Jamie Dimon’s latest prophecy has it all: a crack in the bond market, America on track to lose reserve currency status, and a shadowy enemy within, quietly undermining the nation. Sounds like yet another end-of-empire script. But let’s zoom in — because when the head of the biggest U.S. bank starts quoting tectonic plates and decline theory, something else is usually going on.

Yes, deficits are bloated, and yes, the global system is shifting. But let’s try breathing in and out at separate times. Since when do big banks care about 40-year forecasts? They rarely even get the next quarter right. If there’s a crack coming, it’s not some dramatic collapse tomorrow — it’s a slow bleed disguised as policy: financial repression, stealth inflation, and soft capital controls marketed as stability. That’s how empires actually age — through erosion, not explosion.

Dimon’s warning isn’t wrong. It’s just incomplete. The dollar won’t lose its dominance because America stops being strong. It’ll lose it if enough capital decides the rules are rigged — when foreign buyers of Treasuries get tired of subsidizing deficits, and domestic investors realize they’re footing the bill via suppressed yields and inflated assets. That said, with Europe, China, and Japan all drowning in their own debt loads, the dollar doesn’t have to be perfect — just the least-worst option.

And as for the enemy within? Maybe it’s not a political tribe or ideology. Maybe it’s a system addicted to short-term fixes and blind to structural rot — one that talks tough while quietly inflating away the promises it can’t keep.

Empires don’t need enemies to fall. They just need time, leverage, and bad habits.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

US Big Tech as Defensive Growth

Big Tech names have rebounded from short-lived doubts and could be again viewed as a default flight-to-quality. Why? Elevated cash reserves, potential AI tailwinds, and stable earnings. Yet, it’s not a slam dunk. If we see a 2023-style overvaluation creep, even defensive growth could turn volatile again. The biggest pitfall: If interest rates spike further, these long-duration tech assets could face sudden valuation pressure.

AI Back in Town

The hype around AI software and semiconductor breakthroughs fuels blockbuster inflows into tech niches. Some funds have posted record weekly net buys in leading chip designers. If these companies’ Q2 earnings reinforce the growth story, the rally might keep going.

Equities’ Surprising Margins

Corporate America continues to post robust margins, defying gloomier forecasts from a few months back. Some attribute it to cost cuts and the ability to pass on higher input costs. Others suspect a delayed effect of interest rates or wage hikes. Regardless, if margins stay near record levels, equity valuations may remain elevated, if they decide so.

Energy & Geopolitical Tangles

Global energy flows are in flux, with OPEC+ wavering on production targets and the U.S. pushing for alternative supply lines. Meanwhile, sporadic drone incidents and regional conflicts keep risk premiums on edge. Energy stocks could be short-term beneficiaries of any supply disruption, but a stable or even oversupplied market caps price rallies.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: It’s a fancy trade — your senses need to be razor sharp for this one. We call it the Wavered Trumped. It looks like a broken-wing butterfly at maturity, but just a few days into the trade, it reveals itself as a finely tuned instrument, buoyed by dividends. Watch it closely.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

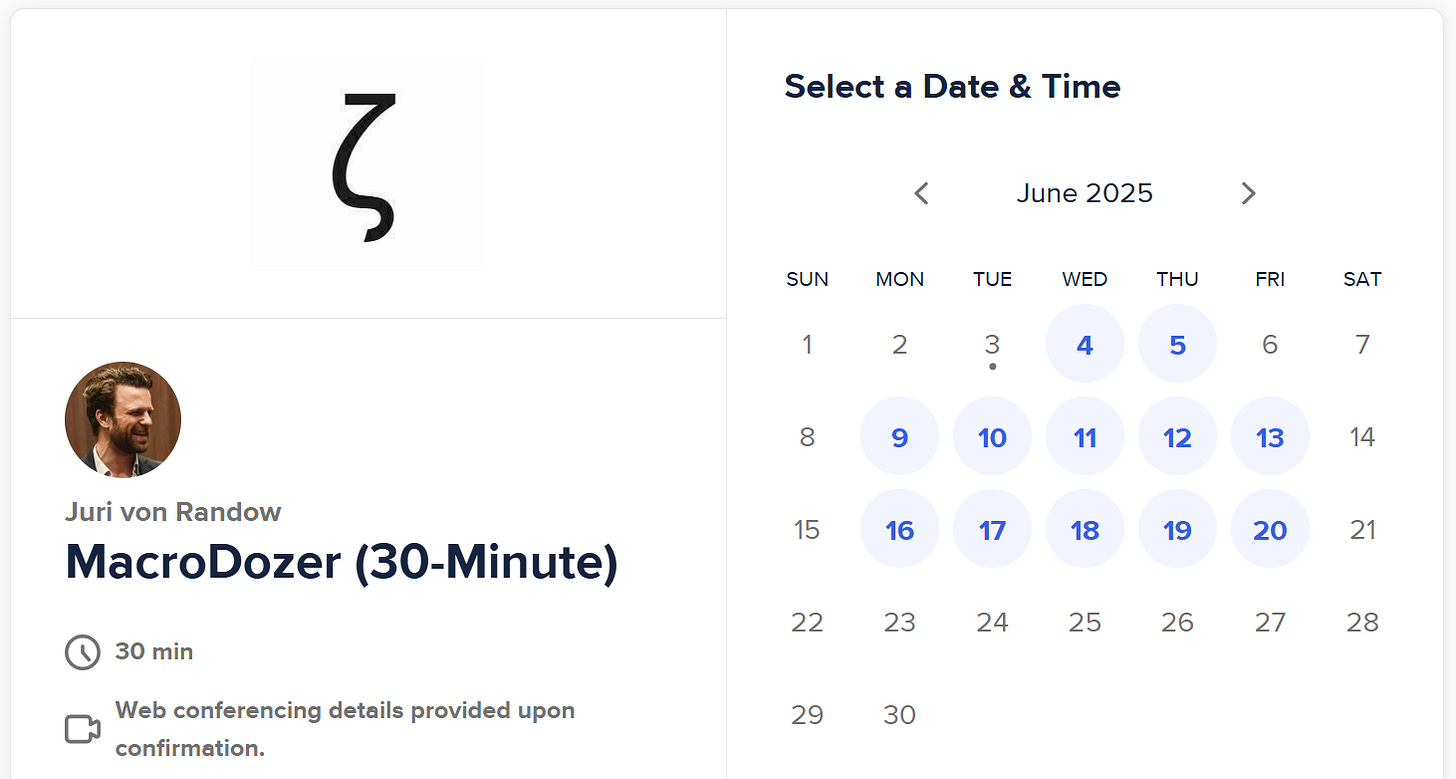

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a 30-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.