What happens, if Tuesday Target arives on Thursday?

Nothing.

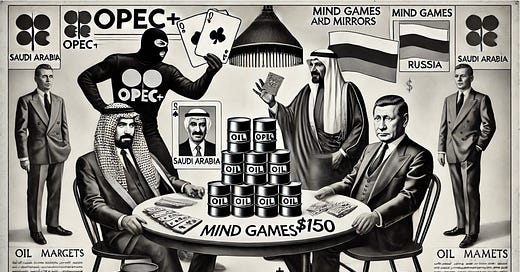

OPEC's Oil Game: Smoke, Mirrors, and $150 Dreams

Looks like OPEC+ has mastered the art of mind games—yet again. Remember that Reuters nonsense about an October output hike? Yeah, they flipped the script faster than oil prices could crash. Now, we’re stuck in limbo with OPEC+ waiting for China’s middle class to riot before they flood the market with stimulus and oil shoots back to $150 a barrel. Call it a masterclass in market manipulation—we are rested enough to see it through.

Election Show and Europe’s Highway to Nowhere

Kamala is lowering capital gains tax to win votes, and “Biden” threatens to block Nippon Steel to “save jobs” in Pennsylvania. Sounds like the usual pre-election BS of promises. Meanwhile, Europe still can’t get its act together on defense spending—Germany is using highway repairs as “defense” since tanks need smooth roads too! War economies are getting real, and Europe might just stroll into another geopolitical crisis—unprepared as usual.

10-Year Yields: The Hot Jobs Bet That Blows Up Something

The market is running wild on jobs reports. Someone out there has thrown millions on the bet that Friday’s payrolls will be so hot, we’ll see 10-year yields spike above 4%. If you’re a trader, that’s your cue to be confused. While everyone is screaming for rate cuts, the 10-year yield might just laugh in their face and head back up. Risk-taking at its best when you only knew about the returns.

Become Rich Overnight with Options? Yeah Right…

TUESDAY TARGET: No target this week, only trade exits. Check out our mind-boggling summer returns in the Exclusive Chat—if you are brave enough to hit the 30-day free trial.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.