🎯 This Week’s Target: MP Materials (MP)

Tariff noise stole the spotlight, but the real action played out in three places: the valves, the vaults, and the night-shift market.

At the valves, Beijing tightened control over rare-earth processing, the invisible choke point behind magnets, chips, and missiles. Mining is everywhere; refining is not. When you own the bottleneck, you dictate the tempo. That’s leverage no tariff tweet can match.

In the vaults, central banks quietly stack bullion while silver markets snap under delivery stress. Gold is becoming the only collateral everyone still agrees on, state money for a world that no longer trusts states.

And when all that broke over a long weekend, the night-shift market — crypto — took the hit. With equities closed, liquidations poured through the only door still open. Bitcoin absorbed the panic, proving again that in a 24/7 world, digital plumbing is where risk goes to confess.

Put it together and you get the story: sovereignty now trades through inputs, collateral, and pipes. Whoever controls those writes the next chapter of globalization.

Below, as always, the rest of what’s cooking:

Wall Street’s Industrial Pivot

JPMorgan’s $1.5 trillion plan cements finance as national builder—funding supply chains, energy, defense, and tech. This is industrial policy via balance sheet, rewarding firms that deliver real assets, not stories.

Earnings = Dispersion Season

Implied earnings swings near 4.7%, highest since 2022. Index vol stays muted, making single-name dispersion trades appealing. Tech, discretionary, and health care hold the biggest catalysts.

China’s Households Slow, State Hoards Metal

Golden Week spending and housing dropped, but Beijing keeps buying gold and tightening commodity links. Weak households, strong state balance sheet.

The Week: IMF Meetings, Banks, and a Patchy Calendar

IMF/World Bank meetings run through Saturday, while US CPI is deferred to Oct 24 amid the shutdown. Near-term focus: UK labor/wages, German ZEW, China CPI/trade, Eurozone industrial production, Fed Beige Book, with Powell headlining a busy Fed‑speaker slate. Large US banks kick off earnings.

Get Rich Overnight with Options? Yeah Right...

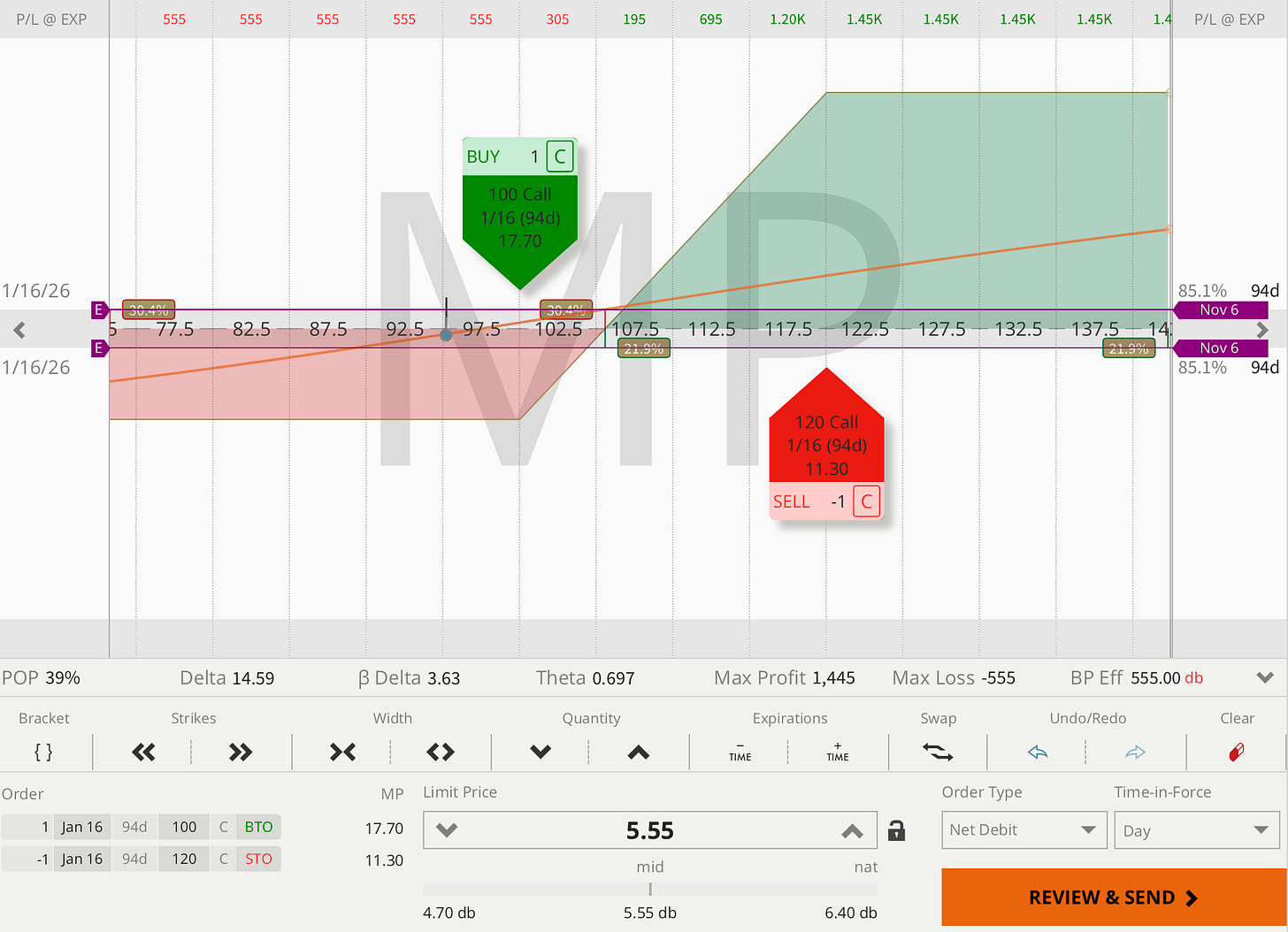

TUESDAY TARGET: MP Materials (MP)

No official trade entry this week, our portfolio is more volatile than ever, so we sit tight, lean back, and watch.

If you are suffering from hyper-FOMO and want to be part of whatever is happening out there, snag yourself a call debit spread on MP Materials. With a 38x EV/Sales multiple (NTM), it is not even trading at its 2021 highs of 46x.

We are NOT doing it (yet?). Which could be the perfect contrarian indicator. 😉

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

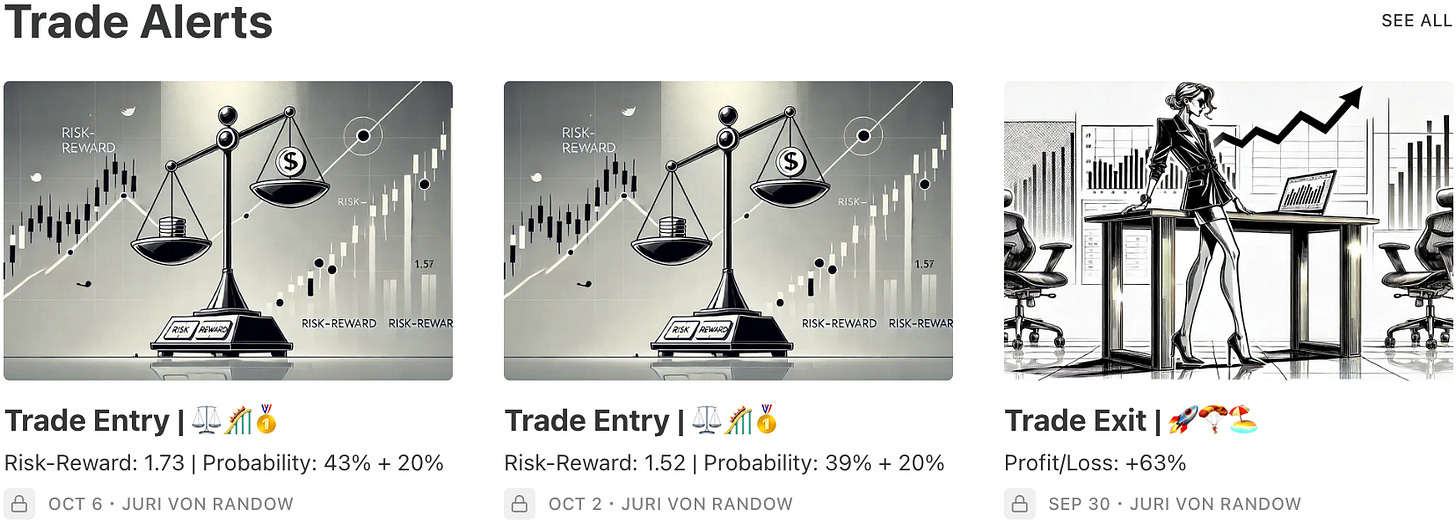

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

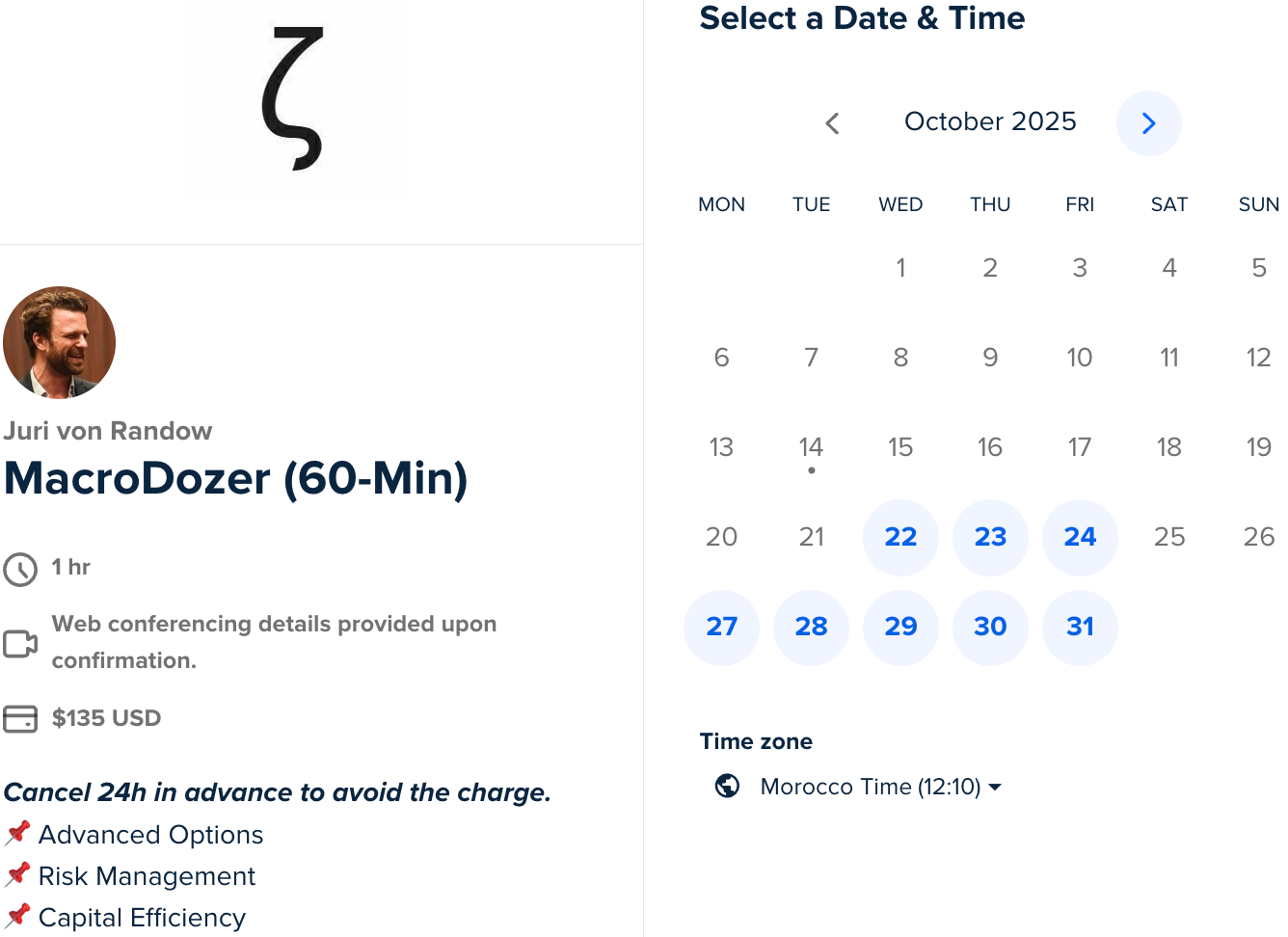

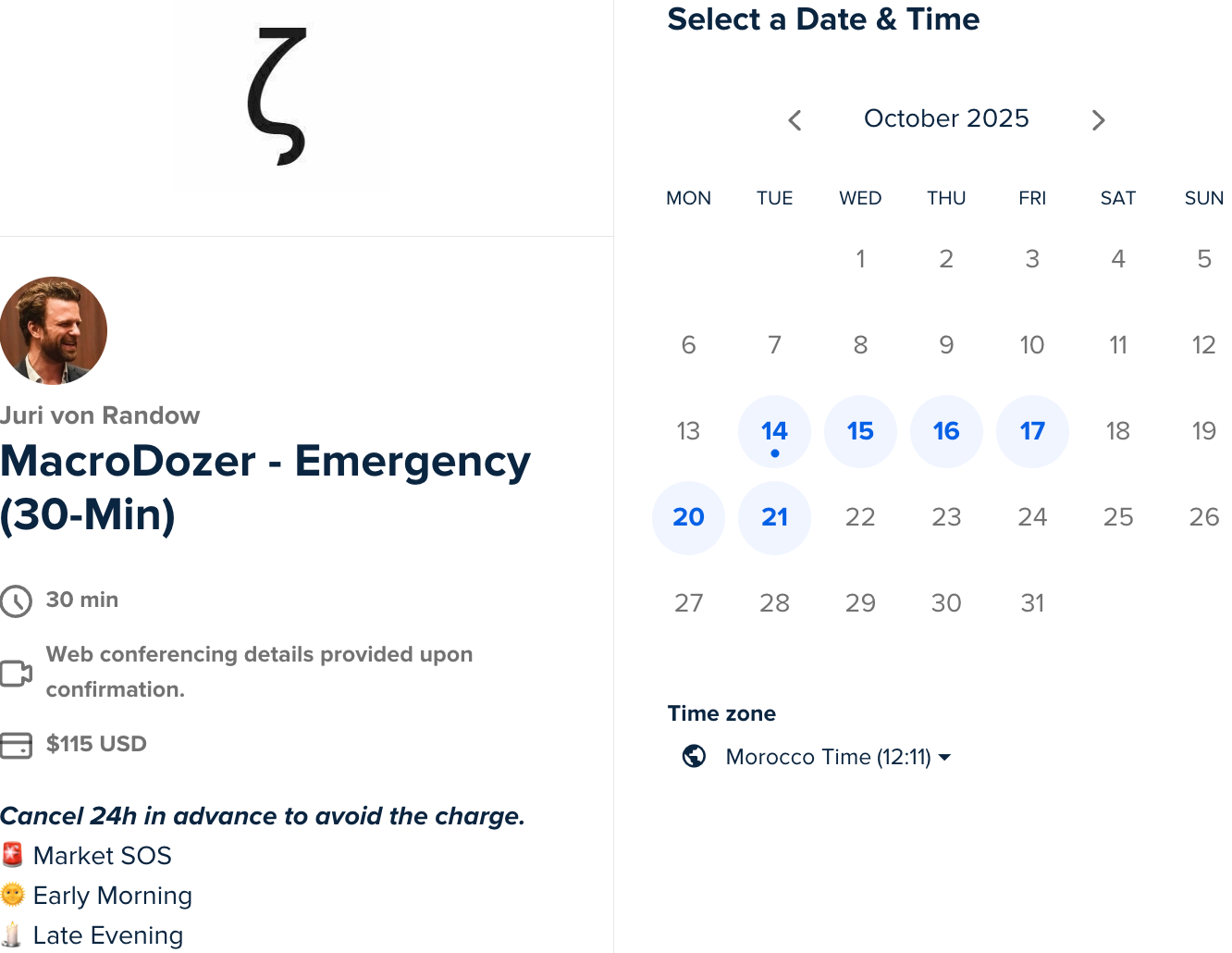

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.