AI is the market’s latest miracle drug — a cure-all prescribed by politicians and CEOs alike. Every national headache, from sagging productivity to geopolitical anxiety, now gets a generous dose of artificial intelligence. But let’s pause the tape before we swallow the next AI booster shot.

The narrative we are sold: reshoring production of high-end chips from Taiwan to American soil is good politics and smart strategy. Bring home those shiny new semiconductor factories, they say, and secure the AI-powered American dream — complete with more jobs, stable supply chains, and tech supremacy.

But here’s what I think: semiconductor manufacturing isn’t just expensive — it’s insanely expensive. We're talking billions for a single plant that takes years to reach full productivity, assuming it ever does, given the yawning skills gap stateside. Even if the concrete gets poured, the real battle starts afterward: rising costs, endless regulation, environmental hurdles, and permitting gridlock. America can print dollars, but it can’t print decades of specialized engineering or erase its own bureaucratic quicksand overnight.

So, what happens next? We pour eye-watering subsidies into reshoring, inflate already bloated AI valuations, justify stratospheric capex budgets, and fool ourselves into thinking we are solving the China-dependency problem. Meanwhile, Taiwan keeps cranking out chips cheaper and faster, thanks to decades of razor-sharp specialization — exactly what reshoring aims (and fails) to replicate overnight.

Ironically, the push to secure American AI dominance through reshoring might just do the opposite — creating a structural price disadvantage that hands rivals an easy competitive win. But politicians — and maybe even investors — won’t lose sleep over that anytime soon. By the time the bills come due, the herd will be on to the next flashy national priority. Quantum computing? Probably real estate sales on Mars first.

Below, as always, the minimum you need to know to get a feel for what's cooking.

Debt Ceiling & DOGE Mirage

Lower Q2 borrowing, driven by cash-draw tricks and tax-season windfalls, lets Washington claim Musk-style efficiency is shrinking the deficit. Don’t buy it. Musk is back to building cars, the big spenders — defense, entitlements, interest — stay bloated, and once the summer debt-ceiling drama is over Treasury will refill the tank, pushing issuance and yields right back up.

Buybacks Roaring Back

With the blackout period ending, corporations are poised to unleash fresh repurchase programs. On paper, this should support equity prices in the coming weeks. But remember: buybacks often paint a rosy short-term picture. Ultimately, they rely on strong earnings and stable credit conditions to remain sustainable. A flurry of buybacks isn’t a panacea if underlying fundamentals deteriorate.

China Tariffs & Pending Summer Squeeze

Chinese exporters have begun quietly hiking prices to offset new US tariff burdens. Combined with noticeably lighter container volumes, there’s a potential supply crunch forming for certain consumer goods. The short-term result could be higher prices or empty shelves — an inflation bump that might catch markets by surprise. Keep an eye on shipping data, not just headlines.

Canada’s Election & The “Tariff Effect”

A recent Canadian federal election underscores how foreign leaders can spin US tariff maneuvers to unify domestic voters. It’s a reminder that heavy-handed trade threats can boomerang politically, strengthening the very counterparts the White House hopes to pressure. Watch for similar dynamics in Europe and Asia, where tariffs might rally local sentiment against US demands.

The Dollar’s Slide: A Turning Point?

A weaker dollar has eased global liquidity constraints and, ironically, stabilized some emerging markets. Yet if the Fed hints at fewer cuts than the market expects — or if new trade deals surprise to the upside — the greenback might rebound. Lean too heavily into the dollar’s downtrend, and you risk being on the wrong side of a sudden squeeze.

Get Rich Overnight with Options? Yeah Right...

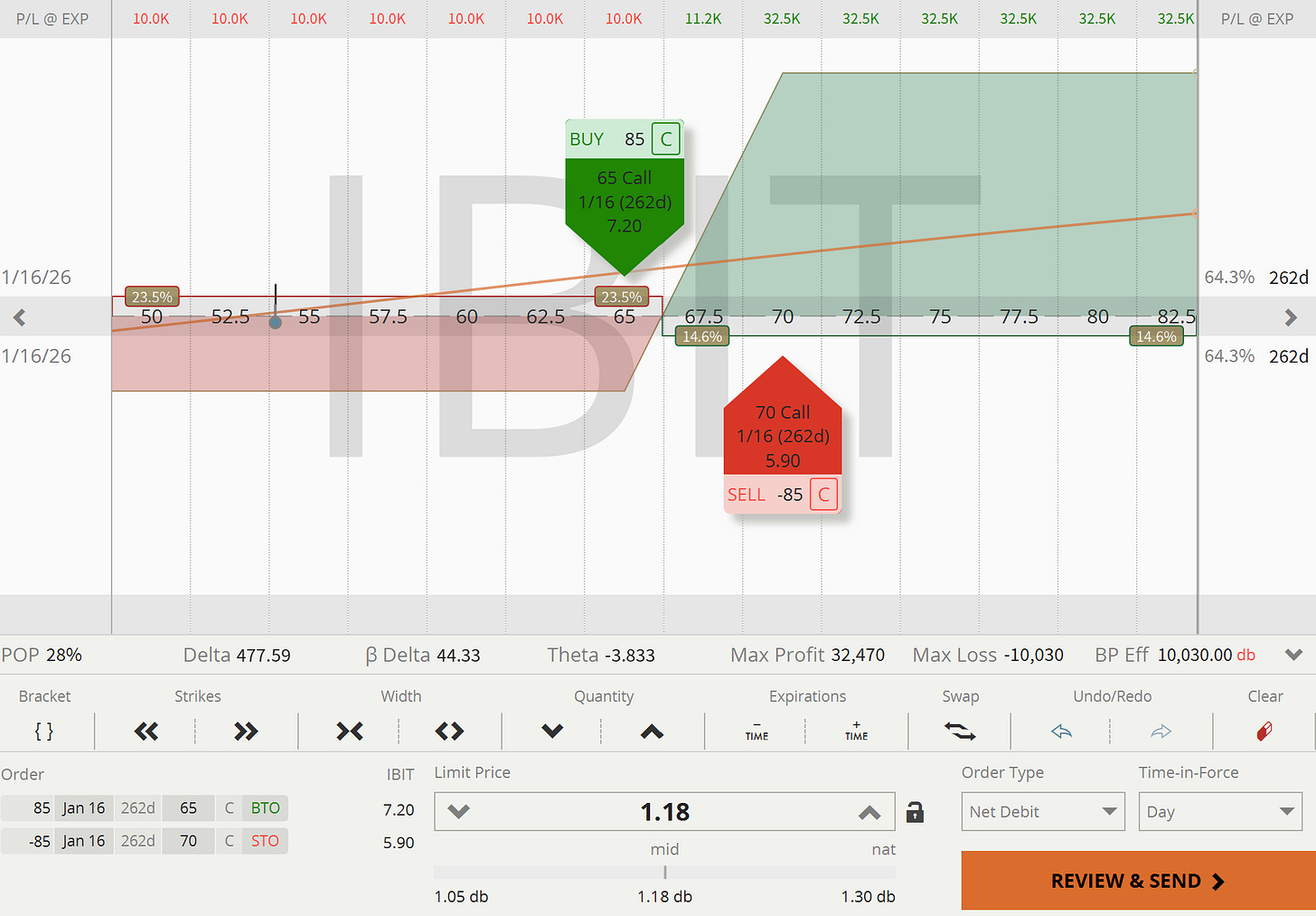

TUESDAY TARGET: If you're bullish on Bitcoin, consider a long-term call debit spread. We're not taking the trade (yet?), as we prefer to sell overpriced options in the short run. Still, the inflation theme isn’t disappearing anytime soon, and gold has already had a solid run. The call debit spread below offers a 3.2x risk-to-return ratio and a 28% probability of profit. With smart trade management, that probability should rise to around 50% — not unacceptable.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about how these trades fit into our broader portfolio approach — or how you might apply similar strategies yourself? Book a free 20-minute call to discuss whatever’s on your mind — from honing your edge to improving risk management or even brainstorming new opportunities.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.