So now the herd is peeing in the bushes over a Chinese AI model that supposedly cost five million bucks to build and might dethrone NVIDIA—American exceptionalism be damned! Here’s the deal, no spin: DeepSeek’s revolution is really just a mix of existing tricks—Mixture of Experts (MoE), distillation, and lower-precision training. Sure, it cuts costs, but it’s no ticket to singularity. If anything, cheaper AI drives more adoption, which boosts demand for GPUs, cloud services, and the whole shebang.

Call me old-fashioned, but I’ve danced this dance before: disruptor appears, market freaks out, incumbents adapt or snap up the challenger, and everyone ends up richer—except those who panic-sell mid-cortisol rush. So before you dump your carefully chosen AI plays for peanuts, remember that new tech arrivals rarely nuke an industry; they push it forward. Don’t let the X-verse hysteria or Goldman’s talking heads run your portfolio.

Here is just enough to know what’s cooking—and all you really need.

Cheaper AI Isn’t a Free Pass—Nor a Total Knockout

The buzz around DeepSeek’s $5M to replicate OpenAI overlooks the massive GPU clusters and hidden R&D costs behind the scenes. While its cost reductions are impressive, building AI at scale still demands immense capital and infrastructure. That’s where the China factor adds to market anxiety: efficient domestic models could potentially undercut U.S. technology. But this is far from a knockout blow. Similar innovations are brewing worldwide, and DeepSeek is best seen as a wake-up call rather than an immediate disruptor.

Hardware Constraints? Engineering Hacks to the Rescue

DeepSeek’s success illustrates how creative engineering can circumvent hardware supply constraints. By optimizing older Nvidia GPUs and deploying innovative model architectures, Chinese developers have maximized limited resources. This ingenuity serves as a broader reminder: where investment and demand align, breakthroughs often emerge—applying not only to AI but also to energy, manufacturing, and other industries constrained by high capital costs or scarce materials.

China’s AI Landscape: A Potential Gem

China's AI ecosystem continues to thrive despite hardware restrictions, with Tencent, Alibaba, GDS, and VNET benefiting from robust domestic demand and government-backed tech investments. This could presents asymmetric opportunities-if geopolitical risks can be managed. Moreover, the race for cost efficiencies could drive U.S. and global companies to double down on innovation, sparking competition that benefits the entire sector.

Get Rich Overnight with Options? Yeah Right...

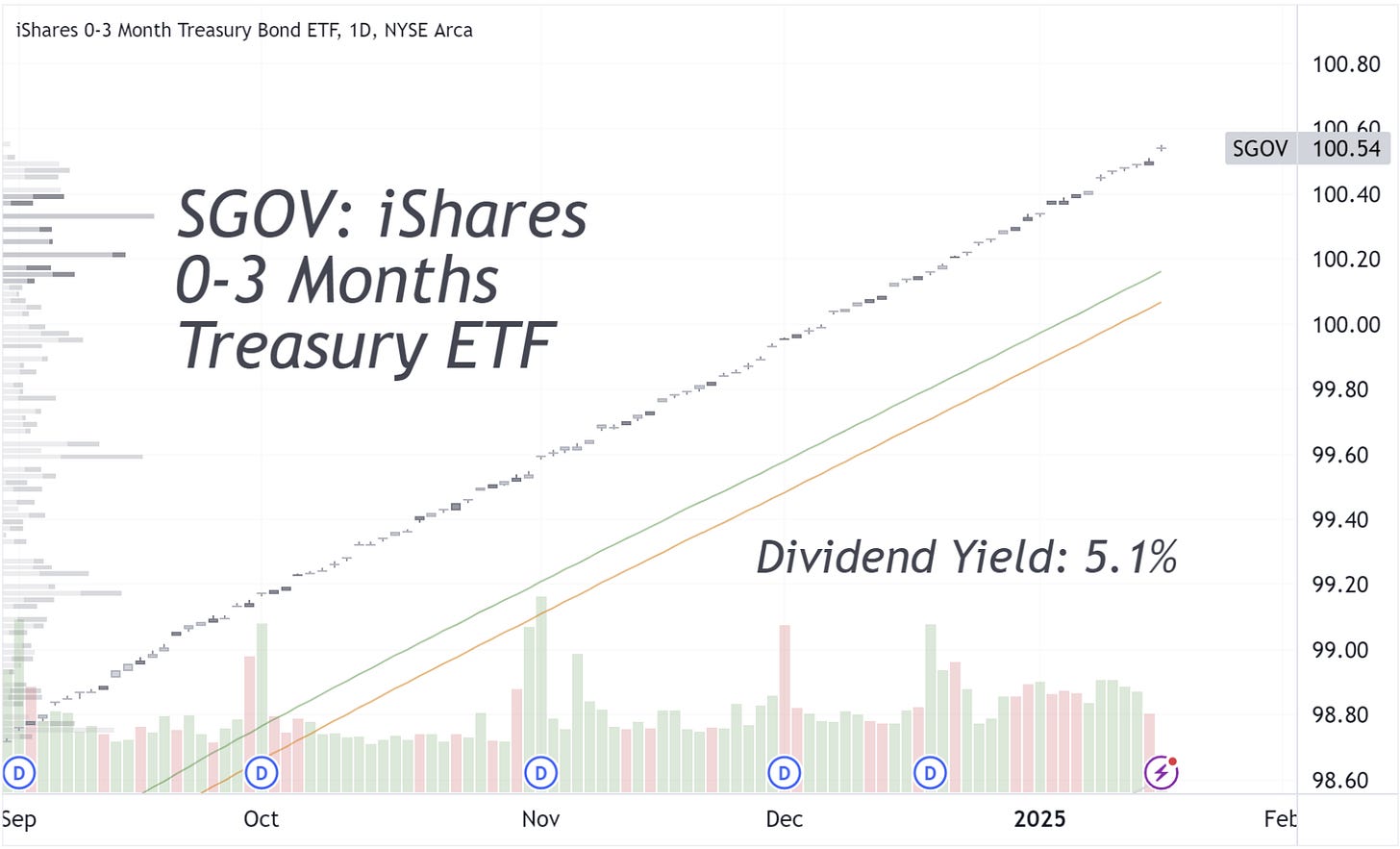

TUESDAY TARGET: No options play today—most companies are reporting earnings, and we prefer to steer clear of earnings lotteries. Instead, we’re spotlighting one of our favorite cash/money market instruments: SGOV. It offers risk-free returns of 5.1%, and we typically keep 70% of our cash parked there.

Some trades look great on paper, but execution is what separates real results from empty hype. If you’re wondering exactly how we’re approaching this one—when to enter, adjust, or exit—check out the full breakdown in our Trade Alerts section. No jargon, no fluff—just a clear, step-by-step look at the process.

Not sure if options trading is even your game? Fair enough. Skip the guesswork—jump on a free 20-minute Zoom call with me. No sales pitch, no pressure—just a straightforward chat to see if learning stock options with me as your mentor makes sense for you.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.