🎯 This Week’s Target: Solana (SOLT)

If Washington pulls the plug on economic data this week, the market won’t sit idle — it will trade by sonar. With the scoreboard dark, pros shift from headlines to signals: repo whispers, Treasury cash flows, options surfaces. Price discovery never stops; it just changes instruments.

The plumbing matters more than the politics. Treasury already refilled its cash tank, draining liquidity into quarter-end. That drag is fading now, even as QT drones on and bank reserves skate the bottom. Combine that with hedge funds de-grossing, pensions selling, and buybacks in blackout, and the setup looks fragile. But fragile often fuels melt-ups: thin positioning plus Q4 seasonality can turn good enough into panic buying.

Meanwhile, AI footprint shows up where statistics lag — cycle times shrink, error rates fall, margins hold. Inflation hasn’t reignited despite the energy draw, hinting at early productivity compounding quietly in the background.

So don’t mistake missing data for missing signals. Markets are loud even when statisticians go mute.

Below, as always, the rest of what’s cooking:

Trading When the Lights Go Out

A shutdown starting Oct 1 would pause most federal data (including payrolls and CPI) while weekly jobless claims, the Fed’s releases, and the Treasury’s Daily Statement continue. That shifts the edge to traders who can read alternative signals — high‑frequency labor proxies, funding markets, and options term structures.

Dollar Risk: The Crowded Exit

After a year of global cuts and a weaker dollar, positioning leans short USD. A stronger U.S. data run or a policy surprise can push the dollar through key levels and jam the exit — pressuring EM FX, long carry, and high‑beta equities in one go.

Hard Money vs. Hydrocarbons

Gold keeps drawing steady official and ETF demand and is pressing new ranges; silver is stretched on momentum. Crude slid on talk of OPEC+ quota bumps and pipeline flow resumptions, widening the gold‑to‑oil gap to rare territory. That spread often mean‑reverts over time.

Growth Path Split: 2025 vs. 2026

Near‑term, the Fed leans toward incremental normalization as labor cools and services disinflation grinds on. Looking into 2026, growth tailwinds gather — fiscal impulse, AI capex, deregulation — raising the risk of re‑acceleration.

The Week: Data and Deadlines

JOLTS and confidence start Tuesday, with ISM manufacturing and ADP midweek, and claims plus factory orders Thursday. Friday’s big test is payrolls and ISM services — unless a shutdown delays them. Globally, Eurozone CPI, China PMIs, and the RBA decision add color. Fed voices are heavy throughout (Jefferson, Goolsbee, Logan, Williams).

Get Rich Overnight with Options? Yeah Right...

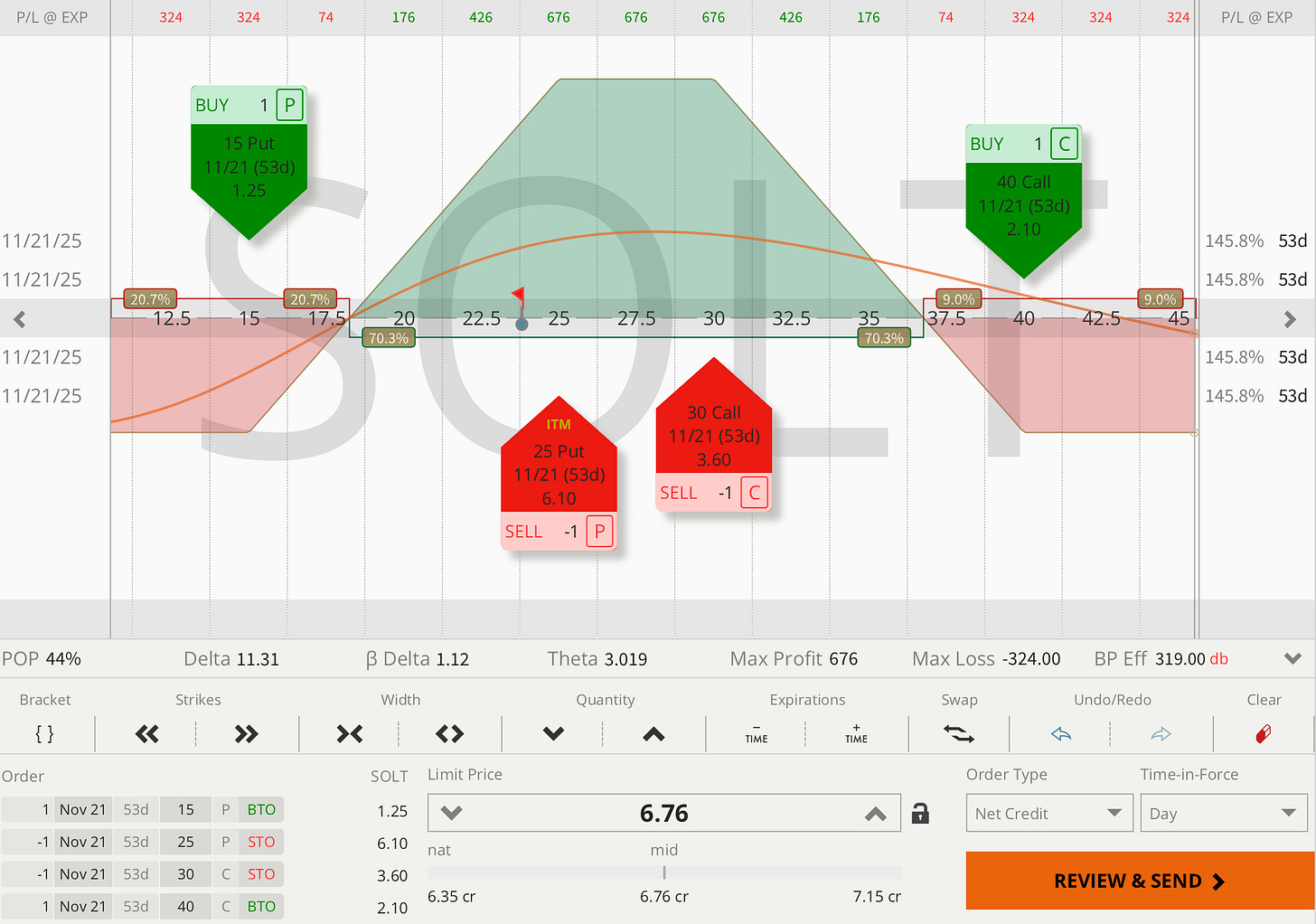

TUESDAY TARGET: Solana (SOLT)

The asset is hot and the profitability window is wide. A second retrace to 16.50 would mean a temporary paper loss of about -25% — acceptable for an annoying downside scenario. SOLT is more liquid than SOLZ, and that’s that edge.

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

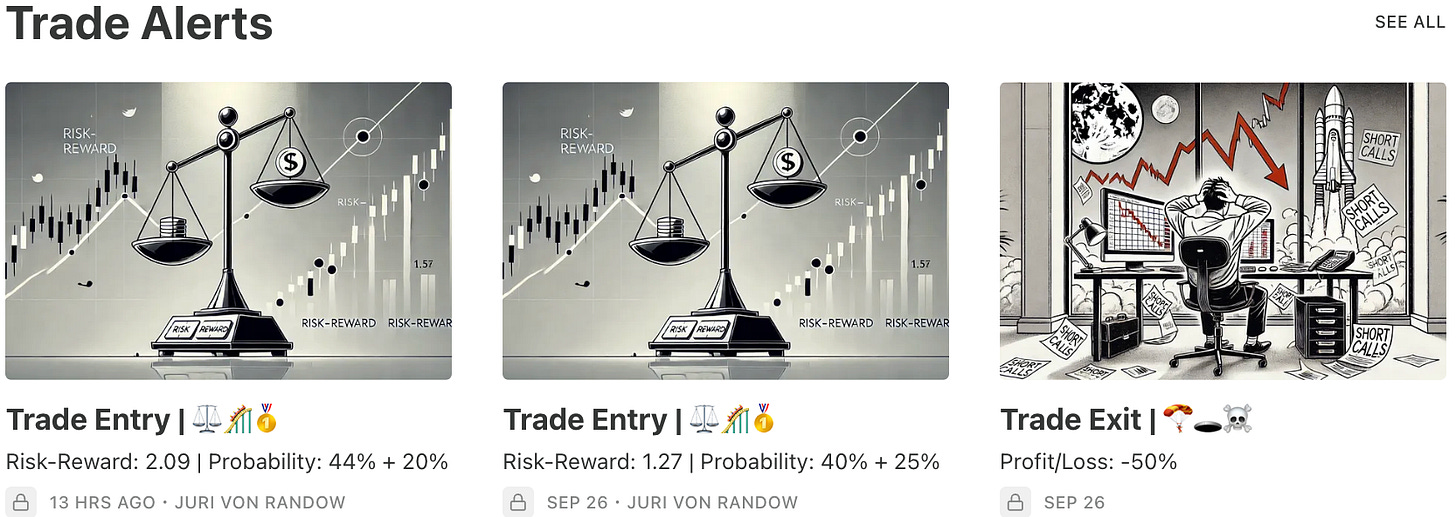

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

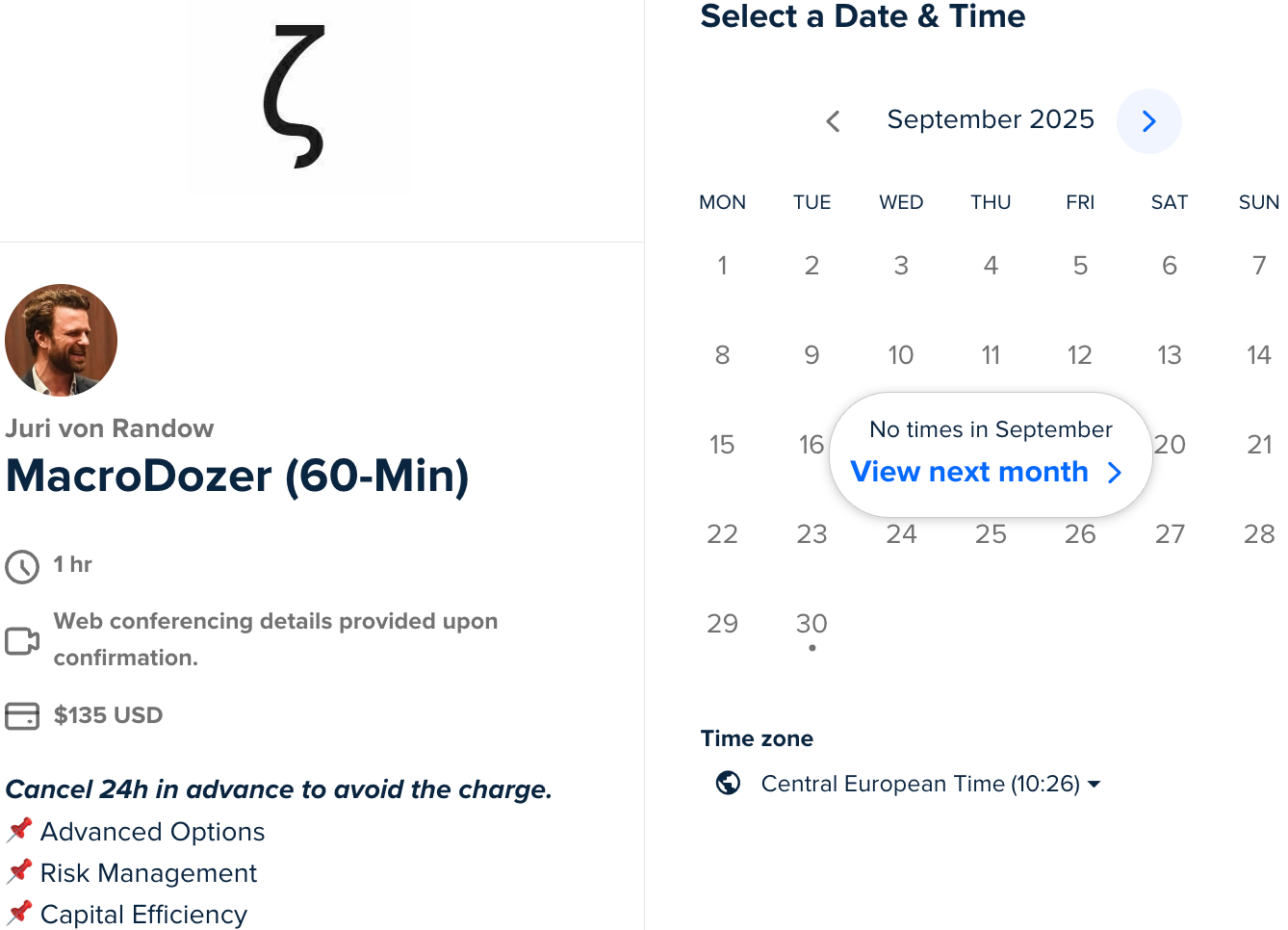

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

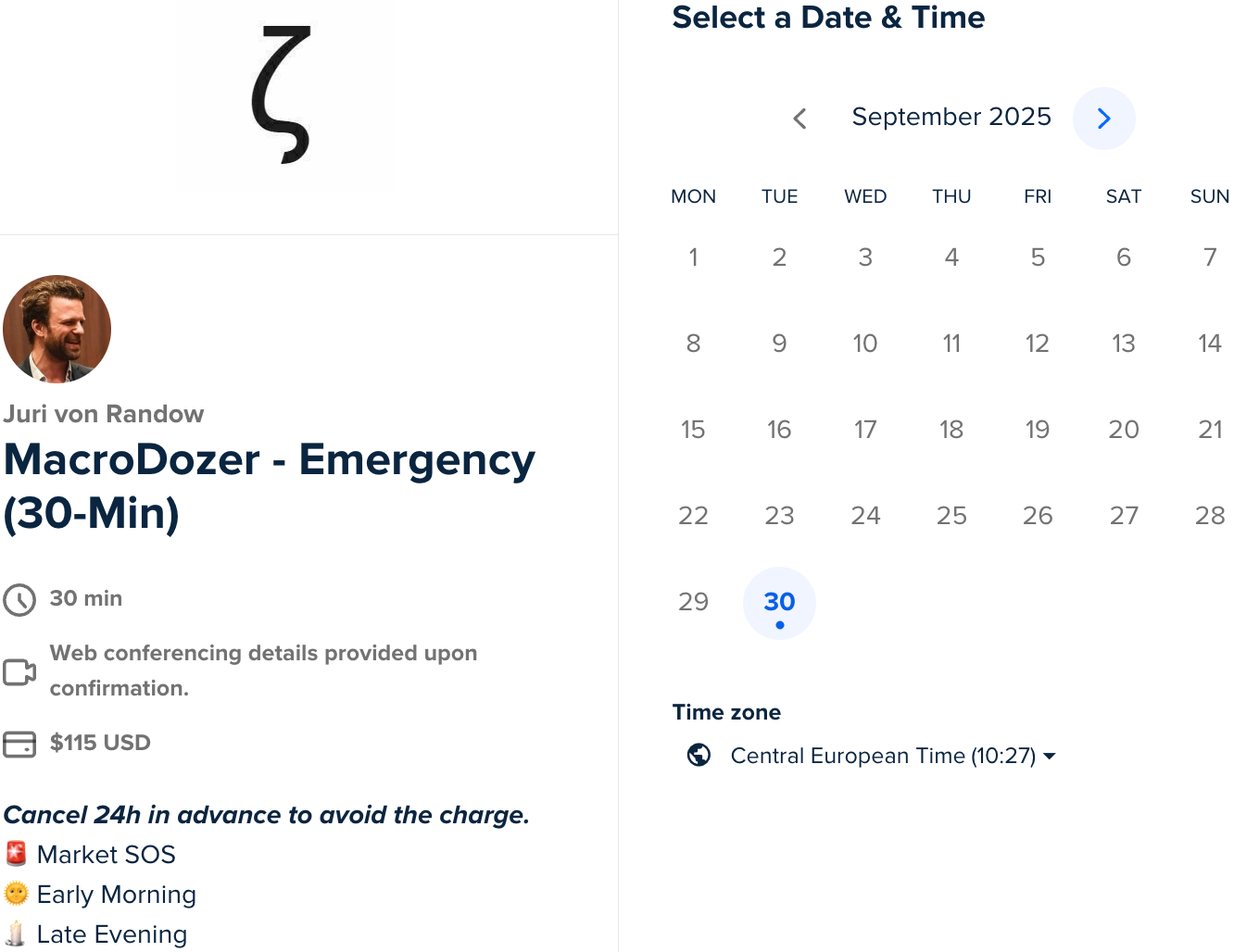

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.