🎯 This Week’s Target: Marvell Technology (MRVL)

Japan just rattled the world’s bond traders. A political upset in Tokyo sent long-term yields soaring, the yen sliding, and global duration desks scrambling to reprice risk. It’s the same tremor that started in Washington and Paris - too much debt, too little patience - but this time the shock came from the planet’s biggest creditor. When Japanese bonds sneeze, Western curves catch a cold.

Back on Wall Street, algorithms are still feeding on their own momentum. Non-profitable tech, meme-era zombies, and high-short baskets are ripping again, powered by retail call-buying and systematic flows that must keep buying strength to stay hedged. Confidence or machinery? A market high on its own liquidity, with no idea where the exit is.

And now, the punchline: talk of a U.S. re-acceleration. If inflation softens and capex broadens beyond data centers, the rally that started in clouds and junk could hand the baton to small caps, cyclicals, and banks. That would turn this squeeze regime into something far more dangerous: a rotation driven by growth instead of fumes.

Put simply: Tokyo just reminded everyone that rates still matter, and Wall Street still doesn’t care. For now, flows rule, but the second they blink, real yields will decide who walks away richer.

Below, as always, the rest of what’s cooking:

Shutdown Fog: Quiet Data, Loud Prices

With the U.S. government shut down, top‑tier data are delayed and bond‑vol (MOVE) has cratered. Expect a backlog and revision risk once the lights come back on. Thin macro information often amplifies narrative trades and systematic flows.

Consumer Divergence: Cracks Are Climbing

Restaurant traffic softness, rising promo reliance, and subprime credit stress signal pressure migrating from low‑income to middle‑income cohorts, while top‑decile spend props up aggregates. Expect more dispersion in consumer‑facing earnings and a premium on balance‑sheet quality.

Oil’s Range, Power’s Scarcity

OPEC+ delivered a modest hike and houses still see crude in a $60–70 band, yet AI‑driven electricity demand pushes energy security back to center stage. Exposure to dispatchable power and transmission offers a separate, less oil‑beta‑dependent way to play energy.

The Week: Minutes, Auctions, and Shutdown Fog

FOMC and ECB minutes anchor mid‑week while the shutdown keeps parts of the U.S. data calendar dark (International Trade, Consumer Credit), shifting attention to NY Fed SCE, TIPP optimism, and Atlanta Fed GDP tracking alongside German Industrial Orders and Canada jobs; RBNZ also meets. The Treasury brings heavy duration supply. With the MOVE index suppressed and auctions concentrated on the long end, term‑premium signals from Wednesday’s 10s and Thursday’s 30s will matter.

Get Rich Overnight with Options? Yeah Right...

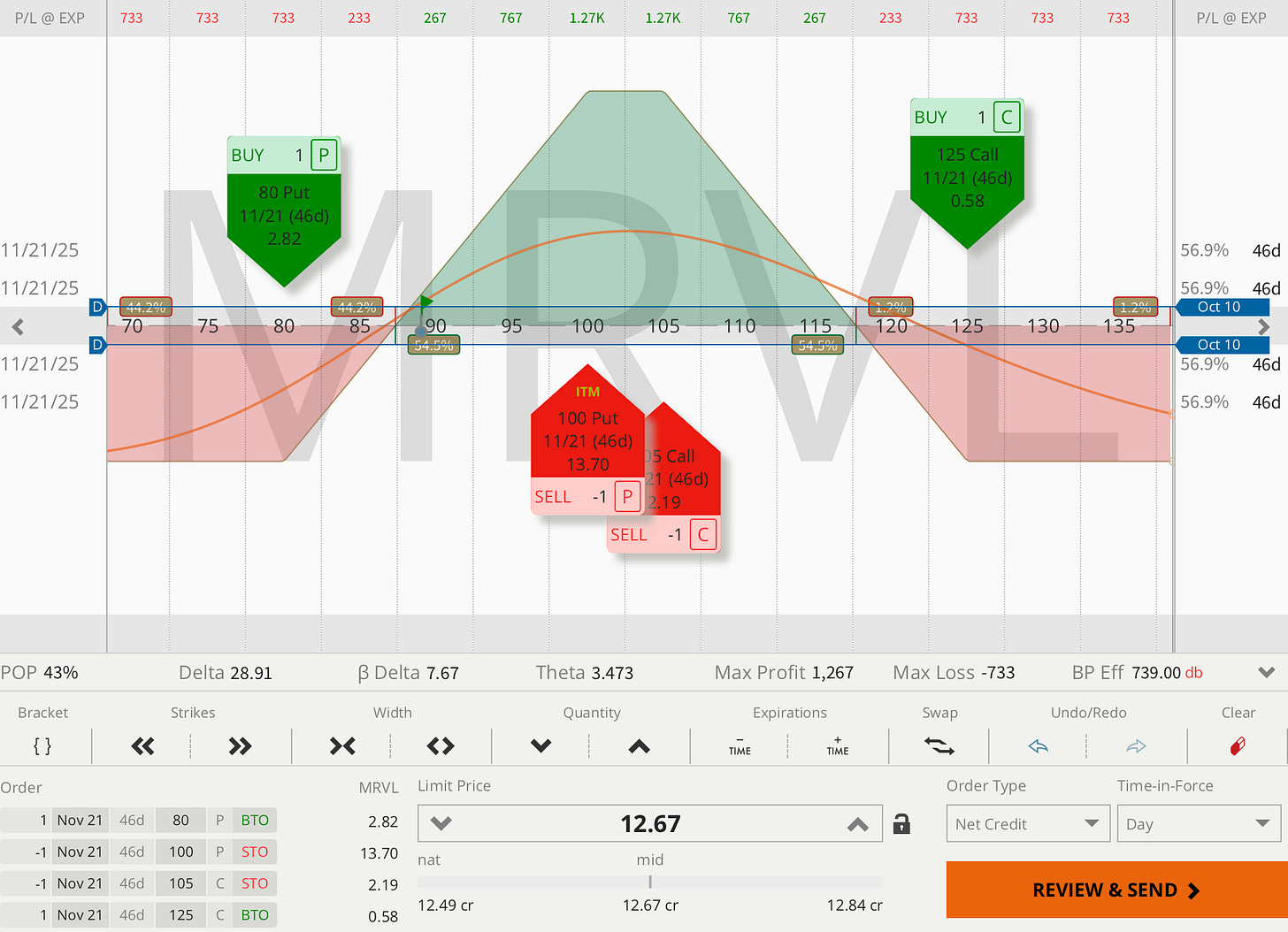

TUESDAY TARGET: Marvell Technology (MRVL)

Usually, we would wait for a 30% retracement after the crossover of the 40- and 50-exponential moving averages. But since this is part III of Equities Can Only Go Up, we won’t.

We also like the fact that this setup could serve as a decent hedge against our SMH position, which might continue to rip higher and make us look foolish again.

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

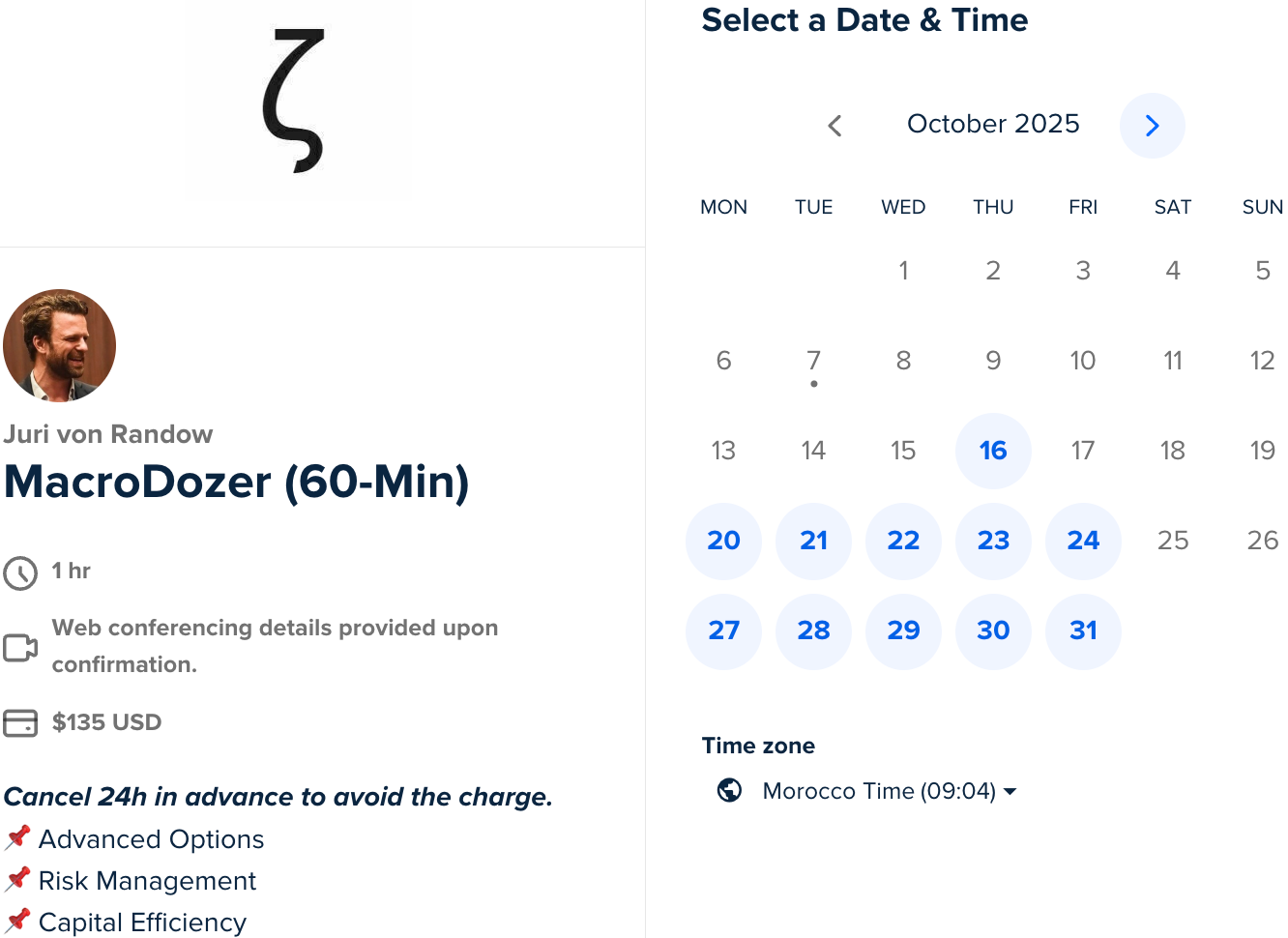

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

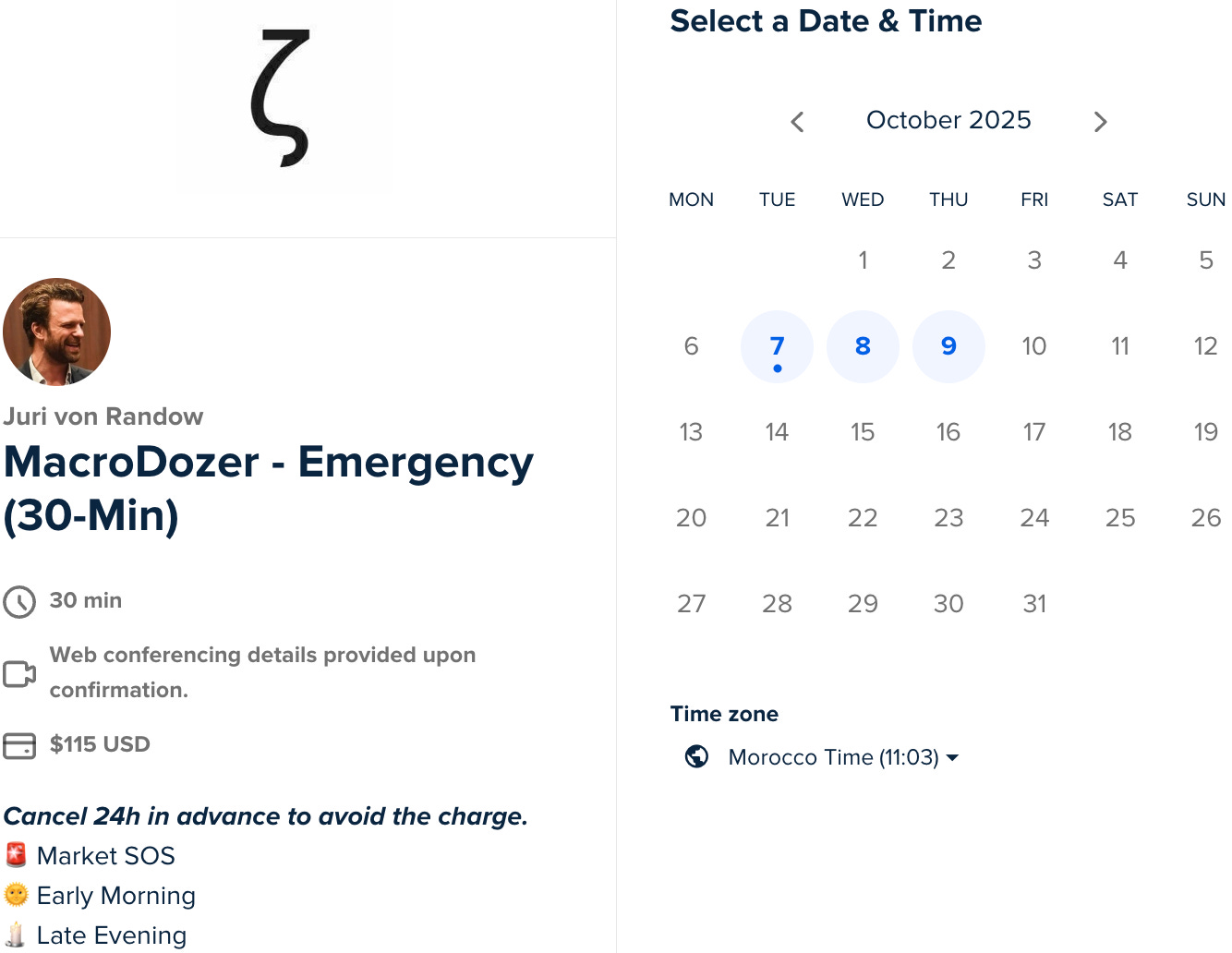

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.