It’s entertaining how markets jump at every whisper of a more diplomatic U.S. stance — especially from an administration that profits from keeping things unpredictable. The White House floats the possibility of easing tariffs, and suddenly half the trading world breathes a sigh of relief, while the other half points to Beijing’s unflinching demand for a clean slate before any real negotiation. Turns out, you can’t patch over years of global economic fracture with a one-liner and a wink... or can you?

Meanwhile, the American retail crowd is charging in like it’s still the post-Covid bull run — snapping up stocks as if every dip is a discount sale. I mean, Apple trading at 7.7x sales feels pretty bottomy to me… if you forget that during real crises, it traded closer to 1.2-1.3 times sales. Are they visionary contrarians or oblivious to the storm clouds? Some folks see everyday investors as the last pillar of optimism propping up a rickety structure. Others argue that, ironically, retail’s unwavering buy the dip reflex might become the accelerant of a future meltdown if these believers decide to bail all at once.

But here’s the deal: For the President to play good cop on tariffs, he needs a second act that either forces Beijing’s hand or keeps his own base convinced the game is rigged in America’s favor. And for Beijing, the path forward means dragging out negotiations until Washington feels compelled to show more than token concessions. Add retail’s relentless bullishness, and you have a market dancing between illusions of stability and a potential faceplant.

Below, as always, the minimum you need to know to get a feel for what’s cooking.

The “Pivot” Illusion

Despite hints from key U.S. policymakers that they may moderate their stance, the tone from recent policy updates suggests it’s more rhetorical shift than actual pivot. While conciliatory language can spark optimism, savvy traders know these pronouncements often aim to calm markets rather than commit to anything tangible.

Bank’s Flow-of-Funds Caution

Recent reports highlight the perils of low liquidity and significant positioning swings. The rapid exodus of systematic funds has subsided for now, but the environment remains delicate. If volatility spikes again, liquidity can dry up almost instantly, compounding market moves.

Europe’s Tech Fines & Retaliation Risks

Newly imposed EU fines on U.S. tech giants highlight the intensifying cross-Atlantic regulatory divide. For American investors, it’s a reminder that regulatory headwinds aren’t confined to Washington, D.C. The broader question is how the White House might retaliate or use trade leverage in ongoing negotiations.

The Tariff Paradox

High tariffs suppress growth and weaken demand, yet ironically, they can also lower the dollar and force foreign players to offload U.S. assets. A cheaper dollar might offer exporters short-term relief, but at the expense of spiking inflation or bond market turbulence. Balancing currency strategy, interest rates, and trade policy is a juggling act — and so far, nobody’s proven they can keep all three balls in the air indefinitely.

Get Rich Overnight with Options? Yeah Right...

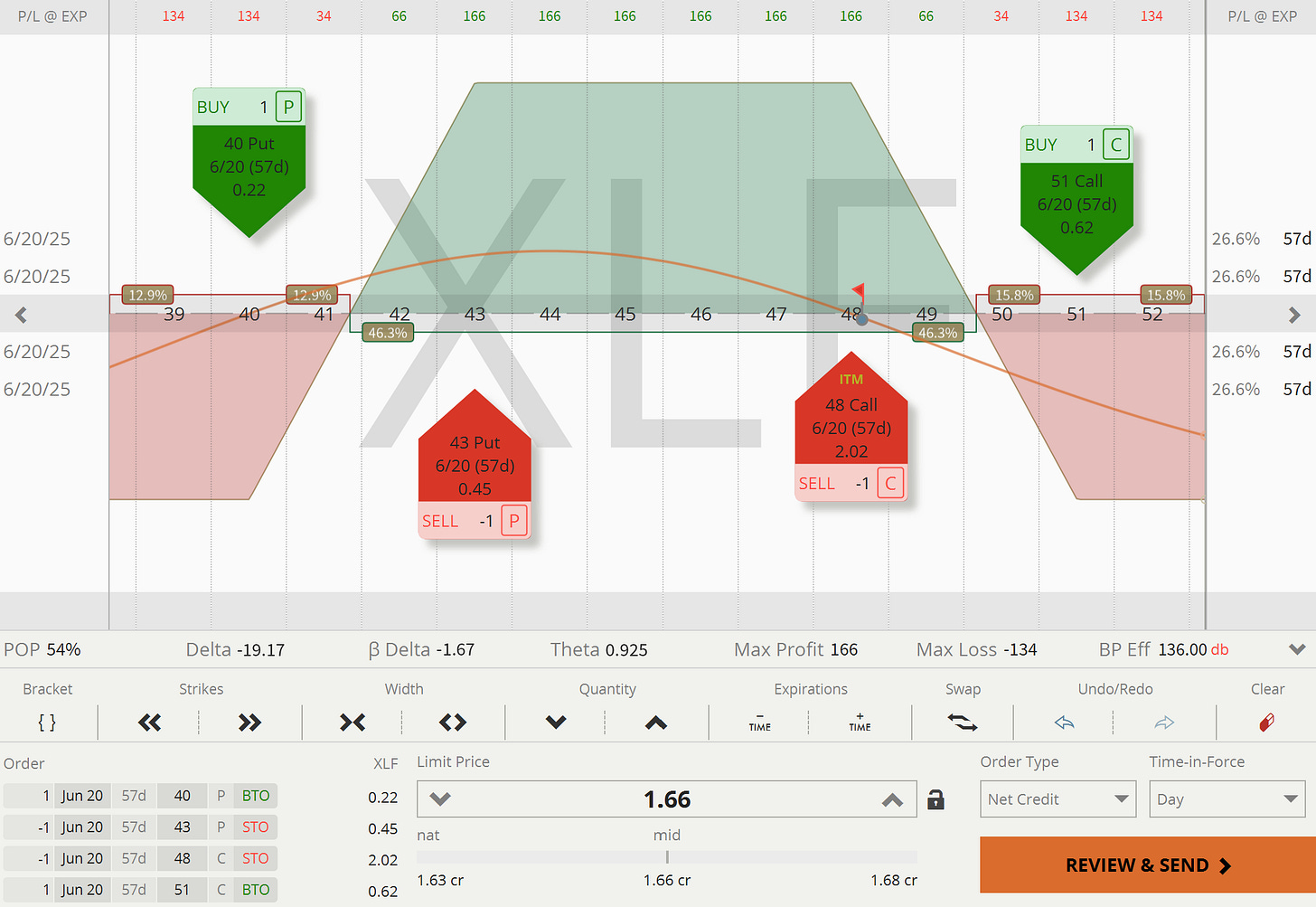

TUESDAY TARGET: We haven’t entered any trades since more than a week — watching the tape has been fascinating. One solid risk-reward setup with decent probabilities is a bearish play on XLF. But since we’re already in that trade for May and feeling a bit of heat, we’ll probably close it out first and look to reposition later.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

Curious about how these trades fit into our broader portfolio approach — or how you might apply similar strategies yourself? Book a free 20-minute call to discuss whatever’s on your mind — from honing your edge to improving risk management or even brainstorming new opportunities.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.