Everyone’s watching America blow its budget with trillion-dollar tax cuts and dreamy debt ceilings — but the real fire may have started elsewhere: under the floorboards of Japan’s bond market. The long end of their yield curve, once the safest corner of global finance, is now in freefall. And Japan’s biggest bondholders — life insurers — aren’t just sitting on losses. They’re dumping 30- and 40-year paper at record pace.

The official story? “Don’t worry, these are just paper losses — we’ll hold to maturity.” The reality? A regulatory shift rewrote the rules, the liability math collapsed, and now insurers are caught in a duration mismatch so brutal it makes Silicon Valley Bank look like a warm-up act.

Why does this matter outside Tokyo? Because these insurers aren’t just in Japanese Government Bonds — they’re whales in U.S. and European bonds too. If solvency ratios break, the forced selling won’t stay local. It’ll ripple through every yield-hunting market. This isn’t about Japan being weird. It’s about what happens when even the most patient capital says: enough.

The Bank of Japan is trying to stabilize things with more bond buying. But it already owns half the market — so adding more is like handing your rich uncle a bucket after the house has burned down. Worse, it turns into a game of chicken: will insurers keep selling until the BoJ panics? Or will the BoJ hold back and risk triggering an insolvency spiral?

Meanwhile, across the Pacific, bond vigilantes smell blood. With deficits ballooning and no fiscal discipline in sight, they’re bidding up long-end U.S. yields in protest. The parallel is eerie: in both countries, markets are losing faith in their governments' ability to manage debt — and pushing rates higher to prove the point.

This may be a slow-moving crisis. But slow-moving doesn’t mean safe. It means pressure builds quietly — until, suddenly, it doesn’t.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

The US “Big Beautiful Bill” & Fiscal Tensions

The latest budget bill is set to raise the debt ceiling by up to $4 trillion and extend certain tax breaks. This kind of deficit spending pleases equity bulls in the short run but raises the specter of even higher long-term yields. If America leans on more borrowing without a plan to shrink the deficit, global investors might push back — especially if a stronger economy fails to materialize to justify the extra debt.

Tariff Surprises: Triple the Revenue

Recent U.S. data suggests tariff revenue is running at about triple its usual pace. For now, that extra revenue might soothe some worries about the deficit. But tariffs have a knack for stunting trade flows and raising costs for consumers — so if the tariff regime persists (or escalates), it could undermine corporate margins and hamper global growth.

The Nuclear Energy Renaissance

Nuclear stocks spiked after a flurry of U.S. executive orders accelerated the sector’s expansion. Early-stage technologies like small modular reactors (SMRs) are gaining traction, while giants in uranium mining and reactor design see fresh demand. Although high capital costs remain a barrier, the long-term play hinges on nuclear’s reliability: it’s one of the few truly 24/7 energy sources with low emissions — attractive to both politicians and data-center-hungry tech giants.

Crypto Surges & the Corporate Treasury Race

Bitcoin recently set fresh highs, partly fueled by companies converting cash into crypto with a leveraged twist. Well-managed treasuries might handle future downturns, but reckless ones could trigger brutal liquidations if BTC tumbles. The result? A new breed of corporate crypto whales ramp up the upside — then risk amplifying the crash once leverage meets volatility.

Positioning: Hedge Funds & Mutual Funds

Recent data shows hedge funds maintaining relatively high gross leverage but historically low net leverage, reflecting a cautious approach to directional bets. Mutual funds, meanwhile, lag in technology stocks despite this year’s strong AI-led rally. If the macro picture shifts, these under-exposed groups might chase breakouts in a hurry — or dump positions just as fast.

Get Rich Overnight with Options? Yeah Right...

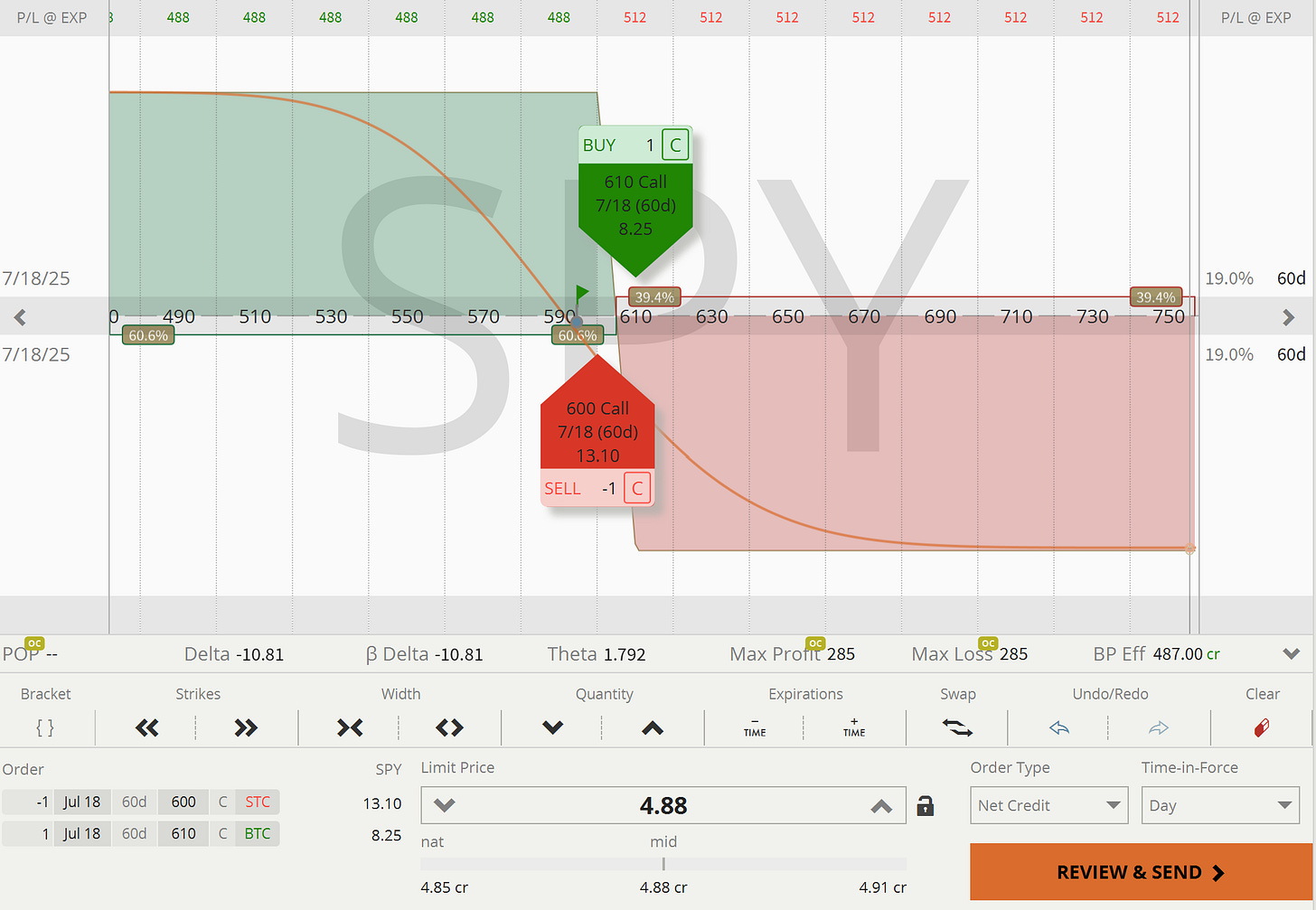

TUESDAY TARGET: Sometimes we win, sometimes we lose — especially when markets move in crash-squeeze style. We don’t mind volatility, but sharp moves down and up with no pause can hit us hard. In times like these, short-term hedges that protect against the worst-case scenario become reliable friends.

So, during the squeeze after Liberation Week, we put on a short-term upside hedge on the SPY — and it did its job. It counterbalanced a net short portfolio with a juicy 148% win. That let us close all short positions with minimal losses, and we’ve kind of already forgotten about the big early gains we made during the mini-crash.

Hedge Entry (May 9, 2025)

Hedge Exit (10 Days Later)

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a free 20-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.