Strength is not what it looks like — it’s what you can get away with without flinching. And right now, Beijing is delivering a masterclass in staying still: banning big sellers from offloading stocks, instructing banks to dump dollars to prop up the yuan, and staging record ETF buying to keep screens green. It may read like resilience. But glance sideways, and you see something else: a regime straining to hold the mask in place, dumping U.S. Treasuries behind the scenes to maintain the optics of control.

And that’s where the real tension brews — not in equities, but in the bond market, where size meets consequence. The selloff in U.S. Treasuries is not just a reflection of inflation jitters or hedgies leveraged to the max on penny trades (so lame). It’s China’s exit, expressed in yield spikes and whiplash bond volatility. The deeper irony? While the Fed holds its fire, unsure whether to calm markets, it’s the Treasury — yes, the issuer — that’s hinting it may step in first with buybacks to absorb future shocks.

One might think China is losing because it’s forced to fake calm. But in reality, it could be scripting America’s next policy panic — leaving the U.S. market itself faker than before.

Something’s got to give. And when it does, it won’t be the loudest player that cracks first — it’ll be the one that’s been holding their breath the longest.

Below, as always, the minimum we need to know to get a feel for what’s cooking:

Mega-Caps: No Longer Bulletproof

Mega-cap stocks, previously the market’s safe haven, are now more fragile than investors assume. Their valuations — still high compared to historic norms — are facing sustained pressure as tariffs, stagflation risks, and fierce tech competition weigh heavily on forward earnings projections.

Bitcoin’s Quiet Outperformance

Here’s a quiet shocker: Despite turmoil in tech stocks and bonds, Bitcoin is outperforming the Nasdaq 100 on multiple timeframes, including YTD and over the past five years. It’s probably just a glitch, but why not give that asset a pat on the shoulder when all of a sudden everything else but Bitcoin feels unstable and risky?

Retail’s Risk Appetite: Delusion?

Institutional investors may be running scared, but retail investors continue to pile into equities, unfazed by recent volatility. Call it defiance, resilience, or delusion — the reality is clear: retail money continues to support dips aggressively… until employment becomes insecure.

Goldman’s Earnings Mirage

Goldman Sachs just clocked record equity trading revenues — no one is surprised. However, beneath the surface lie clear signals of stress: investment banking revenues stalled, advisory services fell sharply, and the firm’s asset management unit suffered significant investment losses. Signs of underlying corporate caution, shrinking deal pipelines, and tougher days ahead.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: We entered the Gold Trust ETF (GLD) last Thursday to add a bit more diversification to what had briefly become a one-sided portfolio. So far, it’s done a good job — already showing an 18% profit in just a few days.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

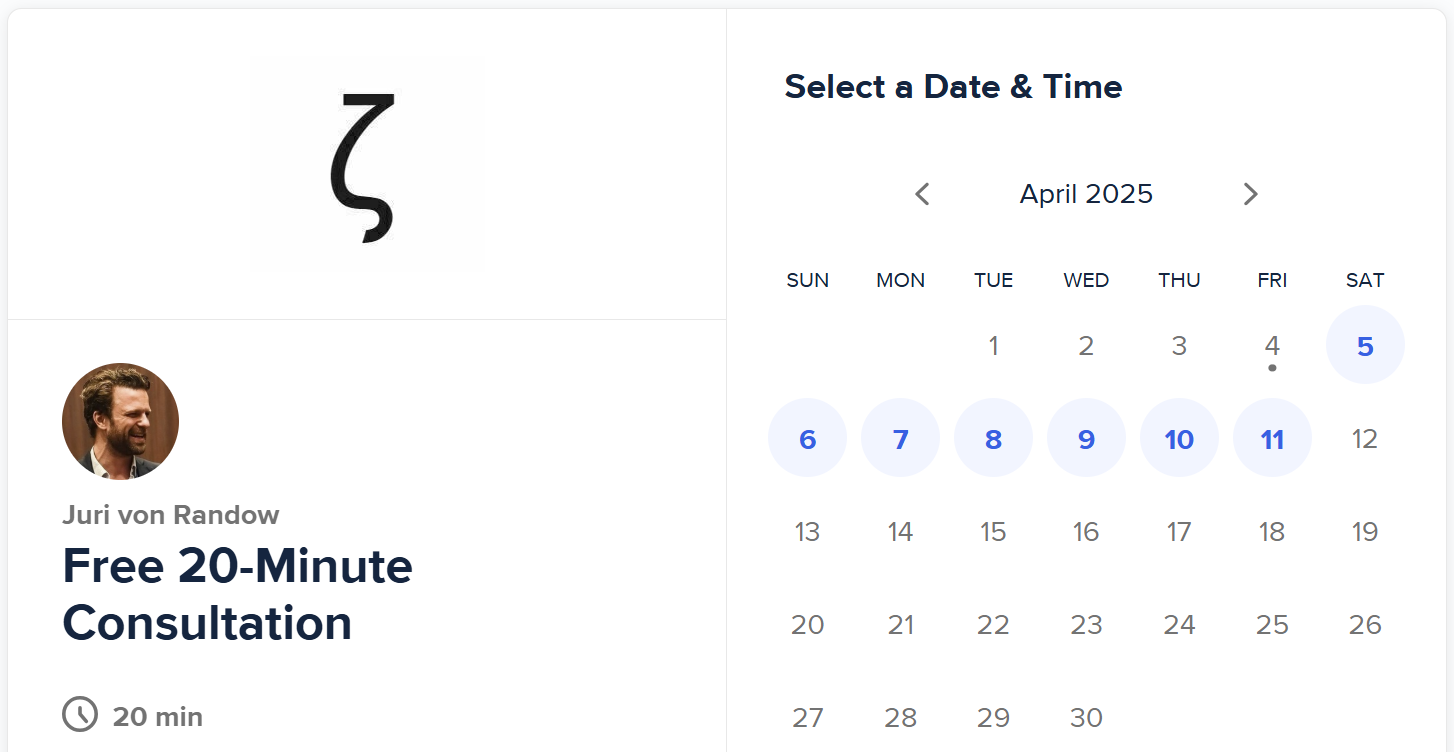

Curious about how these trades fit into our broader portfolio approach — or how you might apply similar strategies yourself? Book a free 20-minute call to discuss whatever’s on your mind — from honing your edge to improving risk management or even brainstorming new opportunities.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.