CHINA: MacDoζe Winter-Blows 1/4

We are kicking off the Winter-Blows quadrilogy with China. Expect heat & fireworks.

Executive Summary

Has Santa been honest all these years?

China could be back with some heated theta burn.

We make ourselves cozy in old trading ranges and turn slightly bullish.

1. Why Do I Care Right Now?

It is mid-November, and Christmas needs to be financed. Hence, MacroDoζer is giving birth to the MacDoζe Winter-Blows quadrilogy. This should keep everybody warm. Who needs cheap energy when we know how to elevate that vascular pump?

We must clarify upfront: MacDoze Winter-Blows has nothing to do with the so-called Santa Rally. We don’t trade tales made up half a century ago. The original story says that the seven trading days after Christmas outperform any other seven trading days between 1950 and 1970. Then people changed it from post to pre-Xmas. Soon after, the entire December was Santa territory, and now financial journalists try to front-run the old man before the Winter even starts.

Intrigued by all this Xmas passion and random historical back-testing, we downloaded the last twenty-year S&P 500 data and looked at every seven-day trading period. Here is what we found.

The seven trading days after Christmas showed 80% positive vs. 20% negative periods indeed, with an average performance of 0.7%. However, a quarter of the positive periods were insignificant, with close to zero performance, and the average negative performance was nearly double the average positive one. One single outlier in team positive was responsible for the overall +0.7% average.

Santa has been lying to us.

We also had a look at all the other 251 seven-day trading periods. Sixty-five were at or above the 0.7% Santa-average, and seventy were at or above the positive-to-negative ratio, with the majority of outcomes again insignificant due to outlier distortions and net zeros post-adjustments.

Generally, the debatable comparability of historic vs. modern markets and the related problem of low sample sizing makes this statistical show-off a nothing-burger.

Santa is dead.

2. Useful Background Information

To celebrate China and its efforts to deal with that long list of headwinds, we dug deep to find this ASHR jewel; a German-structured DWS Xtrackers ETF called Harvest CSI 300 China A-Shares; Germany’s most creative decades have long passed, but at least we know what’s inside that box.

We love the liquidity and the high relative implied volatility compared to our other China ETF favorites, FXI and KWEB. The Chinese CSI 300 Index has found its way back into the old 2019 / 2020 trading range, and we feel comfortable letting China create a bottoming formation from here with its recent October lows.

The latest narratives of China’s zero covid pivot and attempts to potentially care again for markets after the re-election of the Emperor give us additional confidence.

3. Trade Execution

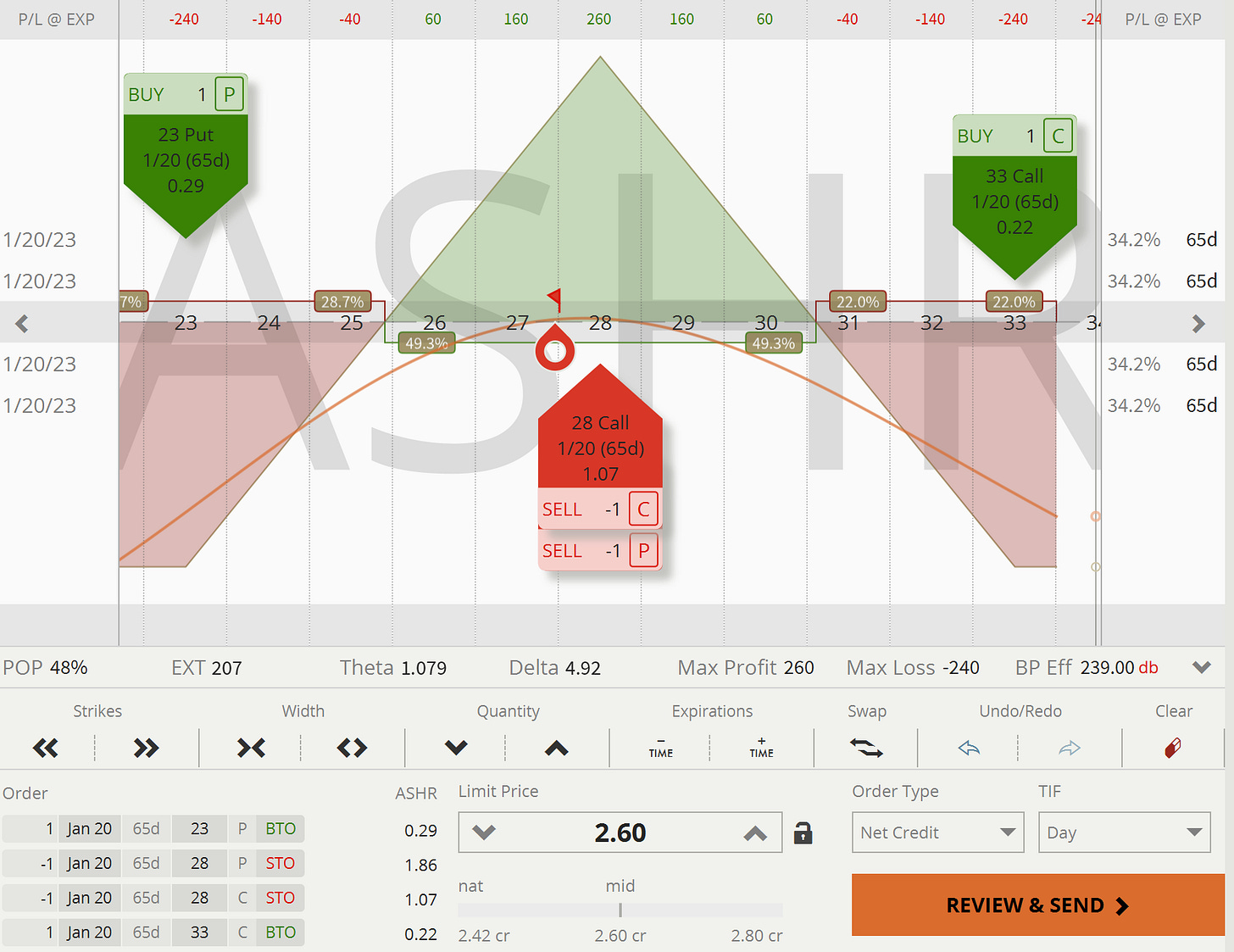

We are selling a slightly bullish risk-defined straddle at 28, with wings at 23 and 33, maturity Jan 20, 2023.

Break-evens are at 25.50 and 30.50.

3.1 Trade Entry - Nov 16, 2022

Total: 2.60 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all update summaries on MacroDoζer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.