BED BATH & BEYOND: Beyond Beds, Baths & Imagination

Using Retail to Defy Gravity and Losing Bags: The New Best Quality of Wall Street's Prophets

Executive Summary

How often do we need to be fooled by phony prophets?

Retail is the answer for slippery activists and losing bags.

It should be reasonably clear who will be the hero of our story.

Finance does have a place in the creativity domain, after all.

Affairs will quiet down, and volatility will contract.

1. Why Do I Care Right Now?

Current affairs should not be beyond imagination. We have seen these non-earnings-related Come-To-Squeezus moments since January 2021, when the GameStop mania kicked off. The real question is, how often do you need to be fooled by a phony prophet1 until you stop buying into those heavenly tales? How often do you need to be embarrassed at your own Musical Chairs blowout when the tunes stop, your pants drop, and no empty chairs in sight?

I thought AMC was enough meme stock play. But then I saw NASDAQ exchange rules kicking in on Tuesday, halting BBBY trading. There is no way we will pass on a temporarily halted market with anxious market makers and a slippery activist who uses retail money to get out of a losing bag.

Life is too short, and we need war stories for the offspring. So let’s not sit in that rocking chair mumbling about how we did not participate in the early 21st-century story-based investment fairs. And maybe it doesn’t even matter if one ends up being the hero, time will tell (usually 45-60 days), and off we go.

2. Useful Background Information

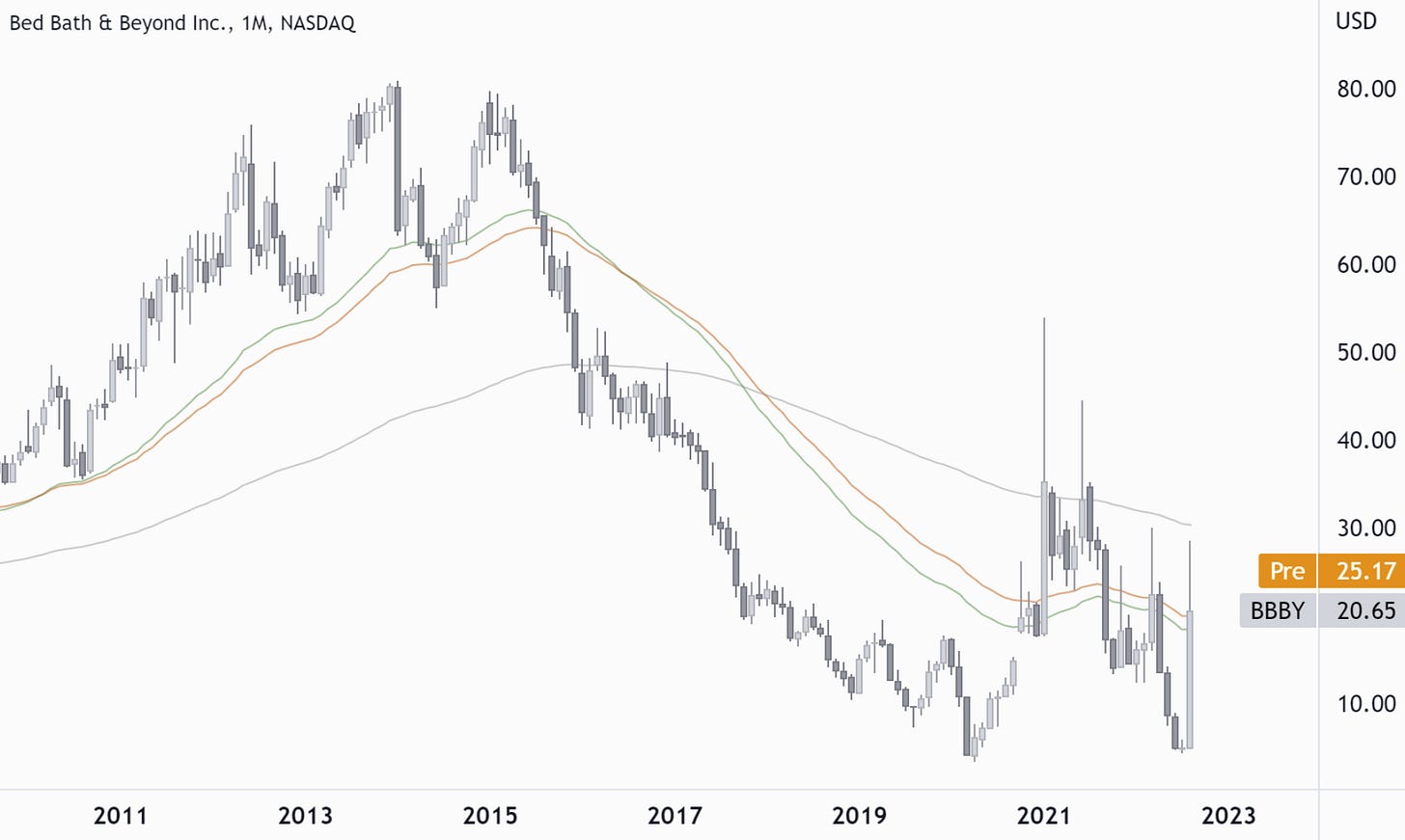

There is no need to elaborate on how Bed Bath & Beyond management missed the online train, how they missed a repositioning after their moment in the 2014 sun, or how they missed coming up with a better trading name.

The company faces significant liquidity issues. The cash burn is high, and the revenues won’t cover it. A quick fix is restructuring or rolling the debt and trying to squeeze more money out of shareholders. The A-game will keep that share price elevated until management can issue new equity while keeping dilution at bay.

I am sure GameStop Ryan and one of the interim BBBY CEOs will devise a suitable plan. Enough inspirational case studies should be out there by now. Plenty of experienced advisors will be ready to get paid top dollar in the line of how to squeeze while we squeeze. Who said finance has no place in the creativity domain?

We are betting slightly against Ryan & Co2 and their elevated share price mission and for affairs to calm down and volatility to contract. However, suppose the music keeps playing for longer than expected. In that case, we roll out our position into the next month and wait for natural forces like gravity or dilution fears to take over.

3. Trade Execution

We are selling a bearish risk-defined straddle at 12, with wings at 1 and 23, maturity Sep 16, 2022. If the short squeeze and the volatility expansion continue into September, we will roll out to October.

Break-evens are at 6 and 18.

Trade Entry - Aug 18, 2022

1) Short Call 12, Sep 16, 2022: 9.10 Credit.

2) Short Put 12, Sep 16, 2022: 2.00 Credit.

3) Long Call 23, Sep 16, 2022: 5.60 Debit.

4) Long Put 1, Sep 16, 2022: 0.01 Debit.

Total: 6.00 Credit.3

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

This time his name could be Ryan Cohen.

Newsflash: Wednesday night, Ryan indicated the entire sale of his shareholding. Shocker, no one expected that!

Total credit equals the sum of the mid-prices of each bid/ ask spread. Brokers usually get filled mid-price for liquid options.