China's Next Big Move

China's latest credit data came in as a disappointing mess, igniting speculation about imminent quantitative easing (QE). Despite high hopes, September's figures showed that total social financing and new RMB loans remained soft. With credit demand weak and M1 growth contracting, Beijing seems cornered into considering QE to reignite its sputtering economy.

If China pulls the QE trigger, brace yourselves: global markets might just experience a liquidity tsunami that could send commodities like oil, gold, and even bitcoin soaring. Until then, we're left wondering if the much-anticipated stimulus will ever materialize or if we're witnessing yet another episode of overpromising and underdelivering from China's one-man show.

Hedge Funds Flip the Script

After eight consecutive weeks of selling, hedge funds have finally capitulated, buying stocks at the fastest pace since 2021. Single stocks saw the largest net buying spree in years, driven by long buys and short covers. The Nasdaq Equal-Weight Index even hit new all-time highs, signaling a broad-based rally.

It seems the bears couldn't resist the FOMO any longer, especially with the S&P 500 posting its 45th record close of the year. Still, it's premature to celebrate—extended relative valuations are still giving skeptics plenty to worry about. As they say, the market can stay irrational longer than you can stay solvent, and hedge funds are apparently tired of fighting the tape.

Tax Cuts for All!

In the political arena, Trump is back with a bang, offering tax breaks left and right. From proposing no taxes on tips and overtime to making auto loans tax-deductible, he's playing Santa Claus in October. And let's not forget his sky-high tariff rhetoric—mentioning numbers up to 1,000%, which could make even the most hardened protectionist blush.

With his odds of winning the upcoming election rising sharply and Wall Street starting to take notice, it's clear he's shaking up the status quo. Given these grand promises, one has to wonder: who's going to foot the bill for this tax-cut bonanza? Perhaps inflation will pick up the tab, as it did under the current administration.

Become Rich Overnight with Options? Yeah Right…

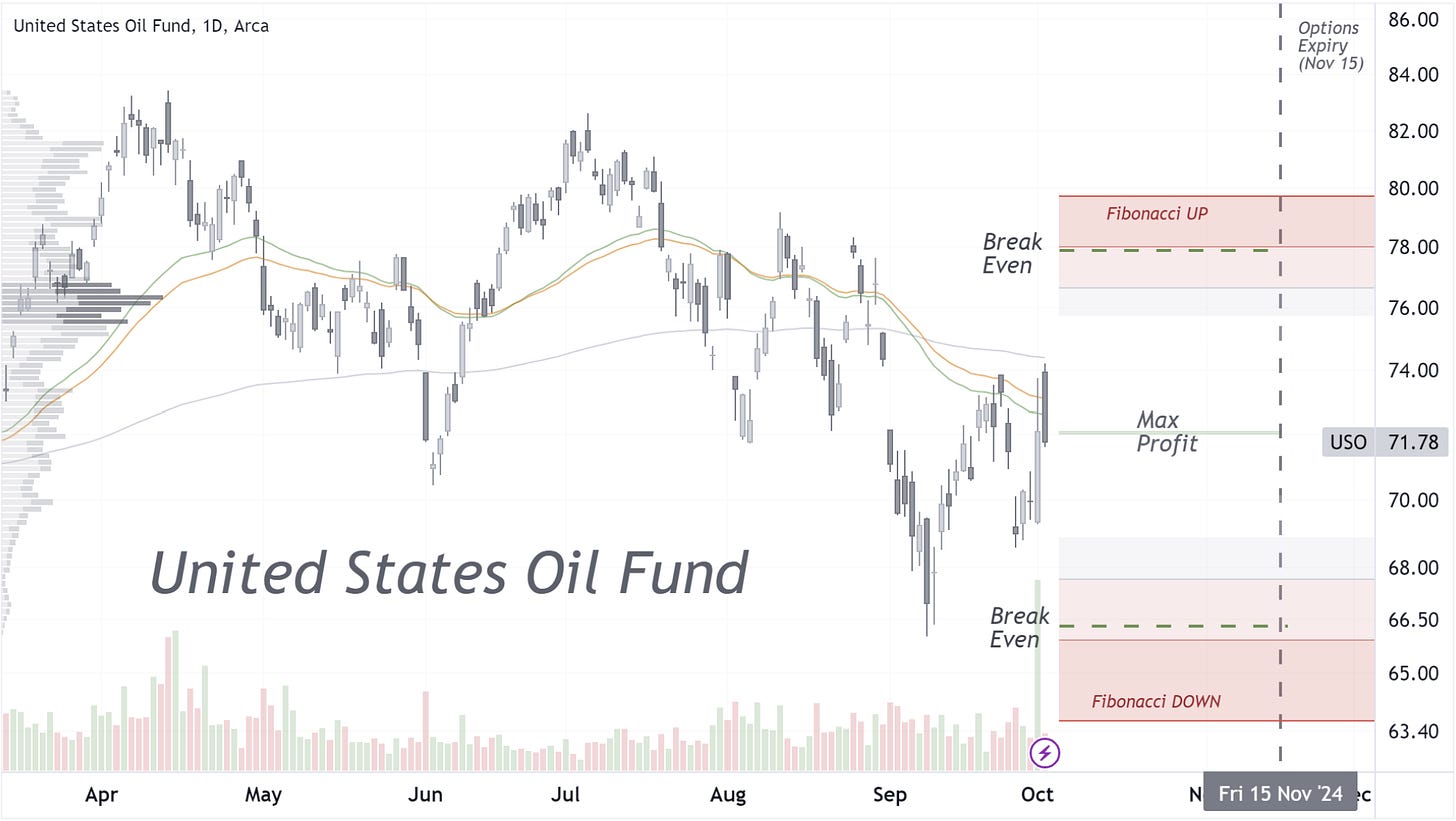

TUESDAY TARGET: We’ve entered the Oil Fund with a $72 target two weeks ago. It seems that Isran's toddler leaders can't decide which part of the Middle Eastern sandbox to disrupt next. USO decided $72—for now—we couldn't agree more.

Check out the details in the Subscriber Chat.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.