XXX: Trading The Unknown

Summer Performance Baloney And Why Not Keep A Secret.

Executive Summary

Getting rhymed and duped.

We analyze the visionary abilities of successful investors.

Burn baby, burn! But don’t Pull A Livermore.

Delving into the Summer games makes us feel Special.

Trading the unknown only once a month!?

1. Why Do I Care Right Now?

I am starting this BrainDoζer without having an asset in mind; nothing relevant is flashing on my screens. Maybe I will delve into the Summer Special performances. We just closed the last trade yesterday. The summer treated us well. Quod Erat Demonstrandum. I am still lost, yet eager. I should expand my watchlist. The number of assets with liquid option chains increases daily, which is good for us.

Famous authors seem to agree: If you are searching for a topic, get inspired by what bugs you most - your little hero story and how to conquer that hate or love.

Rant Around The Economic Fortune Teller

I tell you what bugs me most this morning: experts being so sure about the future. Maybe they seek the intellectual challenge. Analyze the past and make the future rhyme - a positive spin. Still, plenty of words rhyme with plenty of words. I feel like we are getting duped. Tiny errors in economic models go ballistic the further they go in time. Let’s say you are lucky and found that rhyme. (We certainly just did.) You are still left with nothing because the rest of your poem sucks - what a waste of brain power.

But at least we have experts efficiently distributing information. We use that data happily, good enough to stop the rant.

To strengthen my case above on how difficult it is to forecast any future span, I handpicked some of the most successful traders and investors, showcasing a selection of their most catastrophic predictions.

Let’s see how the world’s most respected investors did on the visionary front.

Benjamin Graham, the Dean of Wallstreet and the most Intelligent Investor back in the day. He loses seventy percent of his entire wealth over four years. This careful and thoughtful value investor gradually builds positions after the crash in 1929. He finds out that Mr. Market can talk crazier for much longer than most people can stay solvent.

Jesse Livermore, the Bear of Wall Street, the Cotton King. He is probably the all-time most famous market speculator. His first professional trading account blows up in his twenties. Next, he declares bankruptcy in his late thirties, only to become one of the world’s wealthiest men ten years later. Finally, after his fourth and final blow-up, he commits suicide in his early sixties.

After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!

Maybe he was sitting a little too tight, at minimum four times. I got that. And some risk management thinking could have saved his money and life. But who are we to judge? His great-granddaughter Tracey Lynn Livermore still lectures on how to sit tight. Enduring. Don’t google her.

Stanley Druckenmiller is known for managing George Soros’s money and putting together remarkable investment records. But even Stanley trips up a few times. First, he loses nearly one billion on a bet against the Yen and two billion going long Russia. Then, in 1999, shorting internet stocks command 600 million of him. Finally, he flips and buys the dot.com mania at its 2000 heights. Another three billion down the drain in six weeks.

Warren Buffet, with his stellar track record, also has moments of weakness and malinvestment. The Salomon Brothers’ investment makes him part of a significant treasury scandal. He loses 75% on a US Airways investment. Dexter Shoes, which he pays in pricey Berkshire shares, turns into a multi-year bankruptcy nightmare. And he misses out on US Growth & Tech when it bottoms in the early 2000s. So, even an investment in Berkshire can result in underperformance for years.

High IQ, low IQ, pedigree, non-pedigree, identity ex, why, zed. None of it matters. Either you burn for it, or you don’t. If you do, know how to implement that risk buffer between your greed-anxiety persona and your trades. If you are a creative speculator at heart, get someone to do risk management for you. Otherwise, you will blow up. Our camp will be offended if any of our BrainDoζer street-sharps pulls a Livermore. We won’t be coming to the funeral.

2. Useful Background Information

Let’s delve into some theoretical Summer games performance baloney. It was Special. Of course, it was. We had fun at the Doζe. We will also reveal the unknown trade advertised in today’s title. The ticker certainly won’t be XXX.

No trade exceeds five percent of total equity. We currently use that full five percent for our short premium trades as we do not (yet) engage in long premium situations. We are not in the cash-burn business. We leave that to our friends who resigned in May. No long premium means we have more equity for short premium plays.

Let’s pick our most fun summer trade, MSOS. See below for a quick refresher.

Imagine you listened to Paul Samuelson and put 100,000 to work for excitement & more. You would have used 5,000 a trade. Hence, the +41% on MSOS would have resulted in a 2,050 return,1, meaning a 2.1% return on total equity (2,050 / 100,000). Trade exit date (Aug 26) minus trade entry date (Aug 2) gives us 24 days. That 2.1% return on total equity achieved in 24 days results in a 31% annualized return on total equity (annualizing factor 365/24 = 15x). So technically, we only require one good trade per month to achieve a respectable annual return.

I will not make this calculation more graphical or easier to understand since it is flawed and naive. There will be trades of more than 24 days and plenty of trades with worse or negative performances. Regardless, we used the summer months to swing for the fences while others left in May. My reputation was on the line, so I made it personal.

But don’t be fooled. Don’t think like those experts, dreaming of the past while slithering into the future. The world doesn’t work like that. Every trade is laborious to find, complex to execute, and mentally exhausting to see through.

One good trade per month, right? If you made it to this paragraph, you probably earned yourself a trade and potentially a hug. Trading the unknown. The ticker is XOM. But shhh, let’s keep it a secret.

3. Trade Execution

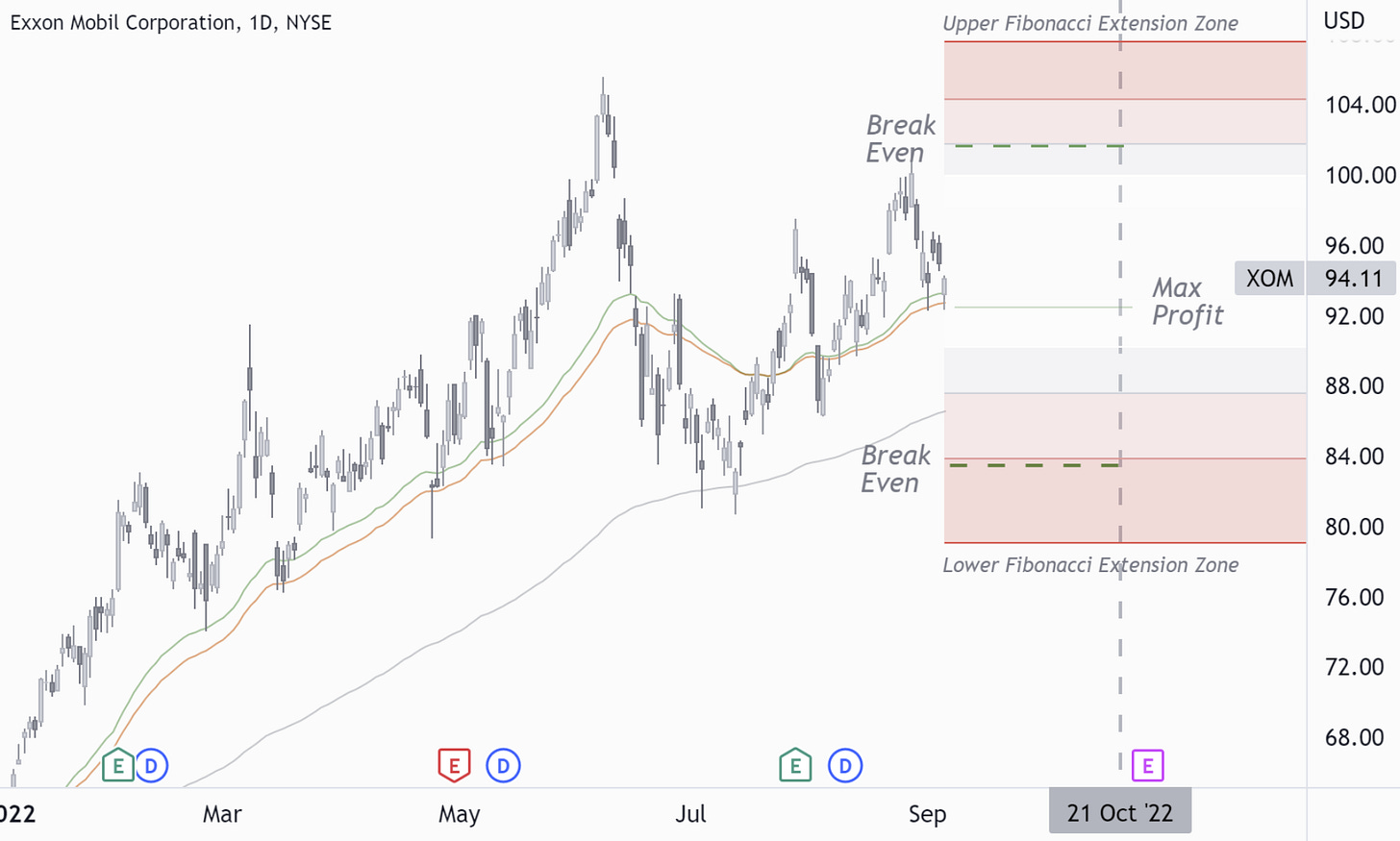

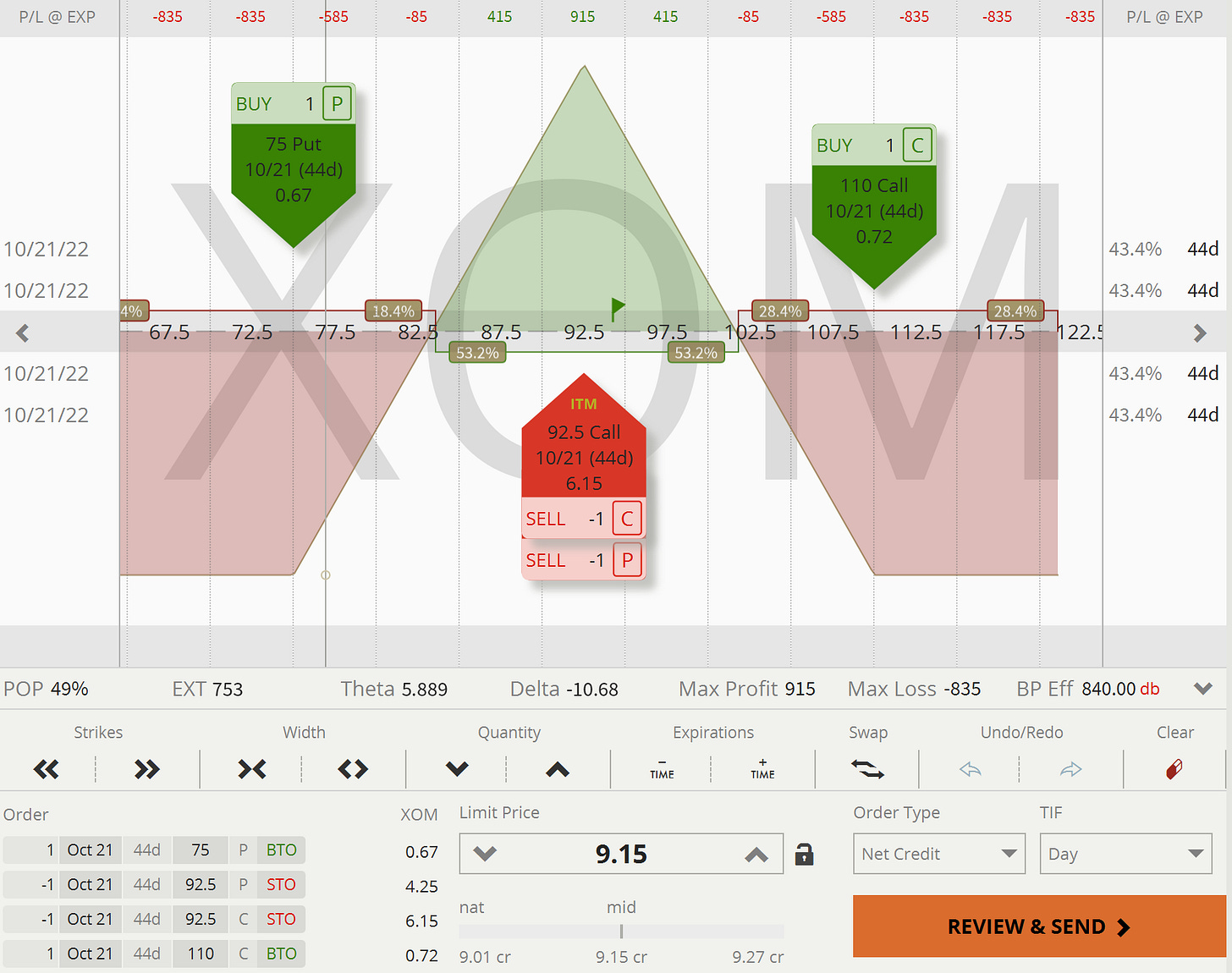

We are selling a slightly bearish risk-defined straddle at 92.5, with wings at 75 and 110, maturity Oct 21, 2022.

Implied volatility is high, yet we see upper resistance (double top @105) and lower support (high volume nodes @85) to play a slightly bearish short volatility trade. There is a risk that implied volatility would not contract before earnings.

We like the low correlation coefficient of 0.40 relative to the broad US equity market.

Break-evens are at 83 and 102.

Trade Entry - Sep 7, 2022

Total: 9.15 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

Excluding bid/ ask spread slippage and other transaction costs.