🎯 TUESDAY TARGET: Riot Platforms (RIOT) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

Europe effectively signed its industrial suicide note in green ink, handing energy strategy to activists while the U.S. stuck to physics. They kept the gas flowing and the factories humming. That pragmatism created a divergence so wide it broke the models.

But this engine runs on a strange fuel. The post-Covid asset bubble convinced 2.5 million Americans to retire early, an army of consumers spending paper wealth, producing nothing, and creating a sticky floor under inflation. The incoming regime sees the trap clearly: crushing inflation requires crashing the market that funds these retirees. Their solution? Run it hot. Sacrifice the currency to save the growth.

Equity markets are front-running this melt-up with slumber-party volatility. Yet, the credit sharks are quietly buying disaster insurance. When the stock market sleeps while the bond market buys protection, you know the bridge we are building is made of flammable material.

Below, as always, the rest of what’s cooking:

The Correlation Trap

Gold and equities are surging in unison, a rare anomaly last seen fifty years ago. This high correlation negates the benefits of diversification. A correction in one asset class risks triggering a simultaneous collapse in the other. Portfolios built on traditional hedging assumptions are now exposed to a synchronized drawdown.

Geopolitical Complacency

Oil markets priced out geopolitical risk premiums immediately following peace headlines. This complacency ignores fractured supply chains and fragile truces. Energy prices are vulnerable to a violent snapback as traders underestimate the potential for renewed conflict.

Bitcoin’s Liquidity Pause

Bitcoin is struggling as institutional ETF inflows pause. The recent rally relied on this external capital injection. Without fresh fiat entering the system, existing leverage becomes exposed. The market requires sustained demand to support current valuations, leaving digital assets fragile to a liquidity pause.

Copper Reveals Reality

Copper prices are slowly moving higher, confirming the physical demands of the AI grid buildout. Infrastructure requires massive amounts of metal. Capital is rotating into hard assets that face genuine supply constraints.

THE WEEK: Data Deluge & Central Bank Scrum

We face a condensed calendar of chaos. Tuesday drops the delayed double-dose of October and November payrolls, stripping away the government shutdown excuses. Thursday delivers the inflation report card via CPI, followed by the ECB and BoE. But the real firework is Friday’s Bank of Japan decision. With markets pricing a rate hike, Tokyo could finally upset the global carry trade just as holiday liquidity evaporates.

Tactics for this Tape

Chasing a melt-up without insurance is for younger traders, they can blow up and start from scratch. You cannot. But generic hedging is a trap. While S&P 500 puts are liquid, they’re crowded and expensive (high skew). Conversely, credit protection (LQD/HYG) is priced for perfection and cheap, if you can navigate the liquidity.

The solution isn’t static. Sometimes the math favors debit spreads to neutralize cost; other times, naked puts, on cheaper, liquid emerging market tickers, or even options on currency futures, offer better, uncapped convexity. The optimal structure shifts daily based on pricing and your personal portfolio composition.

Don’t guess. Reach out to me directly, and let’s scan the chains together to engineer the perfect hedge for your book.

Get Rich Overnight with Options? Yeah Right...

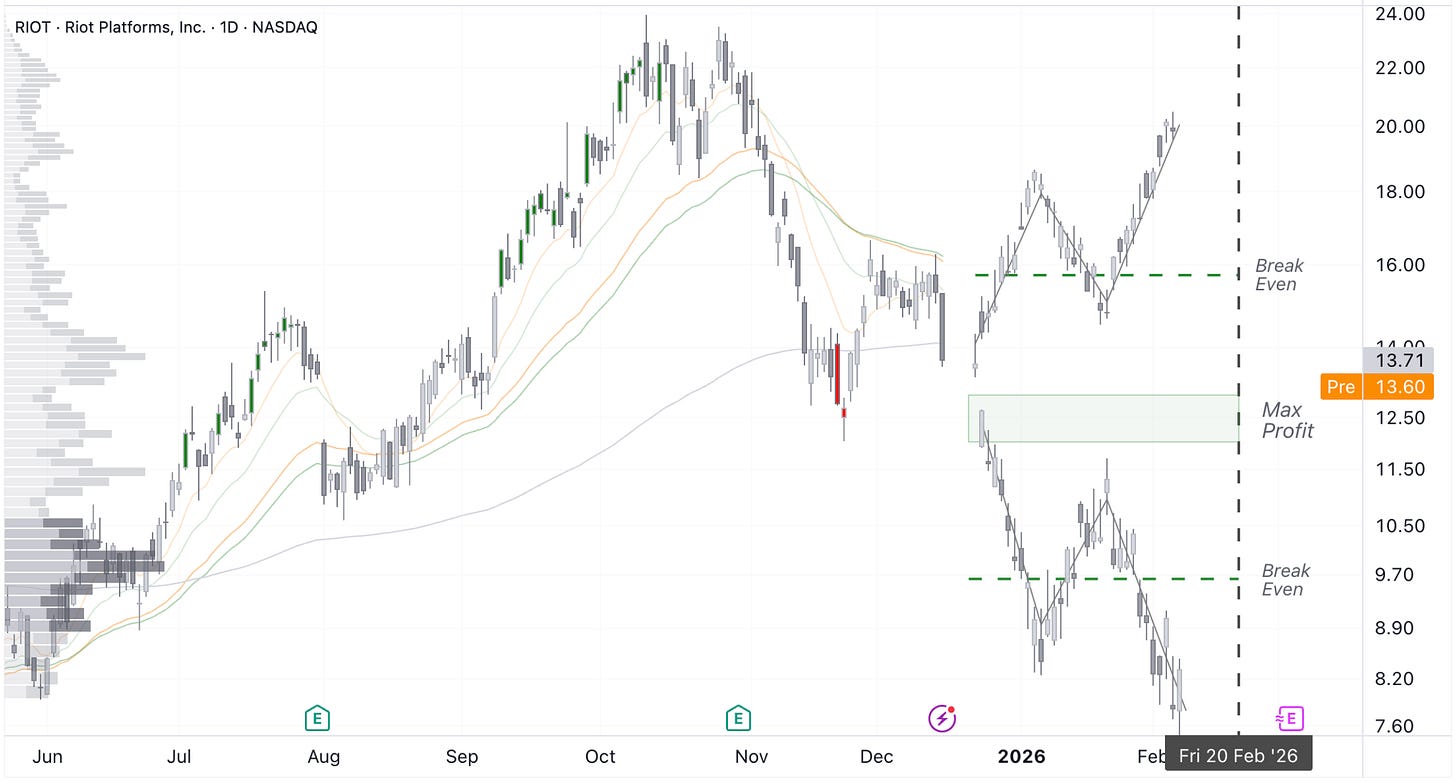

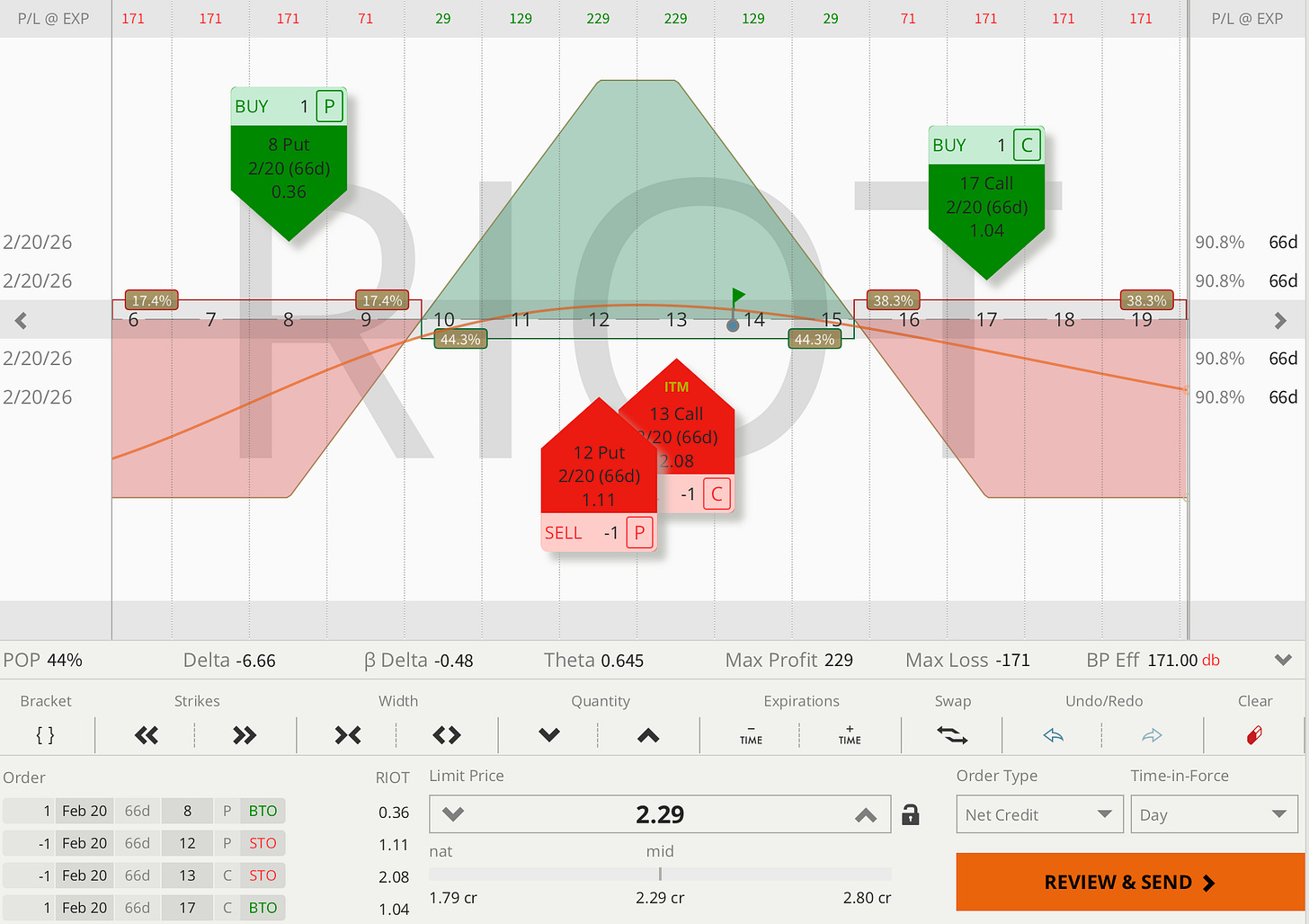

TUESDAY TARGET: Riot Platforms (RIOT)

Not an official trade entry, those can be found in the Trade Alerts section.

Riot Platforms as food for thought. A slightly bearish condor, since the numbers are bad (which goes without saying) and momentum is starting to turn bearish. Yet another indirect hedging technique that could work if a trend change becomes somewhat confirmed.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 Regular Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.

Love the AI commentary Juri it’s easier for me to listen