🎯 This Week’s Target: Tesla (TSLA)

Gold shouldn’t be breaking records with real yields still elevated. Yet it is. That tells us something bigger than inflation angst: investors are quietly abandoning the idea that government bonds are risk-free.

Think about it. France cannot pass a budget without collapsing its cabinet, UK gilts are trading like an emerging market, and Japan’s 30-year yield has touched levels not seen since the 1990s. These are supposed to be the anchors of the global system, but they are fraying. What replaces them? Central banks and treasuries improvising tricks: buybacks, yield-curve tweaks, and — when the panic comes — yield-curve control.

That’s why gold is exploding even while rates look high. Don’t think about inflation today; think about credibility tomorrow. When governments print debt faster than markets want to absorb, the safety net shifts from discipline to manipulation. And once you know the bond market is no longer free, you stop treating bonds as your ultimate hedge. You buy the one thing governments cannot dilute with accounting magic or central-bank gymnastics.

Below, as always, the rest of what’s cooking:

AI’s Fiscal Fuel

AI is morphing into industrial policy. Sovereign balance sheets, from Washington to Beijing, are effectively venture funds underwriting the chip war. That explains why multiples are holding even as adoption surveys show growth slowing: the market assumes governments will subsidize the capex no matter what.

France’s Political Crack-Up

Bayrou’s government fell, Macron faces limited options, and France’s OAT-Bund spread is already near decade highs. Unlike past euro scares, now it’s the bloc’s second-largest economy. Investors are quietly attaching a durable risk premium to French assets.

Japan: The Widow-Maker Returns

PM Ishiba’s resignation and the likely rise of a more fiscally loose successor have shoved 30-year JGB yields to multi-decade highs. With the yen weak and super-long bonds wobbling, Japan could export term premium into global yields again.

Argentina’s Reform Fatigue

President Milei’s heavy defeat in Buenos Aires province sparked a peso plunge (ARS 1,415/USD) and a bond rout. Markets loved shock therapy until voters didn’t. October’s midterms could decide whether reform sticks or unravels.

The Week: CPI, Jobs, ECB

The spotlight is on Thursday’s CPI, with tariffs expected to lift core goods prices. Tuesday’s payroll benchmark revision could cut 500–900k jobs from history, and the ECB meets the same day as the US 30-year auction. Layer in French politics and Japan’s leadership race, and it’s a week where data and debt collide.

Get Rich Overnight with Options? Yeah Right...

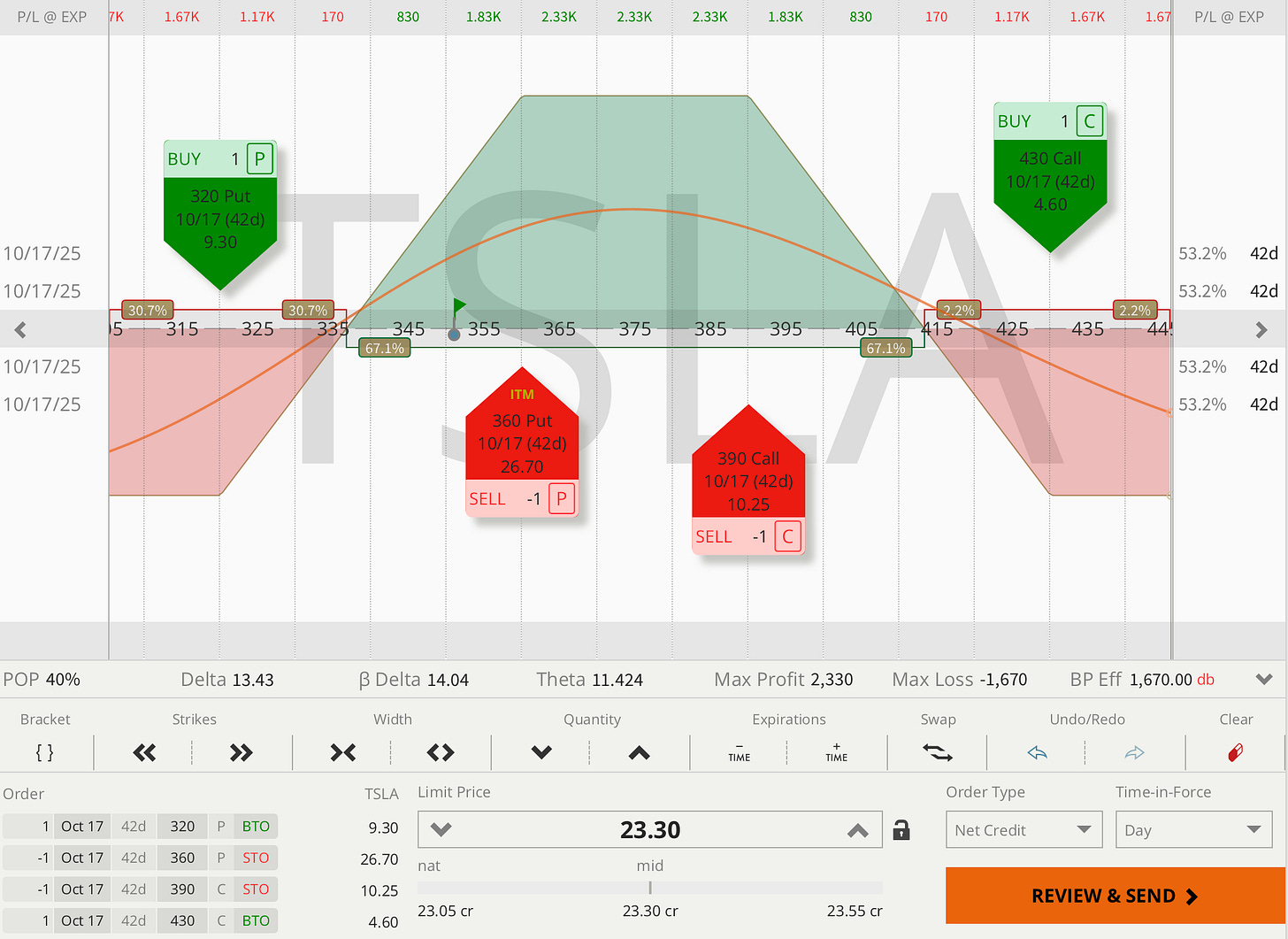

TUESDAY TARGET: Tesla (TSLA)

First Tesla trade ever — who would’ve thought? We used to pull some early tricks on Twitter — the only Musk play we ever touched. And now, here we are, years later — all grown up and braver than ever.

It’s a pure technical trade. Because let’s be real: Tesla’s share price has nothing to do with the company’s valuation.

@Elite Taders — hit me up in MacroDozer Discord if anything is unclear. Early entry, repair, or exit warnings will show up there first.

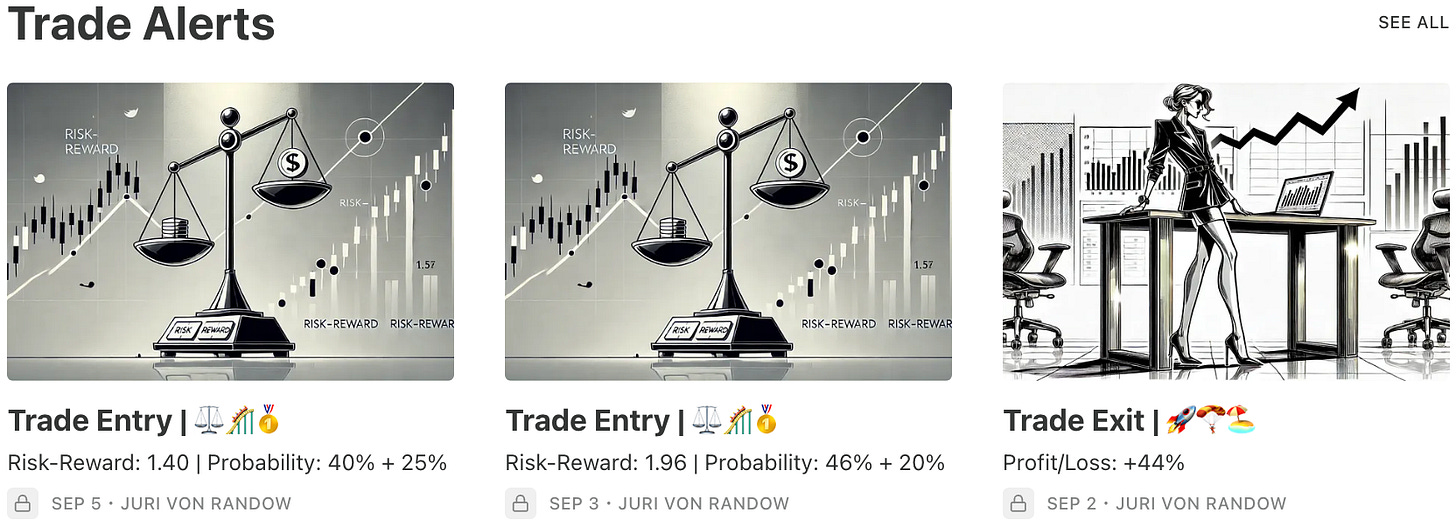

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

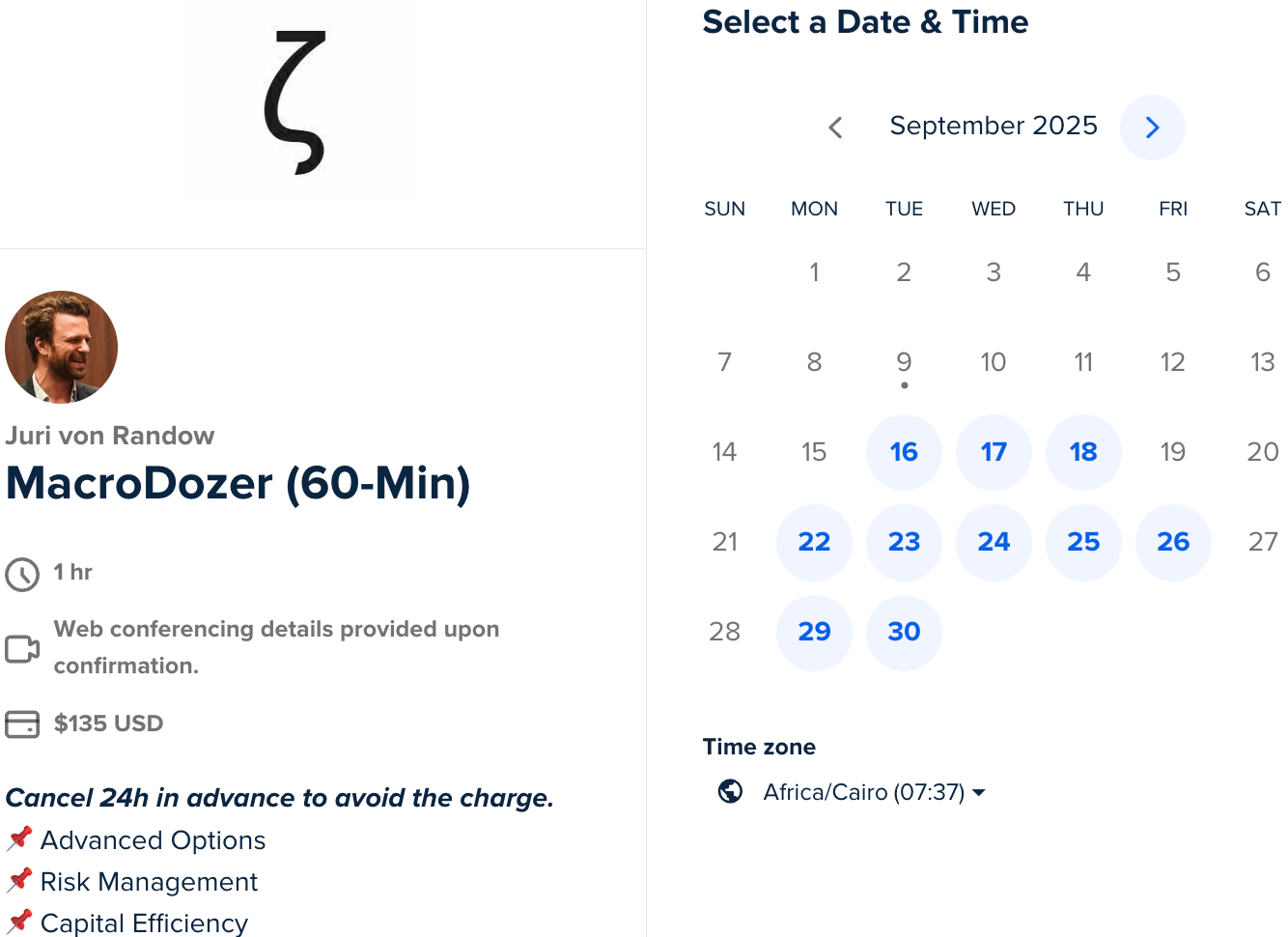

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $120 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

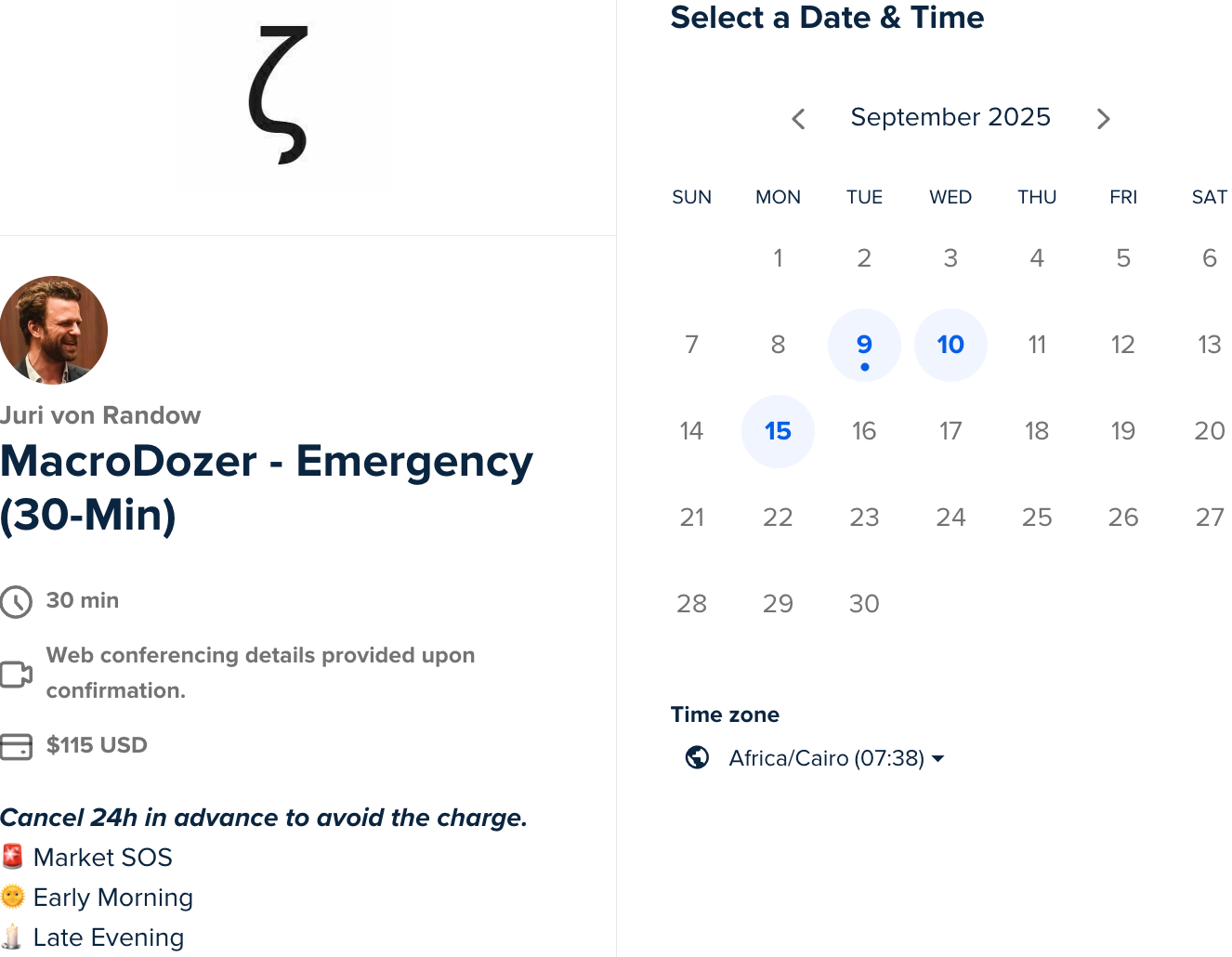

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.