🎯 This Week’s Target: Bitcoin (IBIT)

A handshake between Washington and Beijing is supposed to calm markets, not ignite them. Yet the moment framework headlines hit, liquidity desks lit up. A small push higher and the system starts chasing itself; dealers short gamma scramble to hedge, volatility rises with price, and passive money mistakes mechanical flows for optimism. It is less diplomacy, more domino physics.

Add perfect timing: buybacks back on, seasonality turning friendly, and the biggest tech names reporting with sentiment still defensive. Caution meets leverage, a recipe markets know too well. When everyone is under-positioned and options desks become forced buyers, the next leg might not be driven by fundamentals but by hedging reflex.

This week’s rally risk is built into the market’s machinery. The peace trade just gives it cover. Whether earnings impress or disappoint, the real show is in the mechanics: the flips, the flows, and the feedback loops that turn quiet markets into slingshots.

Below, as always, the rest of what’s cooking:

Index Calm, Single‑Name Whiplash

Index volatility looks sleepy, yet themes under the surface have been swinging far harder than the S&P itself, its widest gap in over five years. Translation: broad beta feels stable while baskets tied to AI, small caps, and shorts experience outsized swings.

Liquidity Pivot: QT Nears the Finish Line

The Fed’s slow squeeze on liquidity is starting to bite. Banks are tapping short-term funding tools more often, and overnight lending rates are edging higher. Early signs that cash in the system is getting tight. Powell has already hinted that balance-sheet cuts (QT) are close to done. When the Fed stops draining liquidity, it usually doesn’t spark fireworks, but over time it tends to make borrowing easier and supports risk assets.

Megacap Earnings: The Real Catalyst for Flows

Five giants report into a market that quietly lowered the bar. Desks see investors focused on capex glide paths, cloud growth, and AI monetization rather than headline beats. With nets cautious and seasonals friendly, good enough can pull in sidelined money.

Germany’s Industrial Engine Misfires

Machinery output sits more than 20% below pre‑pandemic levels, capacity utilization slid, and insolvencies picked up. Another reminder that European policy friction collides with energy costs and export demand. This is why the MDAX tells a grimmer story than the headline DAX.

The Week: Four Central Banks, Q3 GDP, and Super‑Earnings

Wednesday lines up the Fed and BoC (markets lean to a 25bp Fed cut and QT tone‑watch) and a 7‑year Treasury auction; Thursday stacks ECB + BoJ decisions, the Trump–Xi summit, and the first look at US Q3 GDP; Friday’s core PCE and ECI carry shutdown delay risk. Over 40% of the S&P by cap reports: MSFT/GOOGL/META Wednesday after the bell; AAPL/AMZN Thursday.

Get Rich Overnight with Options? Yeah Right...

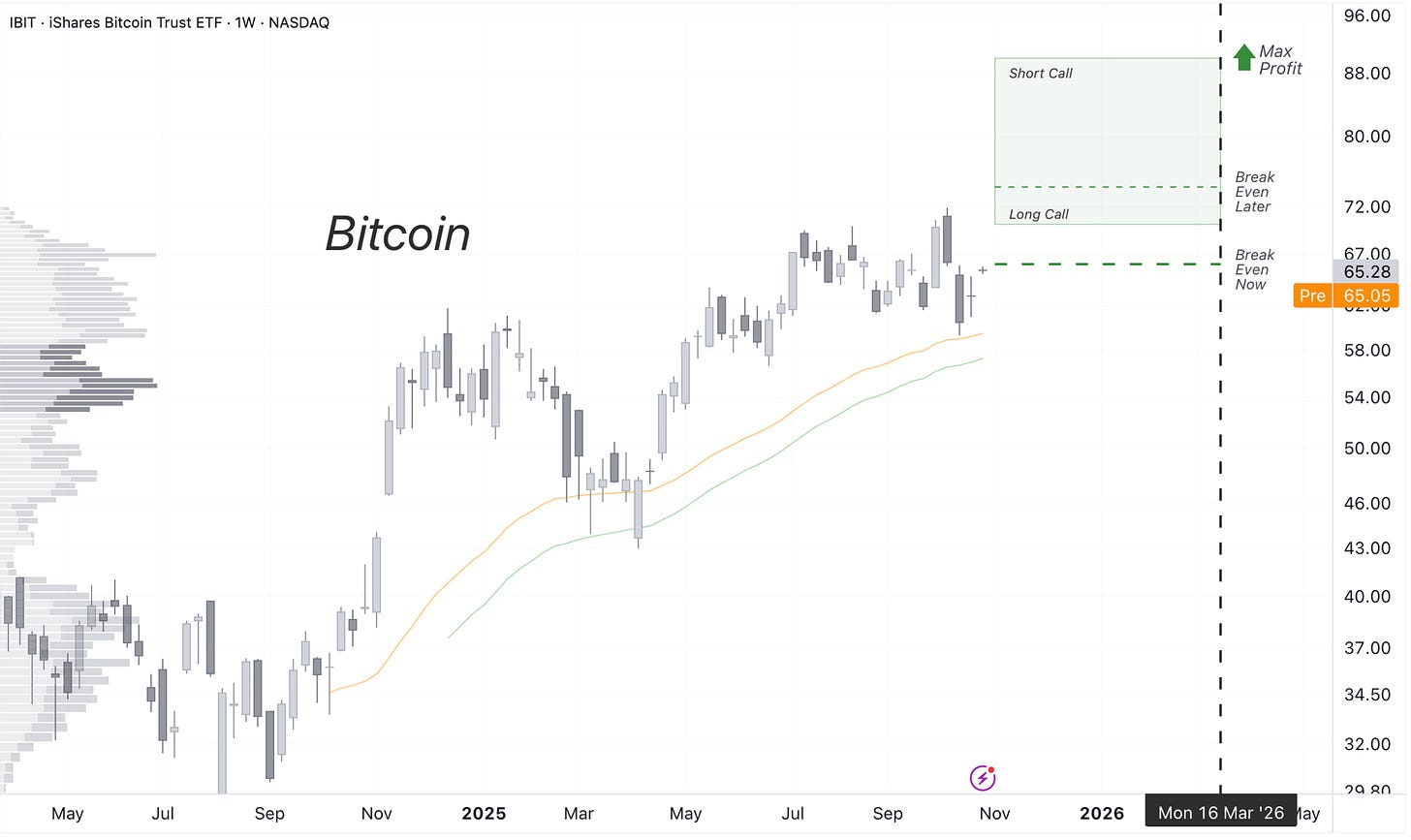

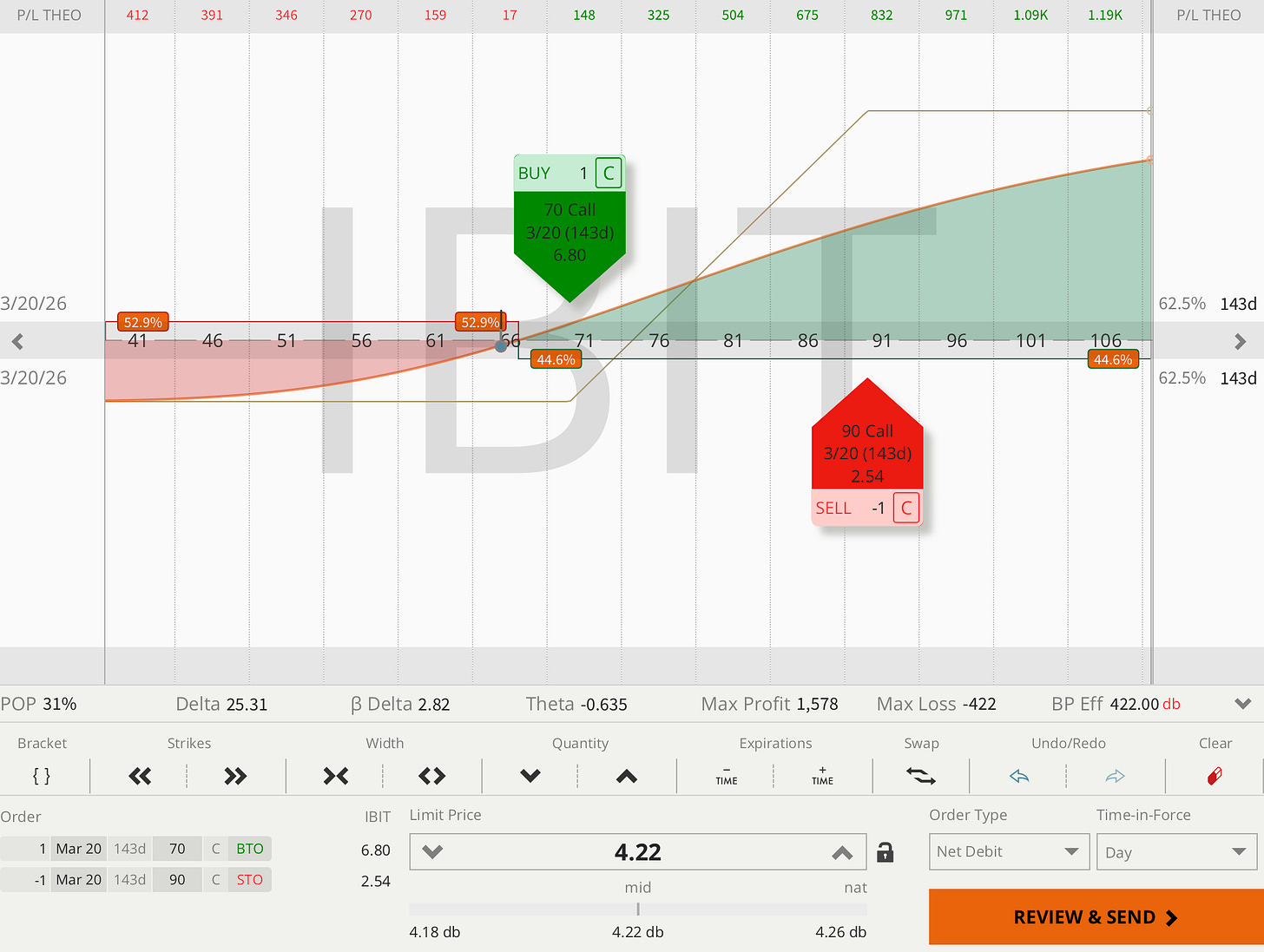

TUESDAY TARGET: Bitcoin (IBIT)

Everyone loved gold and silver at their highs, but they hate Bitcoin while it’s hanging at the 200-day moving average. Funny how that works. No one feels thrilled about going long here, which is exactly why it might play out. Not a trade I’m taking myself, just a little inspiration. Christmas is around the corner, and who doesn’t want a December Bitcoin win to brag about?

I like the look of Ethereum (ETHA) and Solana (SOLT) more, but when things get dicey, institutional money and liquidity tend to stick with the big boy.

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

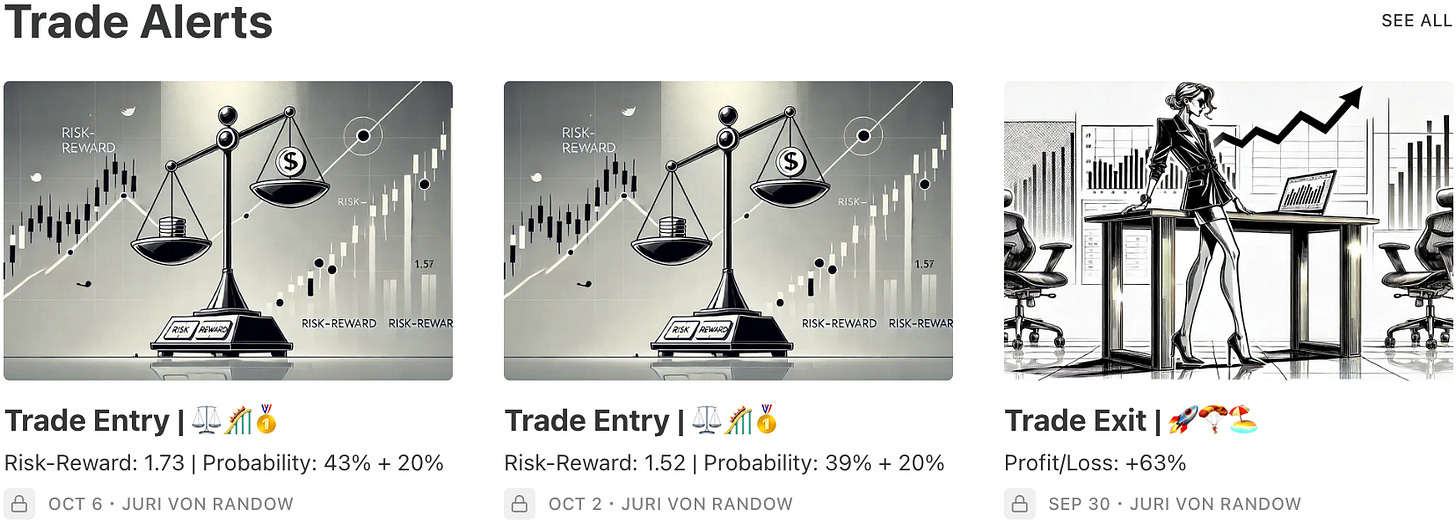

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Rate: $135 | 👇 Book Below

Elite Trader: $110 | 👉 Book / Top Up Here

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.