20+ TREASURY BOND: The 20+ TBond Commandments

Following The Government Into The Downward Trend

Executive Summary

TLT ranks on top of the IV Rank and IV Percentile lists.

Selling premium at the top usually pays off.

TLT with a negative beta may serve portfolios well.

Selling slightly bearish risk-defined straddle results in a 6.20 Credit.

1. Why Do I Care Right Now?

TLT continues to rank on top of my lists on IV Rank and IV Percentile, as high as 85/100 and 95/100, respectively. Both implied volatility measures tend to revert to the mean (50/100), and selling a juicy premium at the top usually pays off.

I am not particularly enjoying playing with TLT. It is not my favorite asset. But considering the market environment and the majority of assets behaving like there was no correlation below 0.90, TLT with a neutral S&P beta and correlation may serve portfolios well over the next 20-30 days.

Also, why not go with the trend? Interest rates expectations won’t go any lower over the next month. The 75 basis-point rate hike is priced in, so let’s settle that matter with a neutral to a slightly bearish position at around 109, with break-even points at 103 and 115.

2. Useful Background Information

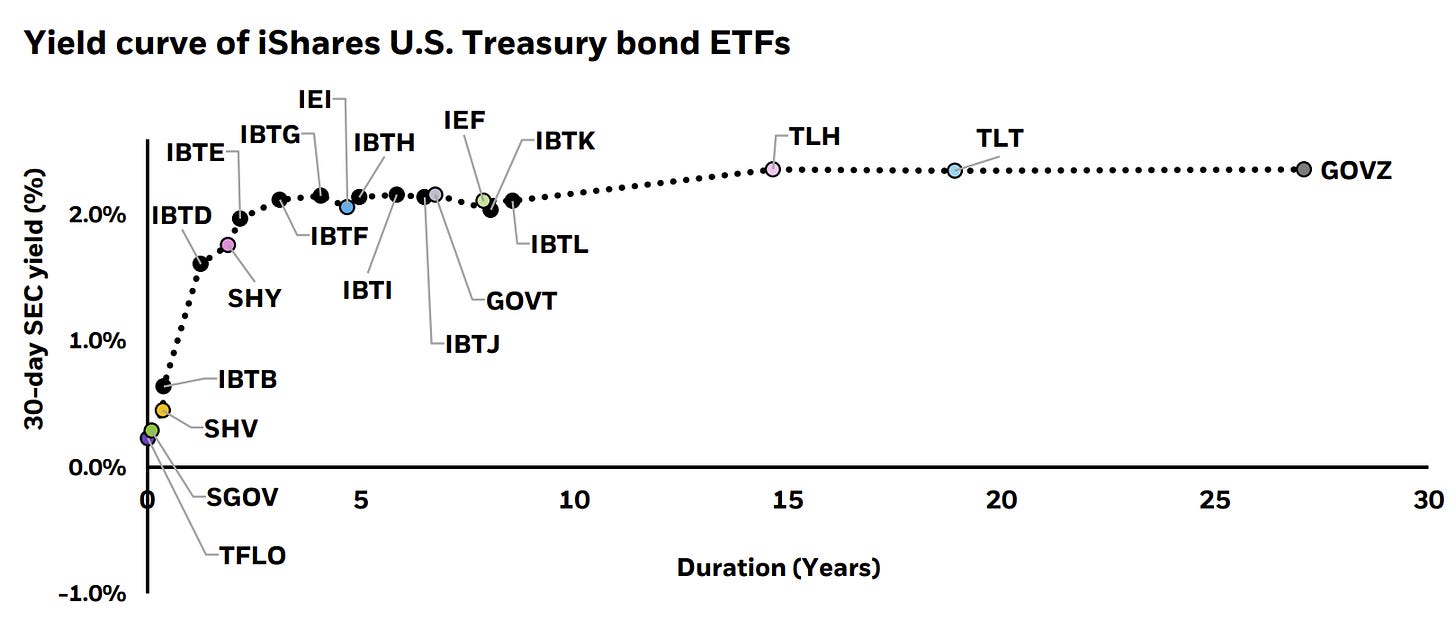

Time does not allow for a lengthy background information section, but I liked the Yield Curve of the iShares U.S. Treasury Bond ETFs, shown below.

The TLT, iShares 20+ Year Treasury Bond ETF, seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than 20 years. The equity beta over three years is -0.10.1

3. Trade Execution

Trade Entry - Jun 16, 2022

1) Short Call 109, Jul 29: 4.80 Credit.

2) Short Put 109, Jul 29: 2.39 Credit.

3) Long Call 120, Jul 29: 0.95 Debit.

4) Long Put 98, Jul 29: 0.62 Debit.

Total: 6.20 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

As of Apr 30, 2022.