NASDAQ: Strong Trend, Strong Fortune

Some Fortunes Have Been Made Following Trends.

Executive Summary

The short premium strategy acknowledging the descending trend beats the long LEAPS strategy for now.

Let’s wrap a slightly bearish straddle1 around the NASDAQ descending channel.

1. Why Do I Care Right Now?

I am dying to publish a long-term LEAPS trade to mix things up.

Rant Around Trade Vs. Investment Farce

A long-term LEAPS trade could potentially qualify as an investment, not just a trade. Maybe not. I guess investments are for slower-paced, more inactive, and comfortable market participants with not too much time at hand. Even the MacroDoζer LEAPS strategy has to be managed. We do not sit around and wait until the market comes to us; we hold its hands, run around, and dance together as young couples do. We call it active money creation; we live and breathe markets, so let’s stick to the trade & trading terminology.

I have looked closely at two broader equity markets that might be at inflection points, breaking multi-month downward trends with liquid enough option chains. However, it is hard to believe that any sub-equity market would rally while the broader market continues to sell off. We leave the long-term LEAPS ideas for later this summer.

Instead, I entered a slightly bearish NASDAQ / QQQ trade last week without publishing it. So let’s look at that again and post a brand new one that will beautifully wrap around the current trend channel.

QQQ implied volatility rank (IVR) is close to 80%, and the implied volatility percentile (IV%) is closer to 90%. A volatile market, where short premium strategies should do alright.

2. Useful Background Information

Invesco doesn’t seem to put much value on design or style, so there are not too many beautiful charts or fun/d facts I can share. The website is also incredibly sterile. Let’s keep it boring, then.

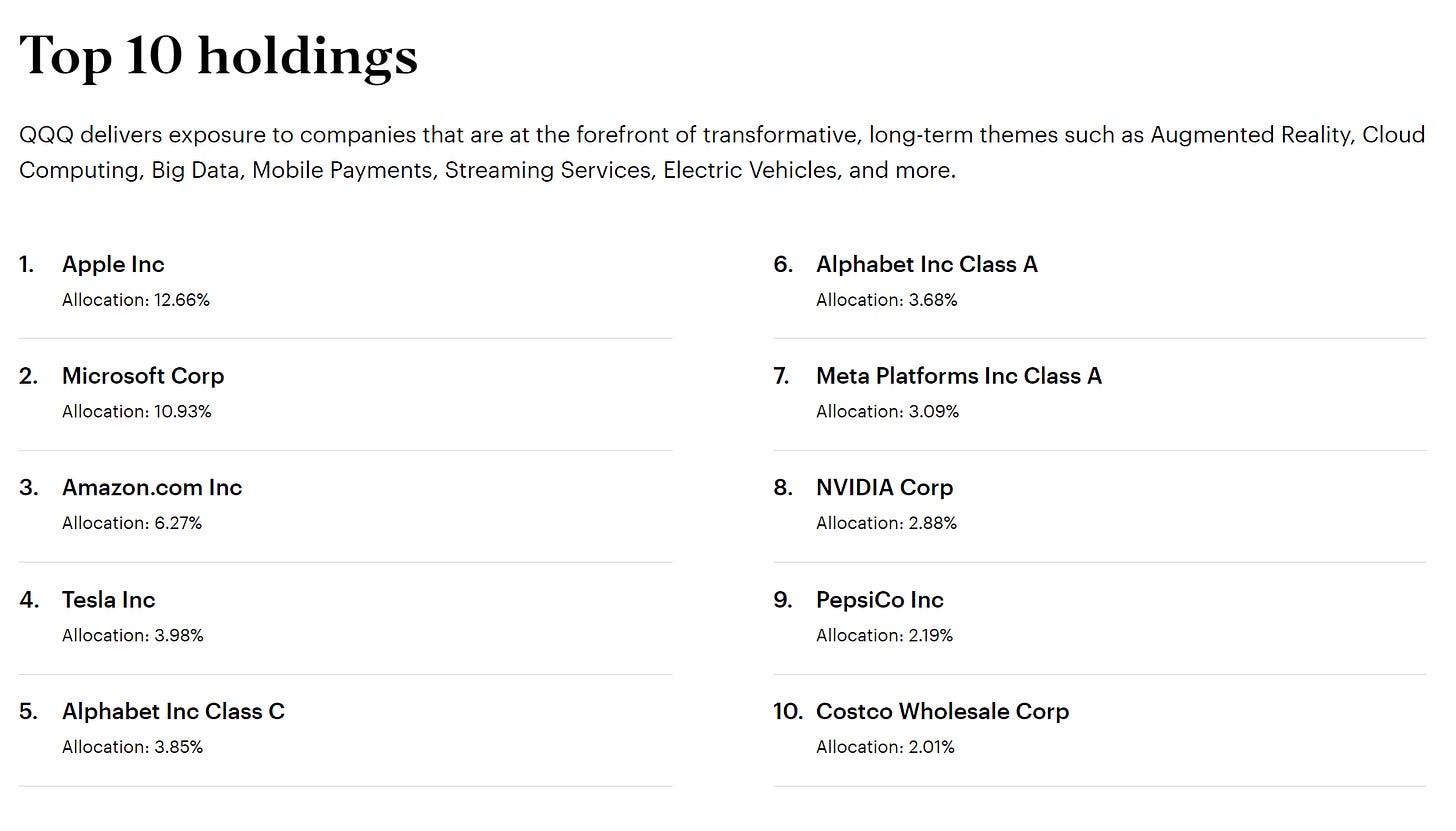

Invesco’s QQQ ETF tracks the NASDAQ. It is the second most traded ETF in the US, with very liquid option chains.

3. Trade Execution

We are wrapping a risk-defined straddle around the QQQ descending channel, slightly north at maturity, betting on a falling NASDAQ with somewhat less downhill speed. There won’t be any complaints if the market moves sideways.

Trade Entry - Jul 5, 2022

1) Short Call 275, Aug 19, 2022: 17.27 Credit.

2) Short Put 275, Aug 19, 2022: 10.29 Credit.

3) Long Call 315, Aug 19, 2022: 1.87 Debit.

4) Long Put 235, Aug 19, 2022: 2.15 Debit.

Total: 23.62 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

All our strangles and straddles are risk-defined, also known as Iron Condor and Butterfly / Iron Butterfly.