STONECO: Brazil's Fintech Fiesta

From zero to hero, one profit at a time.

Executive Tease

When all stars align, the fairy isn’t far.

Taming the jungle with a long wide strangle.

And before we forget: There are insults to science.

1. Driving Forces

Welcome to the world of low volatility. In times of inexpensive premiums, it is wise to avoid excessive selling while the demand for new strategies in a less dynamic environment grows. But fear not. When markets shift, we can effortlessly switch gears and capitalize on long premium opportunities without requiring Einstein’s wits.

Today, we embark on precisely that, with Brazil’s StoneCo Ltd taking the spotlight. So prepare yourself for an electrifying ride!

Rant Around Market PhDs

You may have wondered about our irregular publishing schedule. We only shoot out ideas when we are confident of conquest.1 Losing is a terrible choice. And when the trade works against us, we use all available tactics to reduce risk, extend time, and try to turn the tide.

A fair number of investors don't seem to care much about losing trades. "It diversifies the portfolio. That's what Harry Markowitz told us in 1952," and one feels timelessly cosy about it.

Not inspiring.

We steer clear of gambling traps and their tricky mind games while also side-eyeing those fancy economic analyses promoting emotional attachments and dubious evidence. They are easy targets to blame when most assumptions go belly up. Falling for intellectual satisfaction and a false sense of security before braving the storm?

Not inspiring.

No offence to academic pursuits, but don't expect the markets to pour milk and honey on your chest when you pull the professor. The market-obsessed individual displaying impeccable discipline and profound risk awareness, willing to take and manage it, will grab the market grant.

Less voodoo science and noise, more power transfer to the road.

Spiritus in Via.

2. Background Information

StoneCo Ltd. (STNE) operates in Brazil's fintech sector, providing small and medium enterprises with digital payment, financial services, and software.

STNE faced significant challenges but managed to execute a successful turnaround. The company experienced a decline in its stock price, losing over 90% of its value due to an overreached growth strategy involving the provision of unsecured credit.

The company made several changes to address these difficulties, including a new leadership team. They appointed a new CEO, Pedro Zinner, who was expected to fit better the requirements of a bigger and more diversified company. Additionally, a Chief Risk Officer position was created to reflect the company's efforts to reenter credit markets, and a new board member was appointed to drive technological innovation.

2.1 Valuation

The company's valuation may not appear cheap relative to its main competitor, PagSeguro. Still, the innovative business approach, future margin expansion and the introduction of new credit offerings justify a higher relative valuation.

The company has shown positive next twelve-month (NTM) earnings projections since day one following its IPO. Therefore, we have the luxury of presenting the NTM price-to-earnings ratio as a good value indicator relative to its history.

STNE: P/E Multiple (NTM)

With a forward P/E ratio of 17.4x, close to its all-time low, it is uncertain whether the stock will remain this attractive for much longer. So wait to find out, or grab the opportunity and put some skin in the game.

2.2 Growth

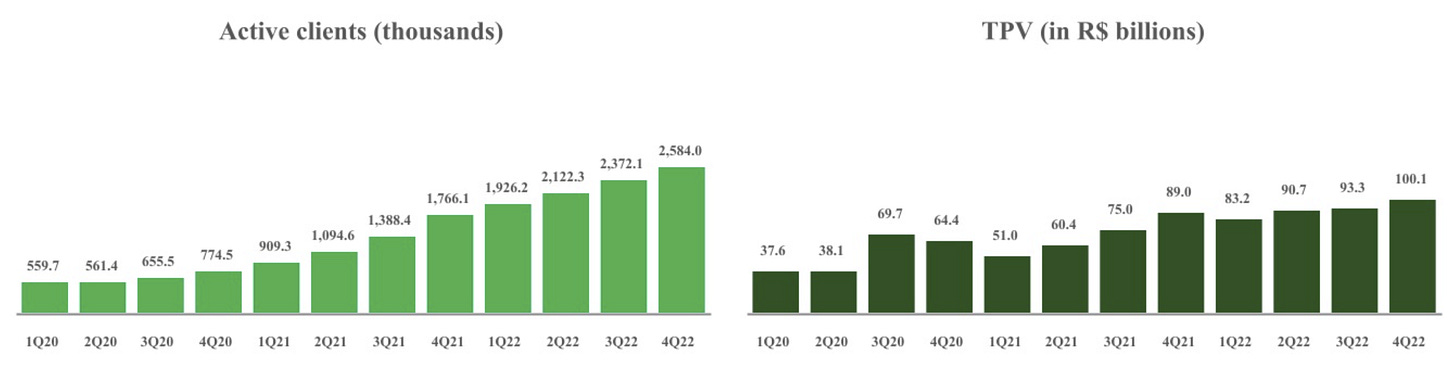

StoneCo's financial performance is impressive, with significant growth in key metrics such as revenue, total payment volume (TPV), and active customers. For example, total revenue doubled in 2022 and saw a 31% year-over-year increase in the first quarter of 2023. In addition, adjusted net income2 increased nearly six-fold year-over-year.

Total Revenue & Adjusted Net Income (in R$bn / R$mn)

The company has a competitive advantage in the market by disrupting the traditional payment industry in Brazil. StoneCo offers superior customer experience, lower fees, faster settlement, and more transparency than conventional banks. In addition, it leverages proprietary technology and data analytics to provide tailored solutions to its clients.

Active Clients & Total Payment Volume (TPV)

Growth is also driven by expanding the distribution network, diversifying the product portfolio beyond payment processing, and taking advantage of Brazil's digitalization and financial inclusion trends. In addition, the company keeps competition at bay by focusing on innovation, customer service, marketing, and acquisitions.

A changing regulatory environment and an improving macroeconomic outlook in Brazil could provide a tailwind. The company is well-positioned to serve the growing Brazilian e-commerce industry as small and medium enterprises expand into online channels.

2.3 Earnings Revisions & Profitability

StoneCo recalibrated its business strategy, aiming to balance growth with profitability. In addition, the company acknowledged past mistakes of growing beyond its means and focused on improving its bottom line. Despite these setbacks, StoneCo and its main competitor, PagSeguro, were the only two companies able to increase their market share during the past two years.

Earnings per share estimates for the upcoming quarter were revised upward by a net of six times, while sales estimates were revised upward by a net of two times.

3. Trade Execution

Promising an electrifying ride, we finally present a long premium strategy with a long out-of-the-money strangle, mainly betting on an upside move over the next 30-60 days. Should the price fall below the 200-day moving average or even retest the April lows, we would book a small profit or loss depending on how fast and deep the fall, and reposition or close the trade entirely.

Our biggest enemy is a prolonged non-volatile sideways move that would slowly burn the option premium/theta we own. Remember, we are long premium now, and theta burn will work against us this time.

We buy a bullish tilted strangle by going long the out-of-the-money call at 18.00 and the out-of-the-money put at 8.00, maturing on Oct 20, 2023, giving us enough time for a move and minimizing daily theta decay. The key is to close or roll the trade early to avoid a maximum loss.

3.1 Trade Entry - June 5, 2023

The options chains are fairly liquid; our average fill was 0.71, slightly above the mid-price.

Total: 0.71 Debit.

3.2 Trade Risks

Price: The risk of a prolonged sideways movement with low volatility is medium.

Volatility: Implied volatility is relatively low, and the risk of a further decline is minimal.

Assignment: No assignment risks, as we are long premium.

4. Expected Value & Conviction

Let’s master our maths. The expected value (EV) indicates the expected profit (or loss) if you make the same trade indefinitely.

Expected Value = (Probability of Profit * Expected Profit) - (Probablity of Loss * Expected Loss)

We want a positive EV after careful macro, micro and technical analysis, considering proactive trade management and early trade closure. We generate the edge by challenging the market probabilities and proactively managing the position.

4.1 MacroDozer Conviction

The market assigns a 20% probability of expected maximum profit at maturity and generates a negative EV on equity of -9%.

We believe the likelihood of realizing 70% of the expected maximum profit with proactive trade management and early trade closure is 35%, with a positive EV on equity of 42%.

StoneCo Ltd. is a Brazilian fintech company that underwent a successful turnaround.

Impressive growth in revenue, total payment volume, and active customers.

Valuation may not be cheap compared to competitors but justified by innovative business approach and future expansion.

Implementing a long premium strategy with a long out-of-the-money strangle, betting on an upside move with downside hedged.

Minimal risks of prolonged sideways movement, declining volatility, or assignment.

5. Final Chapter

Expect updates on BrainDozers within 4-6 weeks. We use the exact headline ending with (+/- xy%) and mark the cover cartoon with a red CLOζED stamp. This way, the performance is easy to track.

We do not send BrainDozer updates via email unless you specifically ask for them here. We want to keep the flow of information short and sweet. However, you can still access a free preview of all updates on MacroDozer as soon as they are released.

My name is Juri von Randow. You can find me on the top banner to the right, MacroDozing like there's no tomorrow. (Email version only.)

Feel free to pass me on. Warm regards.

All BrainDozer articles are purely educational; they are not tailored to any particular individual or portfolio and do not constitute investment advice. Let us know if you are interested in implementing any of our ideas. Perhaps we can help or point you in the right direction.

And before the trade opportunity slips away, which is increasingly happening due to turnaround times for polished articles.

The company adjusted the financials by excluding bond and stock-based compensation expenses.