When Chaos Is the Plan

Adapt. No Time To Whine.

In my latest Tuesday Target, I casually answered my own question — “what’s happening?” — with a simple “not much.”

But what I really meant was this: when you stay close to the head of the herd and read the macro waves well, things usually play out just fine — even when the short-term picture isn’t crystal clear. Riding the slipstream, following the flow. It works... until it gets personal.

Mastering how to surf the market is what we're all about. You're in the right place. It's not just numbers and probabilities around here. Most investments have a strategic core driven by a strong macro perspective. This is our oxygen — it's baked into everything we do.

And lately, the biggest macro driver — the one pushing volatility higher while everyone is still asking “what’s the plan?” — is U.S. trade and currency policy.

What's Going On with U.S. Tariffs?

Let’s talk about what’s really happening behind the so-called tariff chaos. It’s easy to assume this is all erratic posturing — hit allies with tariffs, rattle markets, burn bridges. But zoom out, and there is actually a method here.

The idea is to rewrite the rules of the global order the U.S. itself created — from Bretton Woods to the neoliberal era — and replace it with a new, U.S.-centered system. Think of it as Bretton Woods 3.0, but with tariffs as the opening gambit.

The plan (though still unfolding) seems to follow three deliberate steps:

1. Tariff Chaos (Right Now)

Hit everyone with high tariffs — not to win quick trade victories, but to build negotiating leverage. The market reacts, people panic, and then the long game begins.

2. Reciprocal Trade

The goal is to move to a system where tariffs are symmetrical. If you hit the U.S. with 25%, they will hit you with 25%. Level the playing field. Reward innovation and rule of law — not currency manipulation or wage suppression.

3. A New Global Deal

At some point — maybe sooner than we think — the U.S. will invite friendly countries into a new framework. These countries get low tariffs, security guarantees, and privileged dollar access. In return, they might agree to peg their currencies or help manage dollar strength — think Plaza Accord meets Mar-a-Lago.

But here is the part that’s tripping up most investors — there’s no obvious solution on the table. No vaccine, no bailout, no central bank pivot. Just volatility. And that’s the point. This is not a crisis waiting for rescue — it’s a disruption being used as a strategy. The volatility is the policy tool.

Now, will countries line up for this deal? Hard to say. Trust in the U.S. has taken a hit. But the big picture here is clear: the U.S. wants to reindustrialize and keep the dollar as the world’s reserve currency. Most economists will tell you that’s impossible. But this playbook says otherwise — and it’s already being executed.

So while headlines scream chaos, this is actually strategy. And it matters — because these macro shifts will shape capital flows, drive volatility, and redraw the global investing map. As always, we don’t trade the noise — we have to trade the structure underneath it.

MacroDozer vs. Markets

It’s been a bit of a ride for us too. We set out to squeeze more out of this market, but it hasn’t quite played out the way we hoped. One of the challenges is timing — option expirations sometimes line up in a way that makes it impossible to hold through key events. That’s already happened to us twice this year. We had to close trades that were overdue, and just a few days later, the events hit — exactly the kind of catalysts that would have delivered the real juice.

But well, sometimes you just have to grind your way higher. And with this high implied volatility event playing out right now, we are optimistic that some interesting streaks are ahead.

See how our grind compares to what the broad market has been delivering below. The S&P and NASDAQ basically look like the same asset — no surprise, considering the top six companies make up 30% of both indices.

We haven’t really had our day in the sun yet. This market is pushing us to dial up risk management, de-risk, and hold back from fully pressing our latest trades. That said, here are the updated Sharpe Ratios — we’ve gone from 2.1 to 1.9. Still solid. Still strong risk-adjusted returns.

Behind the Screens

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

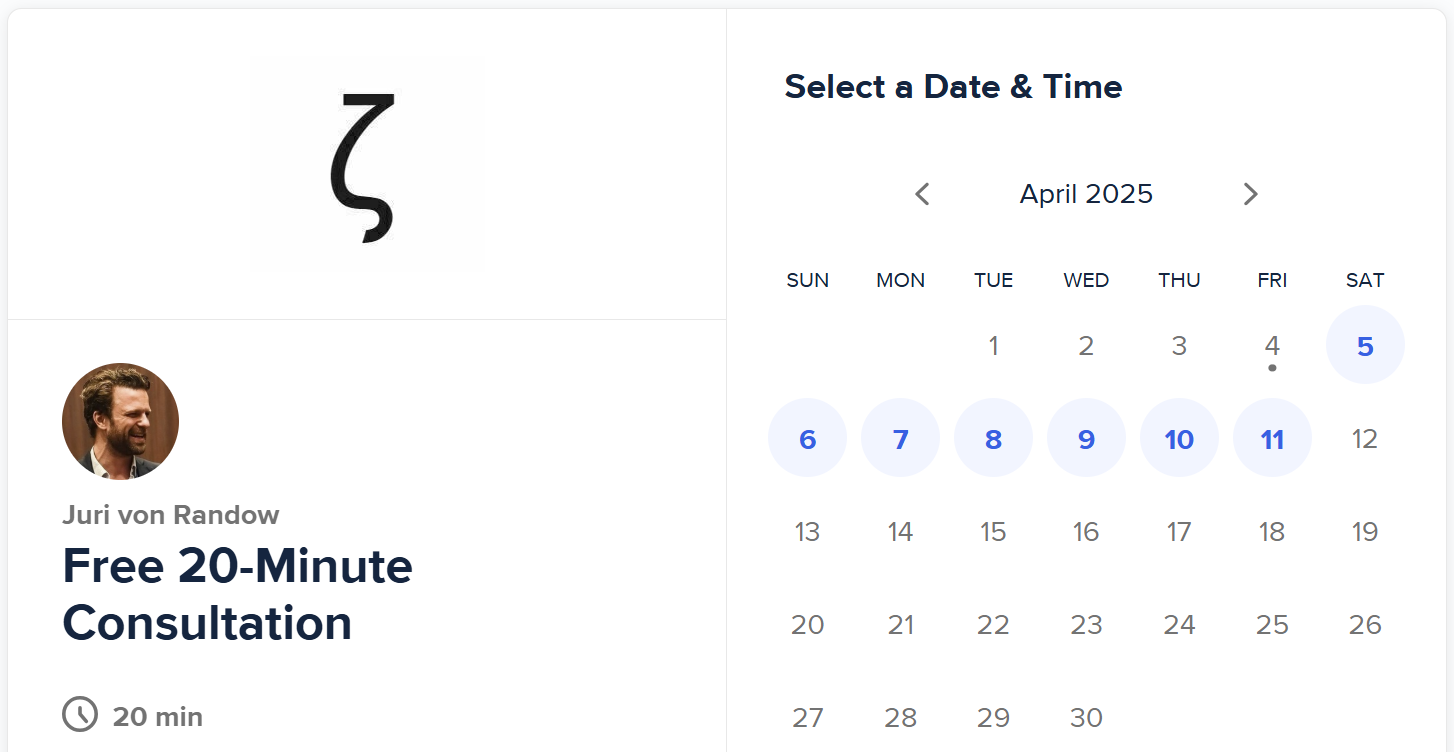

Curious about how these trades fit into our broader portfolio approach — or how you might apply similar strategies yourself? Book a free 20-minute call to discuss whatever’s on your mind — from honing your edge to improving risk management or even brainstorming new opportunities.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.