VIX FUTURES: MacroDoζer Summer Special 5/5 (+62%)

We Are Closing Our Last Summer Special Trade

Executive Summary

“Our income grows as we grow.” Team MacroDoζer.1

We saved the best for last; volatility returned.

A technical retrace came true as if witchcraft worked.

It was an excellent call to stick to the ETF.

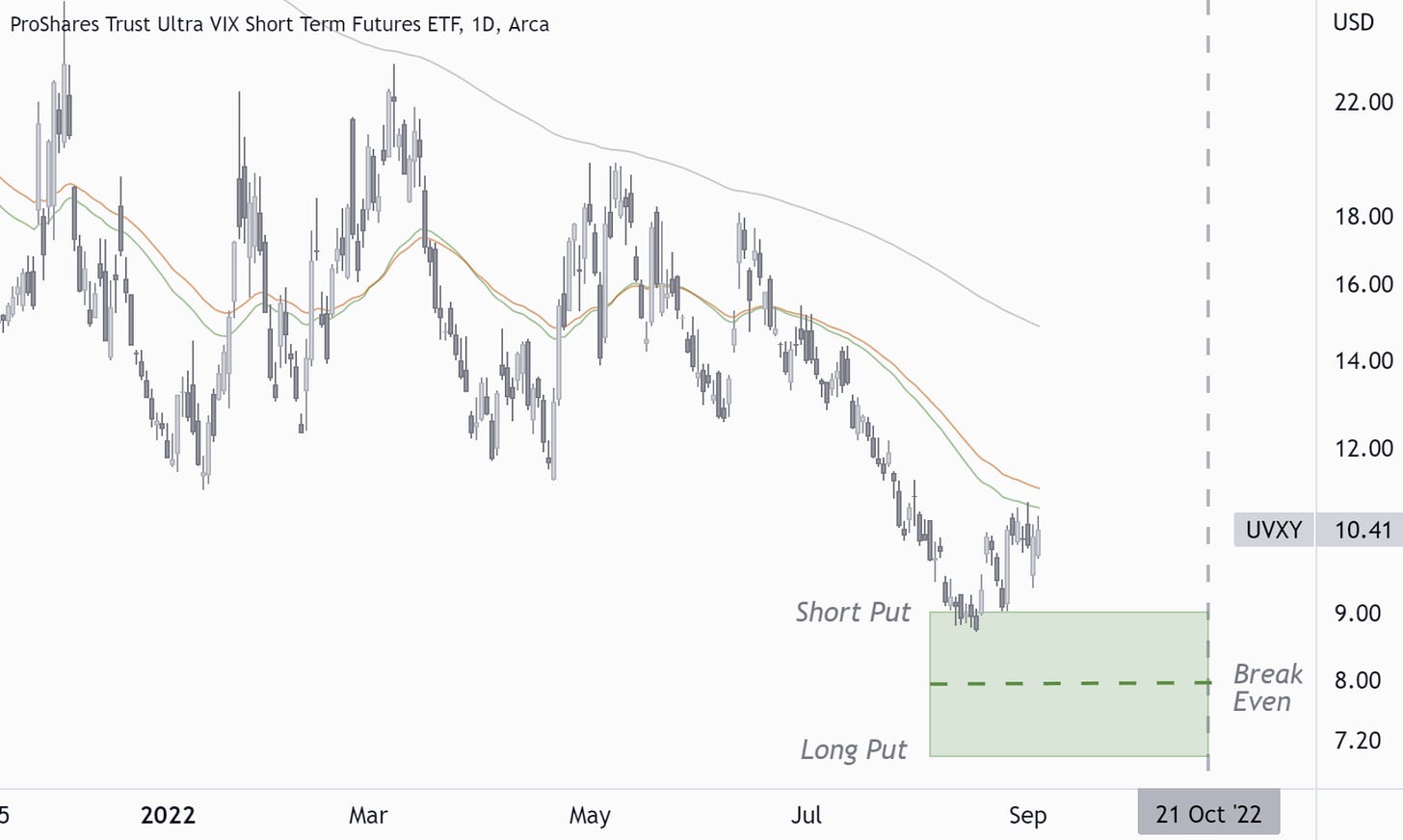

Contango drag, short put credit spread: We lived the summer to the fullest.

1. Recap Situation

We got a bit political in Summer Special 5/5. However, we also believed that the market was due for a correction and felt volatility might come back.

Check out the original BrainDoζer below.

2. Why Now?

The S&P 500 has retraced as we assumed. No surprises.

S&P volatility (VIX) usually spikes when the S&P 500 retraces. It all played out like clockwork. UVXY held up strong despite contango drag, as we anticipated.

3. Trade Execution

Trade Entry - Aug 5, 2022

Total: 1.15 Credit.

Trade Exit - Sep 6, 2022

Total: 0.62 Debit.

The absolute return of this trade is

1.15 - 0.62 = 0.53

The capital used was 0.85, resulting in a return on capital of

0.53 / 0.85 = 62.4%

Original quote by T. Harv Ecker, paraphrased by Team MacroDoζer.