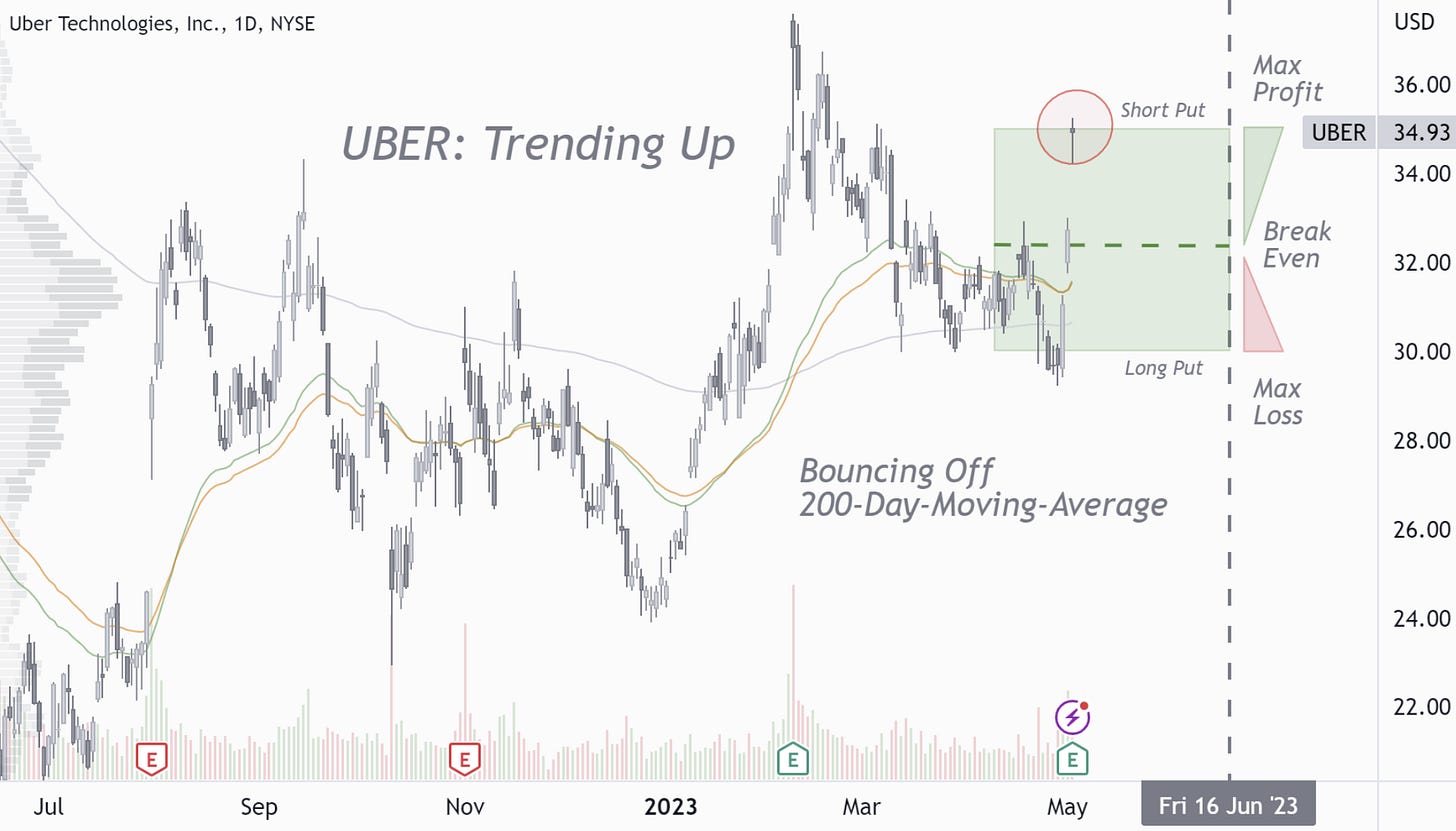

UBER TECHNOLOGIES: Tech or Taxi (+59%)

Either way, it's a party!

Executive Summary

Uber trends, and we are out.

We close the trade, leaving the rest to the whizzes.

1. Recap Situation

We were recreating off the Red Sea shores while dreaming of black market dollars at a thirty percent premium and contra-indicators that might become real signals.

We also analyzed Uber and weren't sure if they had a tech or taxi theme going on in San Fran. Either way, today's results will give them a reason to revel.

Our expected value on equity for another episode of fun and frolic was 26%; we turned it into an actual return on equity of 59% in four weeks.

Check out the original BrainDozer article below.

2. Why Now

The probability of Uber bumping its head at 37 or 38 is relatively high. Moreover, we might only get another 20-30% out of our put-credit spread, a residual reward disproportionate to the risk of losing the return we have already made. Hence, we close the trade.

3. Trade Execution

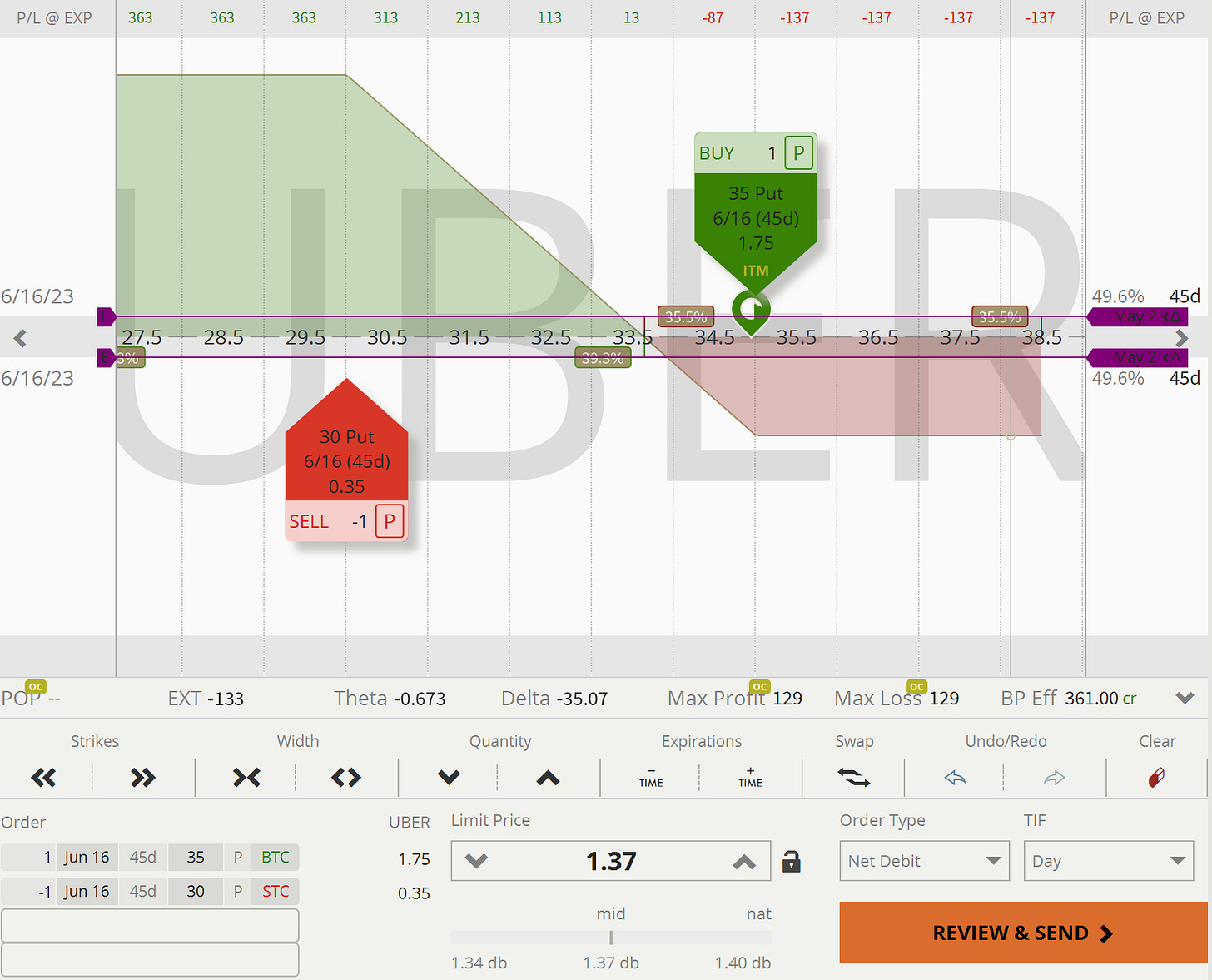

To close the put credit spread we sold for a credit, we need to buy back a put debit spread for a debit, same strikes, same maturity.

3.1 Trade Entry - Apr 4, 2023

The options chains are very liquid, so we were filled mid-price.

Total: 2.71 Credit.

3.2 Trade Exit - May 2, 2023

We were filled at an average price of 1.37, right at mid-price.

Total: 1.37 Debit.

3.3 Trade Return

The absolute return on this trade is

2.71 - 1.37 = 1.34

The equity at risk was 2.29, resulting in a return on equity of

1.34 / 2.29 = 58.5%

All BrainDozer articles are purely educational; they are not tailored to any particular individual or portfolio and do not constitute investment advice. Let us know if you are interested in implementing any of our ideas. Perhaps we can help or point you in the right direction.