NASDAQ: Strong Trend, Strong Fortune (+2%)

Change In Short-Term Trend, Flat Fortune

Executive Summary

Trade set up not perfectly chosen, we do and learn.

The market down less than minus two percent looks bullish.

We try to avoid a potential post-central-bank lottery rally.

Lack of time to maturity plus recent price development make us exit the trade early with a little less than 2% return on capital.

1. Recap Situation

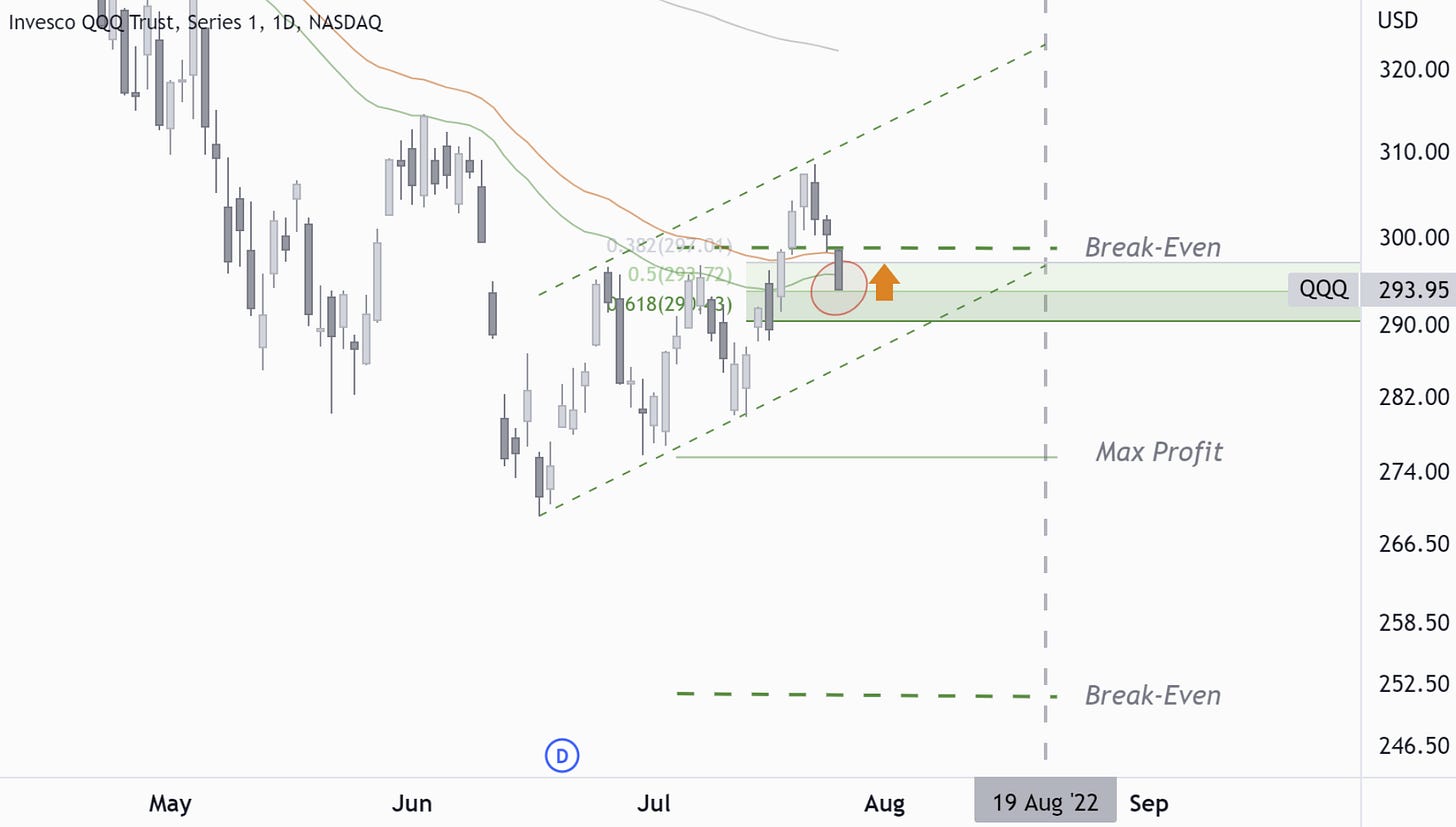

We entered into a good QQQ set-up a week before we published this trade, and we were fortunate to close it today for a 35% return on capital. This publicly posted latecomer trade was already a little volatility deflated, plus it had a slightly worse strike price starting point and overall less time to play out—all in all, a good lesson for us. In the future, we will only post timely trades and no theoretical laggards.

Check out the original BrainDoζer thesis below.

2. Why Now?

Lots of bad news hit the streets, and neither NASDAQ (QQQ) nor S&P 500 (SPY) seem to care. A downward move of less than minus two percent looks pretty bullish on a day like this. Maybe there is no one left to sell at that point, at least not in the short term. Tomorrow we have a central bank lottery event, and the rate hike uncertainty will go away. Back to certainty and clarity; often a reason for a market to rally, no matter the outcome.

The strong QQQ downward trend might still be intact. However, with only 24 days left on the options contract and the price hitting the 50% Fibonacci retracement and the 50-day moving average from the top, we have no genuine interest in rolling this trade into the next month. We are out. We will find a better setup after the central bank news tomorrow.

3. Trade Execution

Trade Entry - Jul 5, 2022

1) Short Call 275, Aug 19, 2022: 17.27 Credit.

2) Short Put 275, Aug 19, 2022: 10.29 Credit.

3) Long Call 315, Aug 19, 2022: 1.87 Debit.

4) Long Put 235, Aug 19, 2022: 2.15 Debit.

Total: 23.62 Credit.1

Trade Exit - Jul 26, 2022

1) Long Call 275, Aug 19, 2022: 22.34 Debit.

2) Long Put 275, Aug 19, 2022: 3.10 Debit.

3) Short Call 315, Aug 19, 2022: 1.71 Credit.

4) Short Put 235, Aug 19, 2022: 0.23 Credit.

Total: 23.34 Debit.2

The absolute return of that trade is

23.62 - 23.34 = 0.28

The capital used on that trade is 16.38, resulting in a return on capital of

0.28 / 16.38 = 1.7%

Total credit equals the sum of the mid-prices of each bid/ ask spread. Brokers usually get filled mid-price for liquid options.

Total debit equals the sum of the mid-prices of each bid/ ask spread. Brokers usually get filled mid-price for liquid options.