🎯 This Week’s Target: China Internet (KWEB)

The crowd heard rate cuts and ordered champagne. Meanwhile, downstairs in the engine room, the plumber closed three valves at once.

First, the spare‑cash bucket at the Fed has been largely drained; there isn’t much reverse‑repo cushion left at all. Second, Treasury is refilling its own account, which vacuums dollars out of markets before they boomerang back. Third, QT grinds on, quietly shrinking the pool again. Speeches sound softer; the plumbing feels tighter.

That matters for behavior. The buy‑the‑dip reflex wasn’t ideology—it was flow. Passive bids, option mechanics, and a sea of liquidity kept every wobble short. When hoses slow, opportunity morphs into a positioning check, and the next shock needs less force to rearrange prices.

Irony of ironies: the U.S. is talking easy while siphoning; China is talking discipline while spraying. China’s tape is ripping through decade‑old ceilings while the macro tape wheezes. Call it policy‑assisted optimism: fresh liquidity, margin accounts waking up, and a shiny AI chip hero to rally around. The wettest tap wins.

Below, as always, the rest of what’s cooking:

The Lagged Inflation That Doesn’t Look Like Inflation

A 40% levy on transshipped goods and fresh sector probes change the margin math before they change the CPI. The path is predictable: powerful buyers push suppliers, firms eat part of the hit, then prices restructure over quarters. The extinction of the de minimis loophole complicate inventories and pass‑through timing.

Energy Risk Is Re‑Pricing in Insurance

A drone strike near Russia’s Ust‑Luga terminal, pipeline hiccups, and refinery headlines nudged crude higher — but the more important move is war‑risk pricing in marine insurance. Underwriters don’t wait for vol indexes; they move premiums as supply lines wobble.

Germany’s Mittelstand Slump

Real‑time VAT/payroll data show Germany’s SMEs contracting on revenue and headcount, with construction and hospitality weak and investment still scarce. Yet European indices are breaking higher on poor newsflow, with the tactical case leaning on mean‑reversion and early signs of capex revival.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: China Internet (KWEB)

If you believe China is wetter than the US, play it with an aggressive call debit spread on KWEB. Be smart with the maturity — pick expiries that keep time decay and volatility bleed low.

PS: We’re not taking this trade. If anything, treat it as a contra signal.

Want these trade ideas in real time? Become an Elite Trader.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

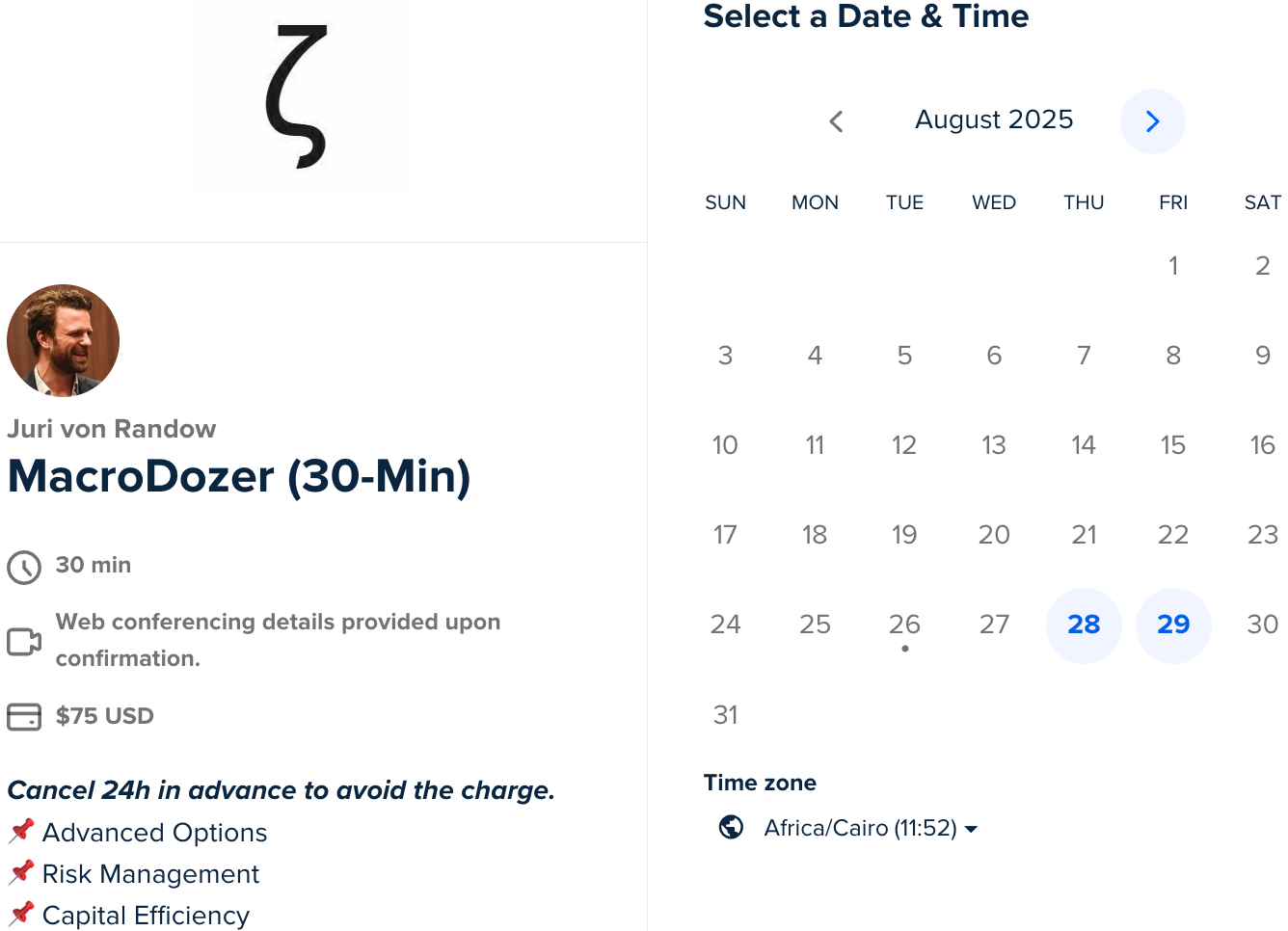

📌 1:1 Mentorship Call

A focused Zoom call to sharpen your edge fast.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: ~$60 / 30m · ~$120 / 60m | 👉 Book / Top Up Here

Public rates: $75 / 30m · $135 / 60m | 👇 Book Below

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

🕓 Pre-Close

Elite members: ~$110 / 30m · ~$180 / 60m | 👉 Book / Top Up Here

Public rates: $115 / 30m · $230 / 60m | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.