🎯 This Week’s Target: Semiconductor ETF (SMH)

Investors still cling to the idea that the Fed, the White House, or some grand geopolitical script is driving this market. That is cute. The real policymaker today is the market itself. Every wobble in bonds, every spasm in volatility, every tantrum in equities forces governments and central banks to adjust in real time. Politicians dancing to the screens.

Look around. Tariffs get softened when futures puke. Fiscal plans get redrafted when bond yields scream. Even Powell’s pressers are less about economic models than about managing trader expectations. The market has become the veto power — an unelected regulator with a Bloomberg terminal. That’s why stocks melt higher while headlines scream doom: traders know weak data now means easier policy tomorrow, and every market dip gets patched up long before a real recession could even show its teeth.

It’s a strange loop: policymakers move as if they are steering, yet the market keeps pulling them along. The real risk comes the day policymakers can’t answer the tug and the leash snaps. When that happens, control goes with it — and nobody knows if the dog slams into a brick wall, or bolts off chasing squirrels.

Below, as always, the rest of what’s cooking:

Fed Week: Cuts in the Spotlight

The Fed is set to cut again on Wednesday, with markets pricing about 25 bps and expecting over 120 bps more within a year. Unlike past cycles, cuts are coming with stocks at all-time highs and a still-resilient economy.

Options Gravity: A $1 Trillion Expiry

Friday’s options expiration is the largest in history, with an 11:1 skew toward calls. Dealer hedging has created an artificial calm — SPX pinned in tight ranges, volatility compressed to historic lows.

US–China: Deals, Delays, and Double Games

The US and China reached a framework on TikTok and extended their tariff truce into November. At the same time, Beijing slapped Nvidia with an antitrust violation. Both moves show the same pattern: give a little to keep trade talks alive, squeeze when leverage allows.

Fiscal Dominance vs. Recession Models

Leading indicators keep flashing warning signs, yet trillion-dollar deficits hold GDPNow near 3%. Retiree spending and government outlays keep the engine running even as private-sector data weakens. Markets are trading the deficit flow, not the downturn signals.

The Week: Central Banks on Parade

Sixteen central banks meet this week, with the Fed, BoC, BoE, and BoJ anchoring the calendar. Markets expect 25 bps from Powell, 85% odds of a Canadian cut, and minor chances of movement in Japan or the UK. Beyond rates, key US data include retail sales, housing starts, and the Philly Fed survey, while Europe watches ZEW sentiment and CPI.

Get Rich Overnight with Options? Yeah Right...

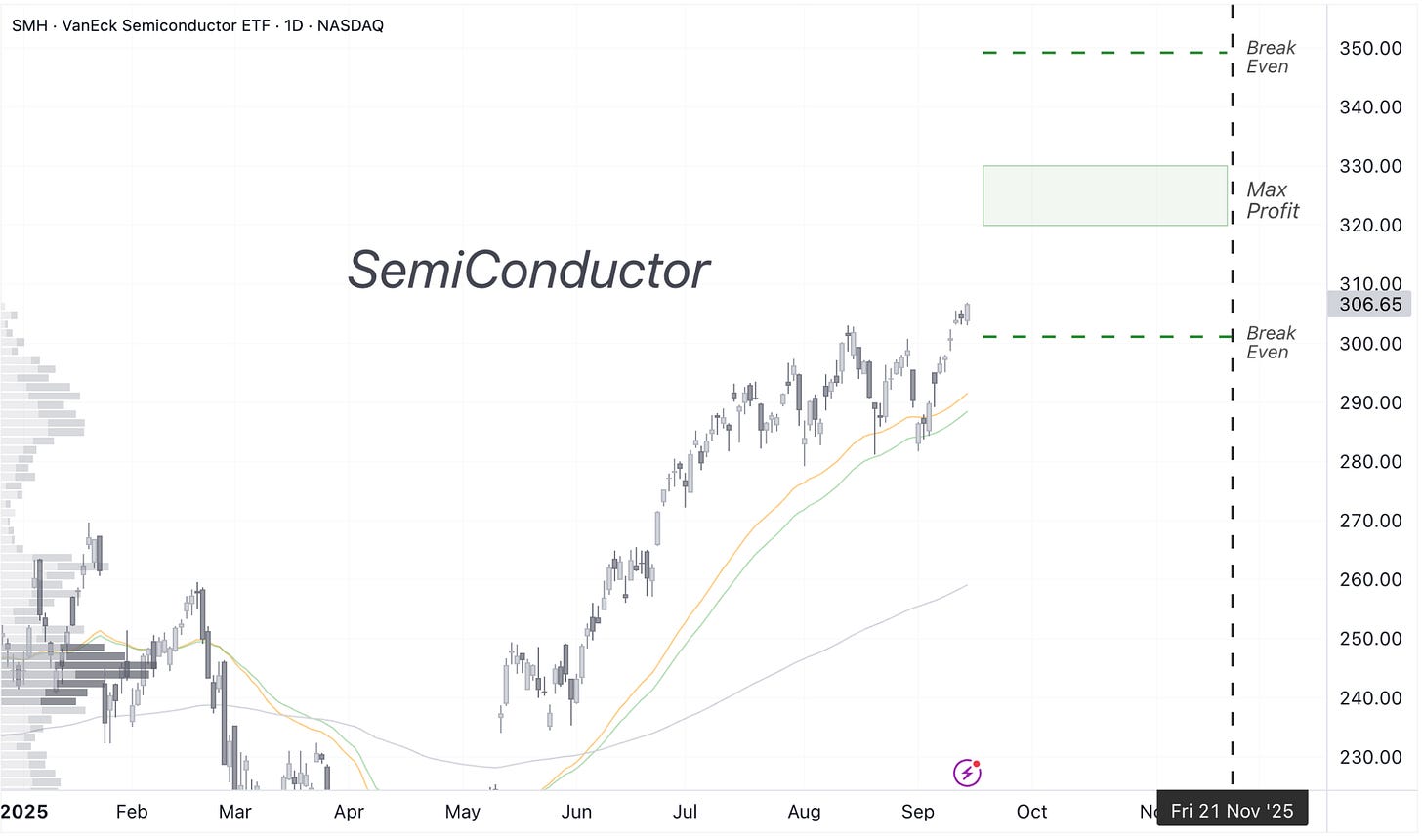

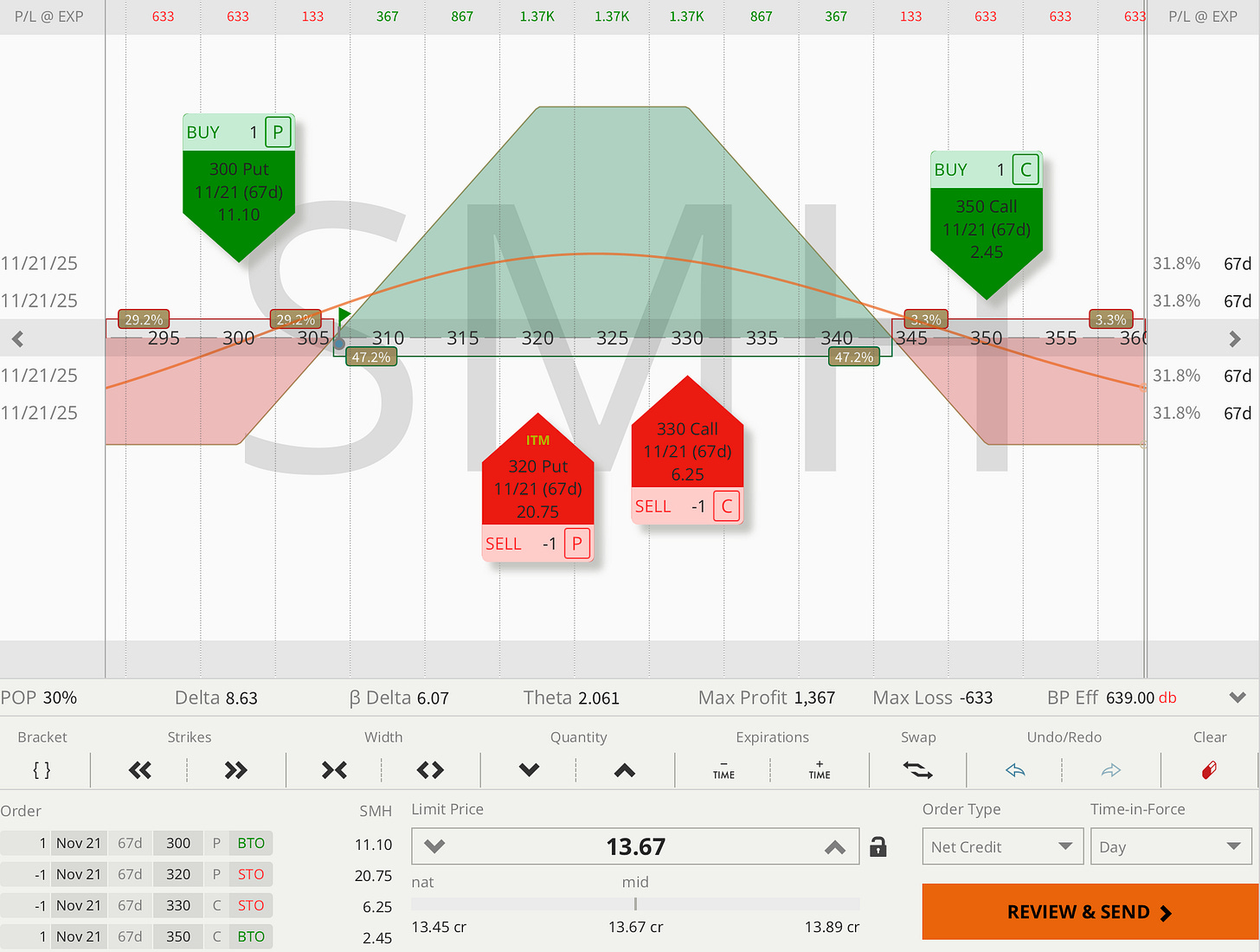

TUESDAY TARGET: Semiconductor ETF (SMH)

Prices can only go up… Earnings season is kicking in, and welcome back to mostly ETF trading. We like this ultra-bullish setup in the current melt-up scenario — because why not. A potential retrace to 30–50% of the last move would only put the trade down by about 30%, which is well within reason. Also, we’re swinging for the fences here by increasing the risk–return ratio from 1:1 to 1:2.2, managing the probabilities personally and manually to further tilt the outcome in our favor.

Our overall portfolio has a fairly large negative delta at this point, meaning it’s leaning bearish. This SMH bullish setup slots in nicely with the current positioning.

@Elite Taders — hit me up in MacroDozer Discord if anything is unclear. Early entry, repair, or exit warnings will show up there first.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

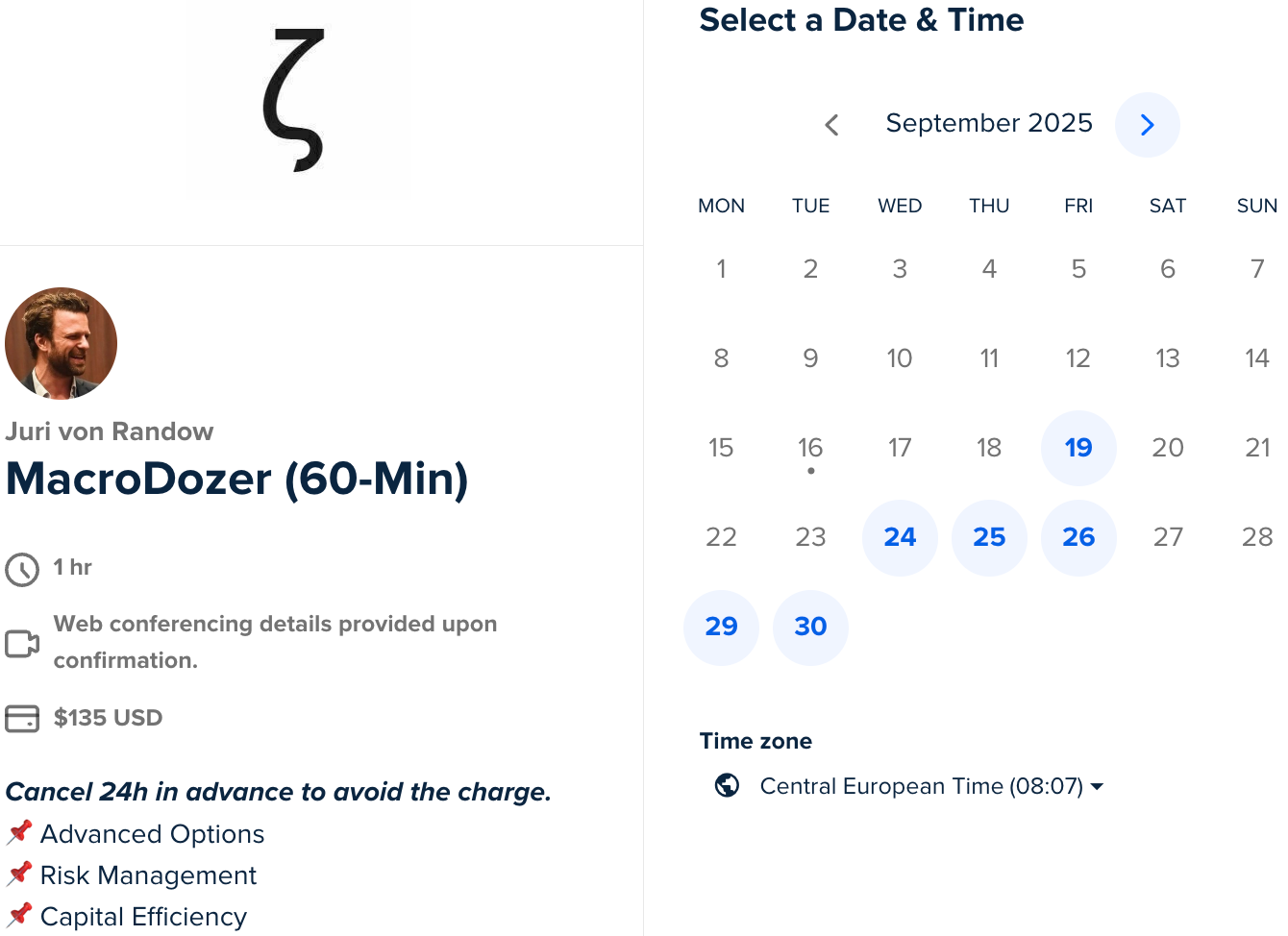

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

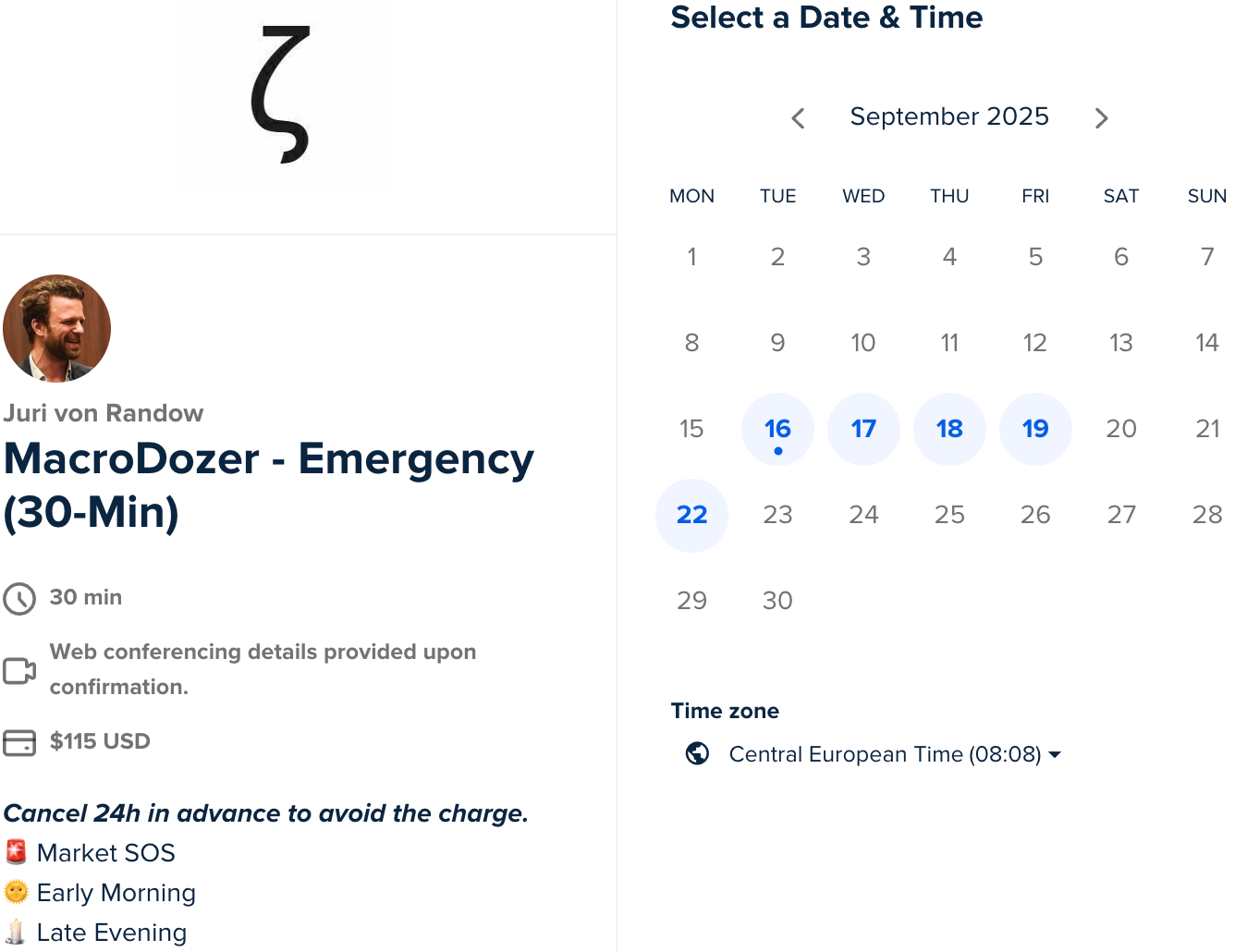

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.