ZIONS BANCORP: Journey To Jerusalem

When musical chairs become abundant

Executive Tease

Musical chairs and burning bushes.

How stakeholder collaboration could triple the coffers.

We poked fun at investment jesters and read a bedtime story to Moody's.

See ”4.1 MacroDozer Conviction” for a real summary.

1. Driving Forces

Jerusalem is only 400 miles as the crow flies from where we currently run our engines. Holy land as far as the eye can see; Mount Sinai, burning bushes and Moses on the horizon, probably about to make yet another brew of that sacred acacia tree mixed with Syrian rue to keep everything on fire.1

ZION stands for Jerusalem, and the game of musical chairs, in German "Journey to Jerusalem", seems to be a good analogy for all kinds of meltdowns happening lately. So is Zions Bancorporation the next regional bank to freeze when the music stops playing again?

Unlikely.

At least not in the next two months, unless the bank's customers actively drive its demise or collectively default on their loans in a still-thriving U.S. economy. ZION's well-diversified and nationwide business customers don't seem as hysterical or troubled as the Tech Valley Unicorn set. They have real businesses and profitability to manage and no time for game theories on bank runs.

A more innovative approach would be for customers and management to join forces, commit to rationality, and invest in ZION shares. This strategy can double or triple everyone's capital within a year or two. The bank is in a stable and safe position even if stakeholders would start to panic over imaginary ghosts.

2. Background Information

Let's shed some light on these ghosts and address the market's top four concerns: 1. Liquidity, 2. Interest Rates, 3. Capital Management, and 4. Credit Risk. A thorough examination of financial reports has enabled us to identify all anomalies in the time series data. We will explain these anomalies and offer insights into probable outcomes until the end of the year as punchy as possible, so stay with us!!

2.1 Liquidity Risk

Management Claim:

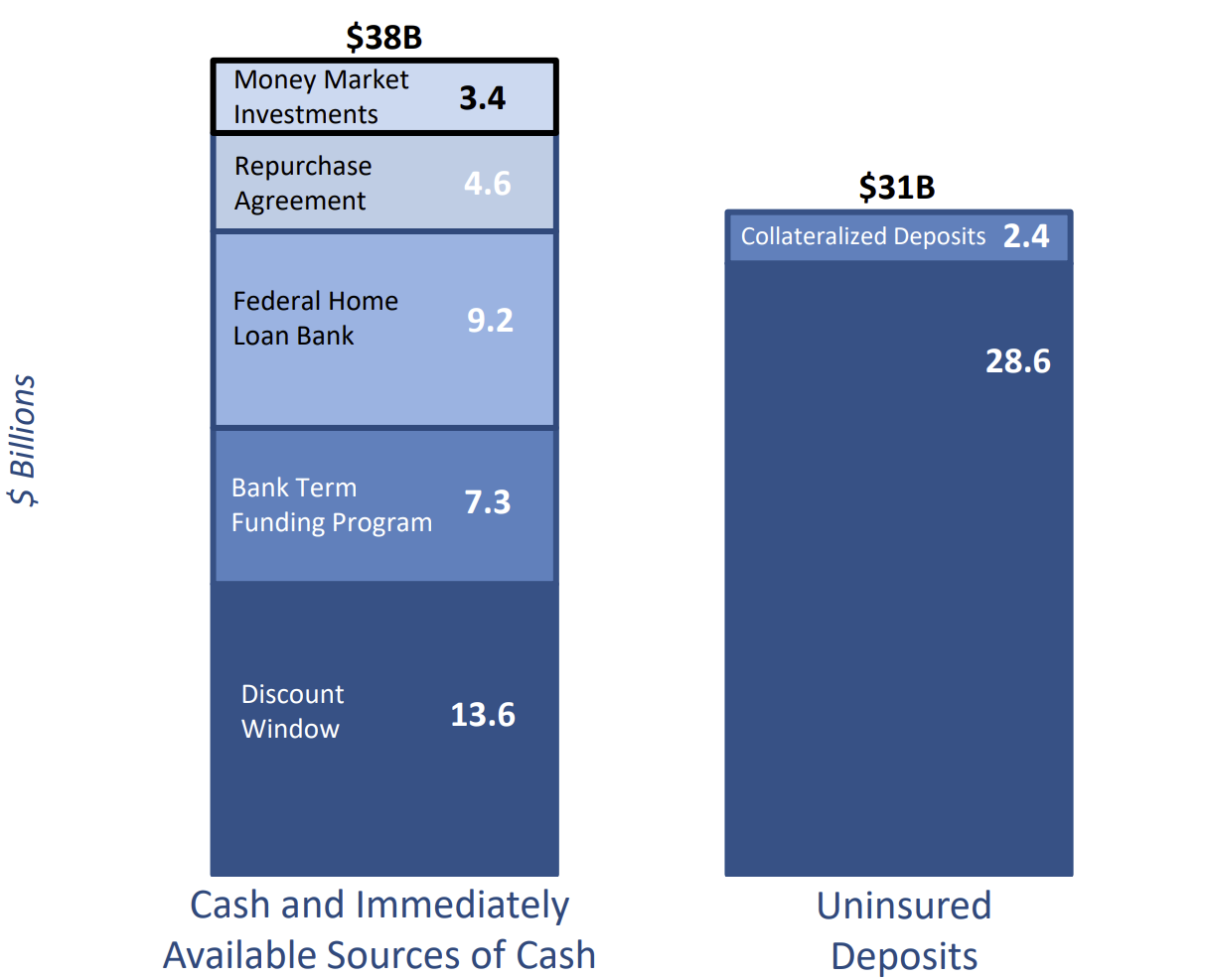

We maintain ample liquidity with diverse funding sources. These include cash, interest-bearing funds at the Federal Reserve, and borrowings against loans and liquid investment securities, surpassing uninsured deposits.

For business customers, it is pretty standard that not all deposits are insured. However, in a worst-case scenario where all uninsured depositors withdraw their funds overnight, ZION had all the cash it needed without selling any securities.

2.1.1 Immediately Available Sources of Cash Vs. Uninsured Deposits

Below you will find more intriguing details about these cash sources. Read them and see how you feel if you learned something new.

Discount Window: The Federal Reserve's discount window is the basis for maintaining banking system liquidity, stability, and effective monetary policy implementation. Offering convenient funding, helps depository institutions manage liquidity risks efficiently, ensuring uninterrupted money flow to customers during market stress.

Bank Term Funding Program: Launched by the Fed on March 12, 2023, this program provides loans to banks with maturities of up to one year. U.S. government bonds, agency debt instruments, and mortgage-backed securities, all valued at par, are accepted as loan collateral.

Federal Home Loan Bank: This interbank lending system comprises eleven regional banks. They usually provide cash for housing, infrastructure, economic development and community needs. Although the system serves a public purpose, each bank in the network operates with private capital.

Repurchase Agreement: A repurchase agreement (repo) is a method of short-term borrowing used by government securities dealers. It involves selling securities, usually overnight, and buying them back the next day at a slightly higher price equal to the overnight rate. "Repo" for the selling party, "reverse repo" for the buying party.

Let's take a closer look at the deposit story.

The sharp increase in large uninsured deposits during the pandemic, when the Fed and the government flooded the economy and the public with liquidity, was an anomaly and is expected to decline to pre-pandemic levels as the Fed tightens and the public becomes cash-poorer again.

Is a drop in uninsured deposits from 49 billion to 31 billion between 2021 and 2023 drastic? Yes, it is. As is an increase from 28 billion to 49 billion in previous years. On the other hand, insured deposits increased from 29 billion to 38 billion from 2019 to 2023 and have not looked back since.

2.1.2 Insured Vs. Uninsured Deposits

The cluster risk on these uninsured deposits is pretty low. They are distributed relatively evenly across all business customers, i.e. even if the 25 largest customers were to conspire against the bank and decide to withdraw their uninsured or unsecured deposits simultaneously; this would only account for three per cent of total deposits.

When people understand that no one will lose any deposits, whether they are insured or not, that part of the equation will quiet down. And yes, during the Great Depression (1929-1939), when 9,000 U.S. banks collapsed with no deposit insurance scheme, plenty of depositors walked away empty-handed. However, during the Savings and Loan Crisis (1986-1995), when more than 1,000 U.S. banks failed, no depositors lost their money, nor did any during the Great Financial Crisis of 2008.

Moreover, we believe it is only a matter of time before Congress and the Federal Deposit Insurance Corporation (FDIC) raise the standard deposit insurance limit from 250,000 to possibly one or two million, which would be an easy psychological fix at negligible cost. This change would benefit business customers and calm down noisy investment jesters like B. Ackmann, who possess limited resources and a restricted grasp of the complexities of the financial system. We must admit, though, "Bank Term Funding Program" doesn’t sound sexy and isn’t going to make the next big tweet in town.

The following charts show additional figures from the balance sheet and the cash flow statement that reflect anomalies related to liquidity risk. All figures are in millions.

Non-interest-bearing deposits are naturally declining in today's high-interest rate environment, while interest-bearing deposits increased by an equivalent amount in Q1 2023. The sum of the two is still well above pre-pandemic levels.

In the cash flow statement, it is easy to see how cash inflows from borrowings and money market divestments offset deposit outflows. Our baseline scenario assumes a gradual slowdown in deposit outflows, most likely ending slightly above pre-pandemic levels.

2.2 Interest Rate Risk

Management Claim:

We control interest rate risks by actively managing net interest income and associated equity value volatilities. Our investment securities portfolio, with a duration of 4.1 years, helps us balance the duration mismatch between loans and deposits.

Typically, the bank does better in a high-interest-rate environment. Still, the pace of change has been rapid and poorly communicated, with mixed messages from Fed Chairman Powell and his presidents.

Interest income improved in the first quarter and reached a new high on an annualized basis, but interest expense due to higher costs for deposits and short-term loans keeps net interest income in check.

It is unclear what management means by "actively managing the volatility of net interest income and associated equity securities". However, they employ extensive hedging strategies using derivatives to mitigate additional investment risks.

In addition, the accounting manoeuvre for fiscal 2022 was remarkable. By writing down the entire loss from the "available-for-sale" investment securities to fair value through the statement of comprehensive income, it was excluded from the actual income statement and year-end bottom line. Although these unrealized losses on investment securities are deducted from the shareholders' equity on the balance sheet, they have no impact on the Basel III capital ratios.

Now comes the most elegant part: the strategic move to transfer half of the securities from the available-for-sale category to the held-to-maturity category allows the more steady cost amortization (/accretion) method to be applied to the held-to-maturity portion. As a result, the deep-discounted fair value of these securities, now kept in the held-to-maturity category, will be gradually accreted to their full value until maturity. This accretion will be recognized through interest income in the income statement. It will continuously boost ZION's earnings figures and bottom line over the next few years.

Elegant.

We do not anticipate any further substantial write-downs for investment losses, whether or not they impact the bottom line. The investment portfolio consists primarily of U.S. government-issued securities and no crazy crypto or Cathy Woods ARK plays. As long as there is no unexpected and aggressive continuation of Fed rate hikes beyond the five per cent level - which is highly unlikely, and treasuries futures markets expect the opposite - ZION should be in a reasonably strong position financially for years to come.

2.3 Capital Management

Management Claim:

We maintain robust regulatory capital ratios, with an improved Tier 1 ratio of 9.9%, surpassing requirements for well-capitalized banks. Our strong earnings capacity supports future capital expansion. Stress testing is regularly employed to inform capital and funding decisions.

The regulatory capital ratios look good because the comprehensive loss from the investment securities measured at fair value has no impact on these ratios. While this may seem problematic, we do not consider it a problem. As the fair value of these securities returns to par as they mature, retained earnings will increase due to this steady capital accretion flowing through interest income, while the current negative accumulated other comprehensive income on the balance sheet will move back to zero over time.

The development of retained earnings looks healthy, the bank has been sustainably profitable, and the common equity has declined due to ongoing share buyback programs.

2.4 Credit Risk

Management Claim:

Our strong credit discipline, robust underwriting standards, and diversified loan portfolio have ensured excellent credit quality for over a decade. Notably, we have actively managed credit risk in our commercial real estate loan portfolio, reducing it to 23% of total loans from 33% in late 2008.

The loan book: we struggled to find anything wrong. It looks healthy, distributed across and within industries and states, dull, and has no signs of increased loan defaults - Conservative banking.

The commercial real estate business is similarly well diversified and has been reduced by over thirty per cent since the Great Financial Crisis in 2008.

Rant Around Credit Rating Agencies

At this point, it seems reasonable to berate Moody's.

There seems to be no clear reason for ZION's credit downgrade. Yes, they are part of an industry. That's it? Impressive.

It is common knowledge that rating agencies are not averse to covering their backsides, especially after the Great Financial Crisis, for which they were partly responsible. Lack of backbone and understanding of micro and macro dynamics are not conducive to the quality of any rating.

If only these bookkeepers believed in themselves and in their ability to recognize creation and destruction at an early stage. They would call themselves economists, only to discover that a change in job title does not cure perpetual slippage.

Good night.

3. Trade Execution

We are selling a neutral risk-defined straddle at 22.50, with wings at 12.50 and 32.50, with Jul 21, 2023, maturity. Break-evens are at 16 and 29.

3.1 Trade Entry - May 12, 2023

The options chains are not the most liquid, and the bid and ask spreads are wide. We were therefore filled a little below mid-price at 5.80.

Total: 5.80 Credit.

3.2 Trade Risks

Price: The break-evens for this trade are wide, but there is always the risk of an upside squeeze or another sharp price decline, depending on how this regional banking crisis plays out. We estimate this probability to be moderate within our time frame.

Volatility: Implied volatility is already high. The risk of a further explosion is low.

Assignment: The assignment risk is moderate since the short sale borrowing costs (4.2%) and the short interest (9.8%) are not outrageously high.

4. Expected Value & Conviction

Let’s master our maths. The expected value (EV) indicates the expected profit (or loss) if you make the same trade indefinitely.

Expected Value = (Probability of Profit * Expected Profit) - (Probablity of Loss * Expected Loss)

When we analyze a situation, we want a positive EV after careful macro, micro and technical analysis, considering proactive trade management and early trade closure. In other words: We generate the edge by challenging the market probabilities and proactively managing the position.

4.1 MacroDozer Conviction

The market assigns a 32% probability of profit to our trade at maturity and generates a negative EV on equity of -18%. The options chains are downward biased and would generate an EVOE of around 0% for a straddle sold at 20, not at 22.50 where we enter.

We do not believe the price will fall further than 15 and assume a similarly high risk to the upside, so we take a straddle position at 22.50. If the price drops further in a hurry, there is the possibility of selling another risk-defined straddle at a lower price. It is always prudent to keep some gunpowder per trade for such occasions to extend the break-evens and widen the maximum profit zone.

We believe the likelihood of realizing the average expected profit with proactive trade management and early trade closure is 64%, with a positive EV on equity of 28%.

The market seems to be overreacting to the current banking crisis. However, we believe most banks, including ZION, can deal professionally with the temporary mismatch of investments and customer deposits.

The Bank Term Funding Program, which went into effect this year on March 12, 2023, keeps most banks liquid - among several other initiatives put in place since the Great Financial Crisis.

ZION is a conservatively managed bank with steady and growing profitability that has used the pandemic investment challenges to its advantage.

Should the crisis get out of hand, Congress and the Federal Deposit Insurance Corporation (FDIC) could come quickly to a psychological rescue by raising the deposit insurance limit from 250,000 to a more timely figure.

We expect market volatility to continue for regional banks as an industry but believe a temporary equilibrium has been reached, hence our neutral position in ZION for a month or two.

5. Final Chapter

Expect updates on BrainDozers within 4-6 weeks. We use the exact headline ending with (+/- xy%) and mark the cover cartoon with a red CLOζED stamp. This way, the performance is easy to track.

We do not send BrainDozer updates via email unless you specifically ask for them here. We want to keep the flow of information short and sweet. However, you can still access a free preview of all updates on MacroDozer as soon as they are released.

My name is Juri von Randow. You can find me on the top banner to the right, MacroDozing like there's no tomorrow. (Email version only.)

Feel free to pass me on. Warm regards.

All BrainDozer articles are purely educational; they are not tailored to any particular individual or portfolio and do not constitute investment advice. Let us know if you are interested in implementing any of our ideas. Perhaps we can help or point you in the right direction.

The acacia tree contains the psychedelic agent DMT, and the Syrian rue contains the MAO (monoamine oxidase) inhibitor, which makes DMT active for oral ingestion. The people of the Sinai Peninsula had access to both plants, which may explain visionary experiences such as burning bushes.