🎯 This Week’s Target: Technology Select (XLK)

The market keeps rising like it owes the crowd a favor. Retail traders hammer zero-day calls, corporate buybacks are warming up as blackout windows fade, and everyone is whispering about the seasonal Santa lift. Feels like muscle memory, buy the dip, spin the gamma wheel, collect the confetti.

Underneath, the real setup looks stranger. Private-credit funds are stuffed with deals no one can price, and pensions built portfolios split between those private loans and passive S&P exposure. If the private marks slip, the liquid side gets sold to meet redemptions. The more alternative the allocation, the more the index becomes the emergency cash box.

Meanwhile, tariff headlines play like background music, escalate, pause, handshake, repeat. Each shift pulls rates and liquidity just enough to keep the AI-capex boom alive, now financed by leverage rather than profits. It’s policy theater feeding a debt machine.

Add the retail crowd’s record flow, and you have a market that looks alive because it keeps re-pricing itself. Who needs fundamentals if you have momentum?

Below, as always, the rest of what’s cooking:

Earnings Heat, Sentiment Chill

Beat rates came in strong to start the week, yet positioning indicators remain subdued versus 2024. Hedge funds net sold in recent weeks; CTAs are still long but twitchy; and survey tone skews cautious despite indices near highs. That combination cushions shocks and fuels squeeze risk if prints surprise on guidance rather than just EPS.

Asia Rotation: Korea, Japan, and Select China Tech

Korea’s index (+60% YTD) reflects a blend of defense, chips, and policy reform; Japan’s breakout is political and monetary; and selected China tech now screens most attractive on earnings trajectory and policy support.

Energy: Mind the Divergence

Oil equities underperformed crude and saw net selling as WTI slid under $60. The equity‑to‑commodity gap can close either way, so trade the spread with respect for balance‑sheet quality and buyback cadence. Event risk in geopolitics remains high, but insurers and shipping costs now dictate more of the realized risk than headlines do.

The Week: CPI, Auctions, and an Earnings Wave

Fed blackout runs into the Oct 29 meeting, so Friday’s delayed September CPI is the week’s main macro catalyst, alongside global flash PMIs the same day. In the run‑up, watch Treasury supply - the 20‑year reopening Wednesday and new 5‑year TIPS Thursday - for signals on long‑end demand and real‑rate bias. Micro will be loud: roughly one‑fifth of the S&P 500 reports (incl. Tesla, Netflix, GM), with Europe busy (Barclays, NatWest, SAP).

Get Rich Overnight with Options? Yeah Right...

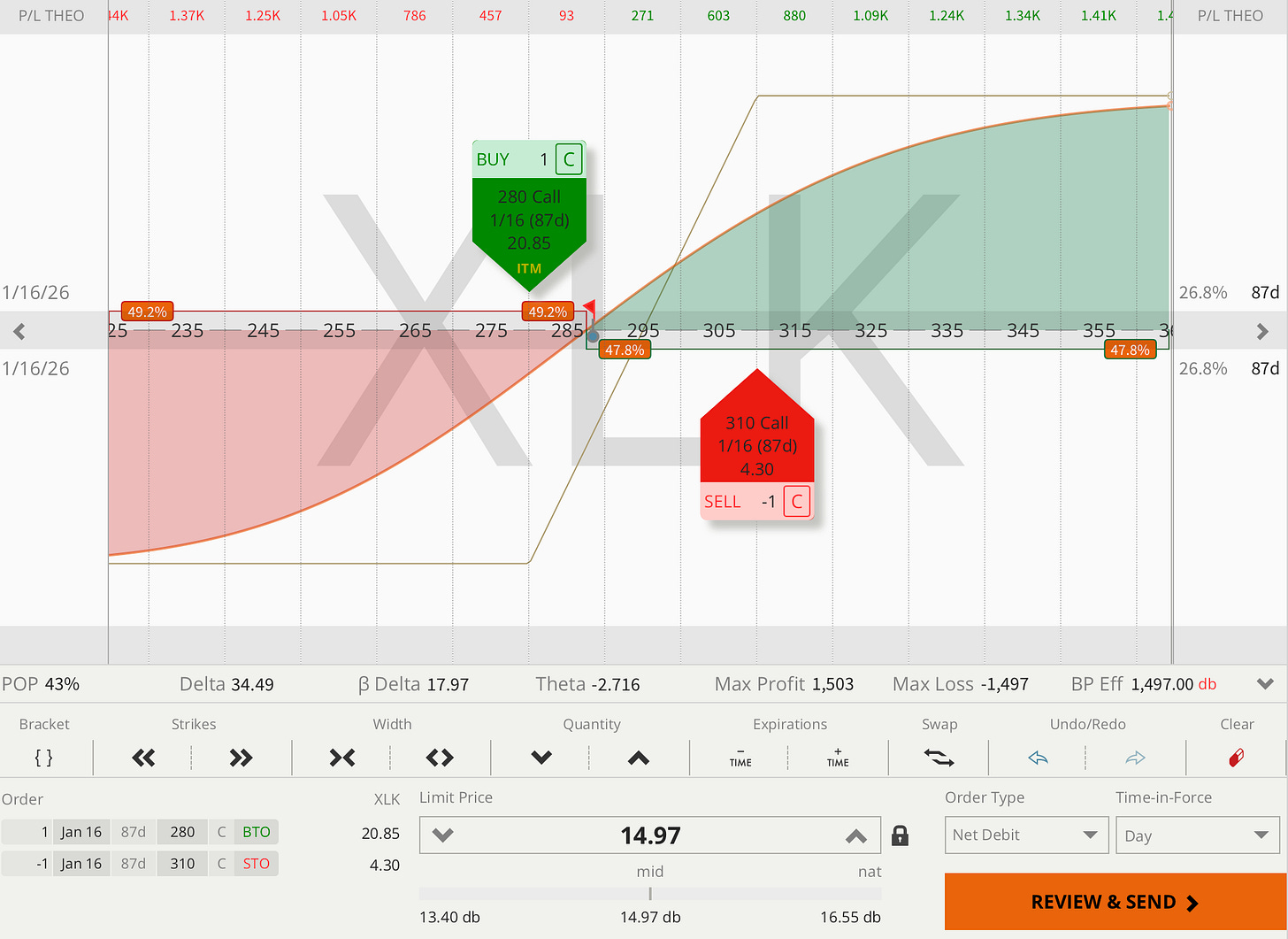

TUESDAY TARGET: Technology Select (XLK)

If you see another leg higher into year-end, consider the 280 / 310 January call debit spread. The structure keeps capital efficient while capturing the continuation of the AI-capex and buyback-driven momentum in large-cap tech.

Should the market retrace over the next few weeks, there’s room for repair — roll into February and layer a 310 / 340 call credit spread to offset decay and widen the payoff.

👉 Elite Traders — hit me up in MacroDozer Discord if anything’s unclear. Early entry, repair, or exit warnings will post there first.

All our recent trades and the reasoning behind them can be found in the Trade Alerts section. Think of it as a behind-the-scenes look into our process, so you can decide if it’s worth adopting (or adapting) in your own strategy.

📌 1:1 Mentorship Call

Book an easy yet focused Zoom call with me to sharpen your edge.

📌 Advanced Options

📌 Risk Management

📌 Capital Efficiency

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $135 | 👇 Book Below

📌 Emergency Call

For urgent trade issues and timing-critical decisions.

🚨 Market SOS

🌞 Early Morning

🕯 Late Evening

Elite members: $110 | 👉 Book / Top Up Here

Public rates: $115 | 👇 Book Below

Tuesday Target is written by Juri von Randow — founder of MacroDozer, professional investor, and trading mentor — delivering institutional-grade trade ideas, market insights, and strategy every week for serious investors.

🚨 Educational content only. Not financial advice. Past performance ≠ future results.