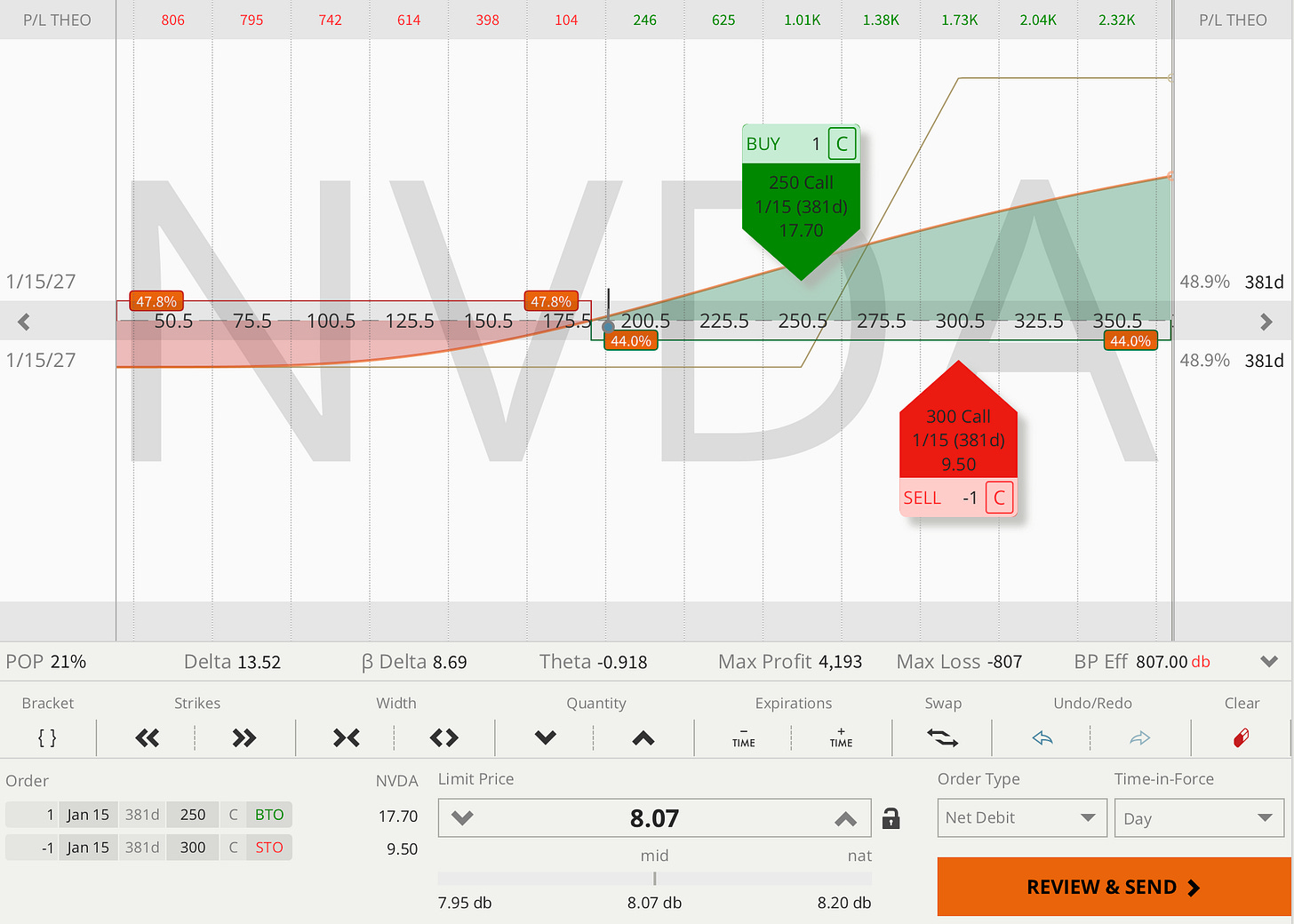

A long-term equity replacement product for NVDA is not for the impatient gambler. It’s a set and forget play, at least for a few months. But turning $800 into $4,000 in just over a year… who wants to do that, right?

Not an official trade entry, just food for thought. Official trade entries for your paper trading accounts are available in the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 60-Minute Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.