VIX FUTURES: Monetizing Hysteria

How To Feel Comfortable And Relaxed

Executive Summary

Are short-sellers to blame for personal failure?

Algos could be more hysterical than humans.

When does Tony Stark live up to his cult status?

Markets might crash, but they won’t.

1. Why Do I Care Right Now?

Is it that time of the month again? You bet it is. While humans and algos, programmed to mimic human hysteria, are losing it again, we sit back and relax. Next, we try and figure out how to put on our favorite short volatility-on-volatility trade in the most innovative way possible. Innovative, meaning we try and predict volatility moves over the next few weeks by applying market physics and avoiding witchcraft; a rough estimate is sufficient. We also try and minimize capital employed while maximizing potential profit. It doesn't sound easy, yet manageable once we visualize the idea and remember how to click a mouse.

A black swan or liquidity-type event does not happen in bear markets, with greed at its lows and fear at its highs. Instead, multiple long-lasting extreme fear readings in a nine-month orderly sell-off mean that everybody had enough time and opportunity to hedge, insure, sell, and plan.

1.1 Fear & Greed Index

That includes short-sellers, other short strategists, and portfolio insurers. These guys, in particular, serve as a healthy counter-force against fast and sharp sell-offs. Being short means you have to cover your position at some point by buying back what you sold before. That often happens after those sharp sell-offs, when you made enough money or feel the market could bounce back and squeeze to the upside.

The public opinion that short-sellers are to blame for a market crash is an entertaining story but false.

Rant Around Short-Selling & Tony Stark

It is one thing when random politicians, trying to make a living by arguing and fighting, are spreading non-truths in the heat of their life agenda. But it is slightly dorky when Planet Earth’s disciple-proclaimed Tony Stark, the rocket man, Mr. Mars himself, rails against short trading strategies.

Leading a secular engineering cult comes with responsibilities. Top of the list, ensure your gadgets are competitive; second, do not spread non-truths. Your disciples will believe you, regardless of their intellectual background. We are talking about a cult following, not the Vienna Circle.

If you know little about financial markets, you must relax and try and educate yourself first. If you suffer from Digital Tourette's or have an ongoing urge to make arbitrary marks, again, you must inform your disciples about your truths and shortcomings.

Who will be left driving cars or flying rockets assembled by arbitrary forces?

Time will tell.

Steelmanning my bear-market-no-crash theory, a liquidity event could still happen, even with markets perfectly prepared for it. No one can hedge against random oppressors playing with battlefield gear or entire industries and countries defaulting due to elephant rate hikes.

However, we are not ready to believe in bullies losing the plot or systems breaking over the next two months. Hence, we throw our money on calming waters and peaceful nights. We know that volatility wants to revert to its mean.

2. Useful Background Information

I wish I had discovered how to monetize hysteria earlier in my life. I would rank amongst the Waltons, Marses, and Kochs by now.

Check out our general thesis on how hysteria and volatility revert to their means.

3. Trade Execution

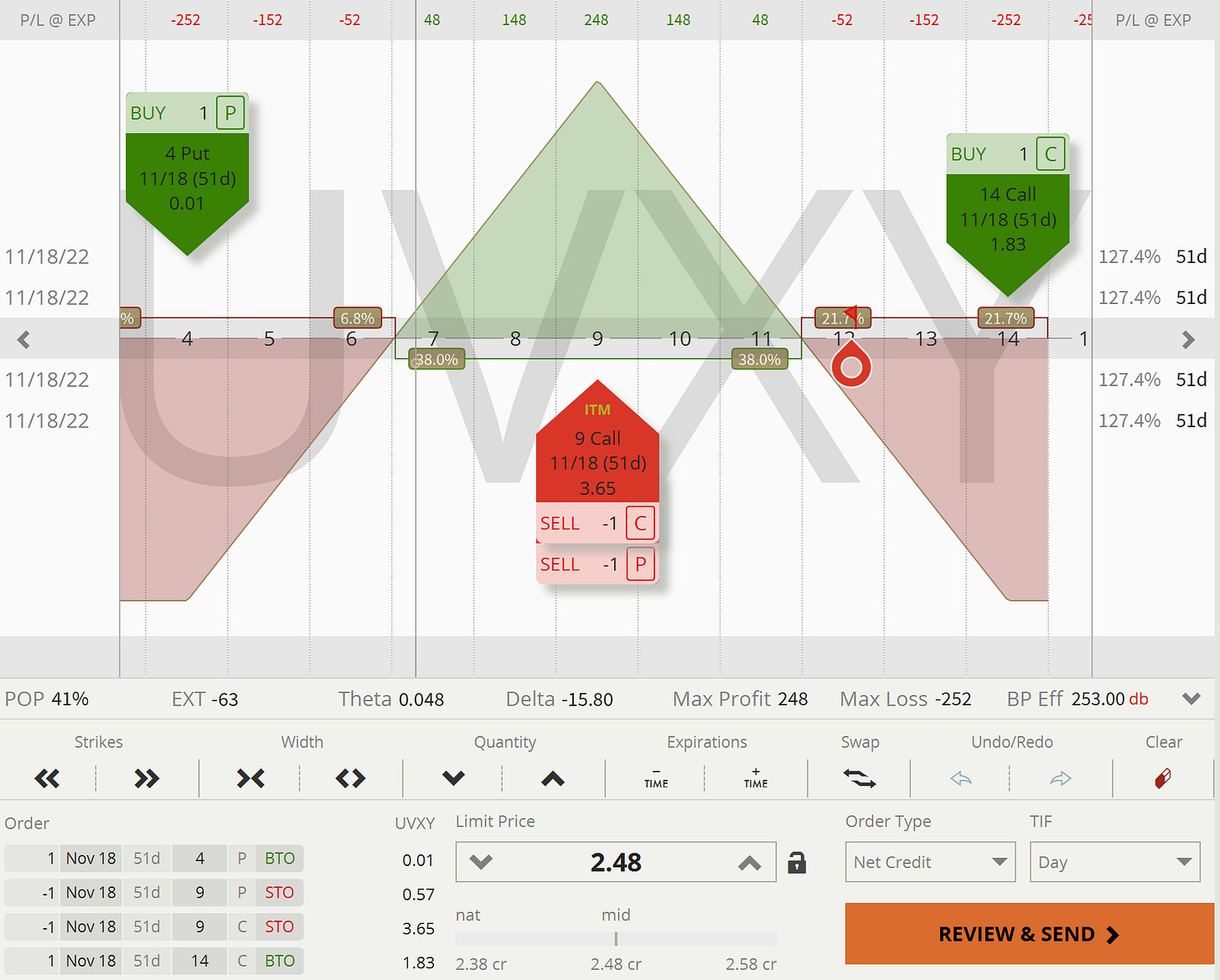

We are selling a bearish risk-defined straddle at 9, with wings at 4 and 14, maturity Nov 18, 2022. Volatility contraction and daily rolling activity of futures in contango will bring the price back to 9.

Break-evens are at 6.50 and 11.50.

3.1 Trade Entry - Sep 28, 2022

Total: 2.48 Credit.

4. Final Comments

Expect updates on BrainDoζers within 4-6 weeks. We use the exact heading, ending with (+/- xy%), and label the cover cartoon with a red Doζed stamp. That way, the performance will be easy to follow.

We are not sending BrainDoζer updates via email unless you specifically ask for it here. We want to keep the information flow light and to the point. You can still freely access all updates on MacroDozer the moment they are released.

My name is Juri von Randow. You can find me on the top banner to the right. MacroDoζing, as if there was no tomorrow. (Email version only.)

Feel free to share. Sincerely.