Blink and you missed it: fourteen bunker-busters, a few stray drones, two competing midnight deadlines, and — abracadabra — peace in our time, sealed neatly via presidential post. Oil promptly cratered 9%, screens turned mint-green, and Bloomberg’s war ticker suddenly looked like an old birthday reminder.

But here’s what should unsettle investors far more than stray missiles: the market reacted as though the Strait of Hormuz were a tourist canal and energy risk could be toggled on or off with a Truth‑Social emoji. Traders spent last week panic-buying crude calls as apocalypse insurance — only to toss them aside within hours of Trump's ceasefire tweet. Systematic funds abruptly flipped from cautious buyers to relentless sellers, and equities waltzed higher despite a 70%-strong buyback blackout quietly draining liquidity behind the scenes. Wall Street’s verdict? Crisis averted — next!

What’s going on here? A decade of central-bank sedation has rewired risk sensors to shrug at anything shorter than a Netflix mini-series. Meanwhile, insurance underwriters have quietly hiked premiums on Gulf voyages to decade highs, acknowledging that stopping missiles is simpler than soothing actuaries. Crude futures ditched their war premium, yet every barrel now sails first-class on the fear index.

The punch line: Wall Street’s volatility complex is treating this ceasefire as a final scene, ignoring the sequel risks — supply chains rerouted, insurers on strike, and a White House that discovered how quickly limited war can goose poll numbers without denting the Dow. Welcome back complacency!

Below, as always, the minimum you need to stay ahead:

GenAI: A Runaway Trade?

Goldman’s AI equity basket is hitting new highs, RSI well above 70, and semis are outperforming software by the widest margin in over a year. With sentiment stretched and positioning heavy, the risk of an air pocket is rising.

Bitcoin Carry Trades Go Global

The MicroStrategy model — issuing long-dated debt to buy Bitcoin — is spreading. Metaplanet in Japan is now trading at over 6× its net asset value, showing investor appetite for bitcoin-leveraged equities remains strong. But stretched premiums often precede sharp mean-reversions. Investors should evaluate debt structure, not just bitcoin exposure.

Corporate vs. Market Sentiment Divergence

CEO confidence continues to fall even as analyst earnings forecasts hit new highs. When those who control capex and hiring start pulling back, equity bulls should take note. The lag between boardroom sentiment and stock prices doesn’t last forever. Watch corporate guidance and investment plans closely over the next few weeks.

Quiet Move, Big Impact: SLR Cut Coming

Regulators are preparing to reduce the enhanced Supplementary Leverage Ratio for major U.S. banks. That adjustment, though technical, could free up hundreds of billions in balance sheet capacity — likely redirected into Treasuries or shareholder returns. Either way, it’s a structural tilt toward more Treasury demand and higher bank risk appetite, disguised as a regulatory footnote.

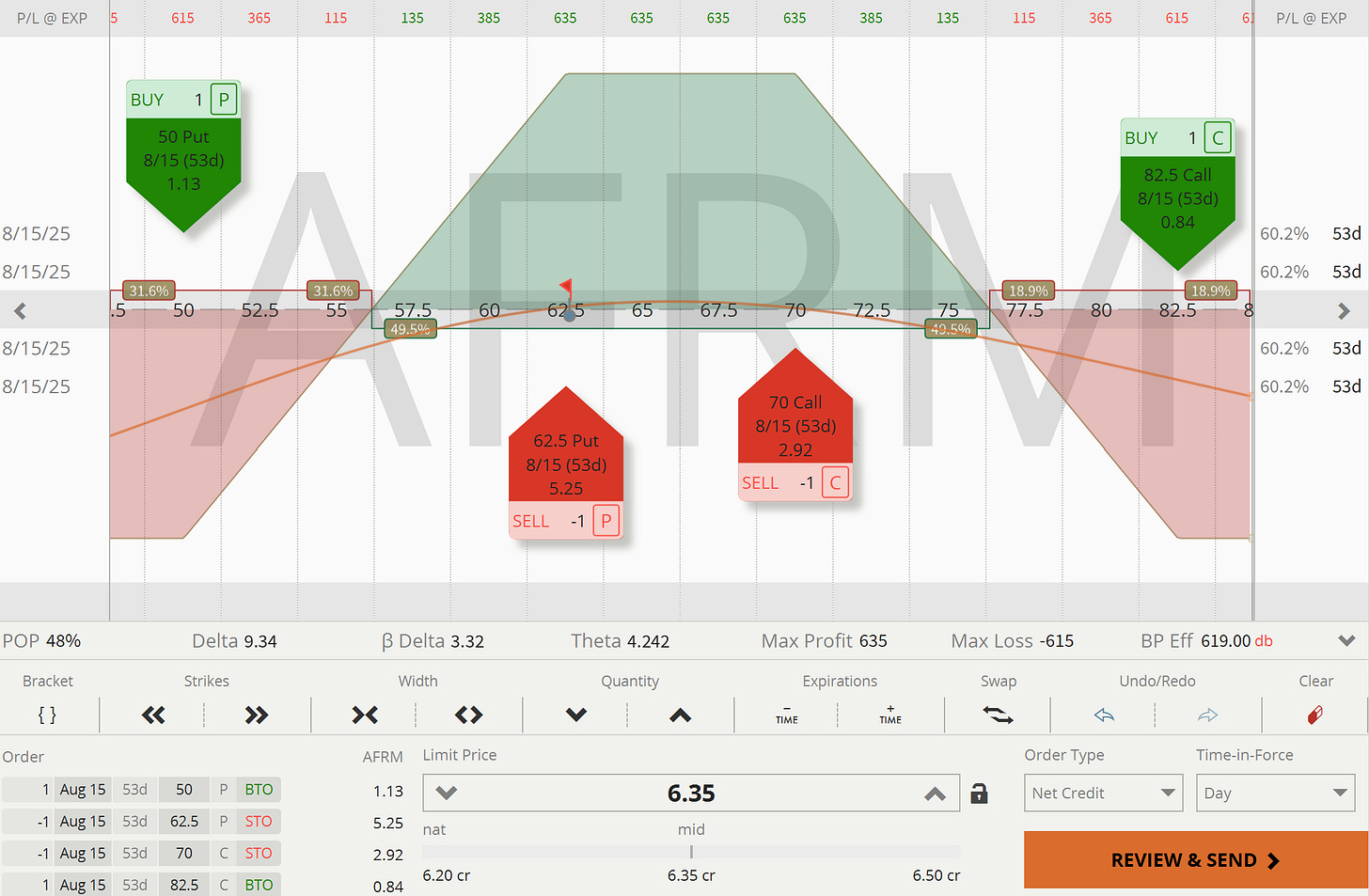

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: We were looking for a high-beta stock we can be slightly bullish on — one that might be affected by earnings only indirectly before option expiry. Affirm is our best shot, and we do feel firm about it — that’s for sure.

Also: the technical setup is clean, the story has momentum, and the risk is defined. A swing worth taking.

Want to get those trade ideas instantly? Check out the Trade Alerts section.

As mentioned above, all our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a 30-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.