Most politicians flip-flop because they're weak or unprepared. Trump flips by design — like an MMA fighter feinting left, then landing a knockout punch from the right. One day he's tightening tariffs and threatening half the globe; the next, he pauses everything, leaving Wall Street scrambling to reverse its recession forecasts. The media calls it chaos. I call it the Art of the Flip: sharp reversals that stun allies, confuse rivals, and create short-term advantages that wouldn't exist if he played it straight. Trump also knows how to weaponize a hyper-politicized media — ideology is easier to trick than independent minds. Most financial journalists don’t analyze much anymore; they just react, feeling whatever their political script tells them to feel.

Now those same voices say the Flip undermines trust, breaks supply chains, and leaves business leaders spinning. Maybe. But the brilliance is in the destabilization: analysts, investors, and foreign ministers all chasing policies that never quite settle. Markets feed on the adrenaline, compliance follows, and prices climb on a cocktail of relief and uncertainty — brushing off the recession talk like it never happened.

So here’s what I think: the Flip can’t last forever. Each pivot loses power — like building up tolerance to fentanyl. Eventually, corporates, trade partners, and even the Fed might stop reacting. That’s when bold moves become empty bluffs. Then again, last time around, the media danced to Trump’s tune until his final day in office. He knows the game. And if he keeps playing it right, he might actually win most of the little battles he started — maybe even the big wars.

Below, as always, the minimum you need to know to get a feel for what’s cooking:

From Doom Calls to Doubling Up

Major investment houses like JPMorgan and Goldman Sachs recently did a 180 on their recession forecasts, hiking GDP estimates and lifting S&P 500 targets just weeks after they’d warned of imminent contraction. The stunning pivot was triggered by cooling inflation data and, perhaps, a healthy dose of tariff uncertainty easing.

Artificial Intelligence: Hype Cycle Rebooted

Nvidia and a slate of AI-focused names are smashing benchmark returns — again. Enthusiasm over next-gen chips and unstoppable “machine intelligence” might pump up relative valuation multiples back to recent highs. However, don’t let FOMO overshadow basic risk management. Keep a keen eye on actual revenues, growth trajectories, and genuine profitability.

Stablecoins: The New Money-Market Funds?

Institutional players are loading billions into stablecoins backed heavily by Treasuries, effectively transforming them into digital money-market funds. This shift underscores how deeply crypto has embedded itself into traditional markets — and how reliant stablecoins are on U.S. debt. DeFi is inching closer to mainstream finance — so the risk of sudden or unknown disruptions will increase.

Syria Sanctions Lifted: Oil, Allies, and the Middle East

In a major diplomatic surprise, the U.S. lifted sanctions on Syria, prompting speculation that new deals — for oil, minerals, even potential real estate ventures — are in the pipeline. With the region already a hotbed of quick-turn policy pivots, this shift could spur short-term alliances (and equally quick betrayals).

Get Rich Overnight with Options? Yeah Right...

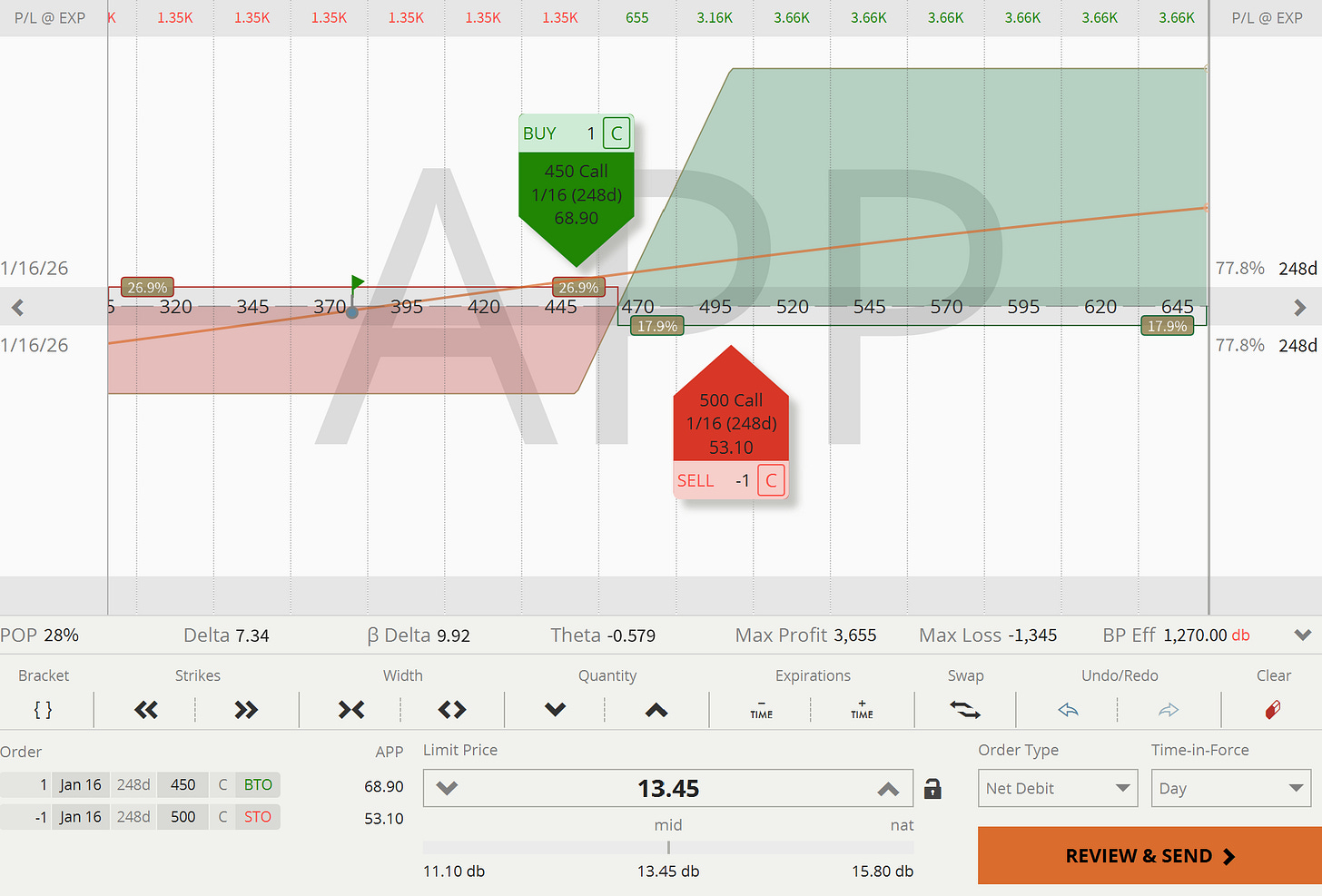

TUESDAY TARGET: We’re swinging for the fences with AppLovin — and trying not to lose our shirts while doing it. Sharp moves, up and down, have defined the past three months. We’re not fans of extremes, but here we are — still standing, still outperforming, while the market crashes and squeezes at the same time. If you’ve navigated this V-shaped madness with options and survived, you're probably flirting with enlightenment.

As for AppLovin: if you're retail, you bought the March and April dips. If you're a hedgie, you'll probably pile in right at the top — and load up on potent put debit spreads. That's just how it goes these days.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about integrating these insights into your own portfolio — or just bouncing ideas around? Book a free 20-minute strategy call. I am happy to help hone your edge or strengthen your risk management.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.