🎯 This Week’s Target: Bitcoin Trust (IBIT)

Washington just found the easiest way to own the future: buy it and bend it.

First, swapping CHIPS grants for an equity stake in Intel amounts to co-ownership of core compute — industrial policy crossing into the cap table. When the referee puts on a team jersey, capital costs are political, competitors face policy risk, and taxpayers inherit the tail.

Next, Powell walks into Jackson Hole with markets already cutting for him. The front end loosens, the long end resists, and we get curve choreography without saying the quiet part out loud. Translation: cheaper short money to goose growth optics, pricier long money to nod at credibility. Stock indices keep grinding higher while small borrowers and regional banks breathe through a straw.

Add the AI capex boom — corporate QE by another name — and the script is neat: the government is effectively underwriting chip-plant buildouts, mega-caps turn data-center infrastructure into steady cash flow, and smaller players pay the bill.

The tell is volatility. Market makers are positioned so their hedging dampens swings (buy dips, sell rips), vol is asleep, and hedges are unusually cheap right now. Call it manufactured calm — sedation by positioning.

My take: soft nationalization is the playbook. It can work — until a key assumption breaks: cheaper short rates, calm long rates, continuing policy support, AI capex humming, and low inflation/volatility. Play it without marrying it: own the likely policy beneficiaries tactically; use bearish condors or funded puts; and accumulate boring, cash-generating businesses the algos ignore.

Below, as always, the rest of what’s cooking:

Sell America Averted

April’s tariff scare saw foreigners dump U.S. equities; May’s Treasury data shows they bought back even more. That doesn’t read like a structural exit from U.S. risk, more like flow whiplash. The medium-term story is slower rebalancing — incremental allocation to ex-U.S. when policy noise spikes — rather than a crash diet.

Liquidity: The Next TGA Dollars Matter

Treasury is refilling its cash account toward ~$850B. The early refill drew mostly from the Fed’s reverse repo pool — low market impact — but that cushion is nearly gone. The remaining rebuild is more likely to drain bank reserves and tighten domestic liquidity at the margin into late Q3.

Health Care: A Boring Rebound Setup

After a two-year drubbing, large managed-care names trade at washed-out relative levels despite demographic tailwinds. Insider buying and selective value interest have started to flicker. Policy headlines aren’t going away, but mean reversion in claims trends plus disciplined buybacks can re-rate the space.

Debasement Hedges

With 80+ central-bank cuts this year and rising chatter about framework tweaks and even soft versions of curve control, gold and crypto have a clean macro bid. Positioning in crypto remains far from universal; gold ownership is wider but still benefits from a weaker-dollar narrative.

Get Rich Overnight with Options? Yeah Right...

TUESDAY TARGET: Bitcoin Trust (IBIT)

Old hands are offloading coins while corporates line up to buy the top in bulk. Momentum’s hot, and the narrative still sells — store of value, inflation hedge, Lightning. No euphoria yet… just disciplined FOMO.

Let’s keep leaning in. Institutional money can’t throw itself into this cloud fast enough. The emperor had clothes — until he didn’t. We’re selling air to his tailor while he’s still taking measurements.

Bonus: this also buffers our now-bearish Ethereum position and makes the overall portfolio more delta-neutral.

Want these trade ideas in real time? Become an Elite Trader.

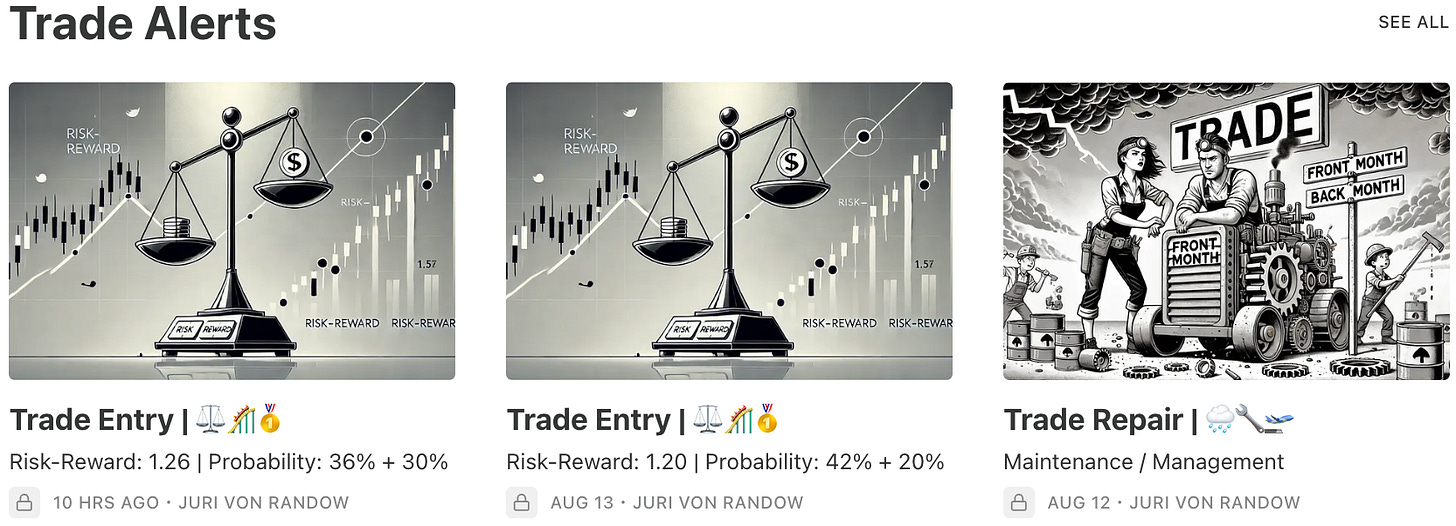

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

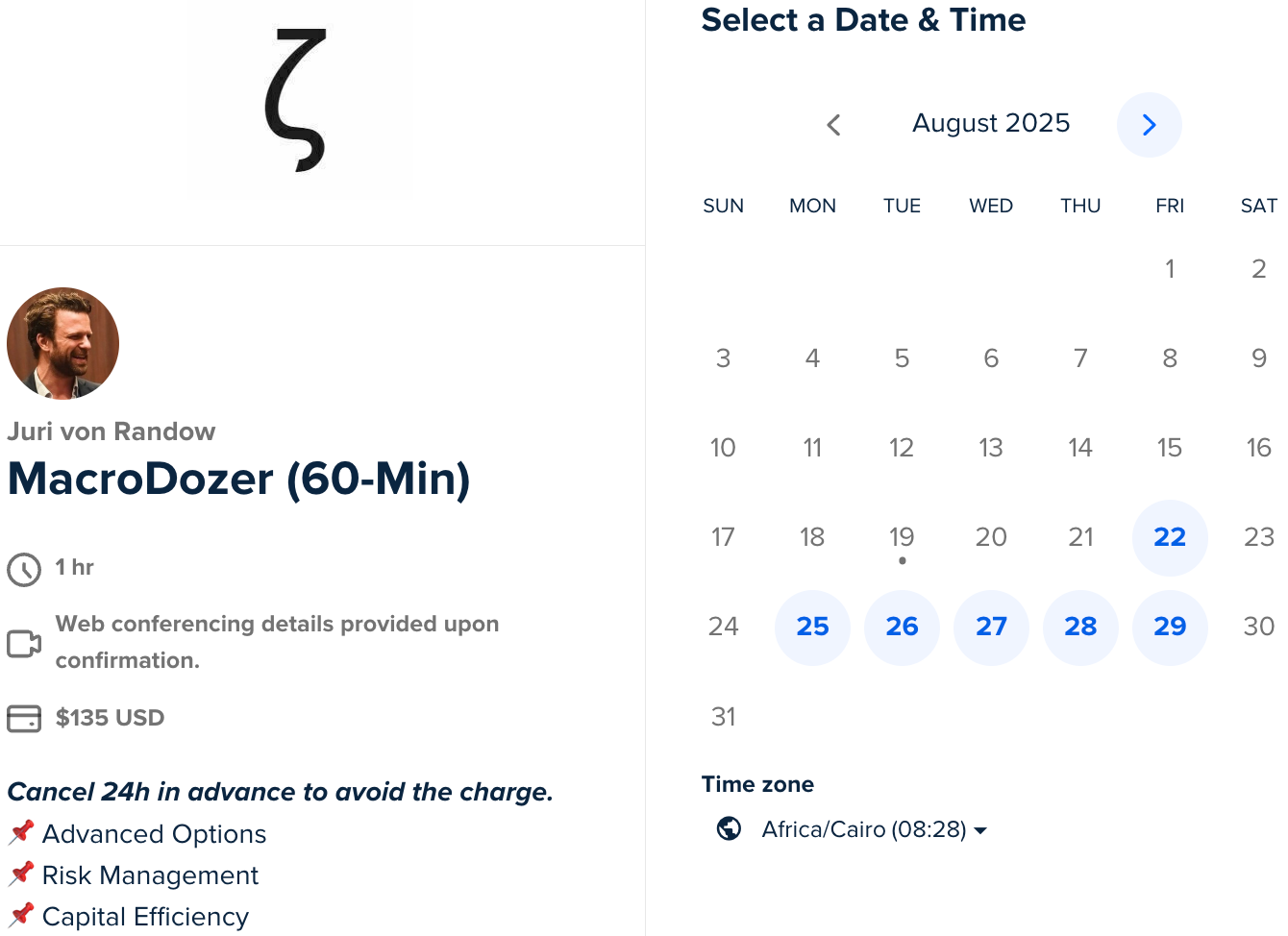

📌 1:1 Mentorship Call

A 60-minute Zoom to master your strategy fast.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

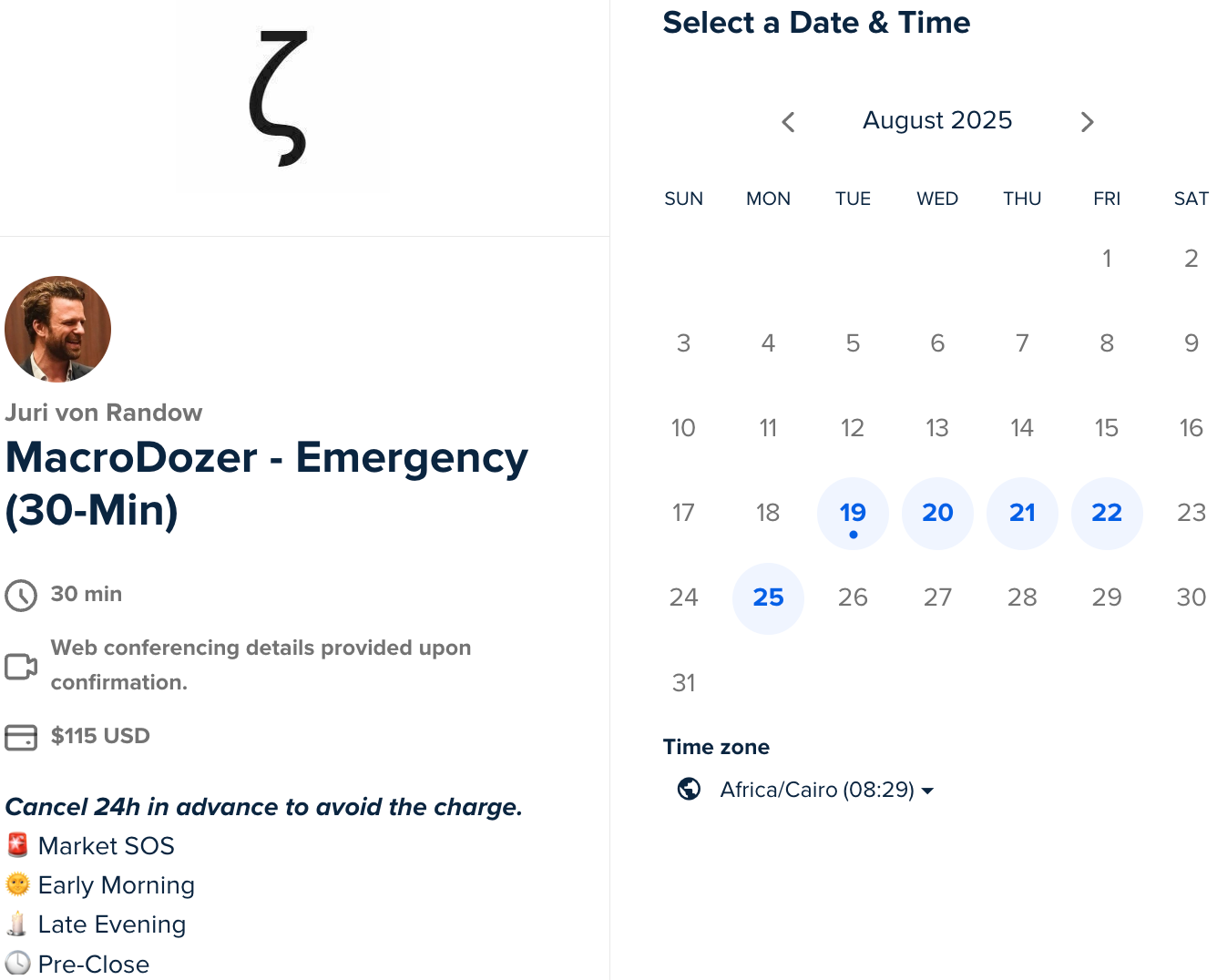

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

🕓 Pre-Close

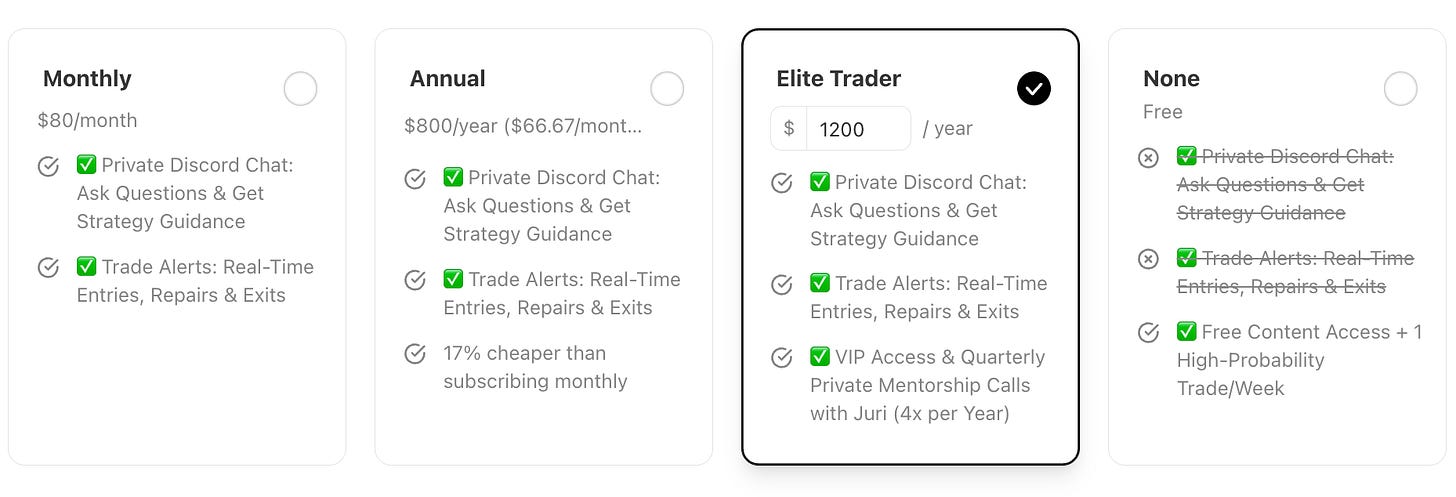

📌 Choose Your Access

Free Access 👉 $0/month

✅ Weekly high-probability trade idea

✅ Educational content

❌ No alerts or chat access

MacroDozer Pro 👉 $67/month

✅ Real-Time Trade Alerts

✅ Private Discord Chat with Juri

❌ No VIP Access

Elite Trader 👉 $1200/year

✅ Everything in Pro

✅ VIP Access (Live Replays)

✅ 1:1 Zoom Calls — up to 8/year

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.