So, it seems the U.S. is at war with Iran — or about to be. Strange how neatly everything is falling into place, as if Trump had pre-announced it months ago. The man talks so much that even his wild predictions occasionally land, but this time, the script feels rehearsed. The missiles, the refueling tankers, the carrier groups, even the new German chancellor acting like NATO’s press secretary — it all snapped into frame without the usual chaos.

And markets? They’re acting like it’s just Tuesday without a Target. Oil has moved, yes, but not in panic mode. Gold’s firm, not frantic. The S&P shrugs while equity vol stays sedated. Transparency from Washington and Tel Aviv has been almost surgical — so neat that traders believe there’s no surprise left to price. No WMD hysteria. No Colin Powell moment. Just a slow, quiet build-up that feels weirdly... orderly.

The wildcard is Iran. A regime backed into a corner rarely plays by the market’s rules. If Tehran strikes back hard — especially in the Strait of Hormuz — global shipping, energy flows, and dollar liquidity could all face overnight shocks. Yet equity desks keep behaving like risk is optional, like war is just a volatility discount.

The silence is telling. No global protests. No European outcry. No dramatic UN walkouts. The absence of resistance — especially from states that usually push back — may be the loudest confirmation that the world quietly agrees: this regime in Tehran has outlived its diplomatic credit line.

Markets love clarity, and for now, everything feels telegraphed. But risk doesn’t ring the doorbell. When it arrives, it kicks down the door. And if you’re still pricing this conflict like it’s a local skirmish, you might want to look again at the map — and your exposure.

Below, as always, the minimum you need to know to get a feel for what's cooking:

Dollar Shorts at 20‑Year Extreme

Asset‑managers have turned the greenback into the consensus punch‑bag: BofA’s June survey shows the largest underweight in two decades. Crowded FX trades rarely die of old age; they unwind on catalysts. A single Hormuz headline that spikes Brent and forces global funding back into dollars could ignite a face‑ripping short squeeze.

Volatility’s Tell‑Tale Skew

Index gamma is still net‑long, masking day‑to‑day nerves, yet three‑month put‑skew just broke to post‑April highs while VIX edges up. Translation: tail insurance is being hoarded, not dumped. The moment dealers flip short‑gamma, reflexive sell‑pressure arrives fast—so size hedges before everyone else chases the same strikes.

Bitcoin & Gold – The Shadow Central Banks

Central banks bought a record 1 kt of gold over 12 months; U.S. policy just embraced crypto innovation while Europe toys with CBDCs. Sound money scepticism is going mainstream. A balanced portfolio can now hold both: gold for nation‑state diversification, Bitcoin for censorship‑resistant liquidity.

Silver: Metal of Chips and Missiles

AI accelerators, solar inverters, hypersonic guidance systems—each needs silver’s unmatched conductivity. Supply is flat, speculative longs only now waking up. A war premium plus AI demand equals a rare dual‑cycle. Call‑spreads dated six months out price far less implied vol than gold or oil.

Get Rich Overnight with Options? Yeah Right...

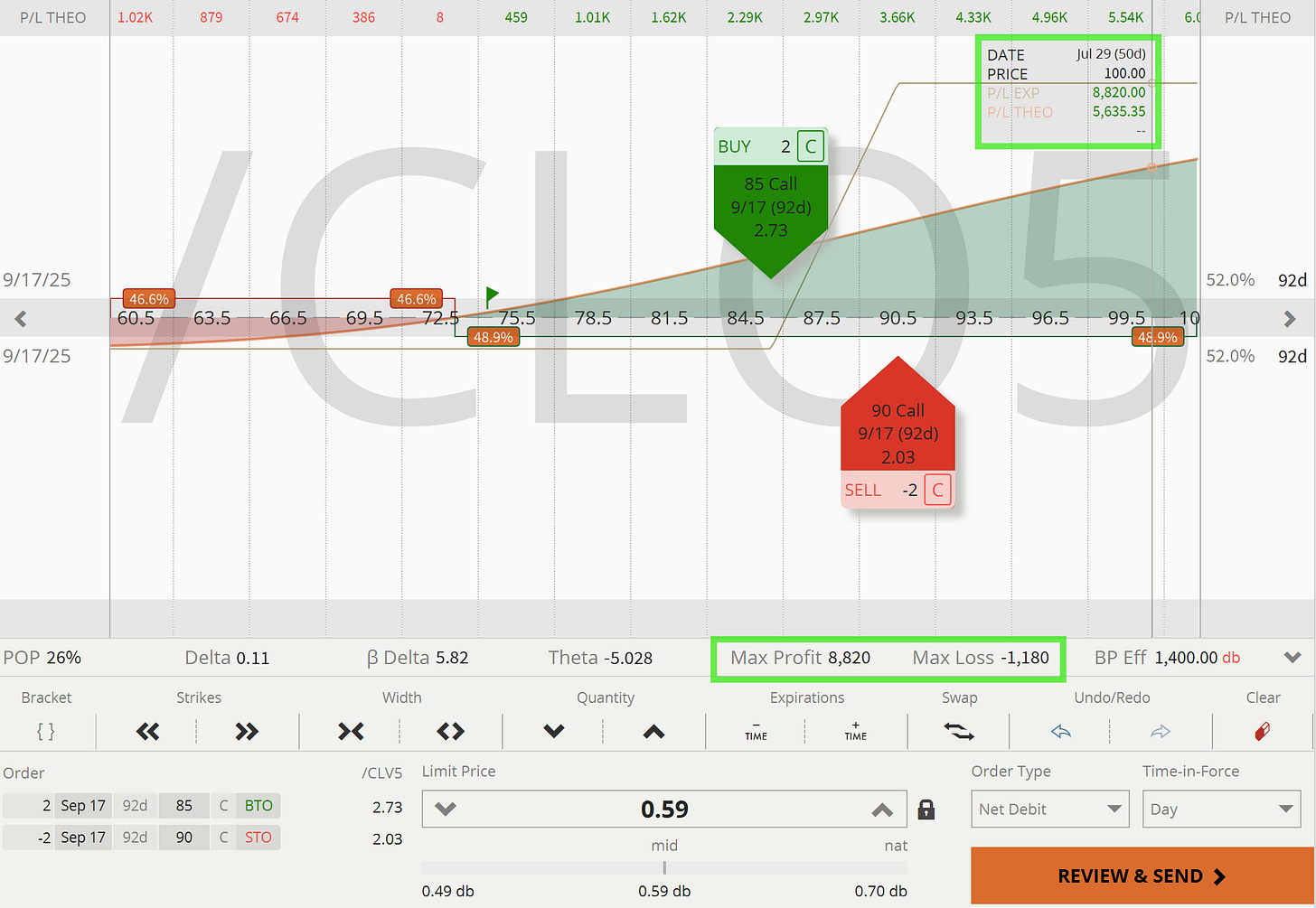

TUESDAY TARGET: Call debit spread on crude oil — a capital-efficient hedge against an Iran–Hormuz shock. Can be closed for a ~50% loss if diplomacy holds, but offers up to 8‑to‑1 upside if WTI spikes toward $90-100 in the coming weeks.

Small hedge sizing recommended to absorb short-term drawdowns without portfolio drag.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a 30-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.