🎯 TUESDAY TARGET: Silver (SLV) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

The halls are decked with record inflows and retail euphoria, but don’t let the festive cheer fool you. The index looks like a runner on a treadmill, sweating hard, going nowhere. It is December 23rd, and while the crowd is busy admiring the wrapping paper, smart money is using the holiday noise to hand off their heavy bags to late arrivals. When billions flood the market and prices refuse to budge, we don’t call it a holiday miracle; we call it distribution.

The most critical shifts are currently hiding in the boring details, ignored by algorithms programmed for spectacle. Take the Taiwan narrative. The crowd prices in a cinematic invasion or nothing at all. They miss the “quarantine”, a silent, logistical strangulation Beijing is actively rehearsing. A naval blockade starves an economy just as effectively as a war, bypassing the need for a single explosion.

We see the same selective blindness in digital assets. While the gamblers chase meme-coin volatility, the adults are migrating the seven-trillion-dollar money market industry onto the blockchain. The real revolution is rewriting the financial architecture, far removed from the noise of the casino.

Happy holidays and Merry Christmas. One more thing before you log off: our next 1/52 | Tuesday Target will land before 2026 even begins. Buckle up, next year won’t wait for anyone.

Below, as always, the rest of what’s cooking:

Midterm Election Cycles

Investors anticipating a linear market rally in 2026 should recall historical patterns. Midterm election years typically begin with volatility and stagnation as political uncertainty weighs on sentiment. Markets despise ambiguity, and the battle for Congress ensures a noisy first half.

Crude Reality

Geopolitical risks are putting a floor under oil prices despite the supply glut narrative. The U.S. seizure of Venezuela-bound tankers and attacks on Russian infrastructure are removing physical barrels from the market. We expect oil to remain bid as physical scarcity fears override the paper market’s bearish sentiment.

The Efficiency Paradox

Companies are aggressively cutting junior roles to fund AI implementation, yet the data highlights massive inefficiency at the executive level. With CEO compensation reaching record multiples of worker pay, automating high-level decision-making offers the highest potential return on investment.

Tokenization Utility

The migration of the seven-trillion-dollar money market industry onto blockchain rails represents the true maturation of digital assets. Major institutions are tokenizing real-world assets to gain settlement efficiency, moving beyond speculative trading. This structural shift validates the utility of the underlying technology. Focus on the infrastructure providers facilitating this transition.

THE WEEK: The Liquidity Vacuum

Trading volumes evaporate as desks empty for the holidays, creating a thin environment where small orders trigger outsized moves. Tuesday delivers the heavy lifting with Q3 GDP revisions and Consumer Confidence numbers. We are keeping a close watch on the mid-week bond auctions. Any indigestion there could spike yields rapidly in a market currently devoid of depth.

Tactics for this Tape

Buying extended rallies during a liquidity drought offers poor risk-reward. We use this quiet period to trim positions and accumulate inexpensive portfolio insurance. With implied volatility crushed by holiday apathy, downside protection is cheap. Cash positions allow us to capture opportunities when true price discovery returns in January. We stay defensive and let the algorithms trade the noise.

Don’t guess. Reach out. Let’s engineer a risk-managed, capital-efficient strategy from the option chain up.

Get Rich Overnight with Options? Yeah Right...

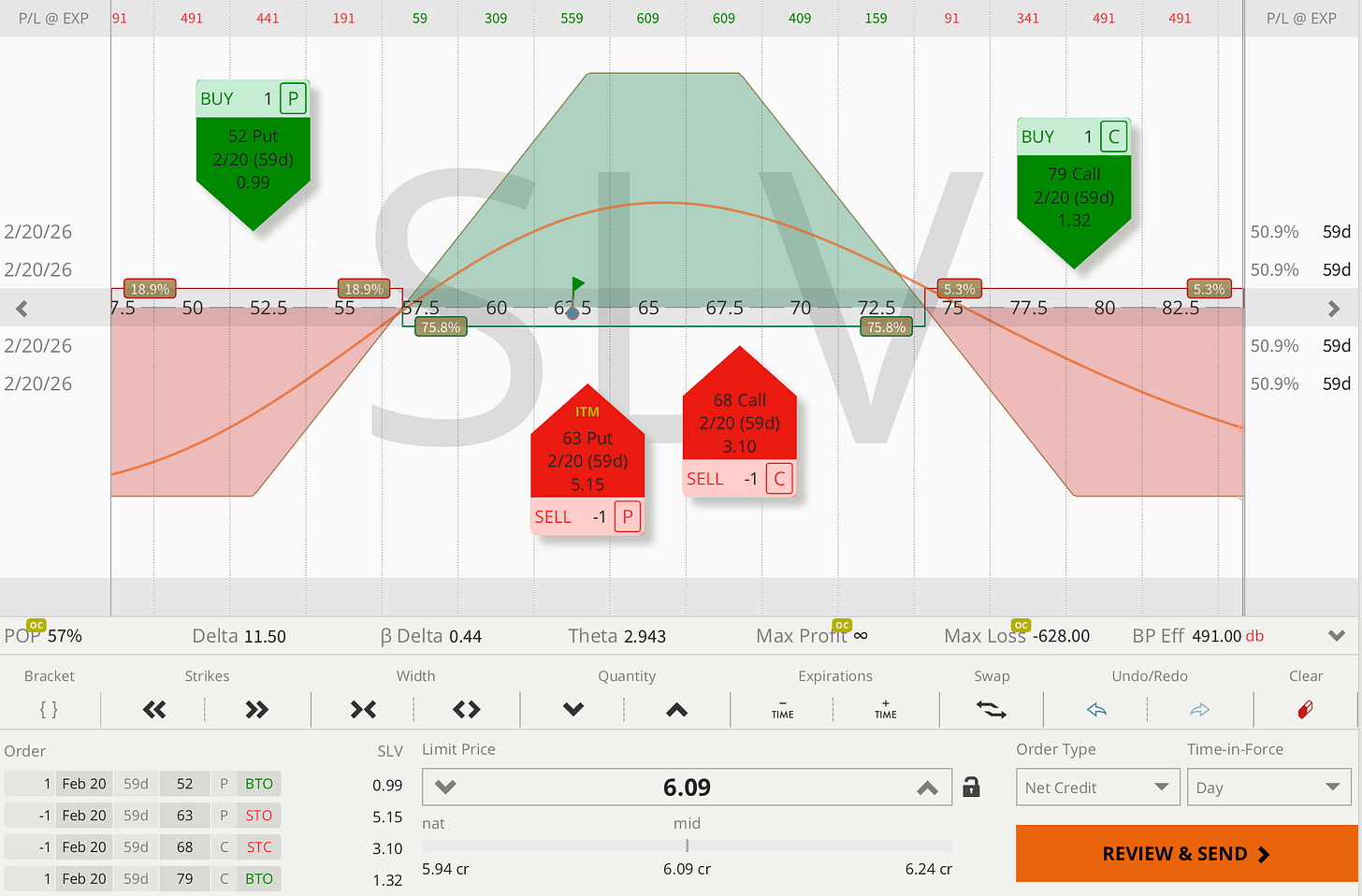

TUESDAY TARGET: Silver (SLV)

We may sound like a broken silver record, but during the holidays this remains one of the most controllable, risk-aware structures you can put on. The upside hedge is already built in, and managing adverse moves is straightforward: roll it out, then bring the untouched call side down. No drama.

This is not an official trade entry. Those are available in the Trade Alerts section.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 Regular Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.