UNITED STATES NATURAL GAS: Who Wants To Make A Widow?

We are playing with Nat Gas and engaging in the ultimate widow-maker asset

Executive Summary

Positive reinforcement vs. narcissistic climaxing.

Nat Gas leads us to the dark side of trading.

We are taming the beast and going for neutral fuel.

1. Why Do I Care Right Now?

Nat Gas is widely known as the widow maker in the trading world. Historically, one would trade spreads of futures contracts with different maturities that can vary and change a lot over the year, depending on supply, consumption, or storage refills. But you do not have to trade spreads to realize how wild Nat Gas can be and how uncorrelated it often seems to anything else, including your gut logic.

We like to tame dangerous beasts; we are also interested in how these widow-makers felt right before they climaxed on narcissism, leaving their innocent families behind. Losing is supposed to be constructive; that’s how we learn and grow, eliminate the clutter, and become more creative and efficient. Any widow can do positive reinforcement.1 Let’s go.

One more thing. We got too excited. Not only do we care for a psychological adventure. We also care about the high implied volatility of the underlying and a relatively low correlation to the broader equity markets with a coefficient of less than 0.25. We also think Nat Gas has found a short-term equilibrium at around six dollars for the December front-month futures contract, translating roughly into twenty dollars UNG. We feel natural resistance above and support below at current levels. We seem to have that gut logic working for us (and some more hard data in the section below).

2. Useful Background Information

The United States Natural Gas Fund (UNG) is an Exchange Traded Product (ETP) investing in Henry Hub Natural Gas front-month futures and other natural gas related futures. It may also invest in forwards and swaps collateralized by a large cash holding.

UNG does not qualify as a long-term investment due to the monthly contract rolling drag. The term structure of Nat Gas futures usually trades in contango, meaning the more you go out in time, the more expensive Nat Gas becomes. However, you have seasonal price fluctuations, so the term structure can change from contango to backwardation, typically in March and April, when the weather in the US is mild, and demand is lower. Backwardation months would boost UNG; the ETP sells the more expensive old front month and buys or rolls into the cheaper new one.

The current term structure for /NG Henry Hub Natural Gas Futures shows $6.0/ 6.4/ 6.2/ 5.6/ and 4.8 for Dec/ Jan/ Feb/ Mar/ and Apr, respectively. Usually, the UNG management rolls from one month to the next in the middle of every month over 3-5 days. So, they will roll the current front month of December to the next front month of January on Nov 14-17, 2022. As a result, UNG will experience a technical drag, and I am sure plenty of traders feed on this monthly feast.

The consensus of Nat Gas staying elevated over the winter months due to well-known fundamentals and a technical drag could be the balancing forces leading us onto the dark side of trading. The ultimate widow-maker experience. You are welcome.

3. Trade Execution

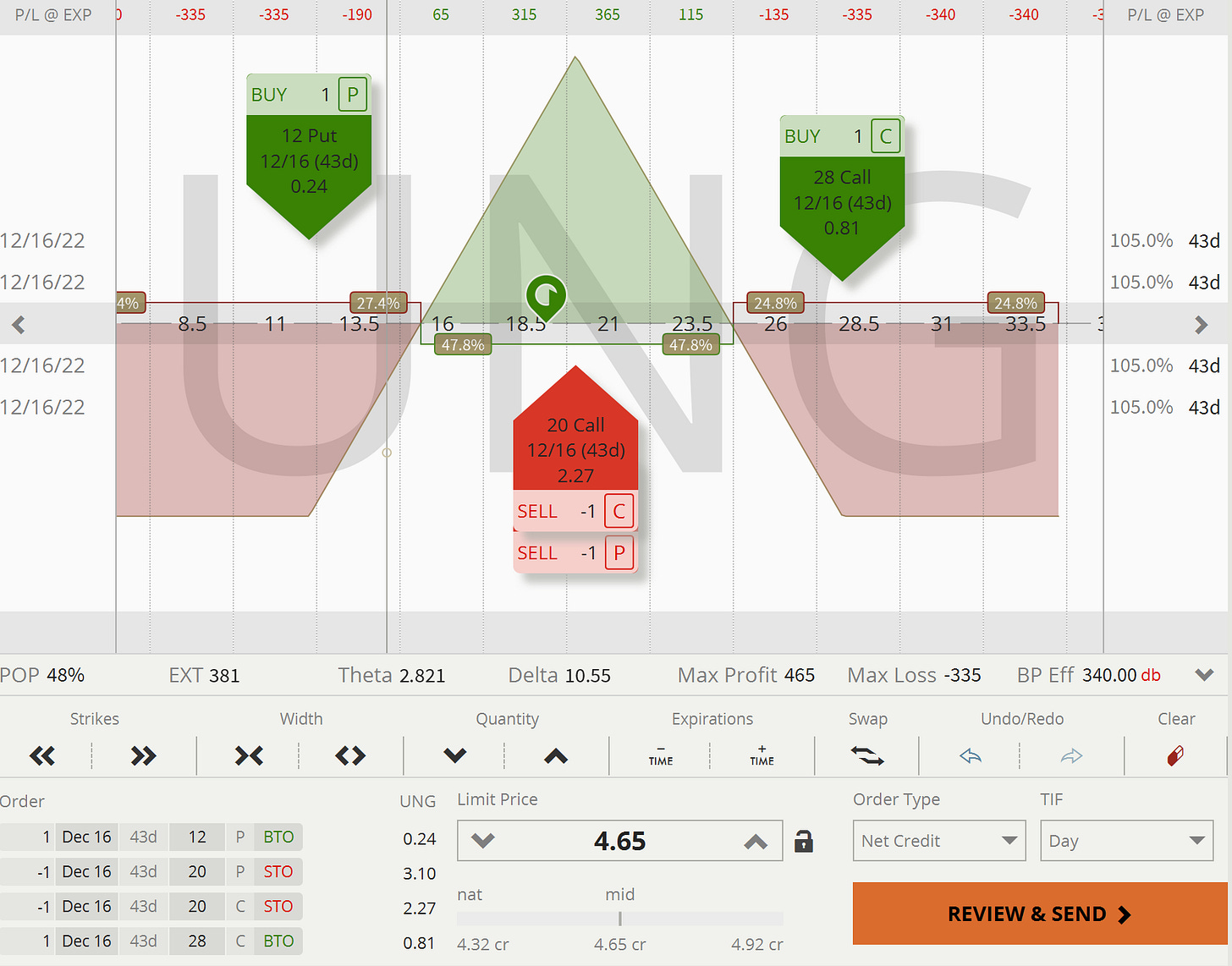

We are selling a neutral risk-defined straddle at 20, with wings at 12 and 28, maturity Dec 16, 2022.

Break-evens are at 24.50 and 15.50.

3.1 Trade Entry - Nov 3, 2022

Total: 4.65 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all update summaries on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

We play with old sayings, stereotypes, and political incorrectnesses for marketing purposes.