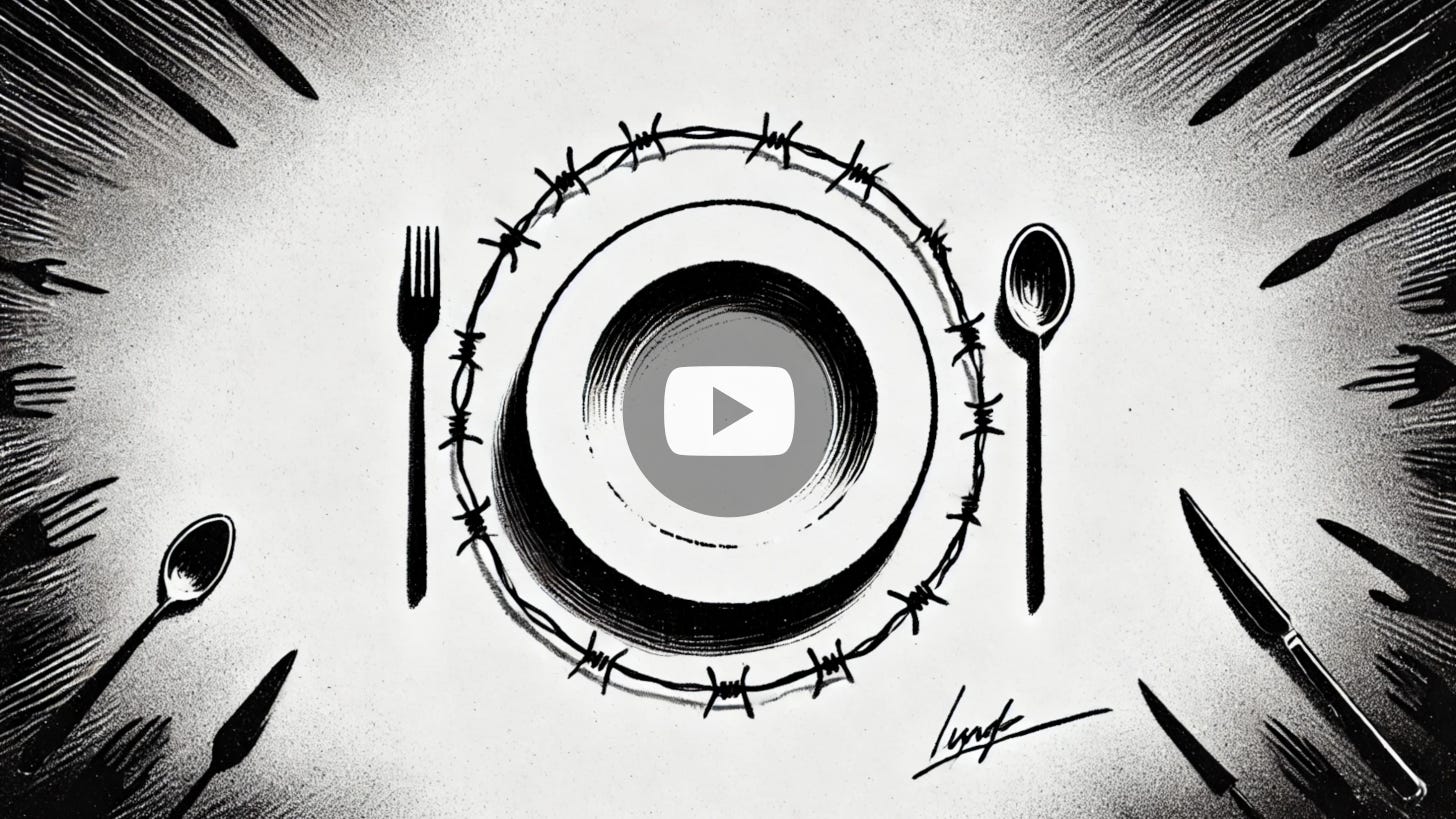

Starvation isn’t collateral damage anymore. It’s policy. It’s leverage. Gaza is no longer about Hamas — it’s about multi-decade blunders dressed up as strategy. This 400-mile tunnel war targets a militant brand, not a future, not a plan, not a path forward. Just another generation ready to wear a new label in 10 years, holding new hostages by then.

From Israelite kings and pharaohs to Romans, caliphs, Crusaders, Ottomans, and British colonialists — this region was always ruled, never settled. By the 1940s, Britain’s Mandate for Palestine was 67% Muslim Arab, 10% Christian Arab, just under 23% Jewish — mostly European Ashkenazi fleeing pogroms and later the Holocaust, plus over 800,000 Mizrahi and Sephardi Jews expelled or fleeing Arab countries. Everyone brought trauma, history, and homeland claims. No one brought a workable plan. Britain bailed. The UN drew a map. War redrew it — and the 1948 Nakba displaced 750,000 Arabs.

Fast forward: you can’t drone-strike your way out of entrenched cycles of violence — or erase a leftover population that wasn’t wealthy, mobile, or lucky enough to flee. Even the Germans, brutally organized as they were, couldn’t fully manage that in the 1940s. This isn’t Bin Laden walking out of a cave. It’s decades of strategic failure, with no serious attempt to build two governments, two economies, two futures. A region that could’ve become a shared economic hub — Israeli innovation paired with Palestinian cultural depth and human capital — is instead a permanent war zone.

Cooperation? Written off. Compromise? Treated like surrender. Mutual success? A casualty, not a goal.

And while radical, visionless politicians keep hammering the same broken tools — Netanyahu: settlements, hardliners, status quo. Sinwar: tunnels, hostages, October 7. Arafat: walked away at Camp David, lit the Second Intifada. And the U.S.? A hall of fame for strategic negligence: Bush Jr. (Iraq), Reagan (Lebanon, settlements), Trump (Jerusalem embassy grenade). The world is already paying. Weapons, risk, and misinformation now move faster than diplomacy ever will.

Sunday’s hypersonic strike near Ben Gurion shattered more than glass. Flights halted, insurers paused, and war-risk premiums in the Med tripled overnight. Oil (net-)bounced, shipping rates surged. Israel responded in Yemen with airstrikes on Houthi sites — another dangerous step up the escalation ladder. When food becomes a weapon and airports turn into targets, geopolitical risk stops being abstract. It hits spreads, shipping, and spot immediately.

Ignore diplomacy long enough, and your portfolio isn’t managing risk — it’s underwriting it.

Bottom line: Both sides are behaving like impulsive four-year-olds with zero frontal cortex. One of them eventually has to grow up — and stay non-violent long enough for gravity to flip the bully. Maybe brain implants for reasoning support will arrive before diplomacy. Either way — good luck to both of you.

Below, as always, the minimum we need to know to get a feel for what’s cooking.

Macro Head-Fakes Everywhere

Lagging economic data is throwing off market signals and fueling knee-jerk reactions. To stay ahead of the curve, prioritize real-time indicators — like freight volumes, private payroll trackers, and satellite data — over stale headline numbers.

Volatile Environment

With geopolitical friction, shifting policy regimes, and structurally higher rates, volatility is very likely here to stay. Active hedging, tactical rotation, and adaptive strategies are the new baseline.

Oil vs. Equities: One of You Is Lying

Oil markets are pricing in slowdown and soft demand. Equities are partying like it’s 2021. That divergence won’t last — either crude is too bearish, or stocks are too optimistic. Traders should watch closely: someone’s going to be wrong, and fast.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: We entered this beauty yesterday — selling a wide-enough iron condor on EFA, trying to rein in that beast. It’s mostly Europe, after all. And the whole re-arming narrative? Not a forever trade. Germany just botched its first chancellor vote in postwar history — Merz came up six votes short. He’ll probably limp across the finish line later this week, but it’s still Germany, where a center-right chancellor leans far-left by U.S. standards ;-) Summer chop, policy drift — let those premiums melt.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about how these trades fit into our broader portfolio approach — or how you might apply similar strategies yourself? Book a free 20-minute call to discuss whatever’s on your mind — from honing your edge to improving risk management or even brainstorming new opportunities.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.