🎯 This Week’s Target: U.S. Oil (USO)

Funding markets are coughing again. Overnight rates spike, the Fed’s repo window hums, and the cash cushion looks thin. The real culprit hides in Washington: during the shutdown, Treasury hoarded a trillion dollars in its Fed account, vacuuming liquidity out of the system like a drain left open. Screens flash stress, but it’s just water trapped behind the dam.

When that dam opens, once Congress ends the standoff, hundreds of billions will rush back into circulation. A stealth easing. The worse the squeeze now, the sharper the snapback later. Sometimes, liquidity pain prefaces melt-ups, not crashes.

Yet the market behaves like nothing is wrong (yet). Indexes float at highs while most stocks quietly sink. The Magnificent Seven do all the lifting; option traders keep layering upside bets, flattening skew and stretching optimism to parody. Machines, meanwhile, are set to sell into any tape, up, down, or sideways, just as corporate buybacks roar back into year-end. The result: intraday chaos wrapped in calm headlines.

And then there is Powell, the maestro of mixed messages, rate cuts one month, ambiguity the next, and no data to guide him through the fog. The punch: in markets ruled by liquidity, where stories masquerade as logic, fog favors those who fly by instruments.

Below, as always, the rest of what’s cooking:

Machines vs. CFOs: The Q4 Tug‑of‑War

Systematic programs (CTAs) are modeled to sell across most one‑week scenarios, while corporates are reopening buyback windows and racing to hit year‑end targets. That clash produces air pockets and late‑day ramps, with small‑cap futures seeing fresh shorts just as November’s seasonality historically favors them.

AI’s Hidden Bubble Sits in Credit

The AI build‑out is increasingly financed in the bond market: AI‑linked issuance is massive, LQD lags as supply hits, and credit desks flag a 2026 re‑leveraging wave tied to capex. Skew in mega‑caps has flattened as calls explode, while some large tech credits show spread and CDS drift wider from very tight levels.

Compute Is Strategy: UAE–US Pact

Washington and Abu Dhabi signed an AI‑and‑energy collaboration as Microsoft committed $7.9B more to UAE infrastructure, with export‑controlled Nvidia chips deployed under strict licenses. Data centers are becoming geopolitical assets; follow the power, the permits, and the partnerships to see where AI scale actually lands.

Asia’s Blow‑Off, China’s Optionality

Japan and Korea sprinted into overbought territory, while offshore China tech trades at ~19x forward with limited index concentration and pent‑up AI optionality. If US/China frictions cool at the margin and capital seeks laggards with power and compute access, the cheap call may sit where investors hold the least exposure.

The Tariff Wildcard Moves to the Courtroom

The Supreme Court will hear arguments on the administration’s IEEPA tariffs, which represent a meaningful chunk of current revenue. A ruling that curtails this tool would ripple through inflation math, fiscal projections, and trade leverage; policy risk, with a legal calendar.

The Week: Data Drip, Courtroom Wildcard, and Fed Voices

With the shutdown pushing into record territory, the tape leans on private data and speeches:

ISM Services and ADP private payrolls land Wednesday, with University of Michigan sentiment Friday, each carrying extra weight while BLS releases are delayed.

The Supreme Court hears the IEEPA tariff case Wednesday, a swing factor for inflation, fiscal math, and trade leverage.

Earnings keep the scoreboard busy (PLTR, AMD, UBER, QCOM, ARM, MCD, PFE, BP, Toyota, Novo Nordisk), while a chorus of Fed officials (Williams, Waller, Jefferson, Miran, and others) shape expectations into December.

Get Rich Overnight with Options? Yeah Right...

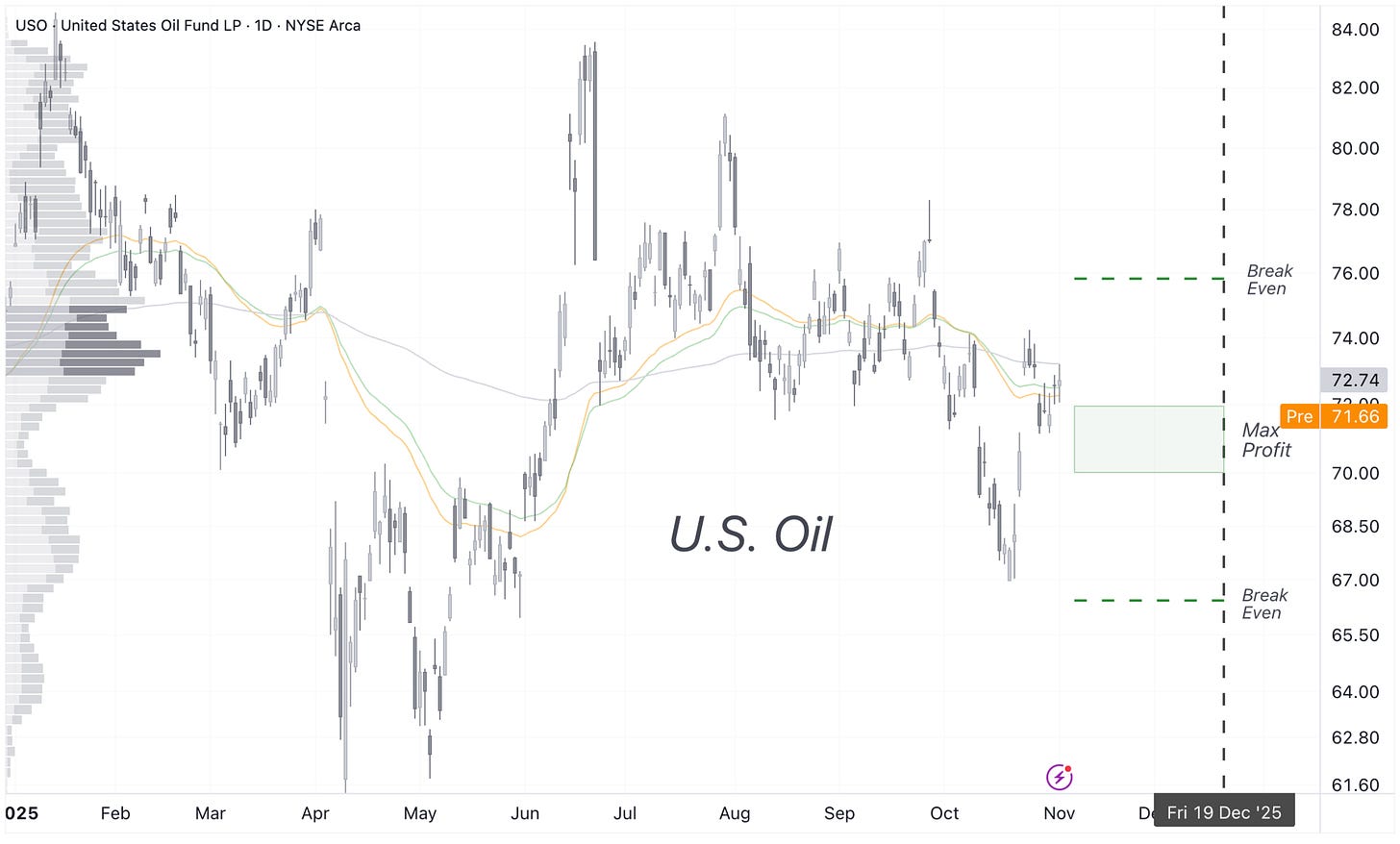

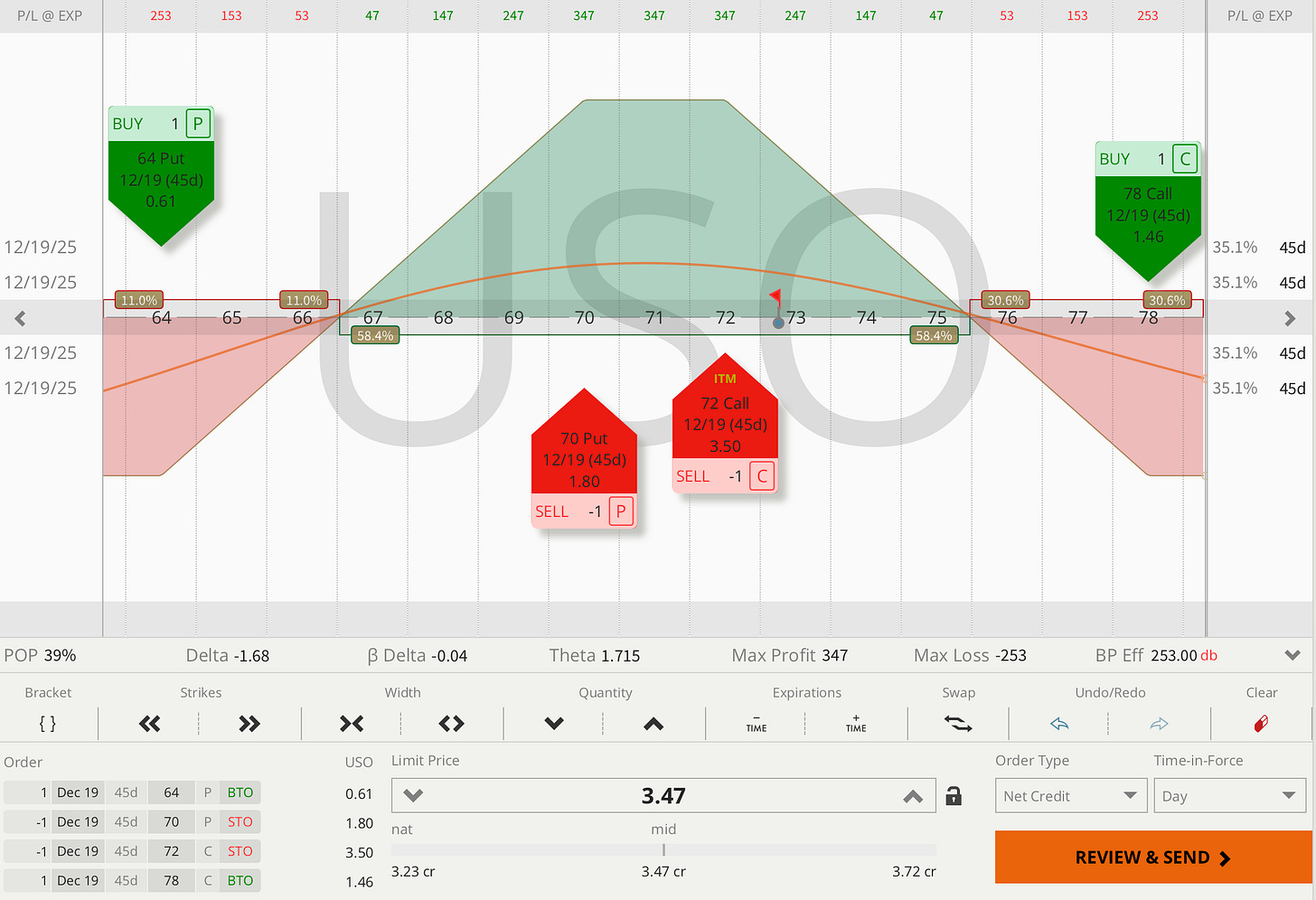

TUESDAY TARGET: U.S. Oil (USO)

Crude is stuck between OPEC+ discipline and slow demand. The cartel announced a minor December output increase before pausing hikes through Q1, keeping prices boxed while insurance and freight costs quietly carry the risk premium. With volatility compressing around $70–73 USO, this iron condor sells that calm. The sweet spot sits in the mid-range where inventories rebuild and traders wait for the next meeting on Nov 30. Defined risk, steady theta, and a payoff that wins if oil simply drifts.

We are not taking any trades at the moment, since our portfolio is extra volatile these days. We are focusing on management of active trades.

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👇 Book Below

Elite Trader: $110 | 👉 Book / Top Up Here

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.