🎯 TUESDAY TARGET: US Natural Gas (UNG) | 👇 Reveal the Play

🧠 ELITE TRADER PLAN: 👇 Jump to Details

Wall Street’s sophisticated class spent 2025 hedging against disasters that never (really) arrived, drowning in risk models while retail investors, the so-called “dumb money”, simply bought the dip and humiliated the pros. Sometimes, knowing too much is the most expensive handicap of all. The retail crowd intuitively grasped the single variable that actually matters: the system is rigged to force liquidity into the veins of the market, regardless of the macro weather.

While the pundits obsess over a quarter-point rate cut this Wednesday, the real machinery is grinding away in the plumbing. The Fed is quietly preparing a massive monthly injection, likely $45 billion, to fix a creaking repo market. They label it “reserve management” to avoid the stigma of QE. We recognize it as a stealth restart of the money printer. This invisible backstop explains why equities float on a sea of cash even when fundamentals suggest otherwise.

The bond market, however, refuses to play along with the charade. Yields are ripping higher in a direct vote of no confidence, tightening financial conditions even as the Fed tries to loosen them. We have a central bank pumping gas while the bond market slams the brakes. That friction creates heat, and sometimes, something breaks.

Below, as always, the rest of what’s cooking:

The Commodity Supercycle

Investors anticipating a “run it hot” economy are rotating out of bonds and into physical assets. Fiscal excess and protectionist policies are creating a perfect storm for commodities, which are beginning to mirror the bullish price action of gold. While bonds suffer in an inflationary growth environment, hard assets like copper and energy are positioning for a breakout as the new safe havens.

Existential Tech Spending

Big Tech capital expenditure is no longer about immediate returns on investment. It has evolved into a war for survival where falling behind in AI development is viewed as an existential threat. This dynamic ensures a floor for hardware and infrastructure spending regardless of interest rates. The mega-caps will continue burning cash on chips and data centers because the alternative is obsolescence.

The Refining Chokehold

Western nations are scrambling to secure mining rights for critical minerals, yet they are ignoring the true bottleneck. China dominates the refining capacity for these resources, maintaining a stranglehold on the supply chain regardless of where the ore is dug. Building batteries or advanced tech without Beijing’s cooperation remains impossible. True energy independence requires massive investment in processing infrastructure, not just new mines.

Global South Energy Realism

Developing nations are quietly abandoning idealistic climate timelines in favor of energy security. India’s push to massively expand coal power through 2047 signals a broader shift in the Global South. As these economies prioritize growth and stability over decarbonization, demand for traditional fossil fuels will likely remain robust for decades. This reality creates a long-term bullish undercurrent for traditional energy sectors.

THE WEEK: Central Bank Overload

Wednesday’s Fed decision dominates the calendar, with markets pricing in a cut despite hawkish whispers. The policy docket is crowded with the RBA, Bank of Canada, and SNB also weighing in. Beyond the central bank theater, today’s JOLTS data tests labor resilience, while earnings from Oracle and Broadcom will confirm whether AI valuations can withstand the collision of high expectations and shifting macro tides.

Tactics for this Tape

Fighting the seasonal liquidity tide is expensive, especially with systematic funds re-levering and corporate buybacks at peak flow. The path of least resistance remains higher, yet implied volatility has collapsed to levels that scream complacency. Rather than chasing extended momentum, the smart play is to respect the trend while utilizing historically cheap options to hedge against a potential bond market tantrum.

Get Rich Overnight with Options? Yeah Right...

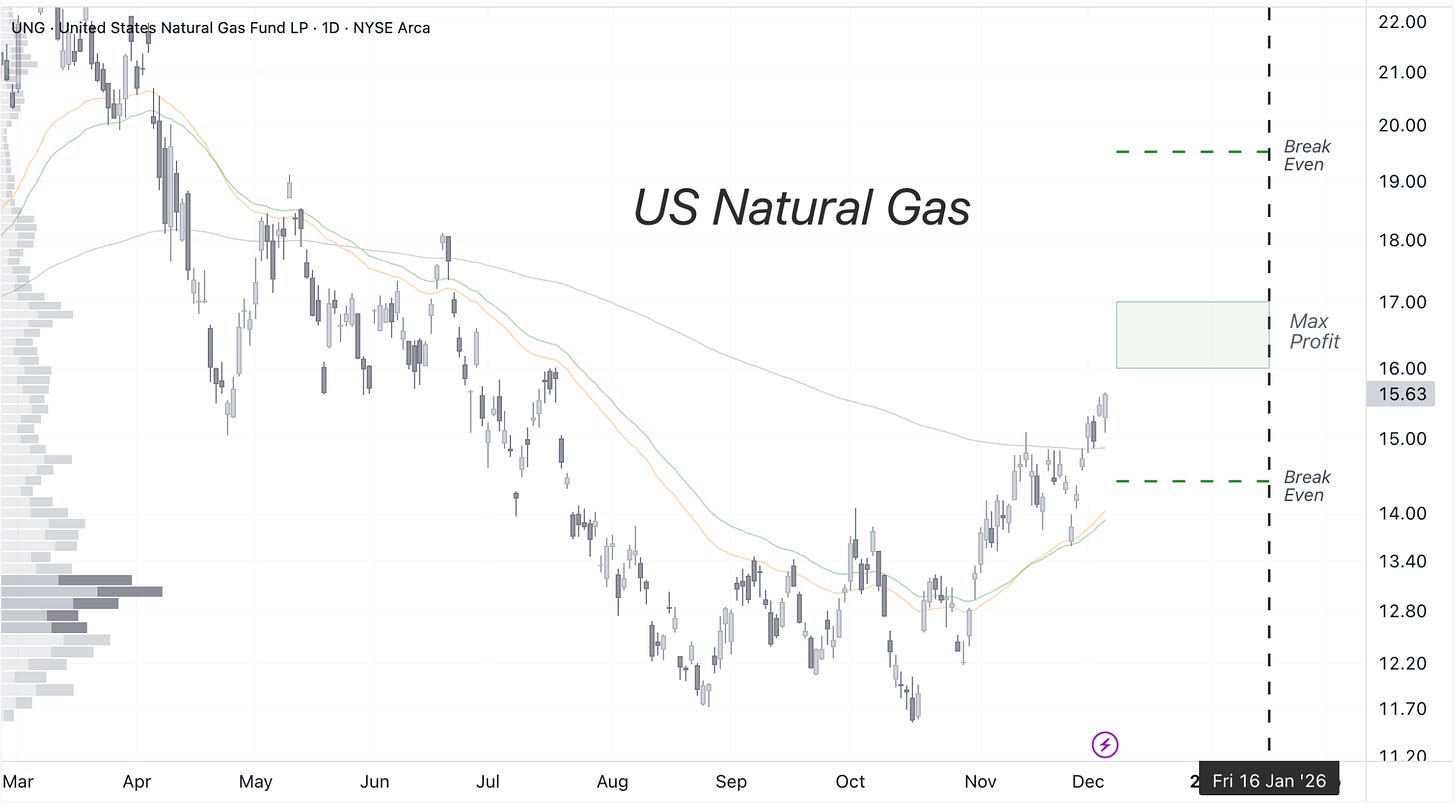

TUESDAY TARGET: US Natural Gas (UNG)

The futures are trading in slight backwardation, which gives UNG a bit of a natural push from the monthly rolling. And yes, it does feel like that old friend that has to come back up at some point, so we’re happy to lean into that mean-reversion tendency with a slightly bullish, defined-risk options structure.

Still: natural gas is the widow maker. If you like a calm life, maybe don’t trade it.

Also: Storage is comfortable and the base case is that winter risks (weather, LNG, geopolitics) stay within a “normal chaos” range, big headlines are possible, but statistically rare.

Our edge here is taking the other side of overpriced wings, with capped risk on both sides. We’ll manage actively if UNG makes a strong move toward either short strike.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

🧠 Elite Trader Plan

And if you need a calm, step-by-step options plan that grows accounts and tames big swings, check out the Elite Trader Plan. In 4–8 sessions, we will bring you fully up to speed, all included in the plan.

📅 Regular Mentorship Call

More time = more value.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👉 Book 60-Minute Call

Elite Trader: $110 | 👉 Book Elite Trader Call

⏳ 30-Minute Session

Less time = more often.

📚 In-Depth Learning

🧠 Strategy Breakdowns

🔍 Trade Reviews

Rate: $75 | 👉 Book 30-Minute Call

Elite Trader: $55 | 👉 Book Elite Trader Call

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.