AMC ENTERTAINMENT: Theatres Open, Drama Continues

Not Only Do We Show The Drama, We Also Produce It, And Our Shareholders Love It

Executive Summary

Marketing Moguls and German Shepherds work hand in hand.

Professional publicity stunts revert to medians faster than ever.

Troubled AMC gambles on Wall Street using investor money.

Stock Promoter & CEO Adam Aron sells private shareholdings at highs.

A new class of securities called APE mocks and dilutes the investor base and enriches management further.

The mania is hysterical enough for a bearish short premium trade.

1. Why Do I Care Right Now?

I am not feeling the fountain pen today. Researching Meme Stocks is like bathing in a dingy pond with no fresh water and no shower for miles and days. Marketing moguls and stock promoters dressed up as CEOs, German Shepherds & Reddits pushing and pulling the herds. Some sheep might survive supplying wool; most will be part of some local butchery event when this is all over. Deception three-point-oh.

I am kidding. We could not be more excited: RETAIL IS BACK!! We love when markets are emotional and inefficient, so let’s dive into that (cine)mania world.

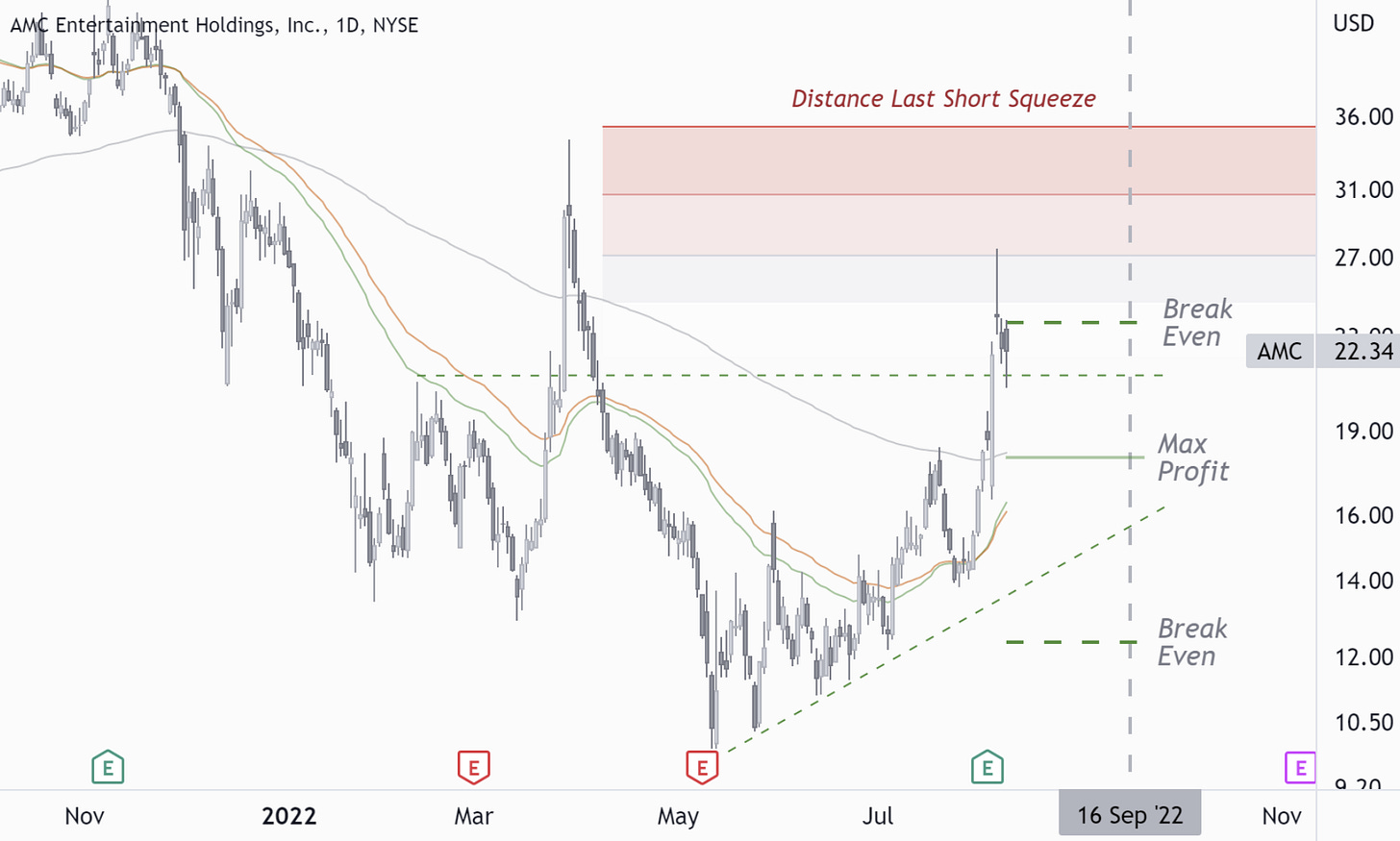

We keep it short and sweet. Time is limited, volatility is up, and we want to milk that sheep while it’s plump.1 There is that risk of a melt-up continuation, so we define risk to the upside by going long the 30 out-of-the-money call. The fair price over the next few weeks should be around the July highs at 18, close to the grey 150-day moving average.

The last short squeeze at the end of March blew into the thirties, short-lived. We understand that price does spike whenever stock promoter Adam Aron does a publicity stunt, but we also believe in price retracements back to median levels right after. If the price stays elevated for longer, we roll out into the next month.

2. Useful Background Information

AMC is a somewhat troubled company, fighting declining theatre visits since 2017. Covid accelerated that trend. More affordable large TV sets, fast and high-resolution streaming, and the installation of entire home cinemas are the antagonists to blame.

Retail investors turned romantic in 2021 and tried to help some struggling companies get back on their feet. The idea was to team up and buy lots of those highly shorted company shares. Professional short sellers had to cover positions, and share prices skyrocketed. With share prices up and company valuations back in the billions, companies could raise new equity while minimizing the dilution of current shareholdings, restructure their most expensive debts, and continue the fight for survival with less financial stress.

AMC raised new money and restructured some of its debt. But the CEO also decided to take that investor money and gamble on Wall Street instead of modernizing AMC’s business affairs. Then he sold a bunch of his private AMC shareholdings at the highs, spreading additional confusion. There are no visible, proactive actions towards tackling the real issue AMC has been facing for many years now: the gradual decline of an industry.

At last week’s AMC second-quarter earnings call, the biggest news was an additional issuance of a new class of securities called APE; the AMC Preferred Equity Units. This is not a joke. The dividend of AMC Preferred Equity units is perhaps the single most significant action we will take in all of 2022.

Congratulations.

Subject to further approval, this new class of securities will allow AMC to issue at least one billion new shares, which would triple the current share count and increase the risk of further dilution. Management would also secure additional financial rewards via an Equity Incentive Plan adjustment.

All of the above are enough red flags for us to fade any major squeeze and benefit from a volatility contraction over the following weeks.

3. Trade Execution

We are selling a bearish tilted risk-defined straddle at 18, with wings at 6 and 30, maturity Sep 16, 2022. If the short squeeze and the volatility expansion continue into September, we will roll out the trade into October.

Break-evens are at 12 and 24.

Trade Entry - Aug 10, 2022

1) Short Call 18, Sep 16, 2022: 6.50 Credit.

2) Short Put 18, Sep 16, 2022: 2.05 Credit.

3) Long Call 30, Sep 16, 2022: 2.62 Debit.

4) Long Put 6, Sep 16, 2022: 0.05 Debit.

Total: 6.10 Credit.2

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

That’s what Audacious Adam said.

Total credit equals the sum of the mid-prices of each bid/ ask spread. Brokers usually get filled mid-price for liquid options.