🎯 TUESDAY TARGET: Brazil (EWZ) | 👇 Reveal the Play

🧠 NEW: Elite Trader Plan. A calm, step-by-step options roadmap to grow your account and tame big swings | 👇 Jump to Details

The market keeps pretending that everything happening right now belongs in separate universes: a Fed preparing for its most divided vote in decades, tech giants racing to expand compute as fast as their debt capacity allows, and Bitcoin swinging around like a 24/7 leverage meter. Strip away the headlines, and all three lean on the same survival mechanism: steady liquidity.

Investors are treating the December cut as a scheduled event rather than a decision. Yet the committee is split down the middle, chatter is volatile, and every options desk is stuck in a minefield of short gamma and thin liquidity. Put volumes have exploded, hedge demand is frantic, and intraday moves now reflect forced flows more than genuine conviction. Markets call this “positioning.” In reality, it’s a crowd waiting for a policy outcome that isn’t guaranteed.

At the same time, the AI giants are pushing a capital cycle we haven’t seen in twenty years. Debt-funded data centers, custom silicon, TPU clusters, and new power infrastructure are expanding faster than revenue can keep up. The story sounds futuristic; the balance sheets look older than they admit. Without fresh liquidity, the entire machine becomes a little too heavy for its own momentum.

Bitcoin, supposedly the outsider, has become the early-warning siren for every shift in policy tone. When the Fed sounds cautious, it bleeds. When cut odds surge, it springs back to life. Even its regulatory backdrop mirrors the broader pattern: debanking dramas for founders, compliance theatrics for headlines, and a price chart that moves in lockstep with risk assets whenever the market senses a pinch.

Three narratives, three tribes, one exit. Liquidity. It’s the channel connecting a stressed derivatives market, an AI capex binge, and a hyper-reactive crypto crowd. When that channel narrows, correlations snap together and everything moves as one organism. Anyone relying on “diversification” discovers the doorframe is narrower than it looked.

Below, as always, the rest of what’s cooking:

Retail as the Quiet Stabilizer

Households have been steady net buyers for nearly two years, adding risk even through pullbacks. Historical data shows this support holds until the VIX rises into the mid-30s, where behavior flips and retail starts liquidating. Below that line, their buying provides real cushion; above it, selling accelerates the downside.

Google’s TPU Strategy

Google’s latest TPU generation delivers major efficiency gains, giving GCP a structural margin advantage in AI workloads. Vertical integration, from chip design to software stack, shields Alphabet from the industry-wide margin compression facing GPU-dependent competitors.

Global Liquidity Still Cushions Risk Assets

Despite the anxiety, global monetary conditions remain loose. Most central banks are cutting or holding, and China’s liquidity push offsets G10 tightening. This backdrop doesn’t prevent pullbacks, yet it reduces the odds of a disorderly global liquidity crunch.

Ukraine Peace Framework Resets Geopolitics

The US-Russia draft agreement effectively cements territorial changes, sidelines Europe, and opens channels for economic cooperation in strategic sectors. Markets reacted with a standard risk-on bounce, though the long-term implications are profound: shifting alliances, altered energy routes, and reduced EU leverage.

The Week: Data Squeeze Before the Fed

This is a short week on the calendar, but macro data are packed into the first three days. In the US, we get retail sales and producer prices on Tuesday, then jobless claims and durable goods on Wednesday, basically the Fed’s last clean look at growth and inflation before December 10, with no more payrolls in time for that meeting. Europe serves up German, French, and Italian inflation plus confidence data, while the UK’s Autumn Budget will show how serious the new government really is about fiscal tightening. Add the RBNZ decision, Japanese Tokyo CPI, and Black Friday spending hints, and you have a week where event risk stays high even as liquidity thins into Thanksgiving.

Tactics for this Tape

Use options to buy time and create asymmetry: add cheap, targeted hedges, and build selective upside exposure in areas where fundamentals and positioning start to diverge, especially long-term AI themes that offer capital-efficient convexity.

Get Rich Overnight with Options? Yeah Right...

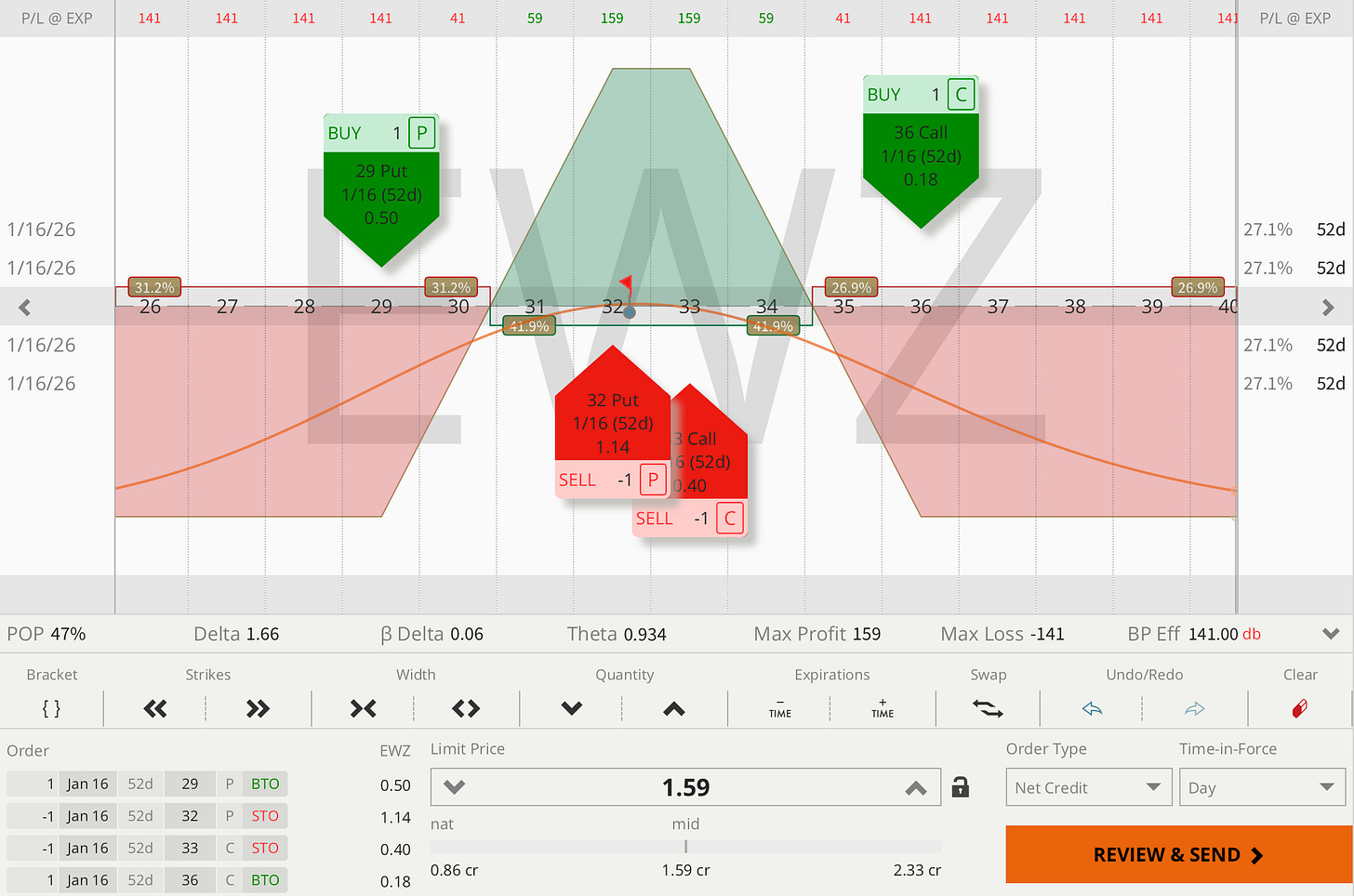

TUESDAY TARGET: Brazil (EWZ)

As usual, this is not an official Trade Alert. We are in cautious territory right now and only execute “150% conviction” setups.

This one might still evolve into a real trade, we don’t dislike the structure. The only hurdle is the upcoming six-month dividend, which could trigger an early assignment if the stock trades meaningfully above the short call. Unfortunately, there isn’t enough liquidity for a clean put-only construction.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, I’ll bring you fully up to speed, all included in the plan.

📅 Regular Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.