If you come home and your kids fight, you don’t stop the fight. You cut off communication with the older one, publicly humiliate and demonize him while giving indirect financial support. The younger one you support openly—what parent doesn't like a bit of virtue signaling—by giving him longer and more dangerous weapons. In the end, if you’re an aging parent, maybe losing your grip on things and letting grandma call the shots, who cares if they burn down the house? At least, you all go out with a bang.

Below, as always, the minimum you need to know to get a feel for what's cooking:

Nothing Says Stability Like ATACMS and Nuclear Warnings

Ukraine’s first use of U.S.-supplied ATACMS ballistic missiles to strike a Russian military facility in the Bryansk region marks a major escalation in the conflict. Kremlin officials have warned such actions could trigger a nuclear response under Russia’s recently updated doctrine, which now considers Western non-nuclear strikes on its territory as potential grounds for nuclear retaliation. The Biden administration’s approval of these strikes has faced criticism for inflaming tensions during its final months in office, complicating the transition for Donald Trump, who has pledged to pursue peace talks. As North Korea deepens its military support for Russia, including munitions and troop deployments, the conflict’s risks continue to grow, with potential spillovers into global markets and investment stability.

Energy Markets Turn Up The Heat

Russia’s decision to halt natural gas exports to Austria and restrict enriched uranium sales to ‘friendly’ nations such as China and India is intensifying global energy market pressures. At the same time, discussions within the U.S. Navy suggest a potential shift toward prioritizing the protection of U.S.-flagged vessels over general maritime security in critical shipping lanes like the Red Sea and Suez Canal. This America First approach could disrupt global trade flows, leave non-allied nations more vulnerable, and further strain supply chains. Natural gas producers, uranium players, and other energy-linked sectors are worth close attention here.

Outsmarting Concentration: Options for 2025 Success

Everybody, and their aunt, is talking about how 2025 will be a stock-picker’s market, as valuation expansion slows and profit growth moderates. U.S. equities have surged over 50% since the 2022 lows, leaving the S&P 500 at valuation highs not seen in some time and increasingly vulnerable to corrections. Risks are compounded by extreme market concentration, with the top 10 U.S. stocks now accounting for more than 37% of index value. In this environment, smart options strategies—market-neutral constructs, volatility plays, and other techniques that don’t depend on perpetual upward trends—offer compelling opportunities to generate alpha.

Get Rich Overnight with Options? Yeah Right...

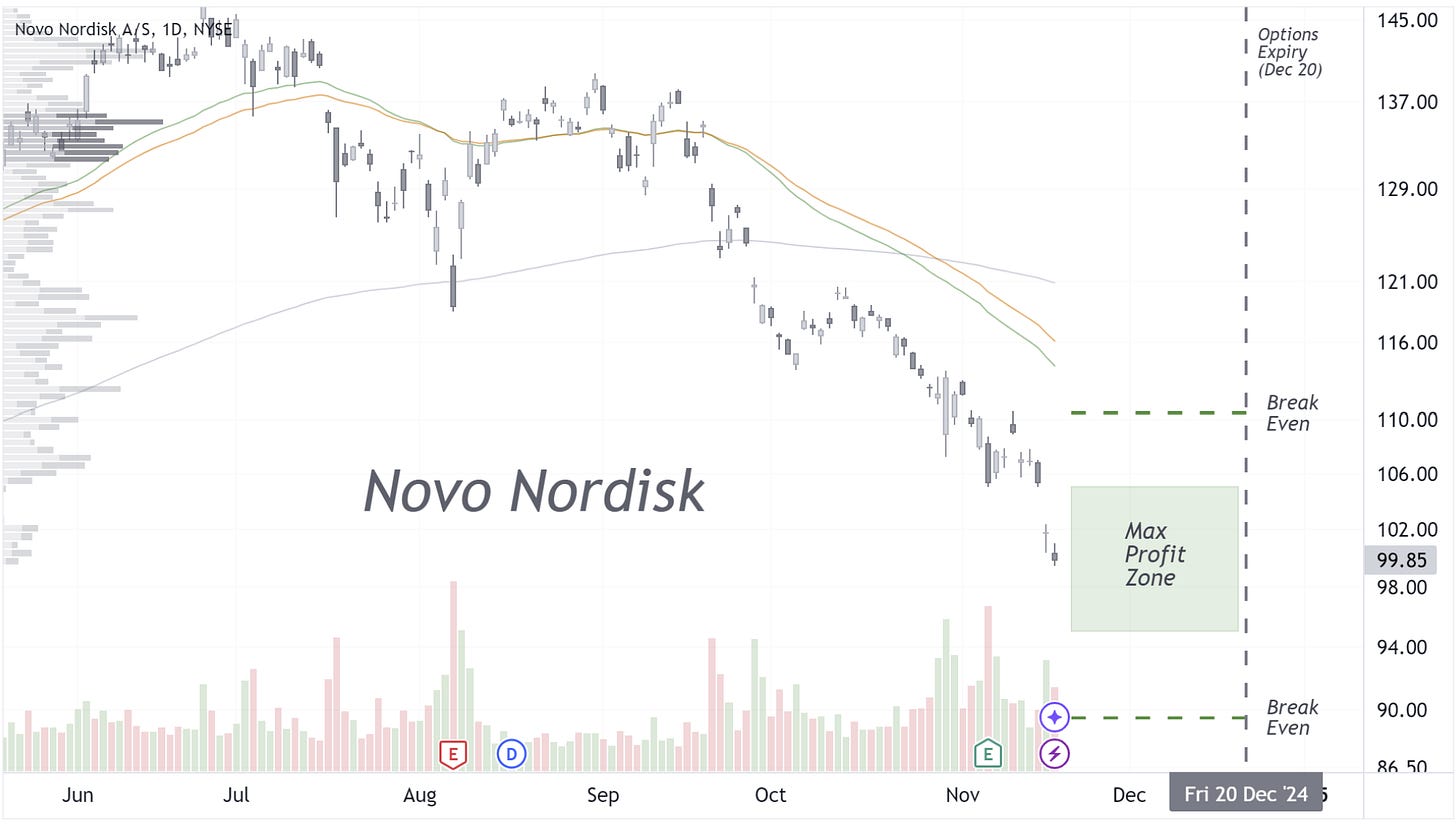

TUESDAY TARGET: Pharma is in a beautiful downward trend; let's see how long this continues. Also, we do get philosophical at times. Curious about who we offended this time?

Check out the details in the Subscriber Chat.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.