🎯 This Week’s Target: Oracle (ORCL)

Silicon Valley just found a new central bank: the grid. Ten gigawatts here, another tranche of transformers there — liquidity now arrives as megawatts. AI’s Intelligence buildout summons steel, copper, turbines, substations, and a small army of electricians. That spend behaves like stealth stimulus: it front‑loads GDP, fattens contractor backlogs, and re‑prices anything tied to electrons.

Follow the money’s new hierarchy: power, permits, proximity. Firms with first call on interconnects and long‑dated PPAs own the bottleneck; everyone else rents it at rising prices. That’s why chips can soar while bullion levitates. When the machine and the metal rally together, markets are voting on time — cash fades, scarce inputs gain priority, and the long end of the curve grows heavier to fund it all.

Under the tape, index vol naps while single names whirl. Dealers sit long gamma, buybacks are in blackout, pensions eye month-end. One sharp headline can flip correlation from calm to chorus.

If you still run 2019 playbooks — software first, infrastructure later — you are late to the party. The grid has become the balance sheet; assets closest to the meter hold the keys.

Below, as always, the rest of what’s cooking:

Fed’s Confusing Cut Wasn’t About Inflation

The September rate cut left markets baffled. Growth forecasts were revised up, inflation marked higher, yet the Fed still cut. The clue: Powell is hedging employment risk, not inflation. Dots show wide disagreement, but the risk-management cut tells us the Fed fears labor weakness more than sticky prices.

Retail Keeps Buying, High Net Worth Keeps Spending

Spending power has shifted decisively upward: the top 10% of households now drive half of U.S. consumption. That’s why retail sales and luxury demand stay strong even as low-income consumers strain under debt and tariffs.

Gamma and Blackout Math

Dealers are stuffed with long gamma, which dampens swings. But with corporate buybacks in blackout and pensions set to unload ~$22B in equities into month-end, one strong shock could force correlations higher fast.

The Bubble Playbook

Bubbles reward those who ride them — until things break. The smart play is not denial, it’s barbell: play the high-beta names, balance with distressed value, and watch bond vol. Credit markets tend to sniff trouble before equities.

The Week: Data and Fed in the Spotlight

This week’s macro focus is Friday’s core PCE — expected at ~0.2% MoM, keeping inflation just under 3% — plus the final Q2 GDP revision on Thursday. Housing, durable goods, and consumer sentiment will fill in the picture. Layered on top: a heavy Fed speaker lineup, including Powell on Tuesday, Bowman twice, and a full roster of regional presidents.

Get Rich Overnight with Options? Yeah Right...

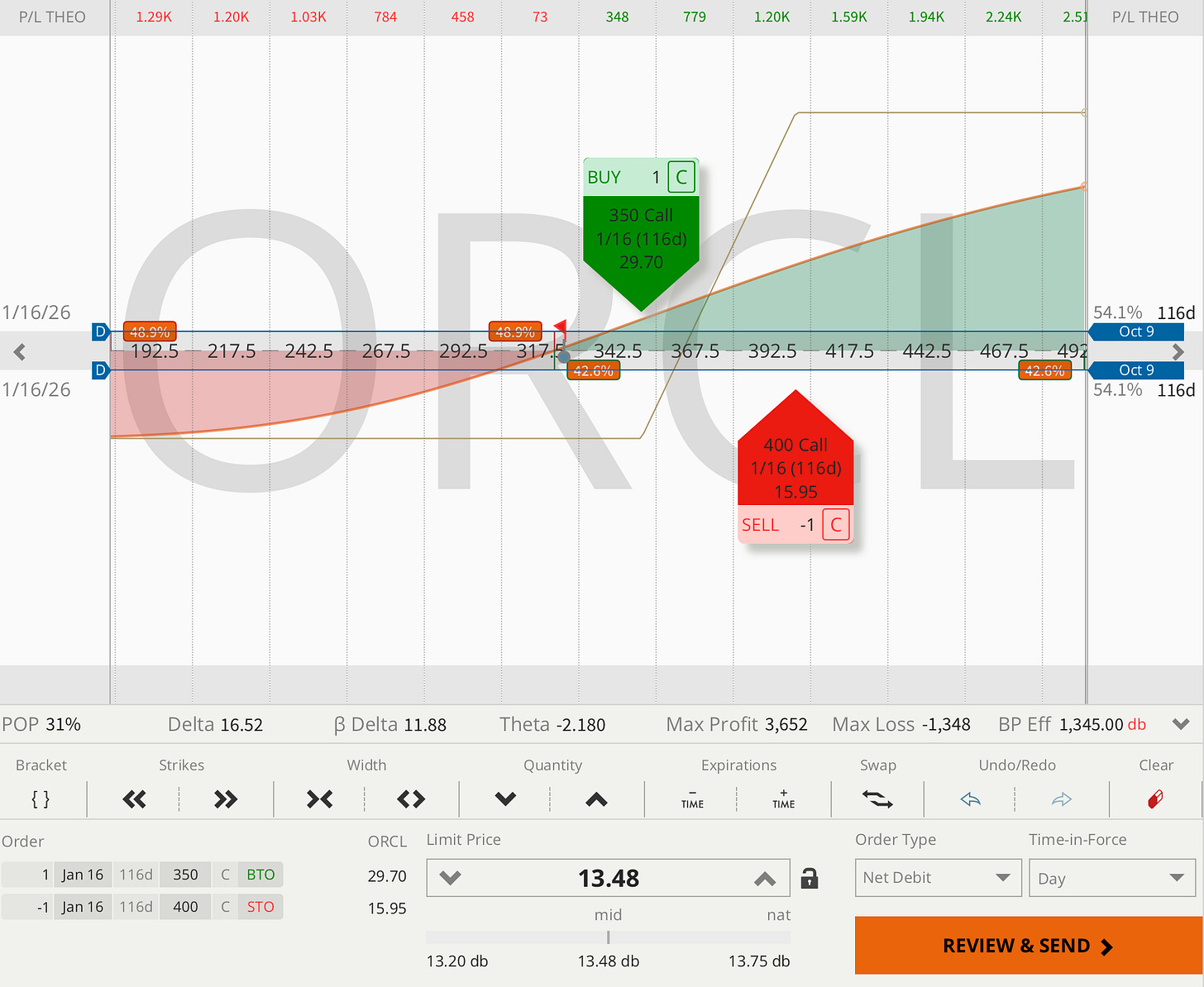

TUESDAY TARGET: Oracle (ORCL)

Prices can only go up… Part II.

If there’s a melt-up, we want in. At ~60 DTE, this setup puts our breakeven near spot (by design) and risks roughly a ~30% paper drawdown on a pullback toward $285 — acceptable for the payoff we’re targeting.

Oracle’s TikTok angle is getting more meaningful: the company already hosts U.S. TikTok data, and new terms would have Oracle managing the U.S. algorithm/security, adding a potential kicker sooner than later.

Our overall portfolio is running a fairly large negative delta — i.e., leaning bearish — so this ORCL bullish setup slots in nicely with the current positioning.

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

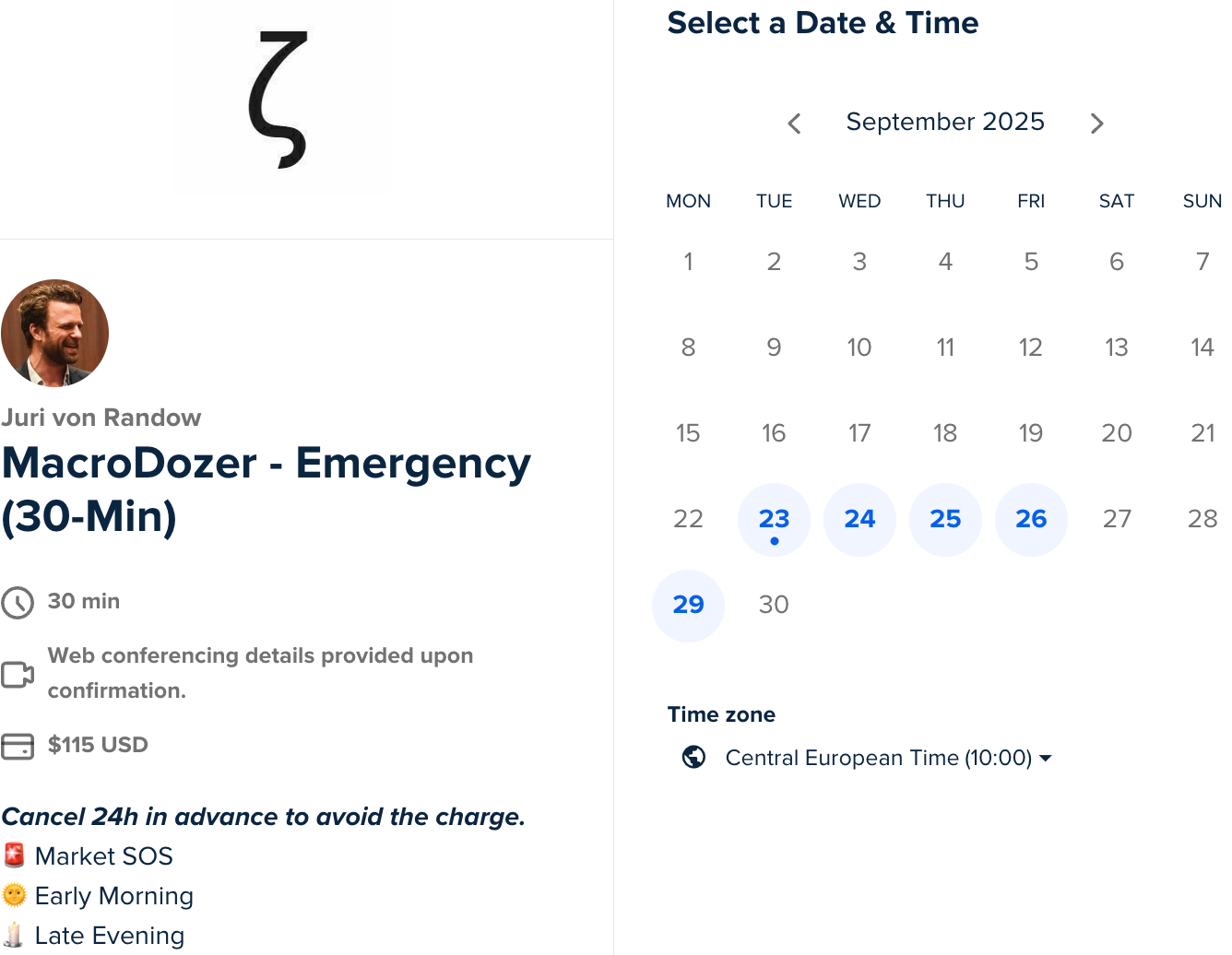

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.