BIOTECH: MacroDoζer Summer Special 3/5

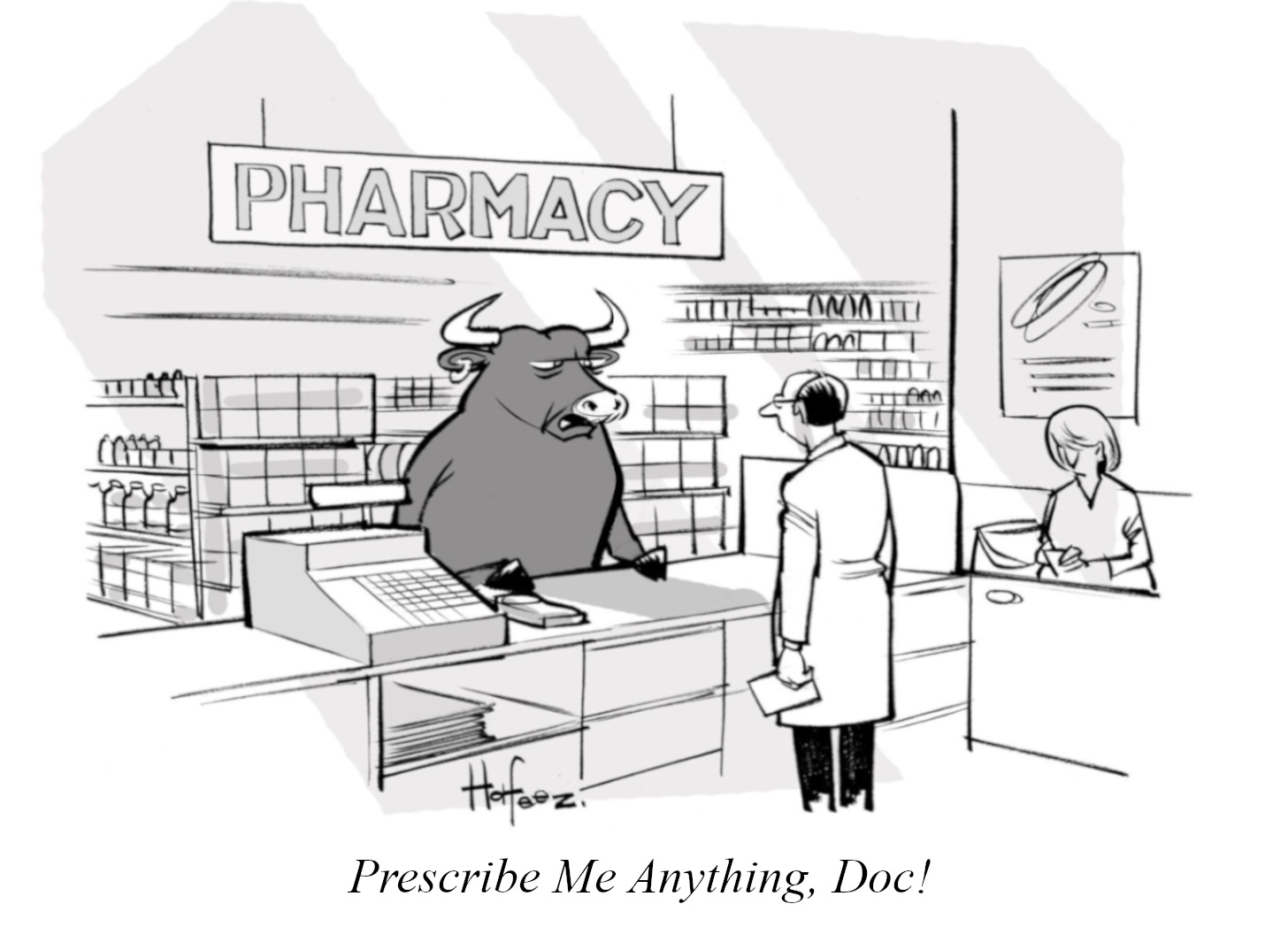

Prescribe Me Anything, Doc! We Got to Show Those Lazy Summer Bears How to Burn Theta and Pretend to Be Smart.

Executive Summary

XBI Biotech looks like a promising market, yet still confined by substantial lower and upper boundaries.

In the meantime, we sell our classic risk-defined straddle.

Biotech might soon be a long LEAPS candidate; we will let the bulls decide.

1. Why Do I Care Right Now?

XBI Biotech was already waiting in my drawers to be banged out as our first long LEAPS position. The biotech market looks promising from a technical perspective. We have a proper bottom formation with higher lows and higher highs, and the green 40-day just crossed the orange 50-day moving average.

Rant Around Never-Ending Financing Needs

Usually, higher lows and higher highs mean fireworks, and off we go to the next bull cycle. But, to be honest, I can’t be bothered to go long. Biotech never convinced me as a long-term investment; it is choppy and can go sideways for years. Moreover, many companies are not profitable and rely on steady external financing—money that is not necessarily smarter than the company—an overall dangerous game.

XBI currently trades right between the 50-day and the 150-day moving averages, two lines that usually serve as support and resistance. Let’s assume that will be the case. An additional reason to rule out a long LEAPS position for now and bet on a continuous sideways move. Potential breakouts to the upside or downside should be held in check by both Fibonacci zones that align perfectly with our break evens.

2. Useful Background Information

XBI is the ticker for the S&P Biotech ETF. It replicates the development of the S&P Biotech Select Industry Index. It is a very liquid product.

The index tracks 135 US-listed Biotech companies, equally weighted, for an unconcentrated exposure to large, mid, and small-cap biotech stocks.

3. Trade Execution

We are selling our classic risk-defined straddle at 83, with wings at 65 and 101. Break-evens are at 73 and 93.

Trade Entry - Jul 27, 2022

1) Short Call 83, Sep 16, 2022: 5.80 Credit.

2) Short Put 83, Sep 16, 2022: 5.25 Credit.

3) Long Call 101, Sep 16, 2022: 0.83 Debit.

4) Long Put 65, Sep 16, 2022: 0.79 Debit.

Total: 9.85 Credit.1

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.

Total credit equals the sum of the mid-prices of each bid/ ask spread. Brokers usually get filled mid-price for liquid options.